First weak signs of growth in commodity prices

PricePedia's updates for January 2024

Published by Pasquale Marzano. .

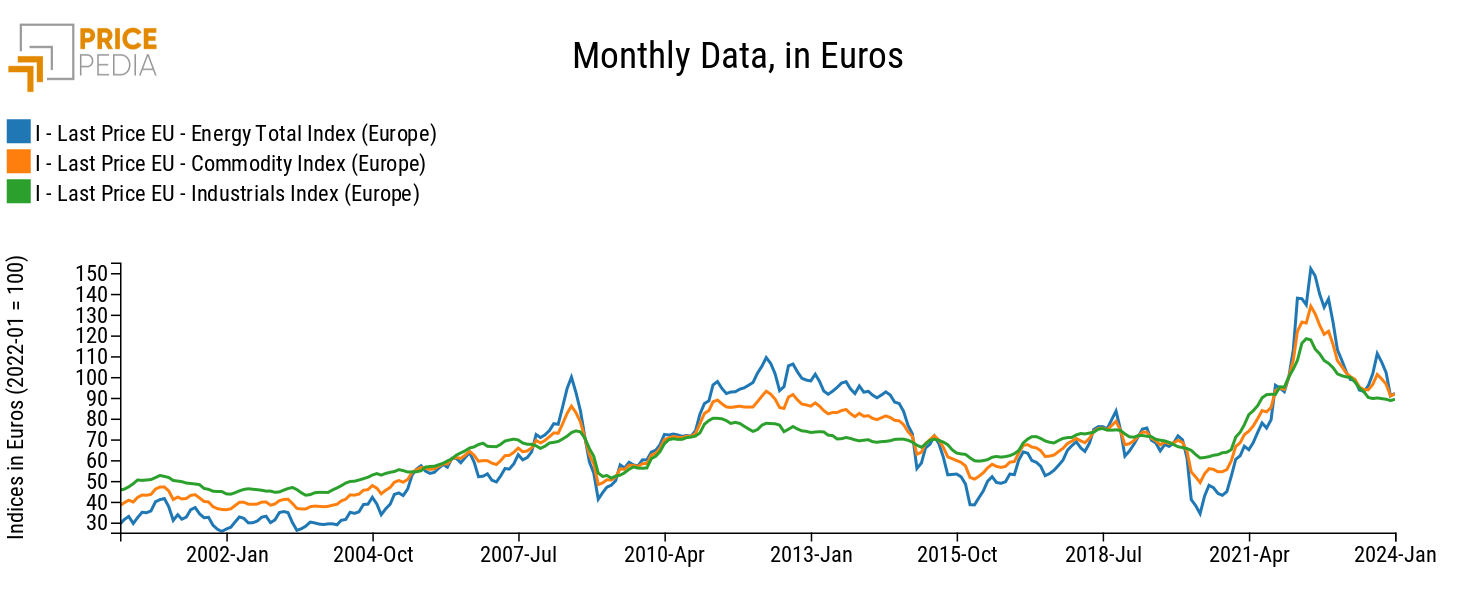

Last Price Global Economic Trends

The PricePedia monthly commodity price update for January 2024 has been published.

At an aggregate level, the price dynamics of raw materials and basic goods shows slight signs of growth, despite the weakness in commodity demand in recent months. Prices therefore seem to have encountered resistance to falling and appear to be sitting on a "floor".

The following graph illustrates PricePedia aggregate indices for Total Commodities[1], Industrial Commodities[2] and Energy.

For all three indices there are increases compared to the values of December 2023: for the Industrial index the increase is +0.7%; the growth of Energy was slightly more accentuated, equal to +1.4%.

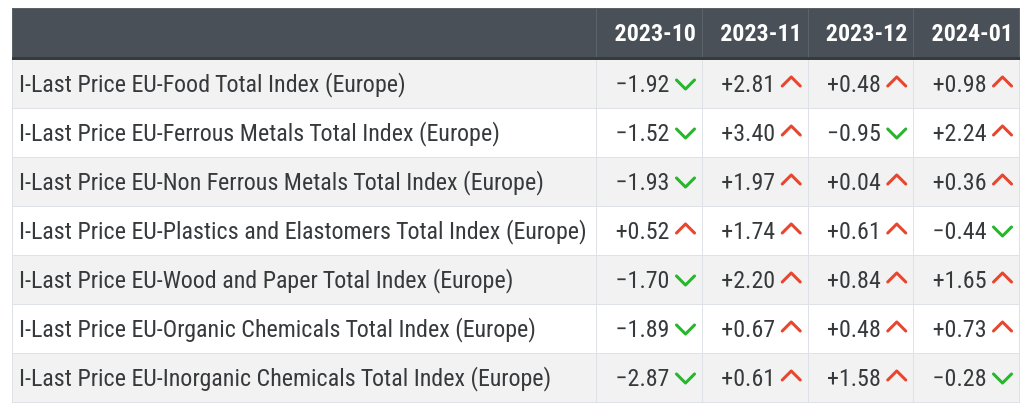

The hypothesis of a price floor seems to be confirmed by the table below, which illustrates the cyclical variations, compared to the previous month, of the main aggregate indices by product category starting from October 2023, measured in dollars.

Table 1: Month-over-Month changes (%) in dollars, October 2023 - January 2024

After the last decline in October 2023, common to all product categories with the exception of Plastics and Elastomers, in the last three months all indices by macrofamily of industry and food almost always show positive, albeit limited, variations.

The greater presence of negative variations in recent months is therefore due to the slight appreciation of the euro exchange rate against the dollar, which went from 1.06 dollars/euro in October 2023 to 1.08 in January 2024.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Added to these first weak signals are the dynamics of indicators of global activity levels, illustrated in the weekly update of financial commodities (Weak demand drives down commodity prices), which shows a progressive recovery in recent months both in terms of world trade and global industrial levels.

However, in order to be able to talk about a real path of significant growth in prices, a less penalizing demand than the current one is necessary.

Commodity prices

Month-over-month trends

Below is illustrated the graph of the cyclical changes from January 2024 to December 2023 in prices in euros referring to the aggregate PricePedia product indexes.

Chart 1: January 2024, % changes in euros compared to December 2023

Source: PricePedia

Compared to the price update of December 2023[3], it can be noted that the number of product categories which, in aggregate, recorded an increase in prices in January 2024, has grown. The decreases that occurred for Plastics and Elastomers, Specialty Chemicals, Inorganic Chemicals and Textile Fibers product categories were also very low, and never went below -1%.

Year-over-year trends

The following graph shows the Year-over-Year changes (January 2024 over January 2023) in euros of the aggregate price indices of the PricePedia product categories.

Chart 2: January 2024, % changes in euros compared to January 2023

Source: PricePedia

From the point of view of trend changes (compared to January last year), decreases are observed for all the macrofamilies illustrated, further demonstration of the fact that the cyclical increases are still far from being considered as part of robust and significant growth.

Inorganic Chemical products present the price levels furthest from the corresponding January 2023 values of almost -20%. For all other product categories, double-digit decreases were recorded, with the exception of the prices of Organic Chemical products, Ferrous metals, Food commodities and Precious metals.

1. The PricePedia Total Commodities index results from the aggregation of indices relating to industrial, food and energy commodities.

2. The PricePedia industrial price index results from the aggregation of the indices relating to the following product categories: Ferrous Metals; Non-Ferrous Metals; Wood and Paper; Chemicals: Specialties; Organic Chemicals; Inorganic Chemicals; Plastics and Elastomers; Textile Fibres.

3. "The second part of 2023 ended with substantial stability in the prices of industrial commodities".

Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.