The EU attempts to defend itself from Chinese vanillin dumping

131.1% duties on EU imports of vanillin from China

Published by Pasquale Marzano. .

Food Price DriversOn June 12, the European Commission adopted a definitive anti-dumping duty of 131.1% on imports of vanillin from China[1]. This definitive measure follows the investigation launched in May 2024 at the request of Syensqo, a Belgian multinational active in the specialty chemicals sector, which produces about 98% of total vanillin output in Europe.

Vanillin is the chemical compound responsible for the characteristic vanilla aroma. It is predominantly synthetically produced and used for over 80% in the food sector-in flavors and seasonings-with the remainder employed in cosmetics (as a fragrance in perfumes), the pharmaceutical industry, and other industrial sectors.

The basic chemical, physical, and technical characteristics do not differ between the synthetic product (including ethylvanillin, also covered by the EU's anti-dumping measures) and the natural one.

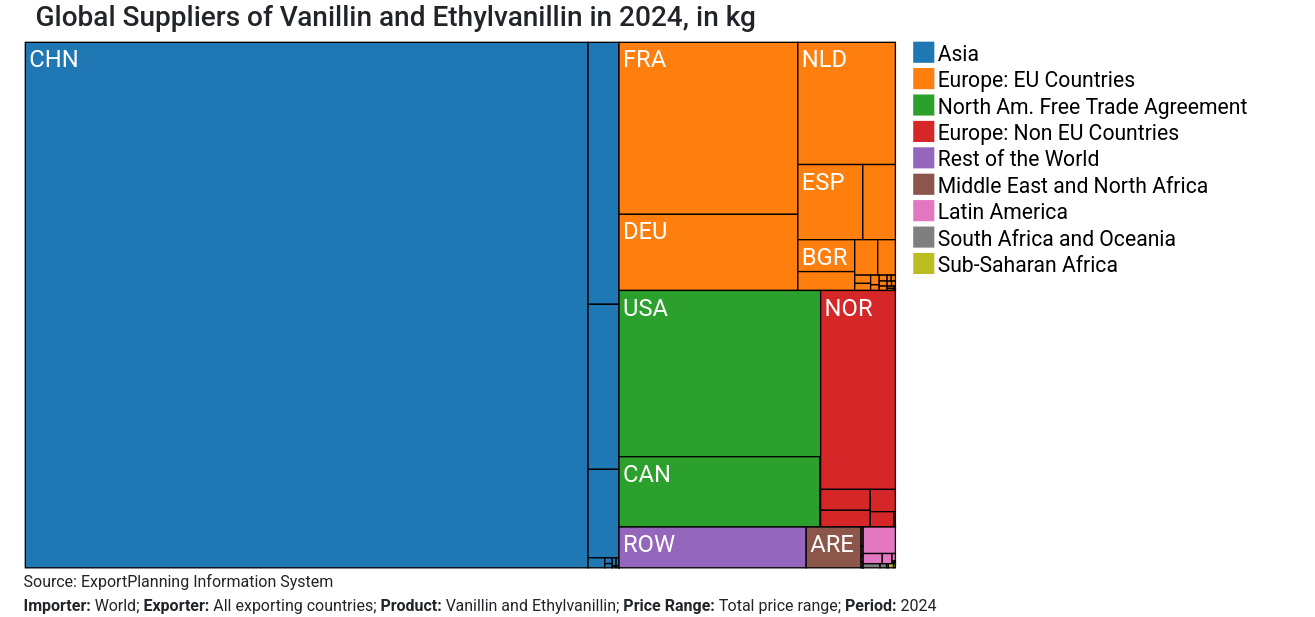

China, the country targeted by the anti-dumping duties, is the world's largest producer and exporter of vanillin and ethylvanillin, as shown in the chart below (source: ExportPlanning).

Global Suppliers of Vanillin and Ethylvanillin in 2024, in kg

In 2024, Chinese exports exceeded 24 million kg globally, almost ten times the volume exported by the second and third largest suppliers, the USA and France, who each barely surpassed 2.5 million kg.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

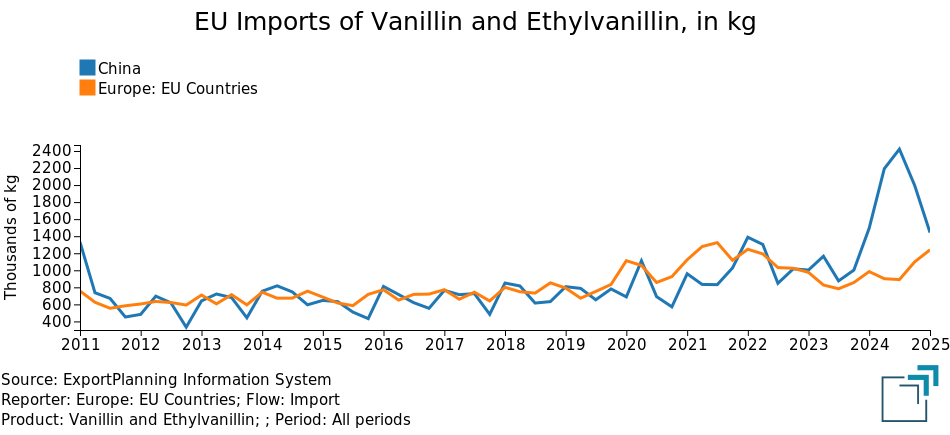

Over the past two years, China has also played a dominant role in the EU market. The chart below shows the quarterly trend of EU imports of vanillin and ethylvanillin from EU member countries and from China.

EU Imports of Vanillin and Ethylvanillin, in kg

From 2011 to 2022, the import dynamics and levels from the two areas were quite similar, with Chinese imports never significantly exceeding those from EU member states.

Starting from Q1 2023, imports from China began to rise, peaking in Q3 2024 at nearly three times the volume of intra-EU trade.

According to the Commission's investigation, during a period when European production costs were rising, the arrival of low-cost Chinese vanillin led the EU industry to cut production and reduce its sales within the European market.

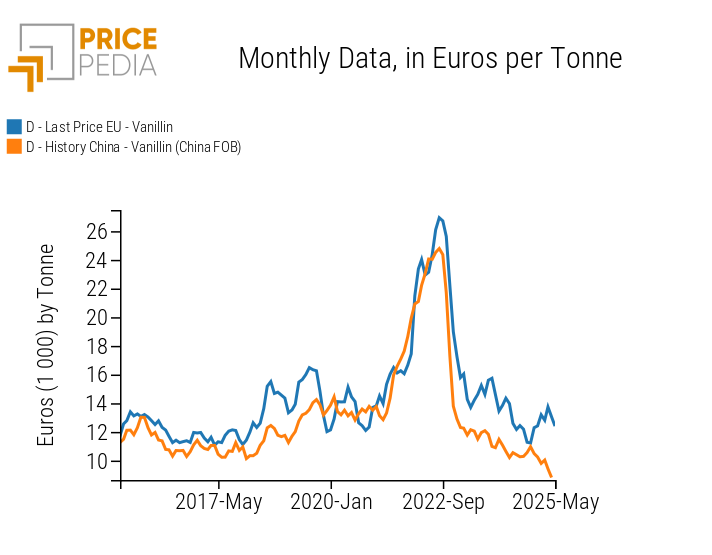

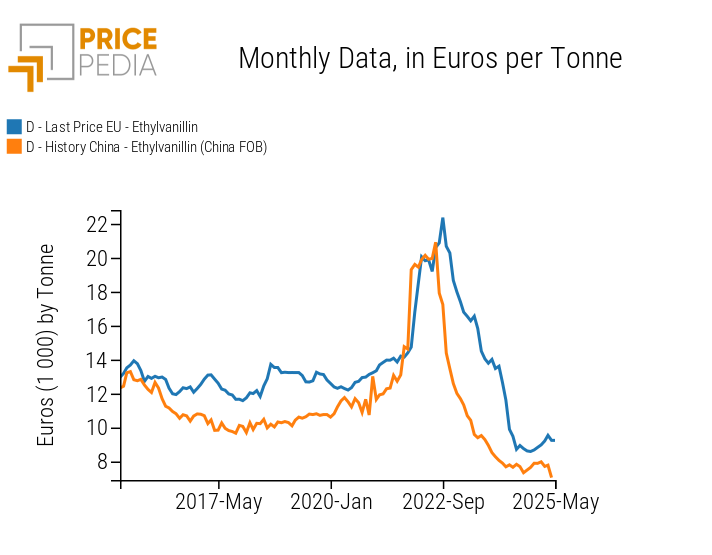

The effects of China's aggressive pricing policy[2] on European prices are illustrated in the following charts, which compare EU vanillin and ethylvanillin prices with Chinese export prices-representative of the sales prices of Chinese firms in international markets.

Europe vs. China: Price Comparison

Vanillin

Ethylvanillin

In the case of vanillin, up until the second half of 2022, prices in the two markets were generally very similar. Starting from late 2022, Chinese prices showed a sharp decline, progressively diverging from European prices. This drop pushed EU prices downward due to increased imports of Chinese vanillin. The total decline over 2023-2024 was similar in both markets: -53% in Europe versus -56% in China. This brought market prices in both regions well below their pre-COVID levels.

A similar trend can be observed for ethylvanillin, where the EU market price dropped by 58%, compared to a 67% drop in Chinese export prices.

Conclusions

The European Commission has recently confirmed China's dumping practices in the EU vanillin market and implemented measures aimed at protecting the European industry. Ceteris paribus, these measures will support EU producers by preventing further price declines caused by Chinese overcapacity.

1. Regulation (EU) 2025/1151 establishing definitive anti-dumping duties on imports of vanillin and ethylvanillin from China.

2. The Commission's investigation, reported in the regulation cited above, highlighted how the vanillin market is subject to overcapacity and systemic distortions, including government control over production input and energy prices by Beijing.