ECB, from dove to hawk

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

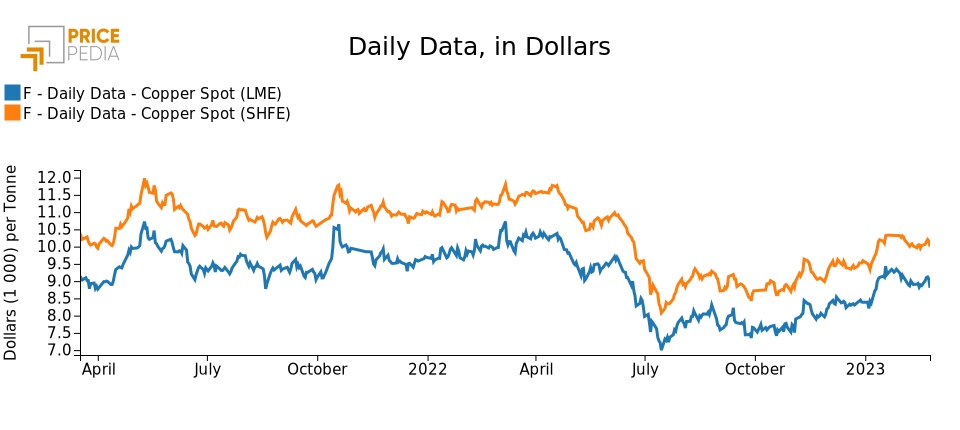

Exchange Rates LME Copper Non Ferrous Metals Doctor Copper SaysIn the first days of the week, copper prices returned to mark a modest rise, but still remained below the peak reached in January. Compared to last week's closing values, the dollar price of copper listed on the London Metal Exchange (LME) on Wednesday marked a 2.8% increase; +1.8% for the price listed on the Shanghai Futures Exchange (SHFE).

However, this was not the start of a new upward trend: in fact, as early as Thursday we can see a modest slowdown from the previous day, strongly confirmed on Friday.

Financial markets’ mood

Uncertainty continues to firmly hold the reins in financial markets as prospects for recovery in the Chinese economy continue to slip. Some commentators speculate about a spring rebound, but caution remains in order. Prices suggest modest signs of recovery in copper demand in the early part of the week, but do not seem, for the time being, to be providing hints of a consolidation.

Also of note in this picture is the role of the dollar, which has been appreciating since early February, and which is making dollar-denominated commodities more expensive for holders of other currencies. Indeed, looking at prices in euros, we can see that the price of copper has once again touched the January highs at both the LME and the SHFE, and then declined again today.

US monetary policy, oriented on the "higher for longer" stance, confirms its influence on copper prices. In fact, the minutes of the last FED meeting, held between the end of January and early February, were released a few days ago, confirming a tendentially hawkish stance.

Concerns about a restrictive monetary policy that could keep weighing on economic activity for longer than previously expected, combined with concerns about still modest Chinese demand, are thus helping to contain a significant rise in copper prices.

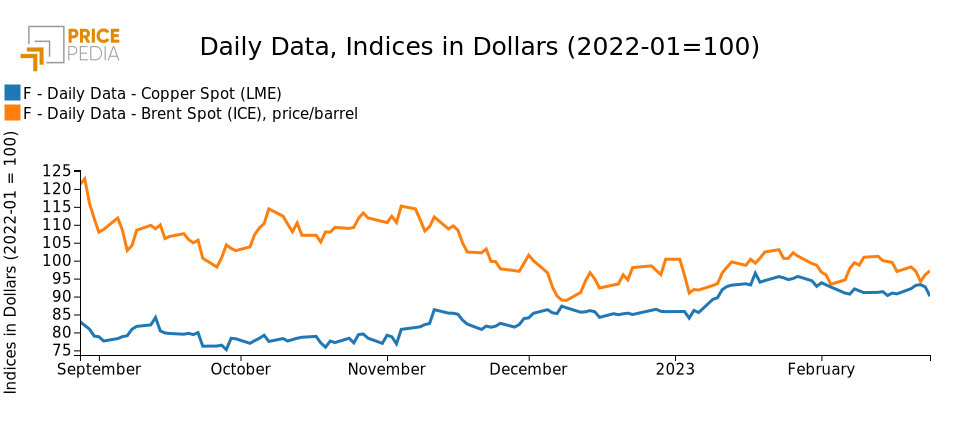

In line with the uncertainty over copper prices, oil prices also seem to remain moderated by a cap of general uncertainty, except for some modest fluctuations. The question that unites the markets on the two fronts is whether or not industrial demand can accelerate enough to drive prices upward or whether, on the contrary, recessionary momentum may prevail. In the early part of 2023, the two prices moved in alignment, signaling the existence of common determinants. In recent weeks they have begun to move in opposite directions, but have remained within limited ranges.

The health of the economy

Looking at indicators that help to investigate and assess the debated state of health of the economy, we report the recent release of the latest S&P Global Flash Eurozone PMI for February, which shows positive signs.

Indeed, in February the growth rate of Eurozone business activity showed an acceleration, touching a nine-month high, and signaling an improvement in the performance of the services sector, as well as a return to growth for manufacturing output. This is the combined effect of a growth in demand and confidence, as well as a gradual adjustment of the snags in the value chain. At the same time, inflation for input costs falls, especially for the manufacturing sector.

The PMI came in at 52.3, clearly surpassing the 50 threshold, increasing from January's milder value of 50.3.

Eurostat instead revised up Eurozone inflation for January, from the previously estimated 8.5 percent to the current 8.6 percent.

The PMI and consumer price index thus outline a scenario of strong inflation in an economy that is, however, showing a fair amount of resilience for the time being. Against this backdrop, market expectations point to a continuation of the ECB's restrictive stance for longer than previously expected, and certainly beyond the scheduled March hike.

After years as a dove, the central bank in Frankfurt now stands out in the eyes of the markets in its new role as a hawk.