Increasingly expensive flax in Europe

Linen prices could continue to rise until at least autumn 2024

Published by Luca Sazzini. .

Textile Fibers Price DriversFlax is the textile commodity that has the European market as its reference point.

The European flax market has attracted increasing interest and has experienced significant dynamics in recent years, in response to the growing demand for natural and sustainable textile fibers. During 2023, the flax sector faced a period characterized by a considerable rise in prices, caused by a poor harvest due to unfavorable weather conditions. Persistent rains during the harvest period reduced the supply of flax and compromised the quality of the seeds, also altering their visual color. This sudden scarcity led to a significant increase in prices in the European market, as evidenced by the dynamics of EU customs prices.

This article aims to examine the flax market, focusing on broken or scutched flax, obtained from the flax plant. Both the dynamics of the global flax trade and the historical series of customs prices recorded in the European market will be examined.

Analysis of the Global Flax Trade

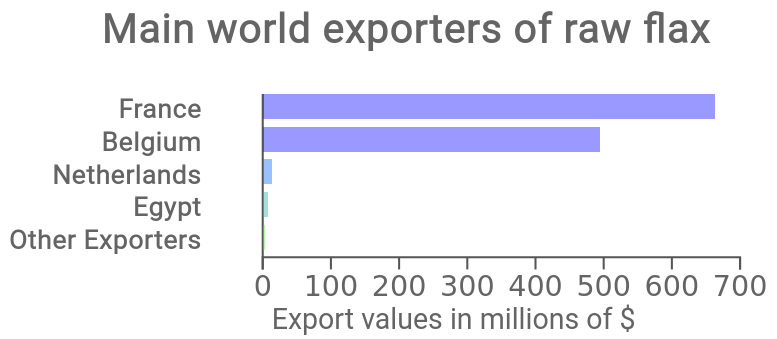

Europe is the largest global player in the flax market and plays a dominant role in the production and trade of this textile fiber. Its leadership not only encompasses flax production but also extends to the processing sector, thus allowing Europe full control over the flax value chain. In the raw flax market, European dominance is particularly overwhelming, as evidenced by statistics on the major global flax exporting countries.

Major Global Exporters of Raw Flax

From the graph, it is evident that France and Belgium hold the duopoly of global exports of broken or scutched flax. These two nations, along with the Netherlands, account for three-quarters of the global production of long fibers (the main product of scutching for the textile industry). In particular, France stands out for its leadership, contributing alone to 87% of the hectares of flax cultivated in Europe, with a production of 131 thousand hectares out of 150 thousand in 2023.

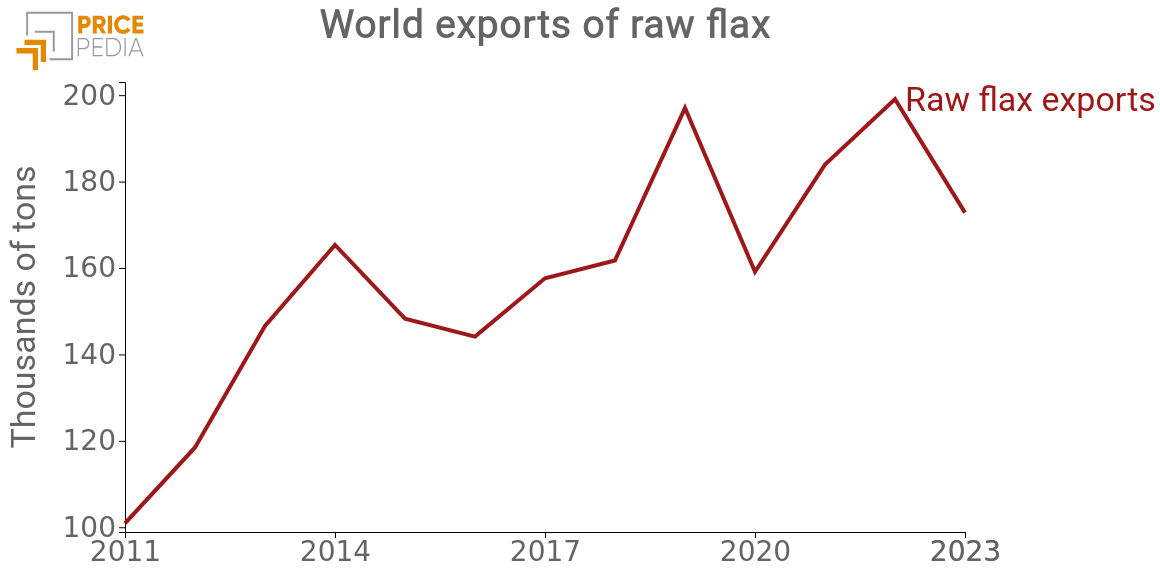

Dynamics of Broken or Scutched Flax Exports

The growing environmental interest has revitalized flax within the fashion industry, thus increasing the demand for linen fabrics. In response, France, Belgium, and the Netherlands have doubled the cultivated area of flax between 2010 and 2020, also leading to a significant increase in European exports of raw flax worldwide.

Dynamics of Raw Flax Exports

The graph above highlights two main aspects:

- the growth of broken or scutched flax exports, alongside the constant demand increase of the last decade

- the decrease in broken or scutched flax exports in 2023, due to unfavorable weather conditions.

This latter aspect led to a reduction in the supply and quality of the produced flax, significantly impacting the dynamics of European flax customs prices.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

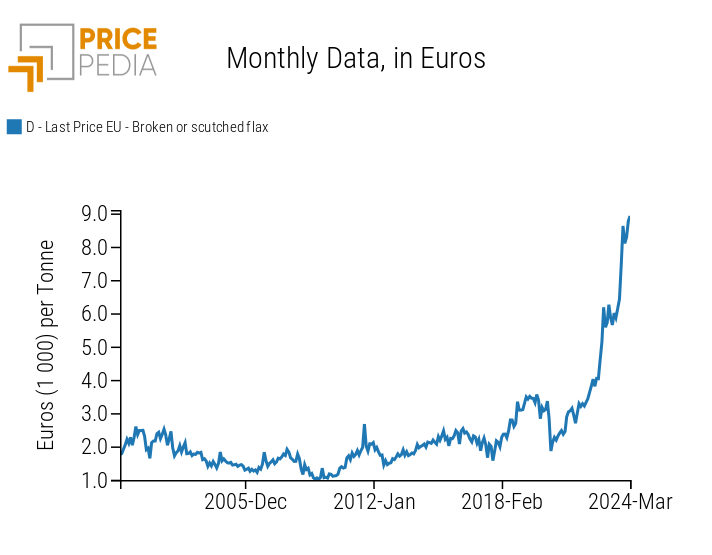

Analysis of Flax Customs Prices

Below is the historical series of broken or scutched flax prices, recorded at the customs of the 27 countries belonging to the European Union.

Historical Series of European Flax Customs Prices

From the analysis of the graph, a strong upward trend in flax customs prices emerges.

From June 2020 to March 2024, flax prices increased from a value of 1861 euros/ton to 8925 euros/ton, thus recording a growth of 380%. This growth intensified particularly towards the end of the last year. From June 2023 to November 2023, flax prices grew from 6000 euros/ton to over 8600 euros/ton, with a growth rate exceeding 40% in less than a semester, in stark contrast to the dynamics of most commodity prices.

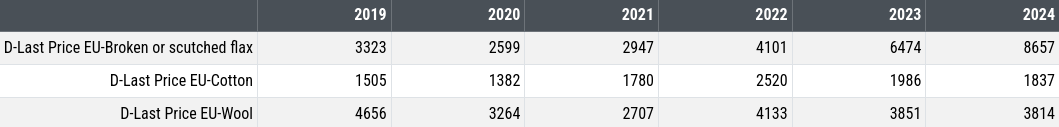

The following table compares the prices of the three main natural textile fibers: cotton, wool, and flax.

Table of European Customs Prices for Main Textile Fibers

From the comparison of the three price levels, the specificity of flax emerges clearly. Historically, the price of flax has always been lower than the average price of wool, but in 2022, the two prices were equal. In the following years, the price of flax continued to increase until, in the first 3 months of 2024, reaching a level more than double the price of wool and over 4 times that of cotton.

Expectations for 2024

According to analysts, in 2024 the cultivation of European FlaxTM1 in France, Belgium, and the Netherlands is expected to exceed 160 thousand hectares, approaching the record value of 163 thousand hectares recorded in 2020. However, unfavorable weather conditions could negatively influence the harvest in the first half of the year. This could keep pressure on flax prices high until autumn 2024 when the scutching2 of the next harvest will begin. In response, European producers have long initiated research and development plans to meet the growing global demand for flax.

Conclusions

In the recent period, there has been a significant increase in flax prices due to a limited harvest caused by unfavorable weather conditions. Prices are expected to remain on the rise at least until autumn 2024.

Meanwhile, European producers, leaders in the global flax market, have already begun implementing new research and development plans to meet the growing global demand for flax.

[1] Registered trademark identifying high-quality flax fiber produced in Europe.

[2] Process by which the various components of the flax plant are separated and treated after harvesting.