The world butane market

An economic interpretation of the relationships between regional physical prices and financial prices

Published by Edoardo Pace. .

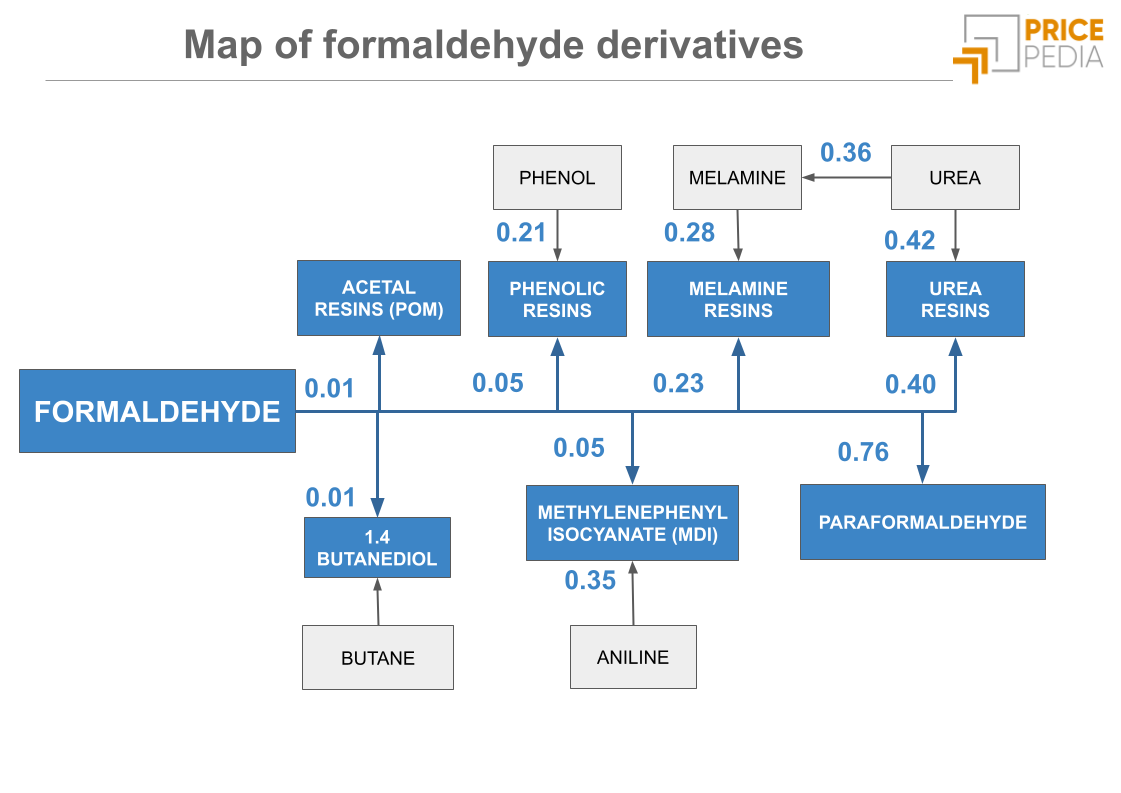

Organic Chemicals Analysis tools and methodologiesAmong petroleum derivatives, butane is one of the least considered and relevant from a purely commercial standpoint. Rarely, in fact, are decisions on how much oil to distill or gas to extract made based on butane. Therefore, butane can be considered a by-product, whose supply is primarily influenced by decisions made for the production of other petroleum derivatives (such as diesel or methane).

Nonetheless, butane has several important industrial applications: when combined with propane, it constitutes a fundamental component of LPG (Liquefied Petroleum Gas), and it is also the raw material from which the petrochemical industry derives butene and butadiene—two essential feedstocks for the production of plastics and elastomers. Finally, it is used in the production of alternatives to CFC gases, including as a propellant in aerosol products.

The demand for butane is characterized by high price elasticity, due to the availability of numerous technical substitutes usable in different industrial processes. Under these conditions, the forces determining the market price tend to be unstable, leading to significant price fluctuations.

Thanks to a liquefaction point just below zero, butane can be easily liquefied and therefore transported. This facilitates integration between geographically distant markets, putting North America in competition with Europe and the CJK region (China, Japan, South Korea).

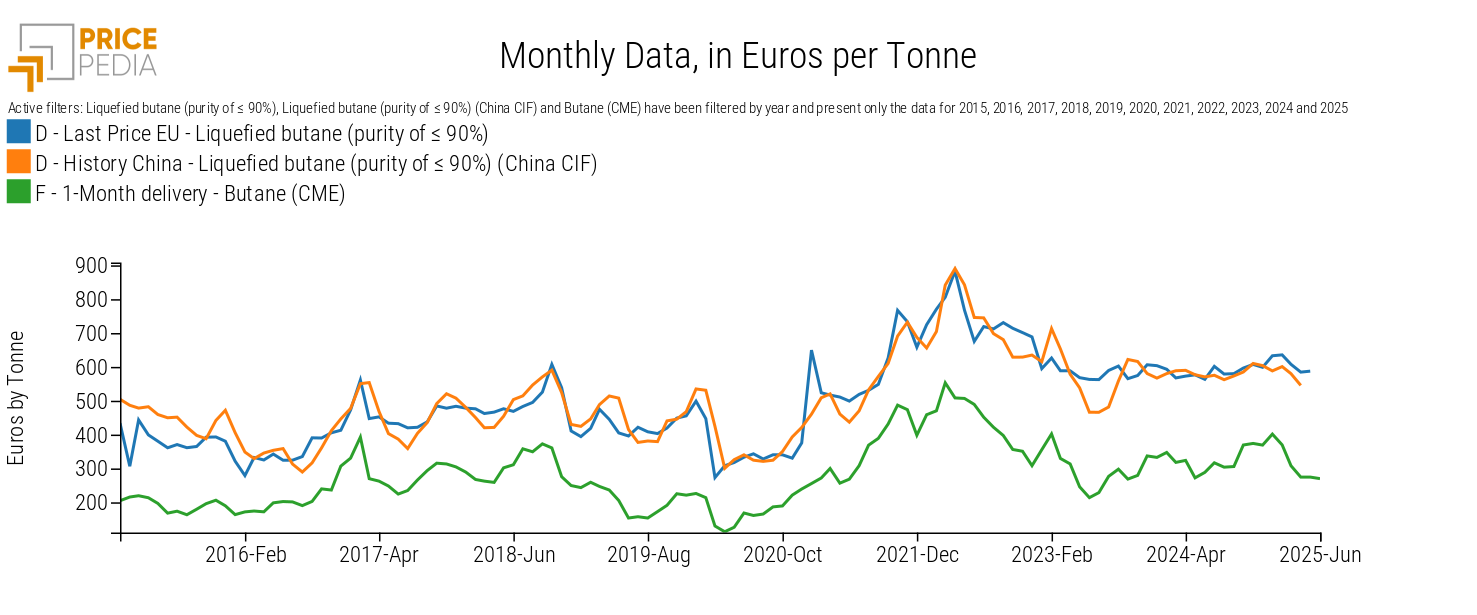

Comparison of Butane Prices

Butane futures are traded on the Chicago Mercantile Exchange (CME), making butane prices sensitive to financial market sentiment as well.

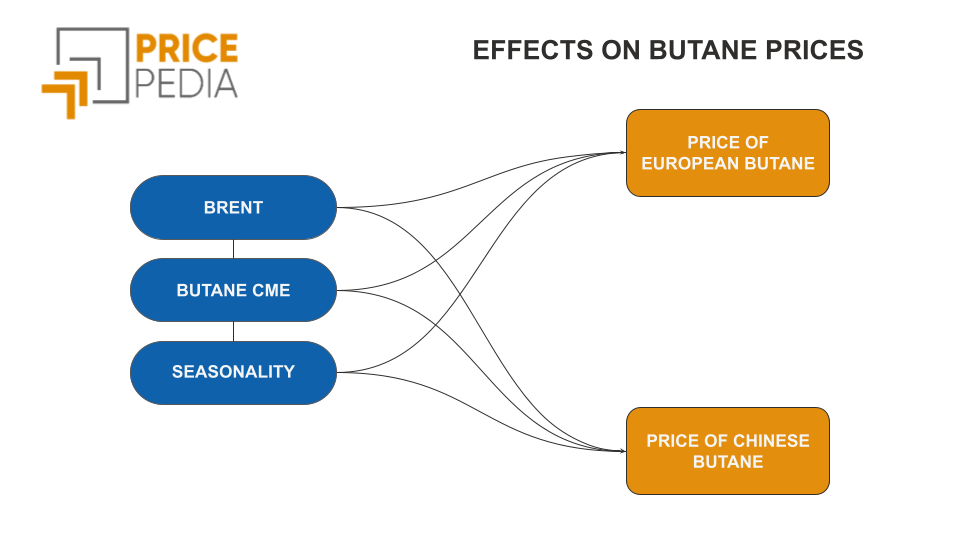

When considering the price of butane imported into the EU and involved in intra-community trade (EU customs price), it is highly correlated with the price of oil, CME butane quotations, and the CIF price of Chinese imports. Conversely, the same holds true for China’s CIF import prices.

In other words, the butane prices monitored by PricePedia are highly interconnected, suggesting that a joint analysis of these values can be very effective in studying price dynamics and their interrelationships, both past and future.

In general, the analysis of relationships among a set of prices can be approached through a statistical method (e.g., using a VECM model), or through an economic approach, in which the relationships are specified based on theoretical and economic analysis, and statistics are used only to estimate the parameters that characterize such relationships. The analysis presented in this article follows the latter approach.

Long-Run and Short-Run Relationships

In the case under analysis, the economic literature suggests the existence of two types of relationships between prices and their determinants: one long-run and one short-run. The long-run relationship is defined in terms of levels, without including dynamic components, which instead characterize the short-run equation.

For the latter, the literature widely uses a model known as the ECM (Error Correction Mechanism). Based on this model, and given the long-run equilibrium conditions, short-run variations can be expressed as the result of two components:

- a shock component, represented by changes in equilibrium values;

- an adjustment component, i.e., the forces that tend to reduce the gap between actual and equilibrium values.

Formally, the model is generally represented as:

- \(\Delta\) is the delta operator (variation),

- \(Y\) represents the actual variable,

- \(Y^*\) represents equilibrium values,

- \(A\) is a constant,

- \(K_1\) is the coefficient measuring the shock effect,

- \(K_2\) is the coefficient measuring the adjustment speed, i.e., the tendency of the actual variable to converge toward the equilibrium value.

Long-Run Equation Results

The existence of multiple statistically significant long-run relationships among the various butane prices and their determinants reveals a collinearity problem among the regressors.[1]

To address this issue, we opted to estimate multiple long-run equations, aware that this introduces another risk: the possibility of equation misspecification. However, for our purposes, this second issue is less critical than the problem of multicollinearity among the regressors.

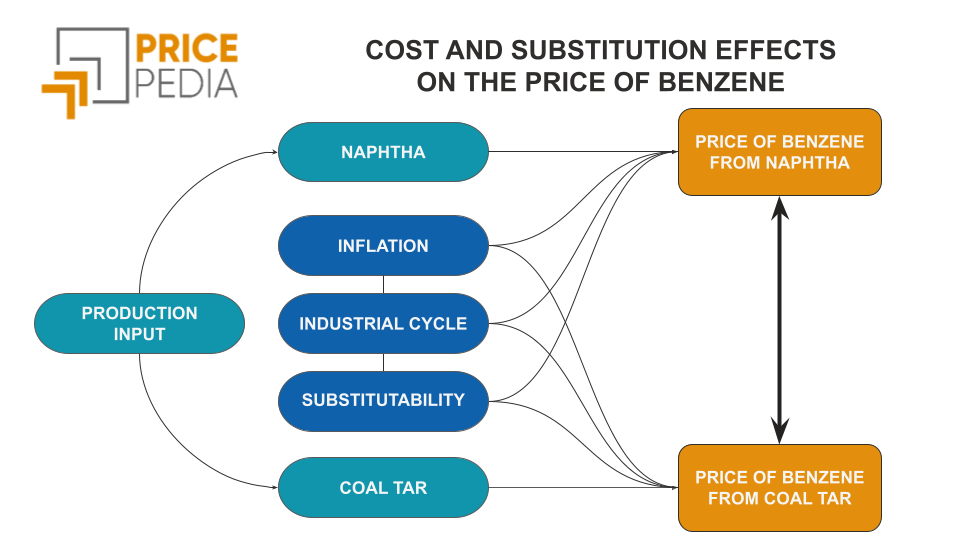

For both the EU customs price and China’s CIF import price, it was possible to identify three different long-run equations:

- Cost equation: the physical price of butane is explained by the Brent oil price.

- Financial equation: the physical price of butane is a function of the financial price quoted on the CME.

- Substitution equation: the physical price of butane in a given world region depends on butane prices in another region.

Estimation Results of the Long-Run Equations

| Effects | EU Custom Price | China CIF Price |

|---|---|---|

| Cost effects | 0.769 | 0.690 |

| Financial effects | 0.694 | 0.618 |

| Substitution effects | 0.982 | 0.820 |

Given the presence of cointegration among the considered variables, all relationships were estimated using simple linear regression (OLS). All coefficients are highly statistically significant.

The equilibrium relationships show that the European butane price is strongly associated with both production costs—represented by Brent oil—and alternative and international markets. The European price also effectively explains the Chinese price, highlighting a bidirectional link. Finally, the CME quotation proves relevant in both cases.

The Short-Run Relationship

We estimated short-run equations for both the EU customs price and the China CIF price, combining all shock and adjustment components derived from the long-run relationships. The table below reports the estimation results, including coefficients (K1, K2) and the corresponding t-statistics.

I risultati delle stime delle equazioni di lungo periodo

| Variabile | Cost Facor | Financial Factor | Substitution Factor | |||

|---|---|---|---|---|---|---|

| K1 | K2 | K1 | K2 | K1 | K2 | |

| EU Customs – Value | 0.34 | 0.19 | 0.33 | 0.20 | 0.23 | 0.16 |

| EU Customs – T-student | 2.04 | 2.63 | 2.44 | 3.33 | 1.72 | 1.49 |

| China CIF – Valore | 0.12 | 0.04 | 0.32 | 0.16 | 0.16 | 0.18 |

| China CIF – T-student | 0.81 | 0.51 | 2.97 | 1.99 | 1.61 | 1.86 |

| K1=shock, K2= speed of adjustment | ||||||

For the EU customs price, all factors have a significant influence:

- The cost factor shows a positive shock (K1 = 0.34, t = 2.04) and a consistent adjustment mechanism (K2 = 0.19, t = 2.63), indicating responsiveness to Brent price fluctuations.

- The financial factor (CME) is also relevant, with a shock (K1 = 0.33, t = 2.44) and an even stronger adjustment (K2 = 0.20, t = 3.33).

- The substitution factor also contributes, albeit to a lesser extent, with a shock of 0.23 (t = 1.72) and an adjustment of 0.16 (t = 1.49), slightly less significant but still indicative of some market integration.

- The cost factor has weak and non-significant effects (t = 0.81 and 0.51), suggesting, surprisingly, a low direct sensitivity to Brent.

- In contrast, the financial factor shows a strong shock (K1 = 0.32, t = 2.97) and a significant adjustment (K2 = 0.16, t = 1.99), confirming the role of CME in the Chinese market as well.

- The substitution factor is also active, with a shock (K1 = 0.16, t = 1.61) and adjustment (K2 = 0.18, t = 1.86), indicating some convergence of the Chinese price toward the European one.

Conclusions

The existence of strong relationships between regional butane prices, the financial price quoted on the CME, and the Brent oil price suggests the usefulness of jointly considering all this information to effectively monitor butane price dynamics and predict future developments.

To this end, two distinct approaches are possible. The first, a statistical approach, prioritizes quantitative data analysis. The second, an economic approach, starts from the theoretical definition of economic relationships and uses statistical tools to estimate the relevant parameters.

This article has followed the second approach, aiming not only for effective use of data but also for the economic interpretation of the results obtained. This has allowed us to highlight three main conclusions:

- The butane market has a global dimension: prices in different world regions influence each other.

- Butane futures prices quoted on the CME play a significant role as a global benchmark.

- The Brent oil price has a significant effect on the EU customs price of butane, while it is relatively insignificant for China’s CIF price.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

[1] If the regressors are highly correlated, parameter estimates may become very unstable or even incalculable.