Milk: a case study of market contamination?

How price benchmarks across regions are interconnected

Published by Pasquale Marzano. .

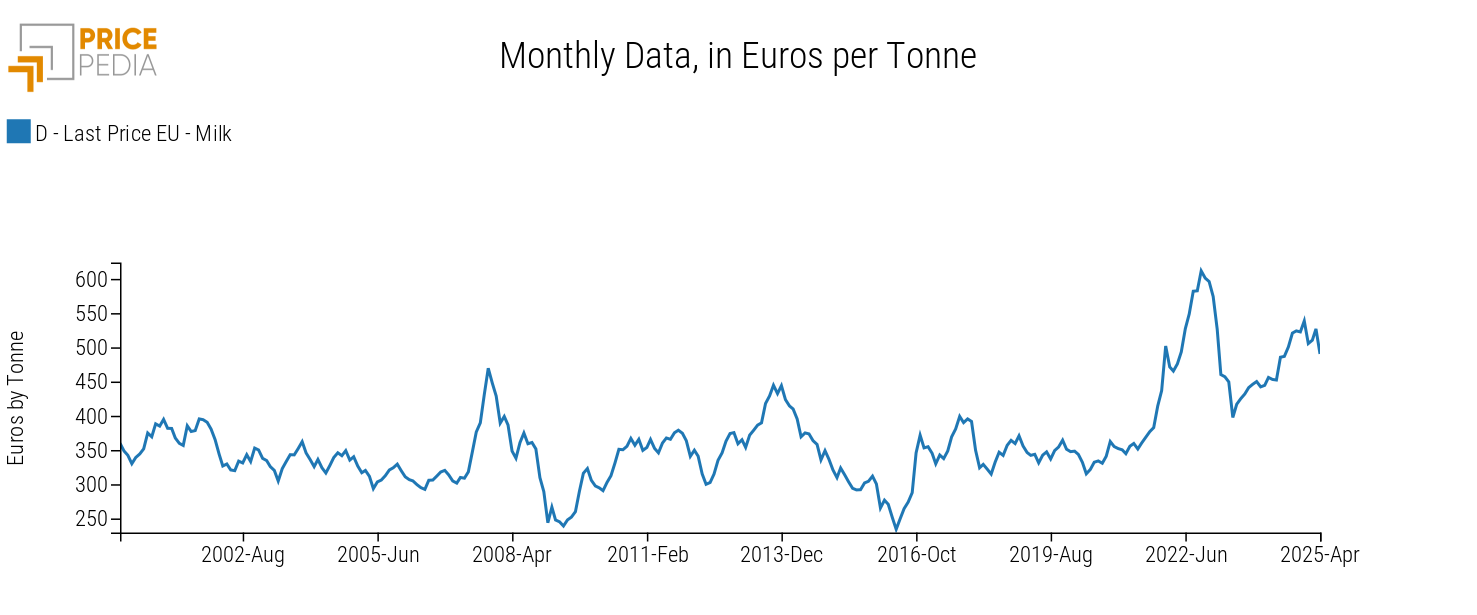

Food Milk Price DriversStarting in 2021, the price of milk in the European market saw sharp increases, reaching all-time highs within a few months and exceeding €610 per ton. After a downward trend in the first half of 2023, prices resumed their upward trajectory and are currently stabilizing at levels slightly below the historical peaks of the last quarter of 2022, around €500 per ton.

The chart below shows the trend of the European milk price based on customs data, expressed in euros per ton.

European Milk Price, in € per Ton

Due to its commodity nature, the milk market is regionalized at the international level. This product, especially fresh milk, is perishable, making its trade with geographically distant areas more complex.

This explains the prevalence of intra-area trade, although extra-area flows are not entirely absent. Certain milk processing methods allow for longer preservation, such as in the case of powdered milk.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

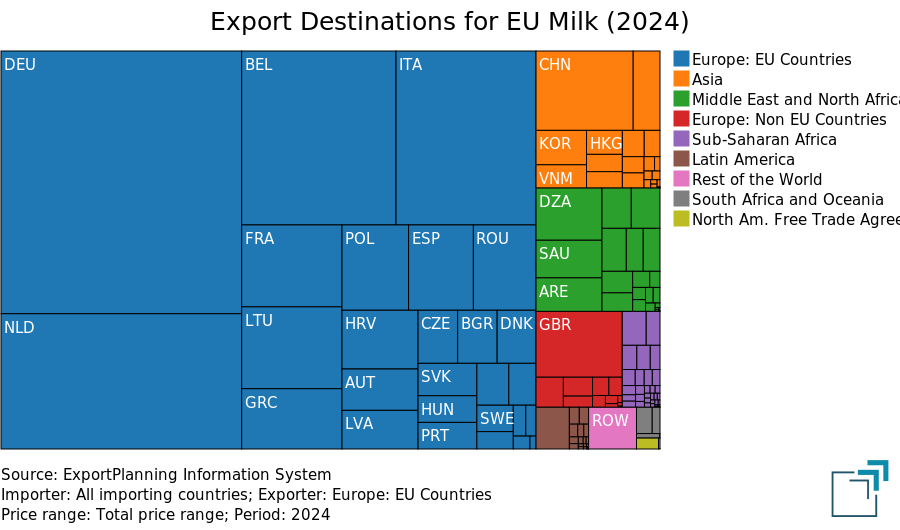

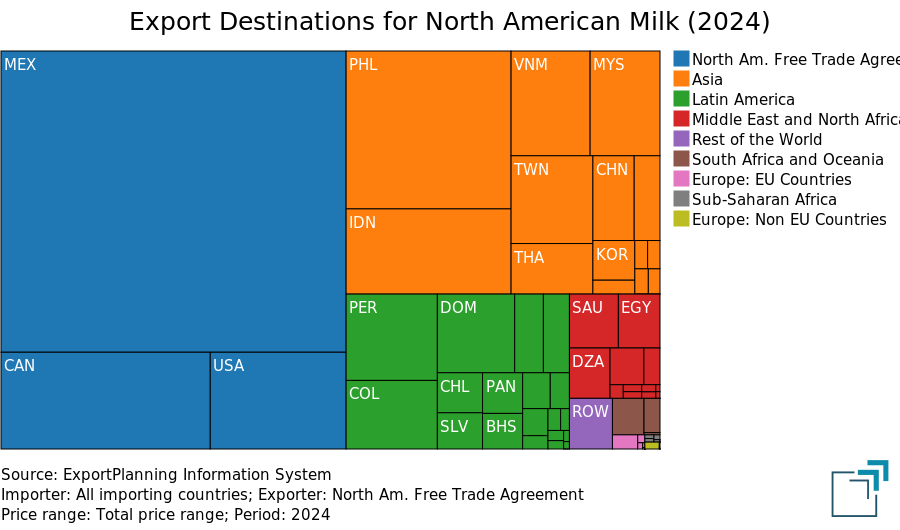

The following charts show the 2024 export destinations for milk from the EU and from North America, both among the world's leading producers (source: ExportPlanning).

Milk Export Destinations in 2024 by Origin

EU Origin

North American Origin

In 2024, the EU exported over 10 million tons of milk globally. About 84% of total EU exports were absorbed by its member states. Trade with various geographic areas is nonetheless present: the second-largest destination for EU exports was Asia (7%), followed by the MENA region (6%).

In the case of North America, milk exports reached nearly one million tons, with intra-area trade accounting for around 50% of the total. Compared to the EU, a higher percentage share went to the Asian market (28%).

From the two graphs it is also worth noting the near-total absence of trade between the EU and North America.

Contamination between prices via export markets?

The lack of a "physical" connection between the two markets should imply a lack of correlation between EU and North American prices. However, a significant correlation between the two price areas can be observed.

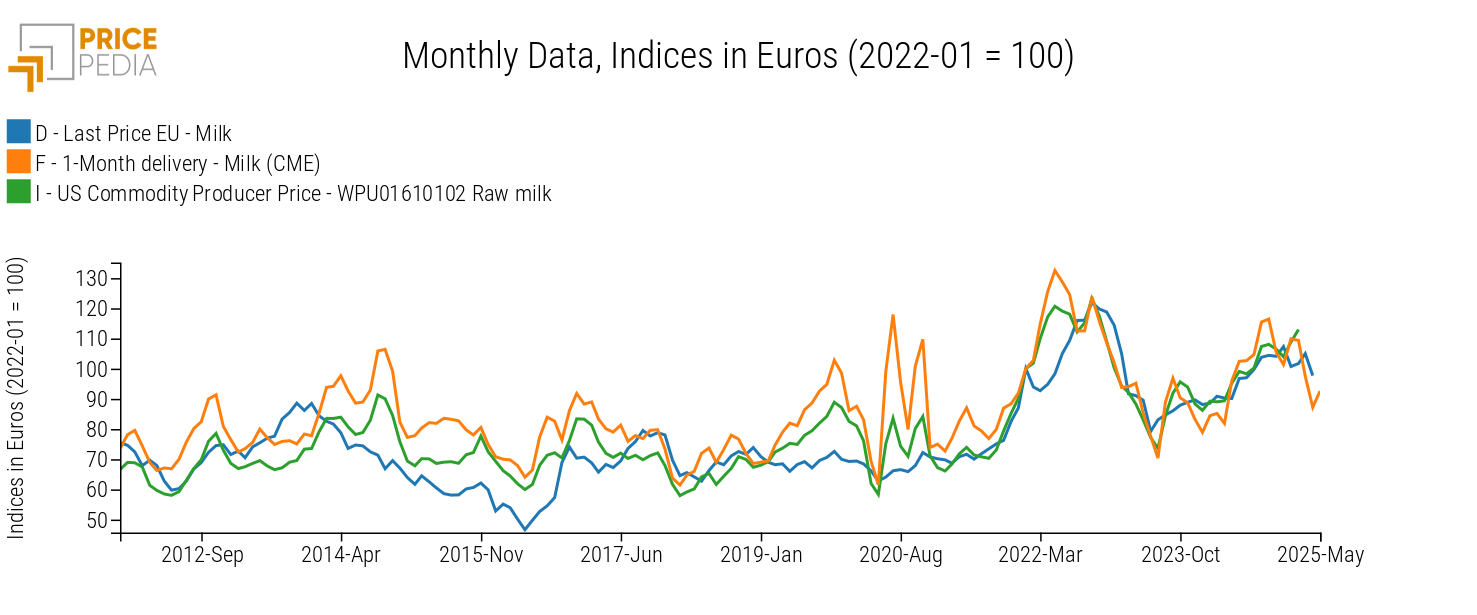

The chart below shows the EU milk price based on customs data, the CME financial benchmark, and the U.S. producer price, which is representative of the North American market.

Milk Prices from Different Regions Compared, Indices in Euro (2022-01=100)

The prices shown tend to follow a common pattern, although short-term deviations may occur depending on the benchmark considered. The strongest price relationship across regions is observed between the European price and the U.S. producer price, which reflects the price at which American companies sell on international markets, including Asia. This relationship is plausible considering that both the EU and North American countries must compete in the same market (Asia) leading to price convergence across the two regions, as they cannot stray too far from each other.