Looking at the data: what does a VECM tell us about the global butane market?

Long-run equilibriums, exogenous effects and comparison with the economic approach

Published by Edoardo Pace. .

Organic Chemicals Analysis tools and methodologiesThe goal of this work is to replicate the analysis described in the article “The world butane market” using a statistical approach based on VECM (Vector Error Correction Model).

A VECM is a model that aims to describe how different variables move together over time. It does not start from rigid assumptions about causality, but rather observes the data to uncover stable relationships between variables and to examine how they respond when those relationships are "broken."

This approach represents a significant difference from the method used in the previous article, where the analysis was based on theoretical and economic reasoning: in that case, the relationships between prices were specified a priori, and statistics were used only to estimate the parameters.

With the VECM, on the other hand, we do not impose in advance how butane prices should influence each other. Instead, we let the model “discover” the hidden relationships in the data and show us how the different markets interact and return to equilibrium when they deviate from it.

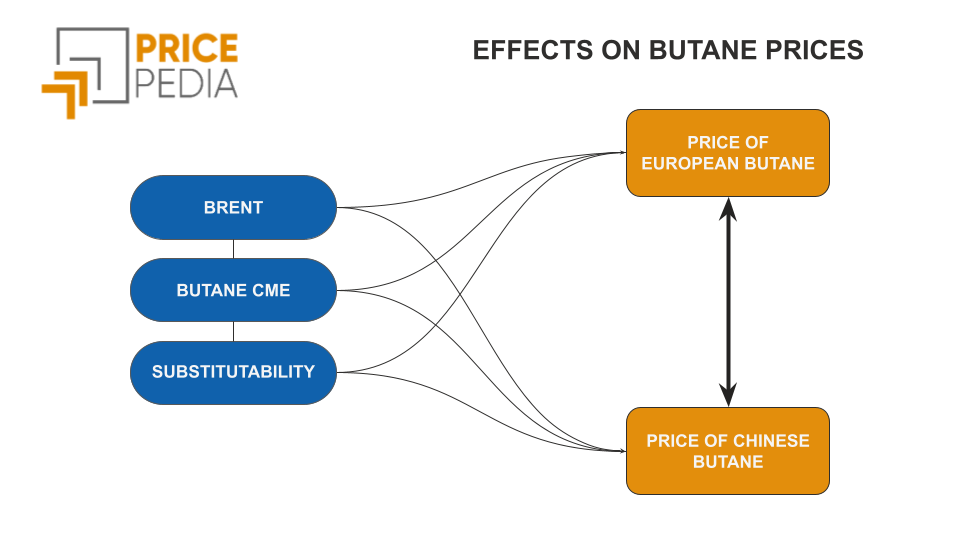

In addition to the butane prices in the three markets considered (Europe, China, and the financial price quoted at the CME), the model also includes two exogenous variables: the Brent price, which represents the main production cost of butane, and a seasonal dummy variable that distinguishes “winter” months from others, thereby capturing the seasonality of butane prices. These two variables help to capture external effects that may influence prices without being part of the internal equilibrium mechanism among markets.

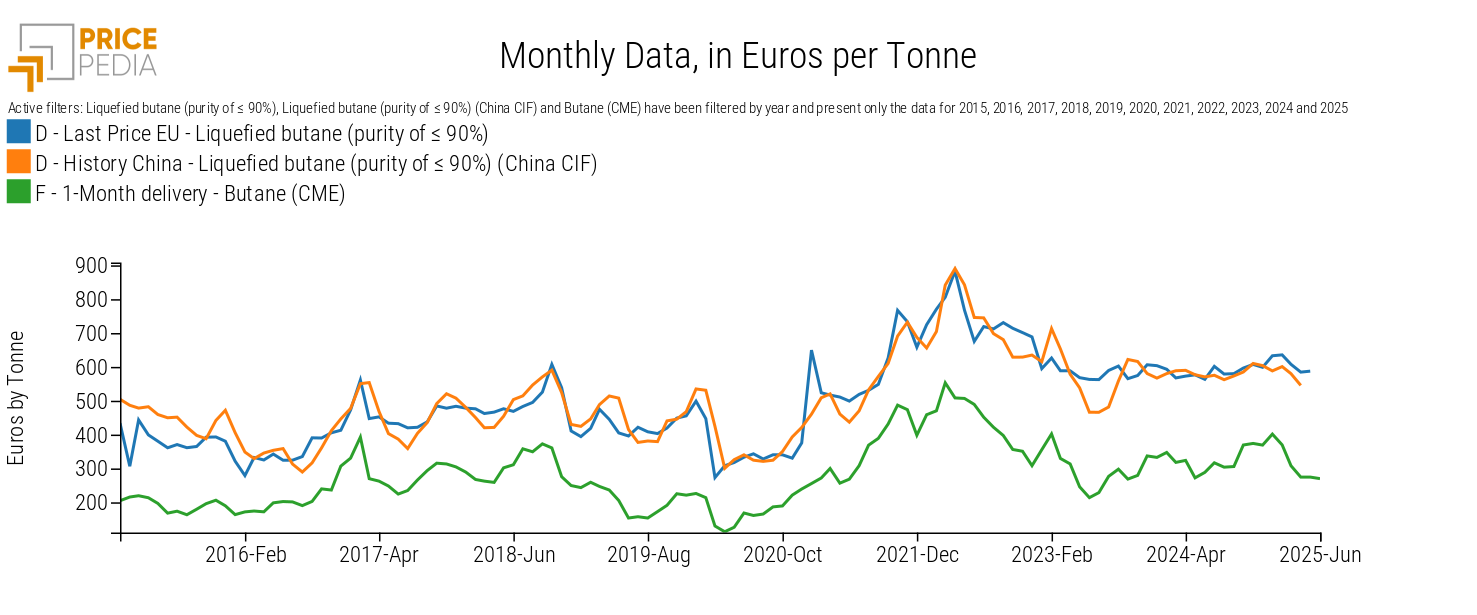

Comparison of Butane Prices

A VECM allows for the estimation of long-run equilibrium relationships between endogenous variables, known as cointegration relationships, and the analysis of short-run adjustment mechanisms through which each variable responds to deviations from these equilibria.

In other words, it is a bit like observing a system of weights connected by springs: the VECM tells us which springs keep the weights in balance and which weights move to return to their initial position when one is displaced.

VECM Results

Effect of Exogenous Variables on Butane Prices

Before analyzing the equilibrium relationships between prices in different markets, it is useful to consider the effect of the exogenous variables.

The table below shows the elasticities of the three butane prices with respect to Brent and the seasonal dummy:

| Butane Prices | Brent | Seasonal Dummy |

|---|---|---|

| Europe | 0.29 | 0.04 |

| China | 0.19 | 0.04 |

| CME | 0.26 | 0.06 |

All parameters are highly significant, indicating that both the Brent price and winter seasonality have a direct and positive impact on butane prices across all markets considered.

The coefficients shown above measure the short-run effect of a change in the exogenous variables on the change in butane prices in the three markets. For example, a 1% increase in Brent leads to a 0.29% increase in the European butane price, in the short run.

The key takeaways are:

- Brent is a fundamental driver in all markets;

- Winter seasonality has significant effects on all three prices, with the largest impact on CME;

- The estimated elasticities are interpretable as short-run elasticities with respect to the exogenous variables.

Long-Run Relationship Parameters

During estimation, a total of two long-run relationships among the analyzed prices was imposed.[1]

The two identified relationships describe equilibrium links between the different butane markets:

- The first relationship connects the butane price in Europe with the financial butane price quoted at the CME. This relationship has a strength of 0.37 in terms of elasticity between the European price and the CME price. In other words, a 1% increase in the CME price is associated with a 0.37% increase in the European price in the long run. (Conversely, if expressed as an inverse elasticity, the strength is 1/0.37 ≈ 2.71).

- The second relationship connects the butane price in China with the CME price. Here, the elasticity is 0.14: a 1% increase in CME results in a 0.14% increase in the Chinese price in the long run. (In inverse form, the elasticity is 7.14).

These relationships represent the equilibrium that tends to persist across the markets in the long run: if prices deviate too much from these proportions, adjustment mechanisms bring the system back toward equilibrium.

Speed of Adjustment Coefficients

The most interesting aspect of estimating the VECM model is its ability to extract from the data information on which prices adjust primarily to restore equilibrium in the two long-run relationships that link the markets. The highly significant estimation results indicate that:

- In the long-run relationship linking the EU price with the CME price, it is the EU price that adjusts, and it does so quite rapidly, with a coefficient of 0.5.

- In the long-run relationship connecting the China price to the CME price, both prices adjust to restore equilibrium, but the CME price adjusts faster than the Chinese price (0.59 vs. 0.33).

Comparison Between the Two Models: Economic and Statistical

Estimating the relationships in the global butane market using two different approaches allows for a comparative analysis that highlights both the points of consistency and any differences.

Similarities

- The importance of Brent and its "exogeneity" in determining the global butane price.

- The existence of strong long-run relationships linking the physical prices in the EU and China with the financial price quoted at the CME in the US.

- The Chinese price appears to be less connected to global financial dynamics compared to the European price, indicating a certain "isolation" of the Chinese butane market.

Differences

- In the economic model, a causal relationship between the financial CME price and the physical prices in the EU and China was imposed a priori. This relationship, although not imposed, is confirmed by the statistical model, with some differences in magnitude.

- In the economic model, Brent had no (surprisingly) significant effect on the Chinese butane price. This was disproven by the statistical model, which correctly confirms the importance of oil in determining the butane price in China as well.

- Lastly, the statistical model includes a dummy variable that captures the seasonality of butane prices.

Summary

This article has described the results of a VECM used to analyze the relationships between two regional physical butane prices (Europe and China) and a financial price quoted at the CME. The results are highly significant and indicate the existence of two long-run relationships among these markets, along with key effects from the two exogenous variables.

We also compared these results with those of a model based on an economic approach, applied to the same global butane market and the same prices. The economic interpretation of the results is broadly consistent between the two approaches, with one important difference in the method: in the economic model, cause-and-effect relationships between prices were, in fact, assumed a priori.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

[1] Johansen cointegration rank tests suggest three relationships, but this would make the model economically meaningless (implying that the time series of butane prices are stationary).