Normalization tryouts on financial markets

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

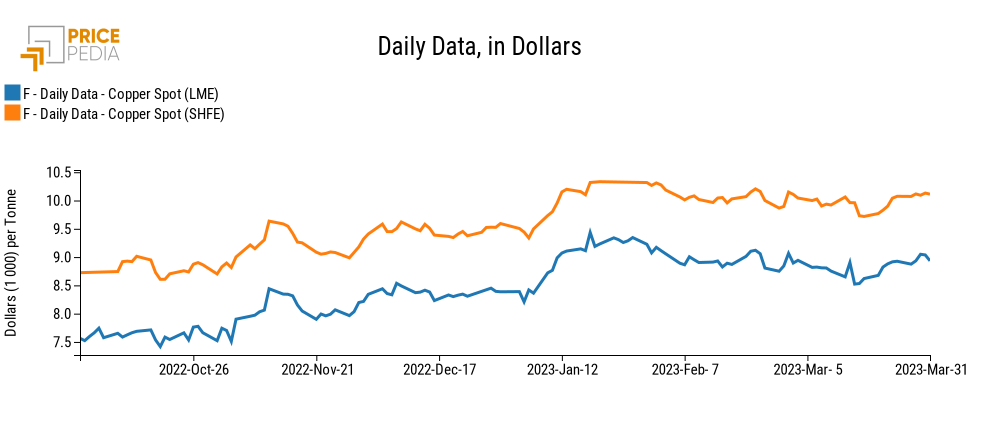

Energy LME Conjunctural Indicators Copper Non Ferrous Metals Macroeconomics Doctor Copper SaysOnce again this week, financial markets confirm a stabilization trend, following the banking shock recorded in mid-March. Indeed, the price of copper continues its upward phase, albeit at a modest pace: the London Metal Exchange (LME) closes the week with an increase of 0.1 percent over the closing values of Friday, March 24, compared to an increase of 0.4 percent at the Shanghai Futures Exchange (SHFE).

In particular, signs of comfort came for financial markets on Sunday, March 26, with the announcement of a deal under which First Citizens Bank acquired a large part of Silicon Valley Bank. Markets reacted with relief, signaling an easing of fears of a generalized banking crisis, benefiting confidence and risk appetite. The price of copper at the LME also showed signs of an upturn from Tuesday, only to partially retrace from Thursday.

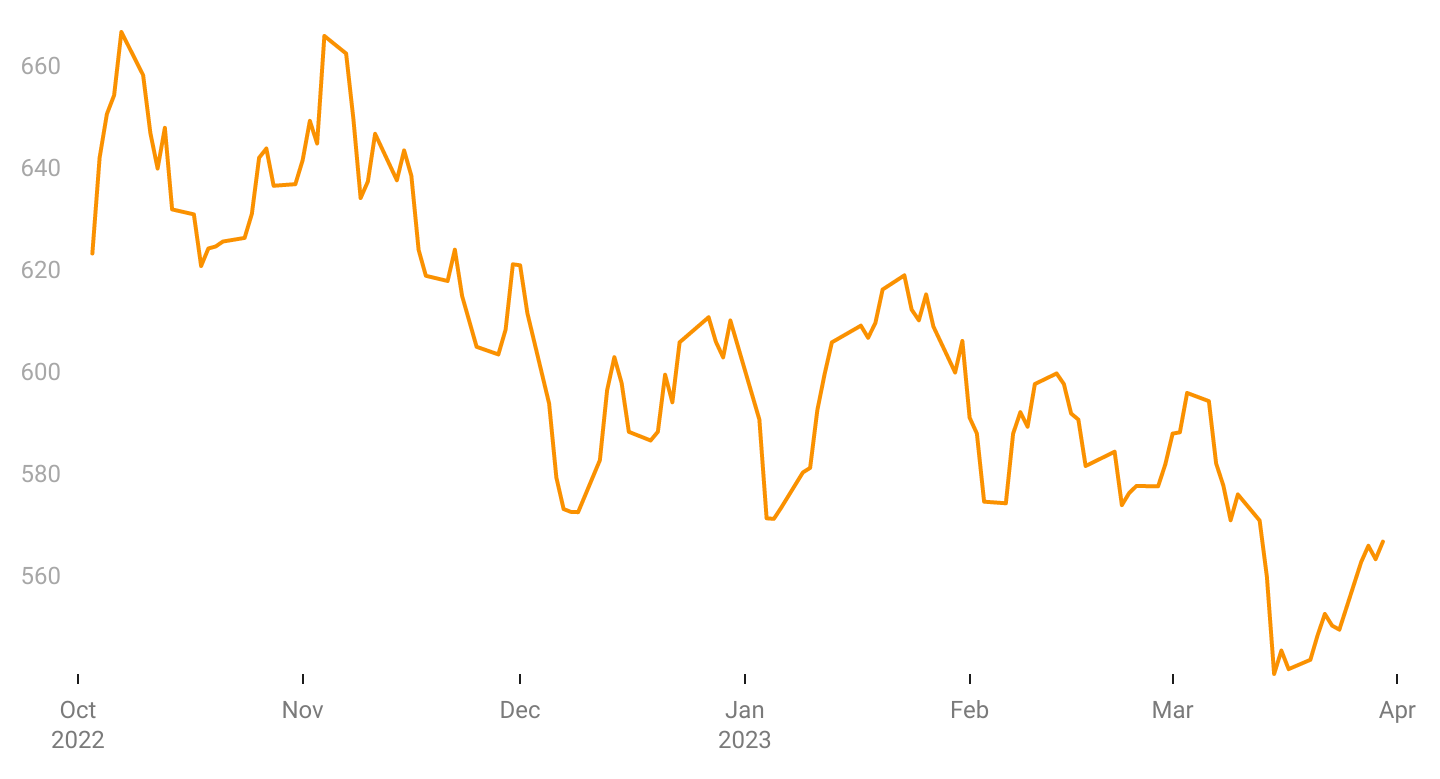

Not only copper as a barometer of market sentiment, but also commodities, more generally, have reflected the gradual recovery of confidence. Let us look, for example, at the Goldman Sachs Commodity Index1: following the shock on the banking front, the index plummeted in the first two weeks of March 2023, touching levels not seen for more than a year; in recent weeks, however, the index got on to a recovery path, although still remaining below the levels of the beginning of the month.

Goldman Sachs Commodity Index

Source: StudiaBo elaborations on Investing data.

Signs of normalization are thus coming from financial markets, in the face of issues that, for now, seem to remain circumscribed. The Fear Index (CBOE Volatility Index) is falling, after peaking in mid-March; the euro-dollar exchange rate is also settling, as concerns and relative risk aversion partially subside.

PMI, an indicator of economic climate

Widening our gaze beyond the financial front, positive signs come from the latest PMI data released by S&P for the Eurozone. For the month of March, the index set above the neutral threshold (50), rising from the value of 52 recorded in February to 54.1, the highest point of the last 10 months. The index thus confirms signs of a recovery in the euro area economy, after the slowdown marked in the second half of 2022.

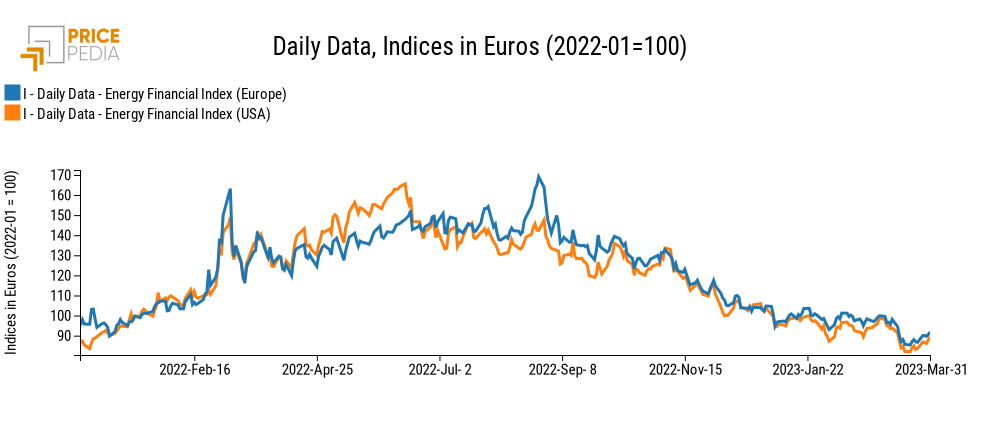

On the other hand, the inflationary momentum shows signs of a decline: for March, Eurostat estimates +6.9%, down from +8.5% in February, mainly due to easing pressures on the energy front. The PricePedia index of energy prices in Europe has been falling for seven months now.

According to S&P, European business confidence shows fair resilience, despite concerns on the banking front. It is reported, however, that growth in the Eurozone PMI index was mainly supported by services, while output recorded by the manufacturing sector stagnated for the second consecutive month.

S&P data thus seem to support ECB's forecasts, which estimate Eurozone GDP growth in Q1-2023 to be modest but in positive territory (+0.1%), and then a slight acceleration (+0.3%) in Q2.

1. The S&P Goldman Sachs Commodity Index is used as a benchmark to invest in commodity markets and as a measure of commodity performance over time. It is a tradable index, readily available to market participants on the Chicago Mercantile Exchange.