Palm oil price: global or regional?

Physical market prices tend to align with the financial benchmark, with some short-term differences

Published by Pasquale Marzano. .

Palm Oil Price Drivers

Palm oil has a global benchmark price, represented by financial quotations from the Chicago Mercantile Exchange (CME) and Bursa Malaysia.

In both cases, the underlying asset of the financial contracts refers to crude palm oil produced in Malaysia, one of the world’s leading producers.

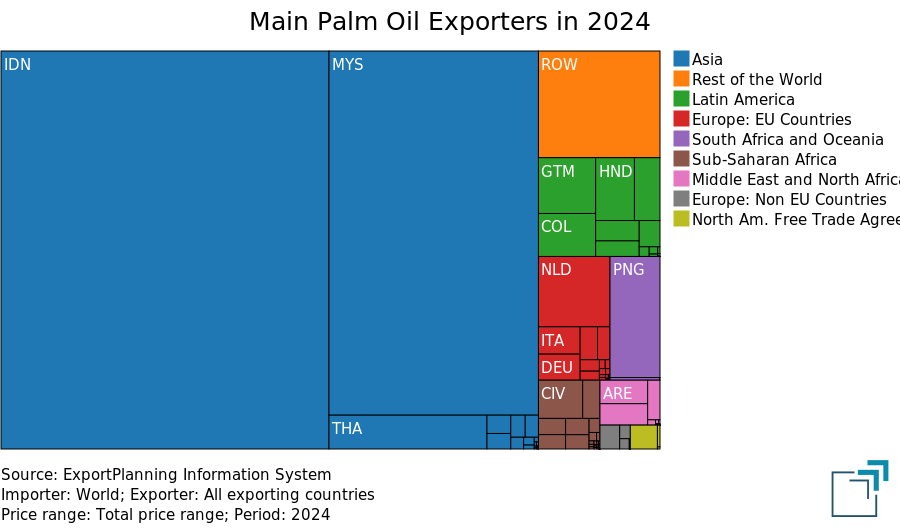

The following chart shows the main exporters of crude and refined palm oil in 2024 (source: ExportPlanning).

Main Palm Oil Exporters in 2024

Asian countries are by far the world’s main exporters of palm oil, led by Indonesia and Malaysia, which in 2024 globally exported 22 million and 13 million tonnes respectively.

Given the importance of this geographical area in the global palm oil market, the Malaysian financial benchmark can be considered representative of global demand conditions and, above all, of supply for this commodity.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

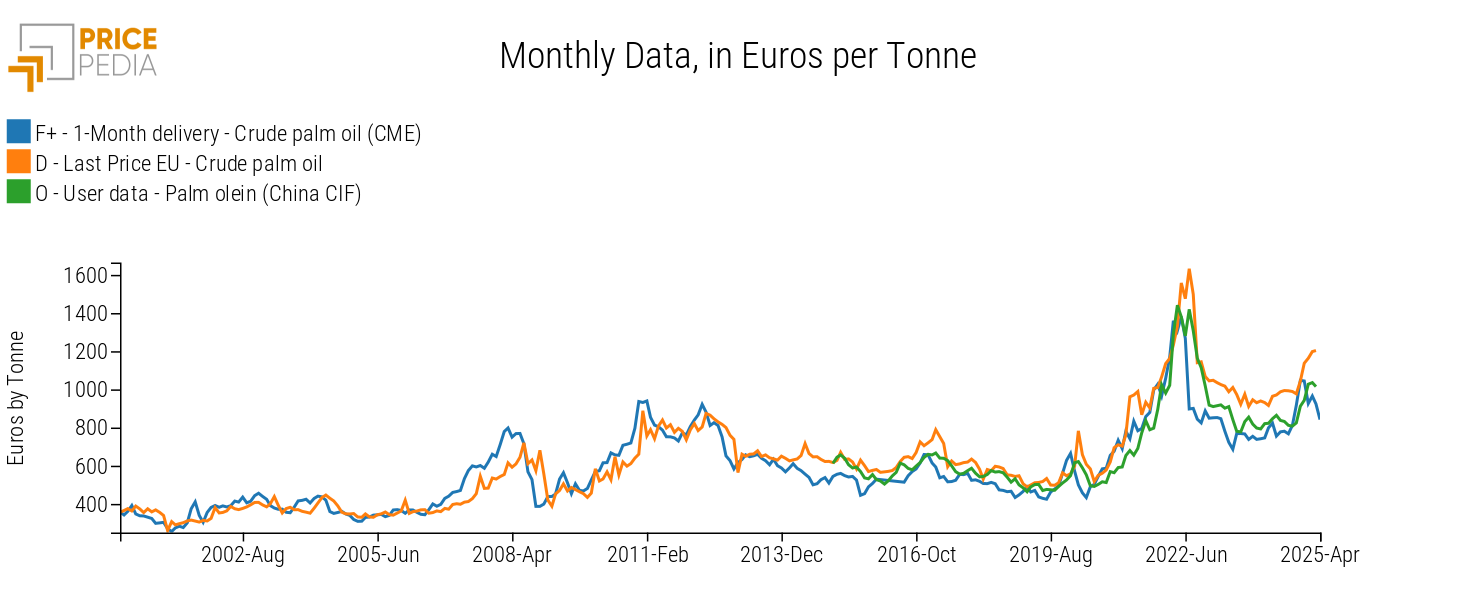

This is evident in the comparison below between the crude palm oil price quoted on the CME and the customs prices of the EU and China, representing the prices at which European and Chinese companies purchase from partner countries. For China, the price of palm olein - a product of palm oil refining - is considered representative of the crude product price.

Palm Oil Prices Compared, in Euro per Ton

The chart shows that the CME quotation is a good approximation of EU and Chinese physical prices. It is also evident that the CME price tends to lead the trend of the other two by several periods. In particular, during the first months of 2025, a decrease in the CME price is observed, while the other two remain more rigid and have not shown significant decreases yet.

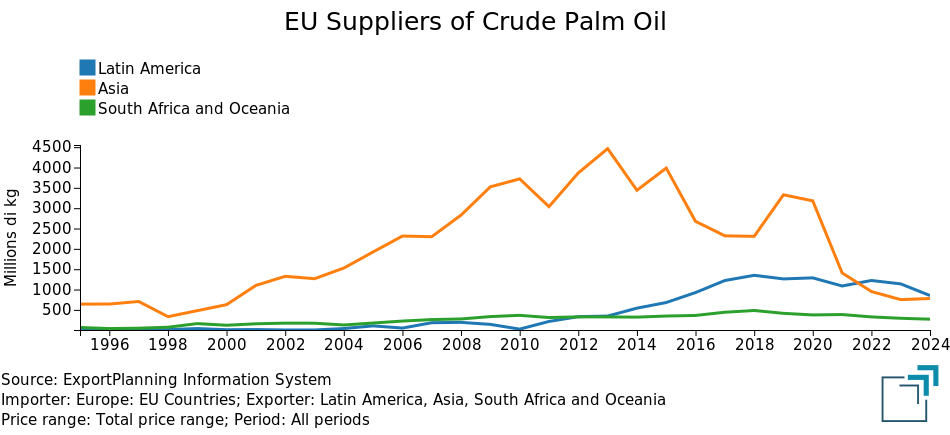

Among the various factors that can influence the delay in the transmission of effects from the benchmark to the physical price, it is useful to consider the composition of the supplier portfolio of the individual regional physical markets. In the case of Europe, for instance, recent years have seen a reduction in imports of crude palm oil from Asia in favor of increased imports from Latin America.

EU Suppliers of Crude Palm Oil

Moreover, even within the Asian producer bloc, there are some divergences in commercialization strategies: Malaysia tends to export mainly crude oil, while Indonesia primarily exports processed oil.

Despite being one of the world's leading palm oil producers, Malaysia tends not to adopt restrictive policies on crude palm oil exports, limiting itself to trading the primary product without significant constraints. Indonesia, on the other hand, seeks to leverage its dominant position in palm oil production to develop a higher value-added domestic processing industry. To this end, the Indonesian government has introduced, over time, bans and restrictions on crude palm oil exports, in an attempt to encourage the production and export of refined oil.

In this context, in recent months, the prices of crude palm oil from Indonesia have increased in ways that do not appear to be correlated with a rise in the global reference price, but rather with government strategies aimed at limiting foreign supply of crude product and promoting the trade of processed goods. This can lead customs prices to rise independently from the Malaysian benchmark, driven instead by the trade policies of exporting countries.

Historically, such actions have never succeeded in influencing prices for extended periods. Eventually, the prices of crude oil exported from different countries have returned to align with the financial benchmark. It is likely that this alignment will occur again this time, leading EU customs prices to fall in line with the recent decline in the CME financial price.