Wood Pulp: in search of a price benchmark

The change in the underlying of NOREXECO contracts in light of the comparison with international quotations

Published by Pasquale Marzano. .

NBSK Woodpulp Analysis tools and methodologiesPulp is the key cost input in the production of graphic paper and packaging paper. Over the past twenty years, several attempts have been made to define a representative benchmark for this product, leading to the creation of various indicators (see the article Prezzi della pasta per carta kraft in forte aumento) which, however, proved to be only partially effective and were discontinued a few years after their introduction.

Over the last decade, global pulp demand has grown steadily, driven both by the transition towards more sustainable packaging solutions and by the expansion of e-commerce and global logistics. In this context, some commodity exchanges such as Norway-based NOREXECO and, later on, the Shanghai Futures Exchange (SHFE), started listing pulp-based contracts, financially settled in the former case and physically delivered in the latter, in order to provide market participants with hedging instruments, as described in the article The Price of Pulp at the End of 2024.

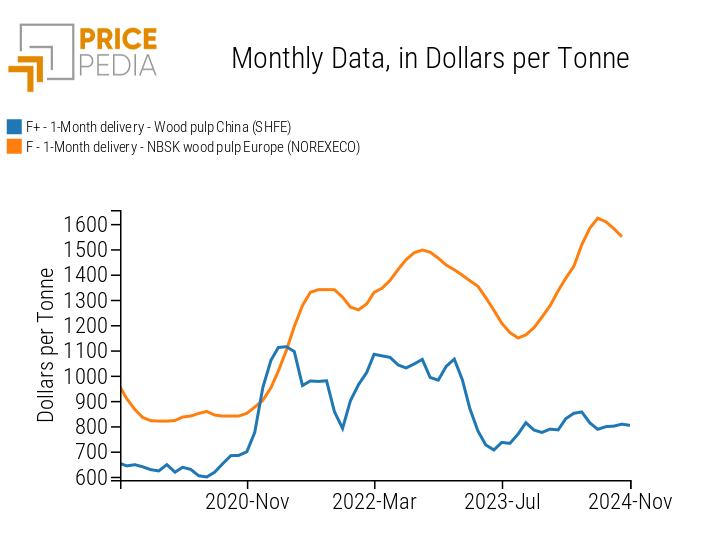

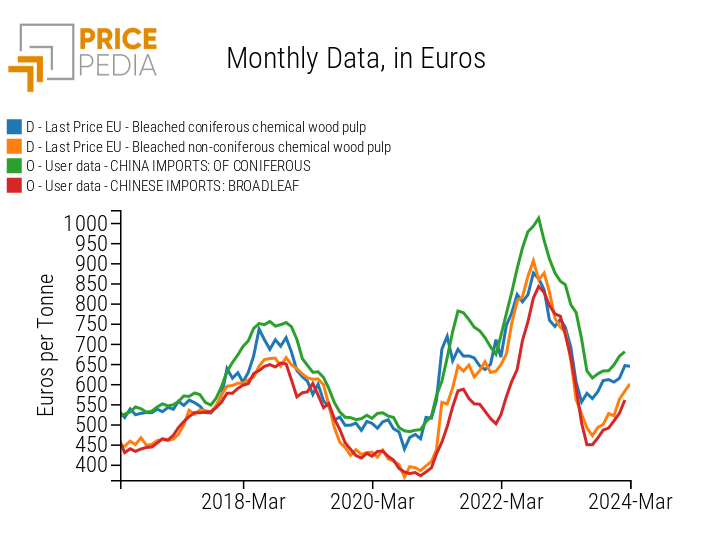

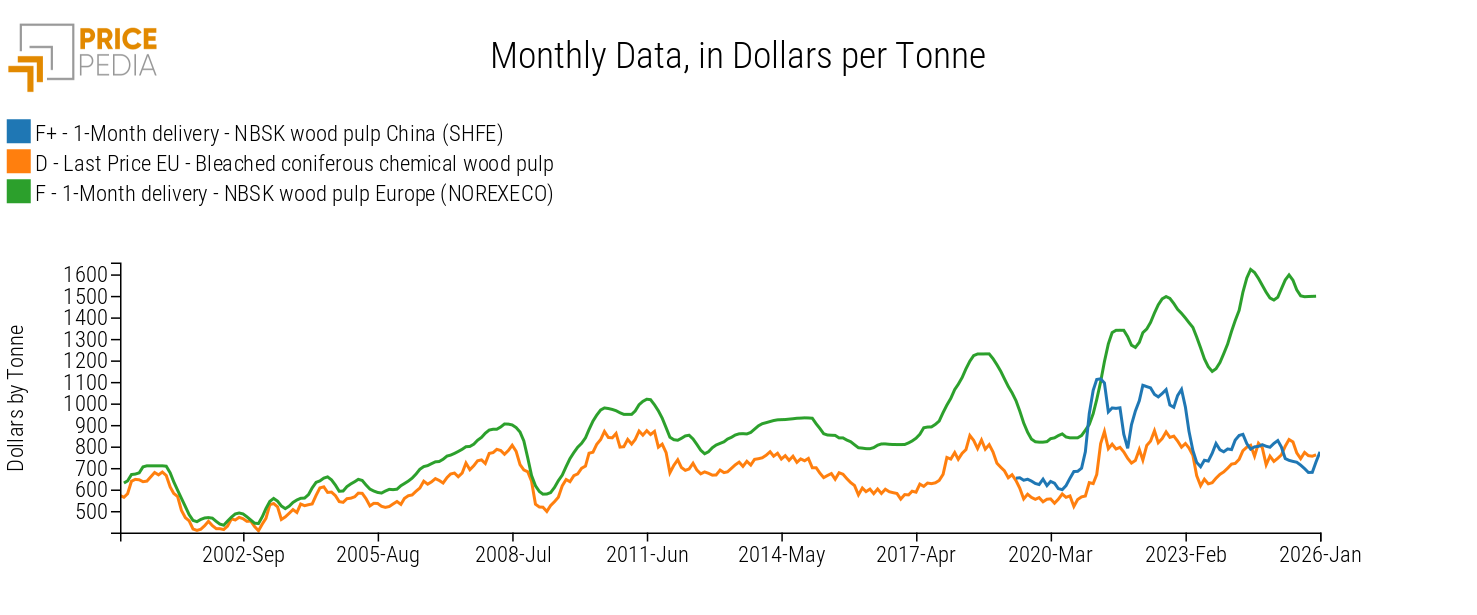

A comparison between these two financial quotations and the physical price observed on the European market, proxied by average EU import prices derived from customs statistics, allows some relevant conclusions to be drawn regarding their actual representativeness.

Pulp: comparison between prices from different sources (US dollars per tonne)

In particular, the SHFE benchmark shows a price dynamic that is consistent with EU customs prices, suggesting that the Chinese market, being the main global demand hub for pulp, effectively reflects marginal supply and demand conditions.

By contrast, NOREXECO quotations display a structurally upward trend over time that is not mirrored either by EU physical prices or by SHFE quotations. This divergence can be explained, at least in part, by the underlying of the NOREXECO contract, which up to December 2025 was based on Fastmarkets’ PIX Pulp index.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

This price represents a gross transaction price based on long-term contracts, calculated on standard delivery and payment terms between buyer and seller, while excluding actual spot transactions and any negotiated discounts or rebates. As a result, PIX provides a benchmark suitable for indexation purposes, but it may be less responsive to short-term imbalances between supply and demand in the pulp market.

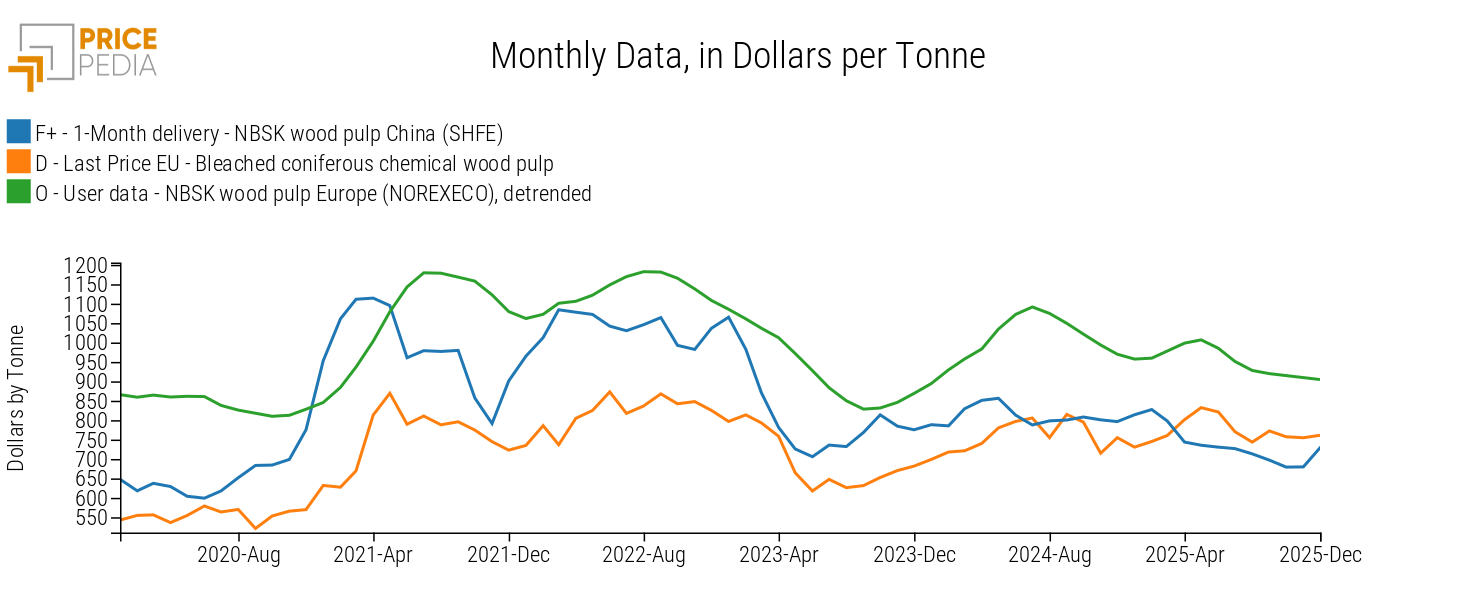

The lower responsiveness of the NOREXECO price becomes more evident in the following chart, where the same indicator has been detrended and compared with SHFE quotations and EU customs prices.

Pulp: comparison between detrended NOREXECO, EU customs price and SHFE price (index in US dollars, 2022-01=100)

As shown, NOREXECO quotations exhibit lower variability than the other price series, in line with the long-term nature of the transactions they represent. Moreover, NOREXECO prices tend to lag behind the other two series, particularly the SHFE price, which often anticipates movements in EU customs prices by several periods.

Change in the underlying of the NOREXECO contract

Starting from January 2026, NOREXECO announced a change in the underlying of its contract, moving from the PIX Pulp, which reflects long-term market conditions, to a spot price[1], i.e. one based on prompt, spot transactions.

This change addresses the need to make quotations more sensitive to the physical reality of transactions, and it is plausible that it will lead to closer alignment with other price references in the pulp market.

1. See the news published on January 2, 2026 on the exchange website https://norexeco.com/news.