Price cycles of isocyanates

The 2020-2023 isocyanate price cycle reproduces the dynamics of the previous 2016-2019 cycle

Published by Luigi Bidoia. .

Polyurethanes Price DriversDuring the 2020-2023 cycle, most commodity prices followed a growth path that is unparalleled in previous cycles: on one side, the stop-and-go of activities between spring and summer of 2020, and on the other, the challenges of global logistics prompted companies to move away from "just in time" purchasing policies in favor of a "just in case" approach, generating significant tensions along the production and distribution chains.

Not all commodities followed this path. In some cases, the 2020-2023 cycle was very close to previous ones. A particularly noteworthy example is that of isocyanates, whose 2020-2023 price cycle was very similar to a previous price cycle that occurred just a few years earlier, in the 2016-2019 period.

Isocyanates

Isocyanates are a fundamental component in the synthesis of polyurethanes, a versatile class of polymers that are applied across a broad range of industrial sectors and consumer products. The two main types of isocyanates used for polyurethane production are toluene diisocyanate (TDI) and methylene diphenyl diisocyanate (MDI). TDI is predominantly used to create flexible foams, which are crucial for items such as mattresses, furniture upholstery, and car seats, providing characteristics of comfort and resilience. MDI, on the other hand, is typically employed to produce rigid foams, widely demanded for their excellent insulating properties in areas like construction and refrigeration. Besides foams, both TDI and MDI are utilized in manufacturing elastomers, adhesives, sealants, and coatings, each contributing specific mechanical and resistance properties necessary to meet the requirements of various applications and diversified products.

The price cycles of isocyanates

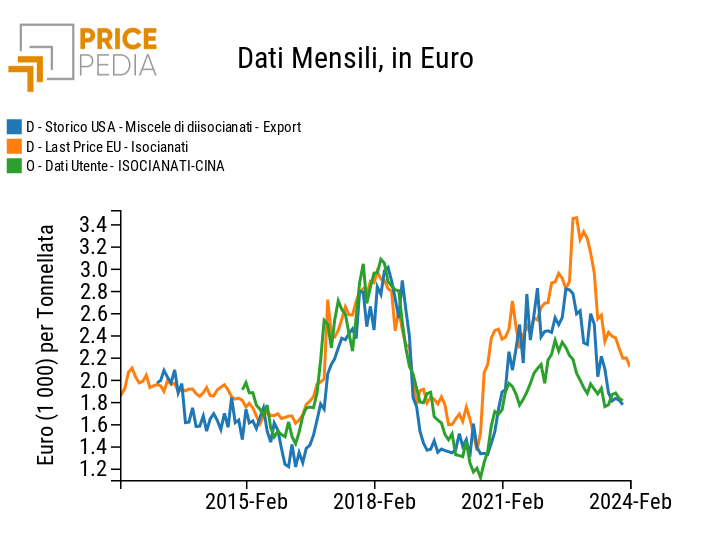

The following graph presents three historical series related to isocyanate prices, concerning three different regional markets: the European Union (orange line), the United States (blue line), and China (green line).

Price cycles of isocyanates

From the analysis of this graph, the following facts can be gleaned:

- The 2020-2023 cycle presents maximum and minimum levels very close to those of the 2016-2019 cycle, suggesting that the determinants of the latest cycle were very different from those of the previous cycle.

- The price dynamics in the three regions of the world are similar to each other, indicating the existence of a global market for isocyanates. In the latest cycle, some differences in price levels were recorded across the three regions, with the highest level in Europe, the lowest in China, and an intermediate level in the United States. During the most acute phase of the price cycle in the European market, the scarcity of isocyanates was greater than in the United States and, especially, in China.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Price Determinants

Isocyanates are intermediate products in the petrochemical production chain, obtained through energy-intensive production processes. Consequently, their production costs are significantly influenced by the prices of oil and gas. However, observing the price dynamics of isocyanates, which were very similar in the 2016-2019 and 2020-2023 cycles despite very different oil and gas prices in the two periods, a pricing model emerges that appears only marginally related to direct energy costs. The greater effect on price dynamics is, in fact, due to the relative scarcity in the commodity market. When the supply is relatively abundant, prices tend to hit a low point; conversely, when the supply is scarce. Therefore, the initiation of new production facilities and temporary closures for maintenance are crucial determinants in defining isocyanate prices.

The 2016-2019 cycle was also determined by a growth in the demand for isocyanates in recent years that exceeded industry expectations, while at the same time, the isocyanate industry struggled to bring new capacity online quickly enough to meet additional demand. Among the supply-side difficulties were significant delays in the start-up of new facilities by BASF in Ludwigshafen, Germany, and Sadara in its large integrated petrochemical plant in Al-Jubail, Saudi Arabia. These were compounded by a series of plant shutdowns and force majeure events, especially in the United States due to the effects of Hurricane Harvey in August 2017.

The 2020-2023 cycle was primarily caused by logistical difficulties that led user companies to precautionarily increase their inventory stocks, resulting in a significant rise in overall demand.

Relationships Between the Prices of Different Isocyanates

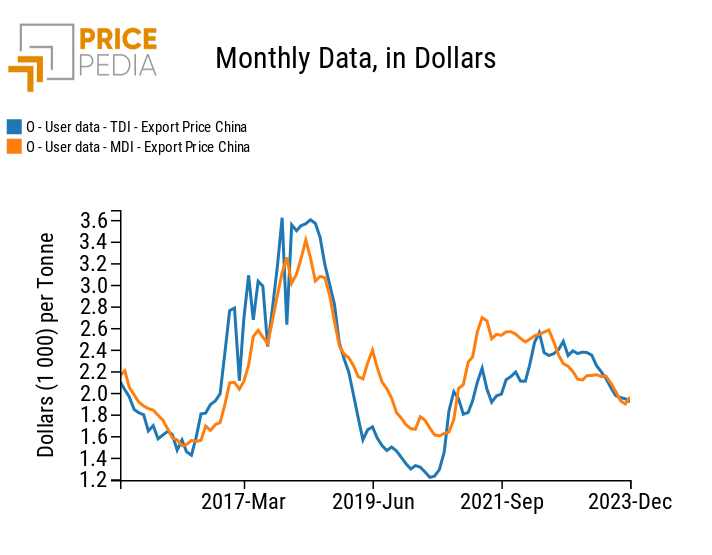

MDI and TDI isocyanates have different production processes, use partially different production inputs, are weak substitutes in their applications, yet exhibit strongly correlated price dynamics. This correlation is particularly evident when considering the export prices of the two isocyanates from China, as shown in the following graph.

Chinese export prices of TDI and MDI isocyanates

The prices of TDI and MDI isocyanates, despite showing significant level differences in some periods, have recorded very aligned dynamics in Chinese export prices over the last 10 years. The forces that led to this alignment need to be sought in the substitutability effects of the two isocyanates, which are significant only in a few specific uses, and in the common distribution networks and demand policies of the user companies.

Conclusions

The analysis of the isocyanate price cycles between 2015 and 2023 reveals a complex landscape where energy cost factors play a less central role compared to supply and demand dynamics in determining isocyanate prices. Although MDI and TDI are produced through different processes and have distinct applications, their price dynamics show a significant correlation, suggesting that broader market factors, such as relative availability and stockpiling policies, have a predominant influence. In this context, the analysis highlights the importance of monitoring not only cost indicators but also market and strategic indicators to understand the price fluctuations of isocyanates. Understanding these mechanisms is vital for users to anticipate future trends in an increasingly interconnected and variable global context.