Sulfur prices: a new global uptrend cycle?

After the peaks of 2008 and 2022, international quotations exceed €250/ton, signaling the start of an intense phase driven by rigid supply and volatile demand

Published by Luigi Bidoia. .

Fertilizers Sulphuric acid industry Global Economic Trends

The upward trend in international sulfur prices continued during the summer.

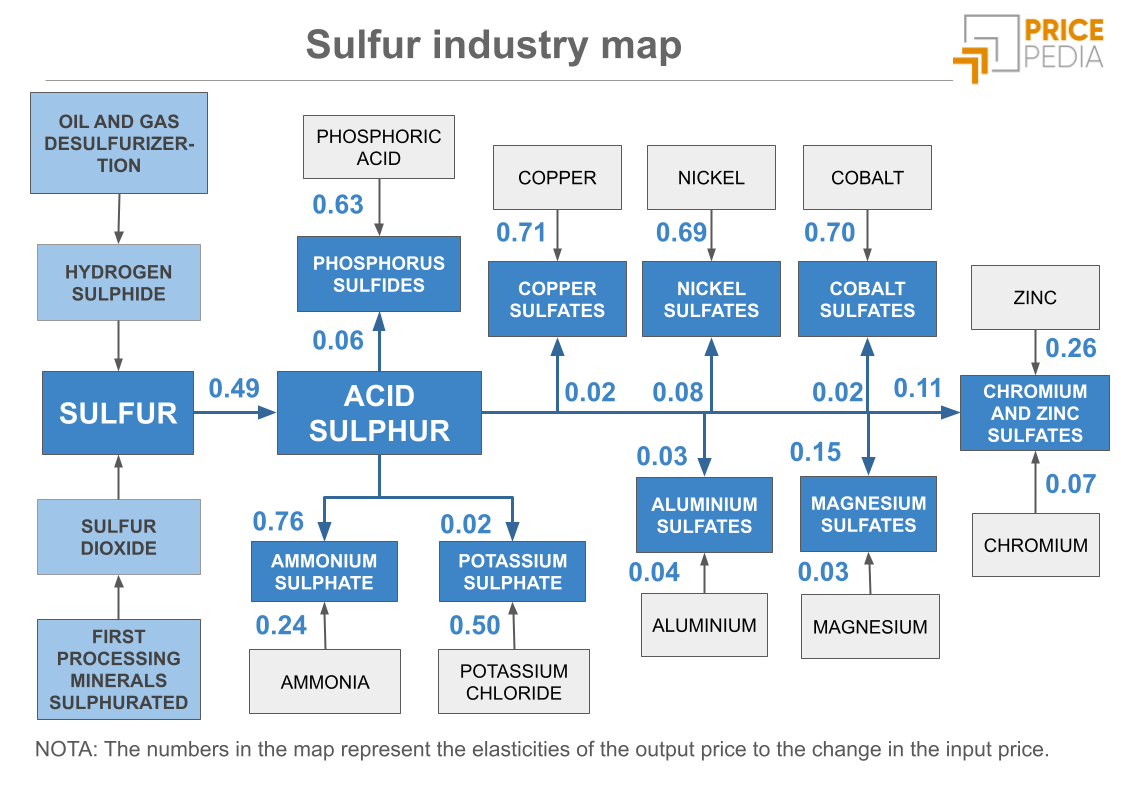

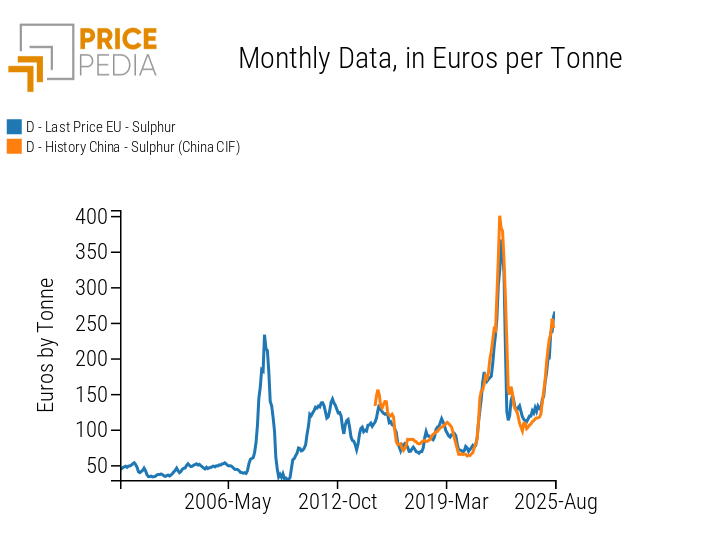

As shown in the chart below, the increase concerns both intra-EU trade prices and Chinese import prices. The strong alignment between European and Chinese quotations also suggests the existence of a single global reference price.

Comparison of sulfur prices in Europe and China

In the article Tensions in the global sulfur market and impacts on the chemical supply chain, published last May, the increases observed in the first part of the year were interpreted as part of a short-lived cycle, consistent with historical trends in the sulfur market. This pointed to a possible price correction in the second half of 2025.

Recent data, however, with sulfur prices climbing above €250/ton, outline a different scenario: the market seems to have entered a more intense cycle, comparable to 2008

– when prices approached the €250/ton threshold –

or to 2022, which led to the all-time high of €370/ton.

In light of these developments, it is useful to further examine the dynamics outlined in the previous article to better understand the drivers at play. Three key factors should be considered:

- The existence of a single global price, despite high transportation costs that could otherwise push toward a regionalization of the market;

- The inelastic supply to prices, since most sulfur is obtained as a by-product of non-ferrous metal processing and of oil and natural gas desulfurization processes. Added to this was a collapse in exports from Kazakhstan and Turkmenistan, the main sulfur exporting countries;

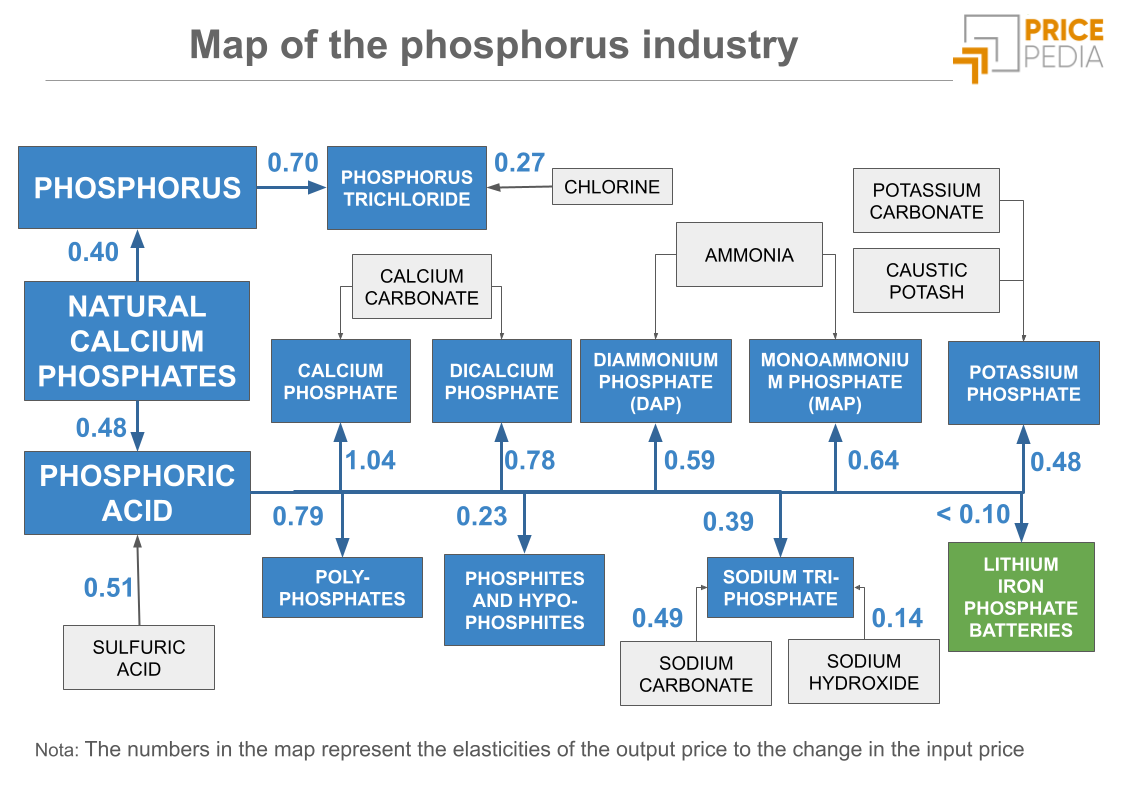

- The volatility of demand, linked to the ongoing global reorganization of the fertilizer market. Sulfur is primarily used in the production of sulfuric acid, which in turn is essential for the production of phosphoric acid, a key input for phosphate fertilizers.

Reshaping of global sulfur supply

The availability of sulfur on the global market is being constrained by a sharp reduction in exports from Kazakhstan and Turkmenistan.

In Kazakhstan, most exports come from the Kashagan oil field on the Caspian Sea, one of the oil deposits with the highest sulfur content in the world. Three main factors explain this decline:

- The exhaustion of stockpiles accumulated in previous years;

- The ongoing legal dispute between the NCOC consortium, which operates the field, and the Kazakh authorities, who in 2022 imposed a fine for excessive sulfur storage on site;

- Growing logistical difficulties in transporting sulfur to Russian ports on the Baltic and Black Seas, the main routes for Kazakh exports.

Turkmenistan’s export difficulties are also due to logistical issues linked to current geopolitical tensions. A significant share of Turkmen exports used to pass through the Iranian port of Bandar Abbas, on the Persian Gulf.

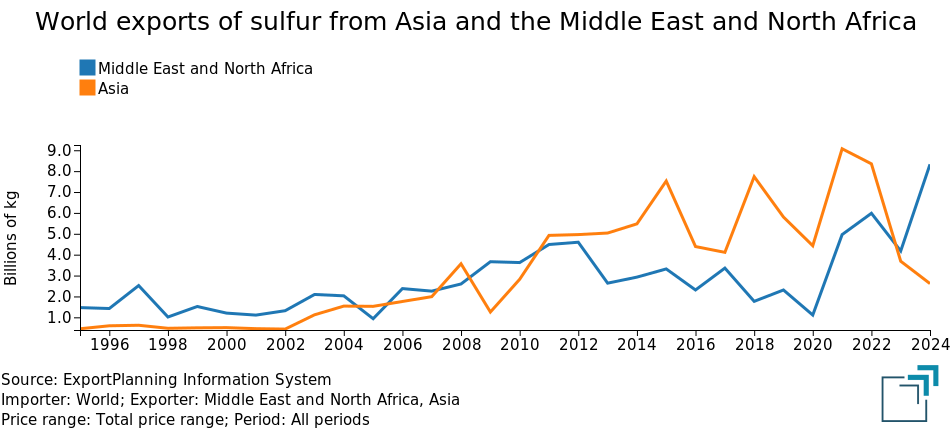

The reduction in exports from Kazakhstan and Turkmenistan has drastically curtailed Asian supply on the global sulfur market. This has been only partly offset by a sharp increase in shipments from MENA countries (Middle East and North Africa), led by the United Arab Emirates and Saudi Arabia. However, this growth has not been sufficient to fully compensate for the decline in Central Asian exports.

Demand-side turbulence

Industrial demand for sulfur is closely tied to the development of the fertilizer industry, which can be divided into four main segments:

- Nitrogen fertilizers: the main ones are urea, ammonium nitrate, and ammonium sulfate;

- Phosphate fertilizers, including monoammonium phosphate (MAP) and diammonium phosphate (DAP);

- Potash fertilizers: the most important is potassium chloride (known in agriculture as muriate of potash – MOP); less important, but still traded in volumes exceeding one million tons globally, is potassium sulfate (SOP);

- Compound fertilizers, capable of providing all three essential nutrients (nitrogen, phosphorus, and potassium).

Sulfur, through sulfuric acid used in the production of phosphoric acid, is fundamental to the manufacturing of phosphate fertilizers[1]. Its demand is therefore strongly dependent on the development of the phosphate fertilizer industry.

This sector, together with nitrogen fertilizers, is currently experiencing turbulence driven mainly by two factors:

- The sanctions imposed by Western countries on Russian and Belarusian exports;

- The export tariffs introduced by the Chinese government to curb fertilizer exports and increase domestic supply.

The reduced availability of fertilizers on the global market from China, Russia, and Belarus is leading other countries to expand their phosphate fertilizer production, leading to greater use and demand for sulfur.

In summary

The recent levels reached by international sulfur prices suggest that the market may be entering a third major uptrend cycle, following those of 2008 and 2022.

The ongoing reshaping of global supply – with Kazakh and Turkmen exports being partly replaced by shipments from the United Arab Emirates and Saudi Arabia – together with stronger demand from countries expanding their phosphate fertilizer production, appear to support this scenario.

For further information, see the article The Phosphorus Industry: Beyond Fertilizers