Bio-based chemistry: a strategic innovation for the ecological transition

Another challenge that European industry is losing

Published by Luigi Bidoia. .

Bio-Based Chemicals Chinese industry

The ecological transition represents one of the most significant challenges of our time, both in addressing climate change and in ensuring sustainable development for future generations. It unfolds across multiple domains: from sustainable mobility to the energy transition, from the circular economy to increased efficiency in the use of the planet’s resources.

In this context, bio-based chemistry represents a strategic tool. It uses biomass – agricultural raw materials or waste – to produce alternatives to petro-based products, helping to reduce the overall environmental impact of the chemical industry. The fields of application of bio-based chemistry are numerous and rapidly expanding: biopolymers, biofuels, biocombustibles, biolubricants, crop protection products and biocosmetics.

A key question, however, concerns the concrete impact of this transformation on the supply conditions faced by downstream industrial users. Is the spread of bio-based chemistry leading to greater or lower availability of chemical intermediates? Is it resulting in higher or lower prices along the different chemical value chains? And, above all, does it strengthen or weaken the competitiveness of European industry?

The analysis presented in this article focuses on chemical intermediates, the fundamental “building blocks” used to manufacture the wide range of chemical products required by advanced economies. In particular, it examines the innovations that enable the transition from hydrocarbon-based intermediates to bio-based intermediates. Their substitution can generate positive effects along the entire value chain, making downstream products bio-based as well and contributing to a structural transformation of chemical processes.

Transformation of chemical intermediates from petro-based to bio-based

The table below presents a list of chemical intermediates, ordered according to the share of global production that can currently be considered “bio-based”. This share represents an estimate, constructed on the basis of a variety of information sources, and should be regarded as indicative. Once the chemical intermediate has been produced, it is no longer possible to distinguish it according to its origin, whether fossil-based or bio-based.

Main bio-based chemical intermediates

| Chemical intermediate | Global production | Bio-based | Global exports | 2025 price (Euro/tonn) | |

|---|---|---|---|---|---|

| (million tonnes) | (% of total) | Leading country | Intra-EU | Leading exporter (FOB) | |

| Glucose (*) | > 100 | 100 | China | 560 | 460 |

| Ethanol (**) | > 100 | 80 | United States | 883 | 660 |

| Glycerol | ≈ 4 | 100 | Indonesia | 972 | 934 |

| Citric acid | ≈ 3 | 100 | China | 1197 | 588 |

| Lactic acid | ≈ 2 | 100 | China | 1664 | 1159 |

| Sebacic acid | < 1 | 100 | China | 3767 | 3482 |

| Furfural | < 1 | 100 | China | 1490 | 905 |

| Furfuryl alcohol | < 1 | 100 | China | 1188 | 1114 |

| Succinic acid | < 1 | 60 | China | 2577 | 2133 |

| (*) Price refers to isoglucose (fructose < 20%) | |||||

| (**) Price refers to denatured ethanol | |||||

The table can be divided into two sections. The first concerns large-volume intermediates, while the second includes specialised bio-based intermediates.

Large bio-based intermediates

Among large bio-based intermediates, two products stand out with global production exceeding 100 million tonnes: glucose[2] and ethanol[3].

In the glucose market, China and the United States have been competing for several years for the position of leading global exporter. Historically, the United States was the country where large-scale production of corn-based glucose first developed, thanks to the abundant availability of this crop on the domestic market. Over the past 15 years, however, U.S. leadership has been increasingly challenged by China, which since 2024 has emerged as the world’s leading exporting country. In the United States, glucose is mainly used as a sweetener in soft drinks and sugar-sweetened beverages. In contrast, in China glucose is not only a sweetener but also an industrial platform underpinning its fermentation industry, the largest in the world. Lower glucose prices on the Chinese market compared with European prices provide a competitive advantage to the entire bio-based chemical industry that relies on this intermediate.

In the ethanol market, the United States has long held a dominant position, supported by its large availability of corn, which enables large-scale production. The only country capable of competing with the United States on international markets is Brazil, where ethanol is produced through the fermentation of sugarcane. In both countries, ethanol is used predominantly as a fuel. When ethanol is considered instead as a chemical intermediate, China appears to be the most advanced country, where it plays a central role as a core platform for the chemical and fermentation industries.

Specialised bio-based intermediates

Alongside large bio-based intermediates, bio-based chemistry also includes a wide range of specialised intermediates, designed for more targeted value chains and applications. It is precisely in this segment that China has progressively established a dominant position over the past two decades, clearly overtaking the European industry, which had historically been a pioneer in the development of bio-based chemical intermediates since the end of the last century.

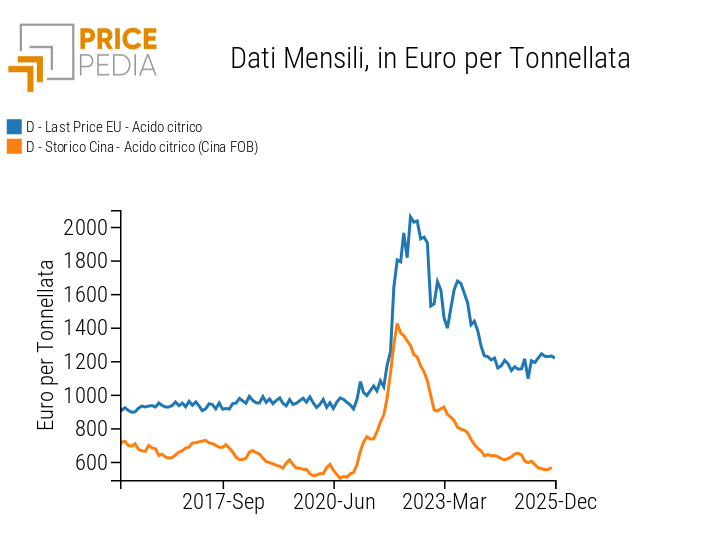

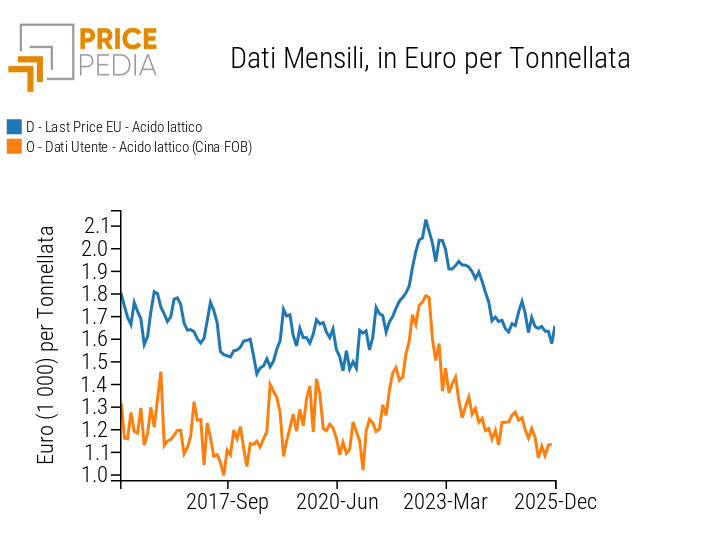

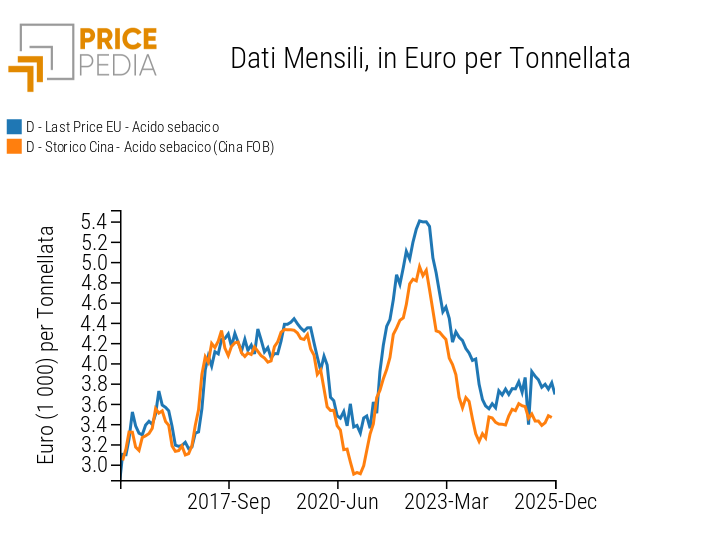

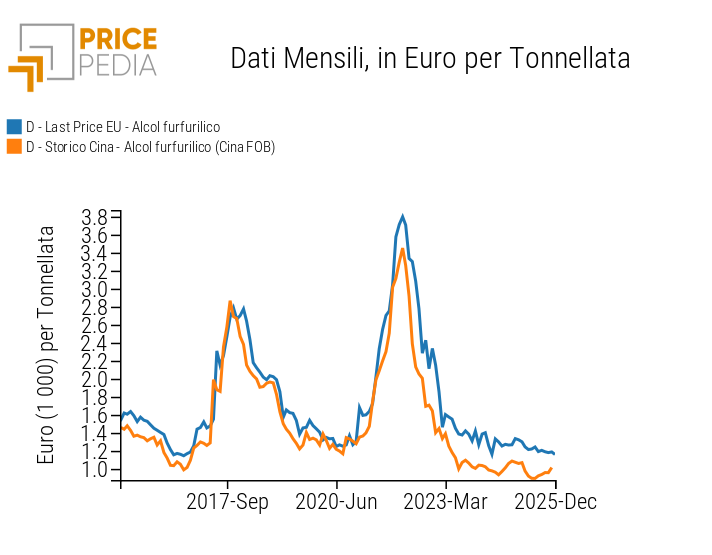

For all the products in this group listed in the table, with the sole exception of glycerol, the Chinese industry emerges as the leading exporting country. China’s leadership in these markets becomes particularly evident when comparing the prices of the various intermediates in intra-EU trade with the FOB prices of Chinese exports. In the four charts that follow, this comparison is carried out for citric acid[4], lactic acid[5], sebacic acid[6] and furfuryl alcohol[7].

Comparison between intra-EU customs prices and FOB prices of Chinese exports

| Citric acid | Lactic acid |

|---|---|

|

|

| Sebacic acid | Furfuryl alcohol |

|

|

From the analysis of these charts, the following key facts emerge:

- In all cases, Chinese prices tend to anticipate turning points in European prices. This indicates a strong dependence of the European market on the Chinese market.

- The FOB price of Chinese exports is consistently lower than the customs price of intra-EU trade. Since it is reasonable to assume that prices on the domestic Chinese market are not significantly different from FOB export prices, this implies that Chinese chemical companies operating downstream in bio-based value chains can purchase intermediate compounds at lower prices than those prevailing on European markets. This price differential is particularly pronounced for citric acid and lactic acid.

Conclusions

With the exception of large bio-based chemical intermediates, where the United States still plays a dominant role, China has long secured the leading position in global trade in specialised bio-based chemical intermediates. For almost all products in this group, prices are determined by the interaction of supply and demand in the Chinese market and subsequently transmitted to other markets worldwide, including the EU.

From the perspective of downstream industries using bio-based intermediates, Chinese firms benefit from a cost-based competitive advantage over EU companies, stemming from the lower purchase prices of these compounds on the Chinese market compared with the EU market. It is highly likely that, within the domestic market, EU firms are able to offset this cost disadvantage through other advantages, more closely related to product specifications and service quality. However, compensating for this cost disadvantage may prove considerably more difficult in extra-EU markets.

[1] Chemical intermediates, together with biodiesel, represent the areas of greatest industrial and economic relevance within bio-based chemistry.

[2] For an analysis of the issues affecting the global value chain originating from sugar-based biomass for the production of biodegradable bioplastics, via glucose, see the article When a distortion in a substitute market reshapes an industrial value chain.

[3] For an analysis of the global ethanol market, see the article The United States at the centre of the global ethanol market.

[4] For an analysis of the relationship between the Chinese chemical industry and the European chemical industry in the citric acid market, see The pressure of Chinese competition on organic acid prices.

[5] For further insights into the global lactic acid market, see the article cited in note [2].

[6] For further insights into the global sebacic acid market, see the article cited in note [4] and From India to bio-based polyamides: how Indian castor seed prices drive the value chain.

[7] For an analysis of furfural within the furanic compounds value chain, see Furanic compounds: China leading global markets.