Determinants of glass prices

Econometric analysis of float and hollow glass prices

Published by Luca Sazzini. .

Glass Price DriversGlass is an industrial raw material lacking a financial market for trading futures contracts, which makes its trade entirely dependent on physical markets, where various types of glass with different characteristics and applications are exchanged. Among these, the most common type is "float" glass, a term derived from the production process in which molten glass floats on a layer of liquid tin. This process allows the production of smooth and uniform glass sheets, ideal for applications such as windows, transparent facades, and high-quality optical components.

Another widely used type in industry is hollow glass, crucial in the packaging sector for the production of bottles, jars, and other glass containers.

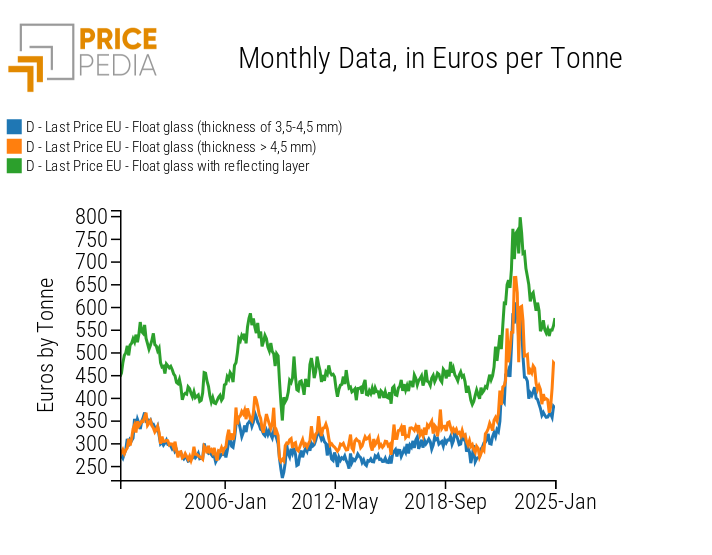

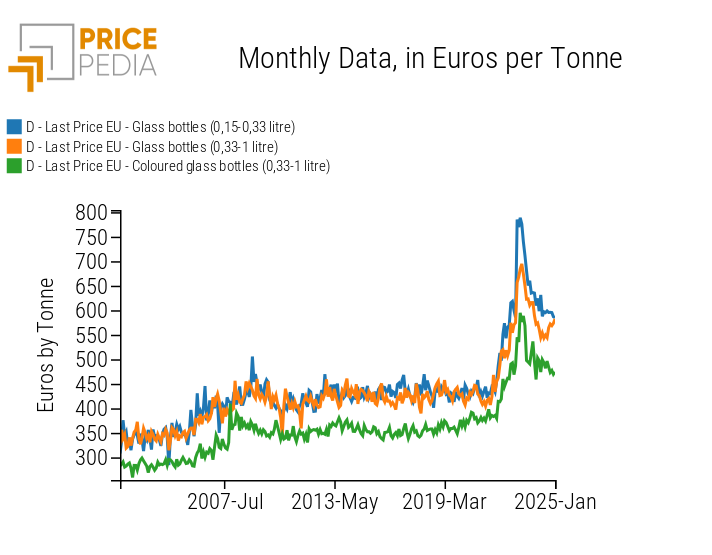

The following two charts display the historical price series of float glass and hollow glass, collected from European customs data and expressed in euros per ton.

| Customs prices of float glass, expressed in euros per ton | Customs prices of hollow glass, expressed in euros per ton |

|

|

For both types of glass, the most intense price cycle occurred between 2021-2023, with a peak in January 2023, when the prices of reflective float glass and glass bottles (0.15-0.33 liters) approached 800 euros per ton. During the initial growth phase, glass prices nearly doubled; however, during the subsequent decline phase, reductions were less pronounced, with prices remaining significantly higher than pre-2021 levels.

In this article, we will analyze the main determinants of the prices of float glass and hollow glass through a statistical regression analysis for each type.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Econometric Analysis

To conduct a statistical regression analysis, it is necessary to first establish the theoretical reference model. In this article, we will use, for both types of glass, a theoretical model based on the costs of production inputs and the demand for glass.

The dependent variables, or the prices of interest in this analysis, are the price index of float glass and the price index of hollow glass, both representing the aggregate price dynamics of the two types of glass, illustrated in the previous two charts.

The theoretical models developed for both types of glass share the same determinants, with a single exception. For float glass, given its purer nature and higher quality, silica sand was used as a determinant, as it is the key raw material for producing high-quality virgin glass. Conversely, for the theoretical model of hollow glass, recycled glass scrap was chosen due to its greater use in the production of hollow glass.

The other explanatory variables introduced in both models are:

- sodium carbonate: used as a flux to lower the melting point and reduce energy consumption during the production process;

- calcined magnesia: used to increase the corrosion resistance of glass and improve its thermal stability;

- natural gas TTF (Netherlands): to reflect the energy costs associated with glass production;

- industrial cycle index: to account for market demand dynamics.

To analyze prices in terms of elasticity, a logarithmic transformation was applied to all variables in both regression models.

The regression results of the two models described are shown in the table below.

Float Glass Regression Model

|

Hollow Glass Regression Model

|

||||||||||||||||||||||||||||||||||||||||||||||||

In both regression models, the sign of the elasticity coefficients is consistent with theoretical expectations.

In the float glass model, all variables are also statistically significant, except for calcined magnesia. When considering the sum of the coefficients of the production inputs, it amounts to 0.63, indicating that an average 10% increase in input prices, all else being equal, results in a 6.3% increase in the price of float glass.

In the hollow glass model, the variables significant at the 5% level are: recycled glass scrap, sodium carbonate, and calcined magnesia. The sum of the elasticities of these production inputs is 0.67, which implies that, ceteris paribus, an overall 10% increase in production input prices translates, on average, into a 6.7% increase in the price of hollow glass.

The corrected R2 values for the float glass and hollow glass regression models are 0.93 and 0.91, respectively, out of a maximum of 1. This means that both regression models can explain over 90% of the glass price levels.

Conclusions

The regression results for glass prices were consistent with theoretical expectations, with both models able to capture over 90% of the glass price levels.

From the comparison of the regression coefficients, the following facts emerged:

- The price of gas has a positive effect on the prices of both types of glass, but it is statistically significant only in the float glass model. This result is consistent with the hypothesis of a higher energy requirement in the production of float glass compared to hollow glass, especially considering that the latter is produced using a higher proportion of scrap;

- The economic cycle has a positive effect on the price of both types of glass. All else being equal, the price of glass tends to rise during periods of economic growth and fall during phases of lower industrial activity. In this case, the coefficient for float glass is statistically significant, while it is not in the case of hollow glass. The reason may lie in the greater variety of uses of float glass compared to hollow glass, which makes it more closely correlated with the economic cycle;

- The sum of the coefficients of production inputs for both float glass and hollow glass is relatively similar, with values of 0.63 and 0.67, respectively. This means that, ceteris paribus, a 10% increase in production input prices results in, on average, a 6.3% and 6.7% increase in the prices of float glass and hollow glass.