Tensions in the Global Sulfur Market and Impacts on the Chemical Supply Chain

Low Sulfuric Acid Prices Mitigate the Effects of the Sulfur Price Cycle on Derivatives

Published by Luigi Bidoia. .

Sulphuric acid industry Cost pass-through

In the first four months of 2025, the EU customs price of sulfur (in euros) increased by 32% compared to the 2024 average. This surge is not limited to the European market: sulfur prices have recorded even sharper increases in imports to China, highlighting a global upward trend.

Industry players attribute these price hikes mainly to stronger demand, particularly from the agrochemical sector, and a relative shortage in supply. However, these explanations appear somewhat weak, especially concerning the actual growth in demand.

Although sulfur and its main derivative, sulfuric acid, are often considered low-value products — typically by-products of other industrial processes — a deeper analysis of this market is worthwhile. Understanding how price fluctuations in sulfur and sulfuric acid affect the costs of chemical derivatives can offer valuable insights into the evolution of the entire supply chain.

Demand-Side Indicators

Sulfur is at the core of a complex chemical industry that produces compounds used both in agriculture and across various industrial sectors. Its overall demand is therefore the result of two components: the first linked to fertilizer demand in agriculture, and the second tied to the global industrial cycle. Since the available data regarding the industrial factor consistently indicate a continuation of the weakness observed throughout last year into the first half of 2025, the hypothesis of a significant increase in demand must be based on growth in agricultural usage.

On the agricultural front, short-term market data is more limited. However, it is possible to gather some insights by analyzing the price trends of two other chemical products highly influenced by fertilizer demand: calcium phosphate and potassium chloride.

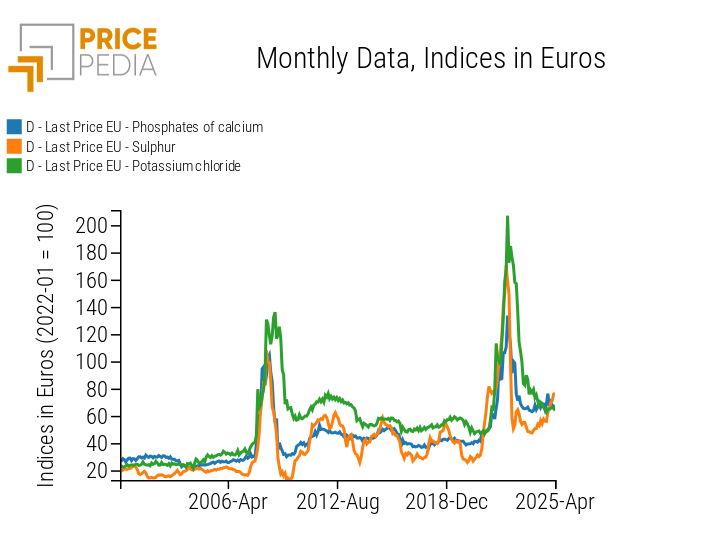

In the following chart, the price trend of sulfur is compared with those of these two products.

Comparison of prices of basic fertilizer chemicals

The analysis of the data presented in the chart highlights several key points:

- All three prices analyzed have experienced two particularly sharp upward phases in this century, signaling significant imbalances between supply and demand. The first occurred between late 2007 and early 2008, when China imposed export duties on fertilizers — initially at 35% (January) and then increased to 135% (May) — to ensure domestic supply and contain food inflation. This policy reduced the global supply of fertilizers, prompting other countries to ramp up production and increasing demand for basic elements such as sulfur. The second major surge happened between the second half of 2021 and the first half of 2022, again with China playing a key role: first by limiting fertilizer exports to protect domestic agricultural production, and later by further reducing exports due to strict lockdown measures implemented in early 2022.

- Sulfur prices are characterized by higher volatility. In addition to the two major price cycles of 2008 and 2021-2022, sulfur has experienced several other significant price swings, with annual increases sometimes exceeding 50%.

If there were a significant increase in demand from the agrochemical sector, we would also expect to see signs of a price recovery for calcium phosphate and potassium chloride. However, the stability—or even downward trend—of these two prices raises doubts about the hypothesis of an ongoing phase of strong growth in fertilizer demand.

Supply-Side Indicators

Today, sulfur is primarily produced by recovering sulfur dioxide (SO₂) and hydrogen sulfide (H₂S), generated respectively in the early processing stages of many non-ferrous minerals and during the desulfurization processes of oil and natural gas.

Its supply is therefore closely linked to the production decisions of the non-ferrous metals mining industry and the oil sector. Although precise data on the current activity levels of these two industries worldwide are lacking, global economic indicators suggest that both sectors may be experiencing a phase of reduced activity.

It is thus plausible to interpret the current increase in sulfur prices as the result of a slight contraction in supply, while global demand remains at normal levels.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Effects on Sulfur Prices

If the assumptions regarding global sulfur demand and supply are correct, the current sulfur price cycle is not at all comparable to those of 2008 and 2021-2022. Instead, it appears more similar to the mini-cycles recorded in 2011, 2015, and 2018.

In April 2025, the EU customs price of sulfur stood at 167 euros per ton, over 40% higher than the average price in 2019. Information from the Chinese market (where prices have increased even more than in Europe) indicates that buyers tend to limit inventories rather than increase them, as current price levels are considered unsustainable not only in the medium term but also in the short term.

In this scenario, it is likely that EU sulfur prices will decline in the coming months. According to the PricePedia forecast of May 2025, prices are expected to fall below 150 euros per ton in the second half of 2025 and stabilize between 130 and 140 euros per ton in the following months.

Effects on Derivative Prices

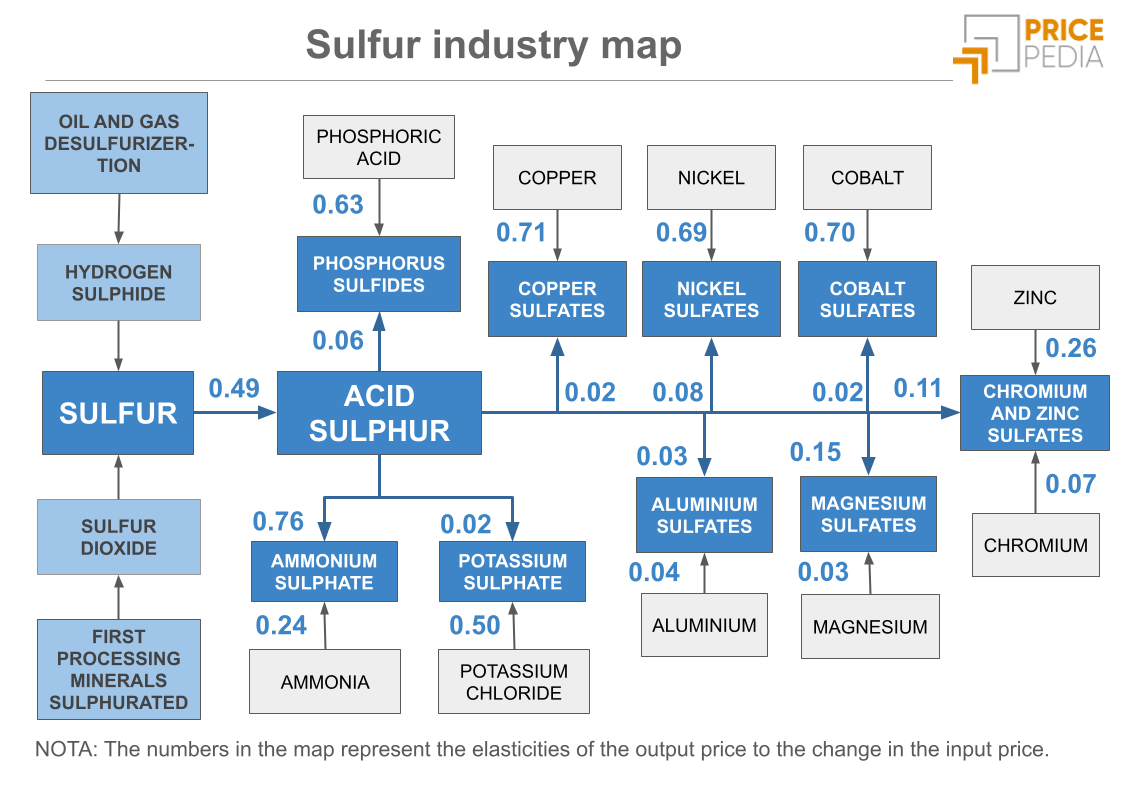

To assess how the current increase in sulfur prices might translate into higher prices for its derivatives, the following map is useful. It illustrates the supply chain relationships between sulfur and its derivatives, highlighting the central role of sulfuric acid in various industrial processes. The numerical values shown in the map indicate the price elasticity of these compounds with respect to changes in sulfuric acid prices, allowing for an evaluation of how such variations influence derivative product prices.

The elasticity linking changes in sulfuric acid prices to sulfur prices is moderate, at 0.47. This value is consistent with the share of sulfur costs in the total production costs of sulfuric acid and with the quantity of sulfur (less than 0.4 kg) required to produce one kilogram of sulfuric acid. Excluding the high elasticity between sulfuric acid and ammonium sulfate prices (0.76), in all other cases, the elasticity is very low, in some cases approaching zero. These low elasticities align with the generally limited impact of sulfuric acid prices on overall cost structures, with the only significant exception being ammonium sulfate.

Summary

In recent months, sulfur prices have experienced significant growth across the global market, including Europe. These increases represent a typical phase of short-term price cycles that characterize the global sulfur market.

The current price level (167 euros per ton) and historical trends suggest a likely decline in the coming months, with prices expected to return to the 130-140 euros per ton range during 2026.

Sulfur and its main derivative, sulfuric acid, have very limited effects on the prices of downstream products due to the low impact of sulfuric acid costs on production processes. It is therefore likely that the effects of this brief sulfur price cycle will go largely unnoticed by companies purchasing the many chemical compounds that involve sulfuric acid in their production.