The monetary policy week

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

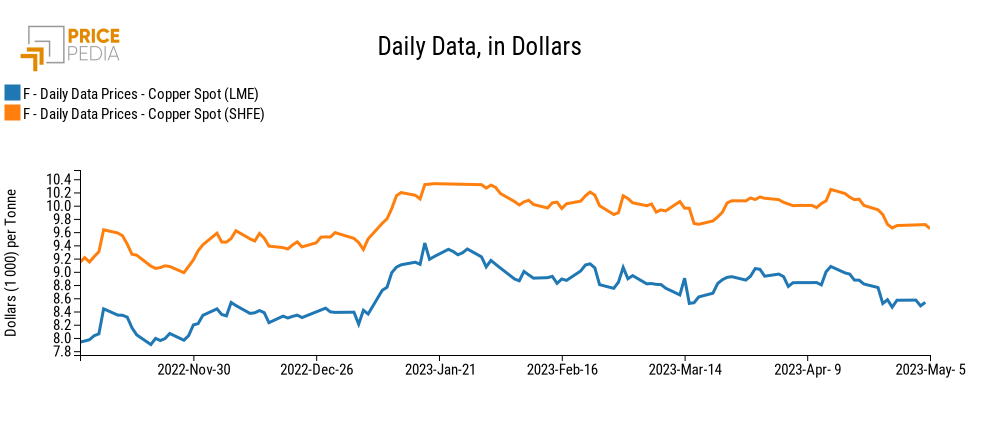

LME Conjunctural Indicators Copper Macroeconomics Doctor Copper SaysCompared to last Friday's market close, no significant signs of movement have come from the price of copper listed in London and Shanghai in recent days, but rather substantial stability. While British markets remained closed due to public holidays on May 1, and then reopened on Tuesday, May 2, Chinese holidays lasted instead until May 3. The Shanghai Futures Exchange (SHFE) was open again on Thursday, when the price of copper was confirmed at levels roughly equivalent to the close of Friday, April 28 (+0.15%); slight declines, instead, at the London Metal Exchange (-0.36%).

Thus, no significant reaction is perceived on the copper front to the latest monetary policy news released this week. Indeed, in our periodic monitoring of the health of the economy, we cannot overlook the latest monetary policy meetings of the European Central Bank and the US Federal Reserve - events that, all the more so at the current historic moment of high inflation and rising interest rates, are the focus of markets' attention.

Two hikes and two visions

The May decisions on both sides of the Atlantic led to a common verdict by the FED and ECB, at least as to the size of the hike, which was in both cases 25 basis points, confirming market expectations.

Thus, the US rate now reaches 5-5.25%, while in the Eurozone the interest rate on the main refinancing operations rises to 3.75%; the ECB's other two benchmark rates, on the marginal lending facility and on deposits with the central bank, also rise by 25 basis points.

On the other hand, the line of the two speeches regarding future maneuvers was different. Indeed, it is noteworthy that the FED, compared to the previous March meeting in which it had anticipated the intention of future hikes, in this week's meeting preferred to opt for a data-dependent approach: "Our future policy actions will depend on how events unfold." As Chairman Powell himself pointed out, this is a significant change.

No explicit statements have been made about a pause in the rate hikes, but that possibility now seems increasingly clear. Again from Powell's words, "We're much closer to the end of this than to the beginning [...] you know, we're getting close or maybe even there."

From the ECB's announcement, on the other hand, the prospect of a pause in the rate hike cycle did not seem as forthcoming: as reflected in President Lagarde's statements, "we are not pausing, that's very clear." The Frankfurt-based institution therefore preferred to opt for a line that remains vague on rate developments; again, the approach is said to be dependent on economic data, but further hikes are seen as likely "in light of continued high inflationary pressures" in pursuit of the 2 percent inflation target.

Manufacturing industry also falters in China

Widening our gaze to the East, we report the release this week of April data for the Caixin China PMI for manufacturing and services. The index for services remained well above the neutral threshold (50), standing at 56.4. Thus, the sector continued its expansion phase in April, mainly due to an improvement in market conditions and an increase in the number of customers, according to surveyed companies. However, a slowdown in the pace of growth is reported in terms of both output and new orders, compared to March. Services thus confirm a gradual normalization, with the exit from the pandemic emergency.

Not as dynamic was the performance of manufacturing, for which a marginal deterioration in business conditions was reported in April. Indeed, companies reported only a partial increase in production; the index fell from an average level of 50 in March, to 49.5 in April. Though marginal overall, this was the first deterioration in the health of the manufacturing sector in three months - an element that in turn weighed on the price of copper.

At this stage, industry and services thus seem to be moving in divergent directions: along the same lines we can find the Eurozone, as revealed by the related PMI indices, and as also signaled by the ECB in its latest monetary policy statements.