Monthly commodity prices update for May 2025

European prices under downward pressure

Published by Pasquale Marzano. .

EU Customs Global Economic TrendsThe May 2025 update of PricePedia's monthly commodity prices has been published. Overall, prices in euros recorded a slight month-on-month decline, of nearly half a percentage point, continuing the downward trend that began in February of this year.

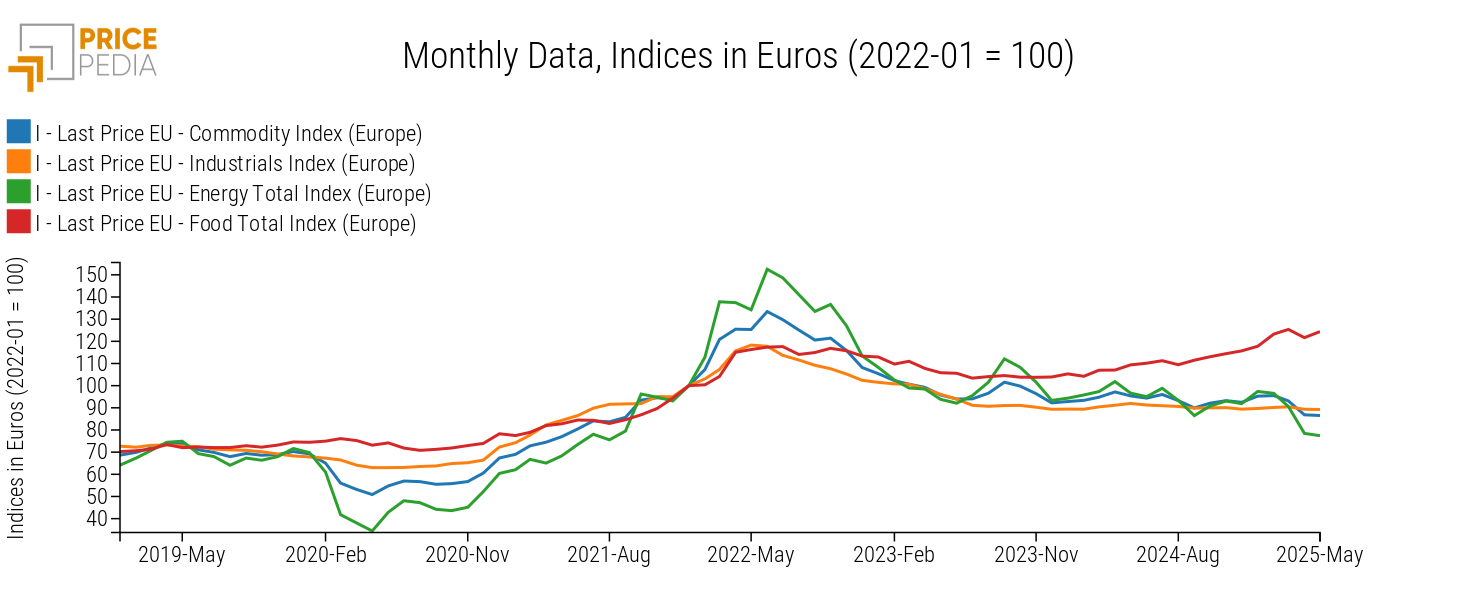

The following chart shows the price trends in euros of raw materials related to the European market for the main PricePedia aggregates: Total Commodity[1], Industrials[2], Energy, and Food, indexed to 100 as of January 2022.

On a monthly basis, only Food commodities showed growth in May, rising by more than +2%, driven by increases in tropical goods quotations.

Meanwhile, the decline in energy commodity prices continues (-1.3%), influenced by the drop in oil prices.

As for core industrial commodities, while monthly prices remained essentially stable (-0.1% in May), year-on-year they show a decrease of about -3% compared to May 2024 levels, reflecting the weakness of the global economic environment and, consequently, the deterioration in global demand for raw materials over the first few months of the year.

Industrial commodity prices in May 2025

In this context of weakness, it may be useful to examine the performance of individual categories that make up the PricePedia Industrial index.

To this end, the following chart shows the year-on-year price changes in euros in May 2025 compared to the same month last year.

Chart 3: May 2025, % change in euros compared to May 2024

Source: PricePedia

Compared to the previous 12 months, prices in the chemical sector increased by 4-6%, particularly in the Pharmaceutical, Specialty Chemicals (including fertilizers, pigments, and tanning products), and Inorganic Chemicals categories.

In contrast, Organic Chemical prices trended downward, falling by -6% compared to May 2024 levels.

Among the other core industrial categories, price declines of varying magnitude were recorded: the sharpest drop, around -8%, was seen in Ferrous metals, affected by global oversupply and, along with aluminum, by protectionist measures from the U.S. administration. It is also noteworthy the year-on-year decline in prices of Non-Ferrous metals, Plastics and Elastomers, and Textile Fibers, averaging -2.6%. The decline in the Wood and Paper category was less pronounced, at -1.3%.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Among the categories that have experienced price declines over the past year, one contributing factor is certainly the downward pressure from the Chinese market, which continues to grow below expectations (see the latest developments described in the article China drives commodity prices downward). The table below compares the annual changes in European prices and Chinese FOB prices (representing Chinese export prices on international markets) for the same aggregated indices.

Table 1: Europe vs China. Annual variation rates (%) of aggregated PricePedia indices in euros

| 2023 | 2024 | 2025* | |

|---|---|---|---|

| I-Last Price EU-Ferrous Metals Total Index (Europe) | −15.04 | −7.48 | −5.40 |

| I-History China FOB-Ferrous Metals Total Index (China) | −21.98 | −14.38 | −7.74 |

| I-Last Price EU-Textile Fibers Total Index (Europe) | −6.56 | −4.50 | −2.70 |

| I-History China FOB-Textile Fibers Total Index (China) | −16.27 | −6.40 | −7.97 |

| I-Last Price EU-Organic Chemicals Total Index (Europe) | −18.11 | −2.95 | −2.04 |

| I-History China FOB-Organic Chemicals Total Index (China) | −24.93 | −6.95 | −4.42 |

| I-Last Price EU-Plastics and Elastomers Total Index (Europe) | −16.19 | −3.82 | −0.71 |

| I-History China FOB-Plastics and Elastomers Total Index (China) | −21.61 | −7.52 | −2.54 |

| * average of the period January-May | |||

On average over the first months of 2025, Chinese prices show more pronounced declines than their European counterparts. This dynamic, already underway since 2023, is forcing European companies to navigate an international context of steadily falling prices, which in turn is exerting downward pressure on commodity prices traded within Europe.

1. The PricePedia Commodity index is the aggregation of Industrials, Food and Energy indices.

2. The PricePedia Industrials index is the aggregation of indices related to the following categories: Ferrous Metals, Non-Ferrous Metals, Wood and Paper, Pharmaceutical Chemicals, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers, and Textile Fibers.