Banking shock also weighs on copper prices

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

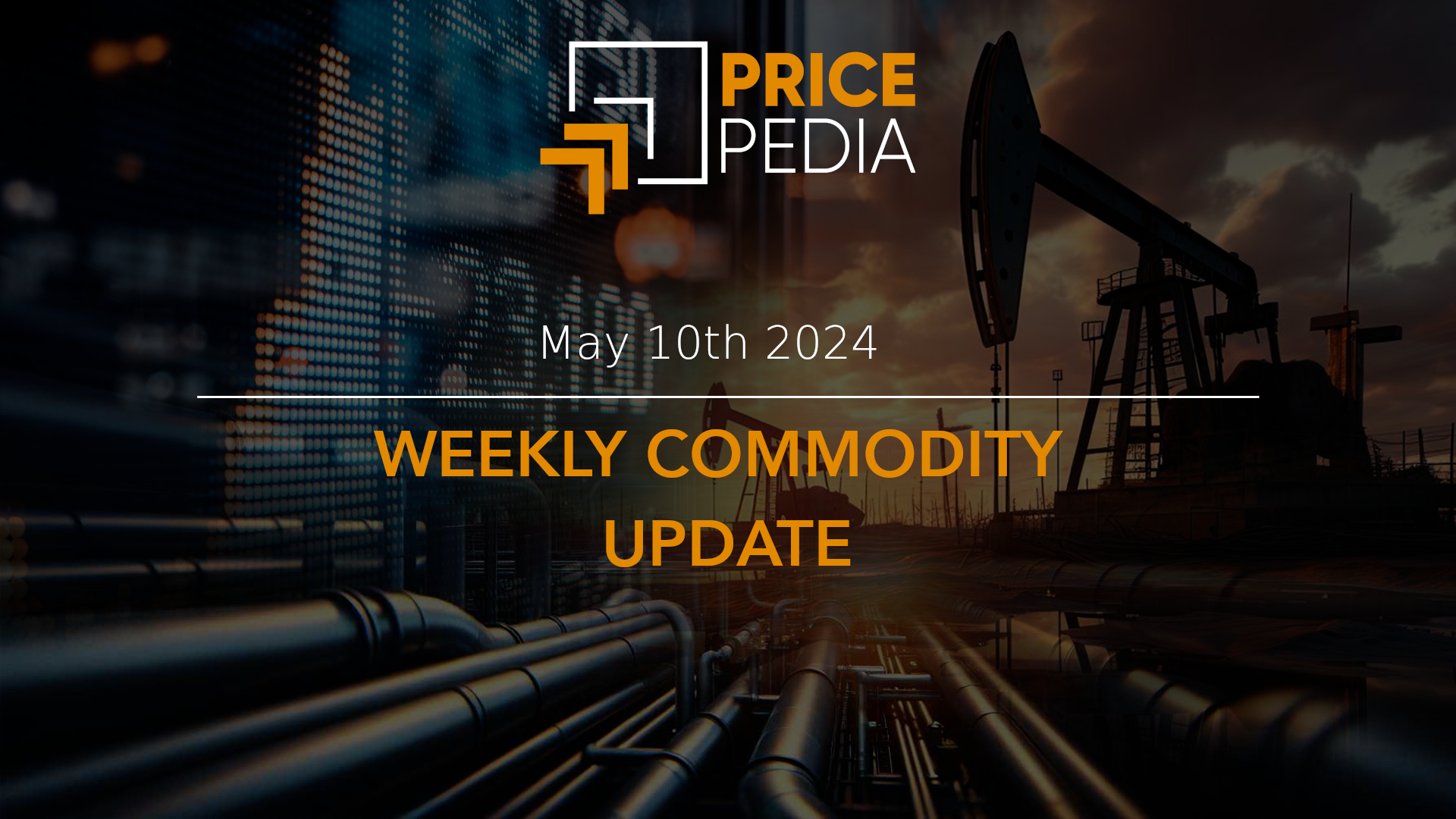

LME Conjunctural Indicators Copper Non Ferrous Metals Doctor Copper SaysAfter a week marked by significant shocks on financial markets, the price of copper also experienced inevitable fluctuations. Compared with last Friday's closing values, the dollar price quoted on the London Metal Exchange (LME) fell by 1.5 percent, compared with a 2 percent drop on the Shanghai Futures Exchange (SHFE).

If the banking sector shock was localized on the Western front, between the United States and Europe, meanwhile, tentative signs of recovery came from the Chinese economy: in fact, modest growth rates were recorded for both retail sales and industrial production in the first two months of 2023; at the same time, copper inventories began to show signs of reduction, after two months on the rise.

However, all in all the gloomy outlook seems to have prevailed, dominating the international scene: at the end of the week, prices recorded at both the LME and the SHFE in fact returned to the values of early 2023, at the start of the climb led by an optimistic outlook on Chinese reopening.

Tensions on financial markets, from Silicon Valley to Switzerland

As reported all over the news, the past few days will be remembered for a significant shock on financial markets, bringing back memories of the dreaded 2008 crisis. Since last week, there have been the collapses of three banking institutions in the Western world, two US banks (Silicon Valley Bank and Signature Bank) and a Swiss bank (Credit Suisse) a few days ago. Though the shock appears to be more circumscribed compared to what happened more than a decade ago, the succession of such events has brought with it inevitable market tension.

Against this background, we can also find two key monetary policy decisions, both in the US and in the Eurozone: central banks thus face an even more delicate economic scenario than initially expected. In particular, yesterday the European Central Bank held its monetary policy meeting that, despite tensions, confirmed a rate hike of 50 basis points. Unlike the previous meeting, the institution avoided making assumptions about future hikes amid a general increase in uncertainty, sticking to a data-dependent approach based on inflation developments and the effectiveness of rate hikes in containing it.

Despite the shock that occurred on the banking front, the ECB also emphasized the resilience of the sector in the Eurozone, and its readiness to take action to safeguard it.

Instead, the US Federal Reserve is scheduled to meet next week, when it will be confronted with persistent inflation and, at the same time, the need to ease tensions and ensure financial stability.

The shock in numbers

Against a general backdrop of market fears and growing risk aversion that dominated the week, copper prices therefore reacted downward.

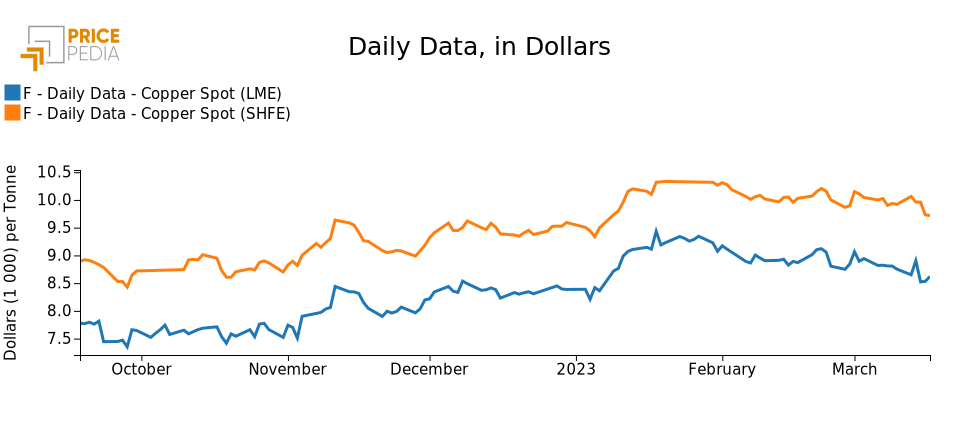

The impact of the shock can also be read clearly from additional indicators: consider, for example, the "fear index" (VIX Index), which rose more than 38 percent between March 8 and March 13, and then fell on Thursday, when the message came from Switzerland that financial risk was under control, thanks to a loan of more than $50 billion agreed by Credit Suisse with the country's central bank.

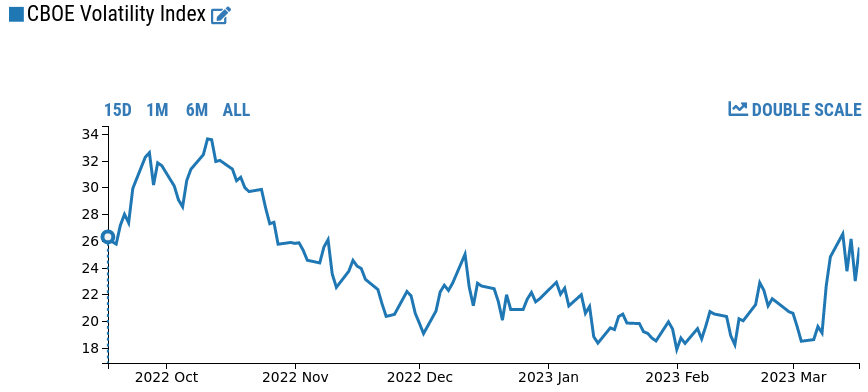

The price of gold in recent days has also marked an ascent due to its role as a safe haven asset toward which investors have turned: between March 8 and today, the dollar price of gold rose by more than 8 percentage points.

F - Daily Data - Gold Spot, price/gram: Gold Futures, Continuous Contract #1 (OR1, Chicago Mercantile Exchange), till 15th July 2022 Gold price from London Metal Exchange, price/gram

F - Daily Data - Gold Spot, price/gram: Gold Futures, Continuous Contract #1 (OR1, Chicago Mercantile Exchange), till 15th July 2022 Gold price from London Metal Exchange, price/gram

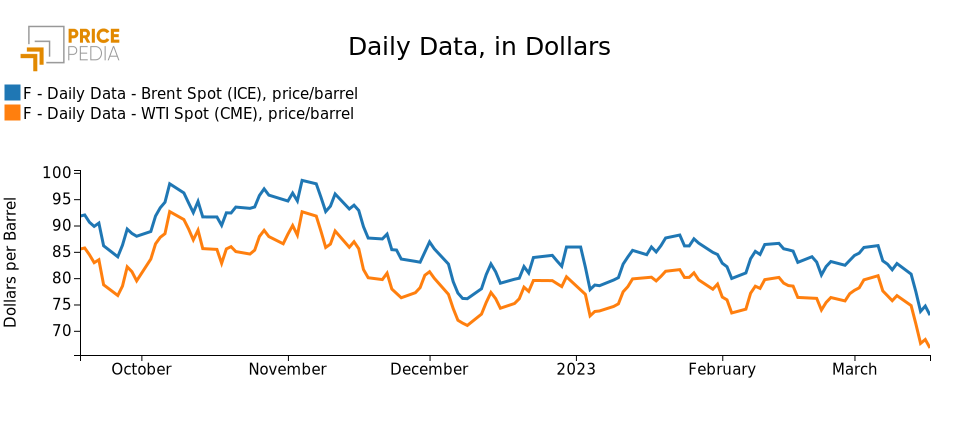

In contrast, the price of oil fell, penalized by uncertainties on the financial front. Today, both Brent and WTI touched a low point since late 2021.

This brings to a close a gloomy week in the markets that, after a better-than-expected opening of the year, brought uncertainty back to center stage.