When a distortion in a substitute market can reshape an industrial value chain

From sugar-based biomass to biodegradable bioplastics

Published by Info PricePedia. .

bioplastics Chinese industryThis article examines the bio-chemical value chain that, starting from sugar-based biomass, leads to the production of bioplastics for packaging, with particular reference to the role of industrial sugars, lactic acid, and polylactic acid (PLA). In this context, the European market for white sugar used as a sweetener does not represent a segment of the value chain under analysis, but rather a regulated market that, through price-driven substitution mechanisms, can generate significant indirect effects on production costs along the bio-chemical value chain considered. The aim of the analysis is to reconstruct the causal chain of price transmission in order to use it as a tool to better understand market dynamics and formulate more accurate forecasts.

The European sugar market as an external source of distortion

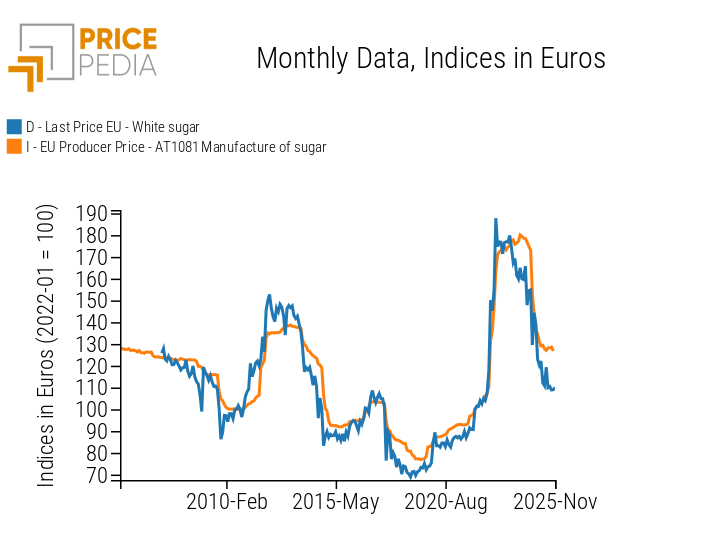

Sugar[1] production in Europe has historically benefited from a high degree of protection. Until 2017, this protection was primarily ensured through a system of production quotas; in subsequent years, through customs duties applied to extra-EU imports. The removal of production quotas initially led to a significant decline in prices: in the 2018–2019 period, wholesale sugar prices fell below EUR 400 per tonne. As shown in the chart reported below, prices gradually recovered in the following years, eventually recording a sharp increase in the second half of 2022. In less than six months, prices almost doubled, mainly due to the effects of drought on the European sugar beet harvest (see Persistently high sugar prices in Europe).

Price of white sugar in the EU

The subsequent normalization of the European market, in parallel with that of the international market, has allowed for a significant reduction in prices in recent years. Currently, prices in the EU market stand at around EUR 550 per tonne, while international prices, as reflected in ICE quotations for Sugar No.11 futures contracts, have been below EUR 300 per tonne since September 2025.

Sugar prices in the European Union have historically remained significantly higher than international prices. The 2022 crisis, however, displayed exceptional characteristics, pushing EU prices above those observed in the United States—another highly protected market—and generating a price differential with international markets close to EUR 400 per tonne.

The focus of interest for the present analysis lies in the effects that this price dynamic has exerted on the glucose market and, more broadly, on the bio-chemical value chain of polylactic acid (PLA).

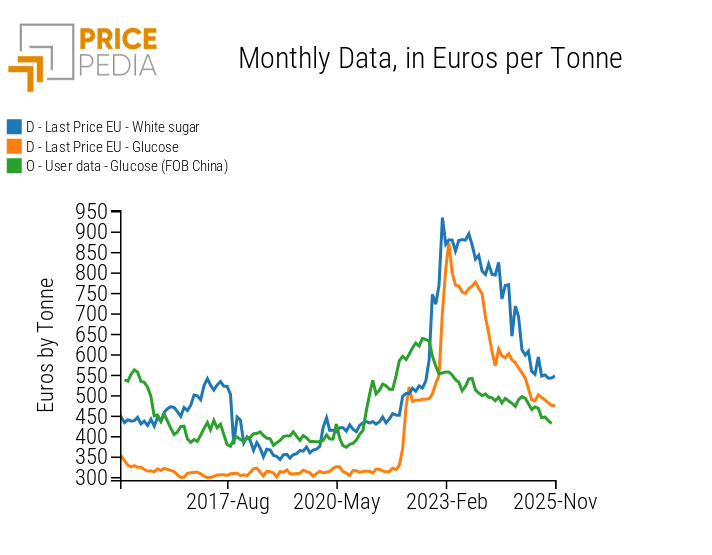

Economic substitutability between sugar and glucose in the European market

There is a high degree of economic substitutability between sugar and glucose[2], particularly in large-scale food industry applications. When the price of white sugar increases, firms tend to shift demand toward glucose and its derivatives (such as isoglucose), thereby exerting upward pressure on the prices of these products as well. This substitution effect becomes evident when comparing the price of sugar in the European Union with the price of glucose in the EU market and the price of glucose exported by China. As shown in the chart reported below, the increase in sugar prices is transmitted to European glucose prices with a delay of several months, while no significant increase is observed in the price of glucose exports from China.

Price of glucose in the EU and China

The sharp increase in glucose prices in the European Union between the end of 2022 and the first months of 2023 reversed the cost differentials between the EU market and the Chinese market. Prior to this shock, glucose produced from corn starch was less competitive in China, partly due to the relatively higher price of corn in the Chinese market. Following the late-2022 shock, the price of Chinese-origin glucose became significantly more competitive compared with the corresponding price in the European market.

Cost divergence and implications for lactic acid production

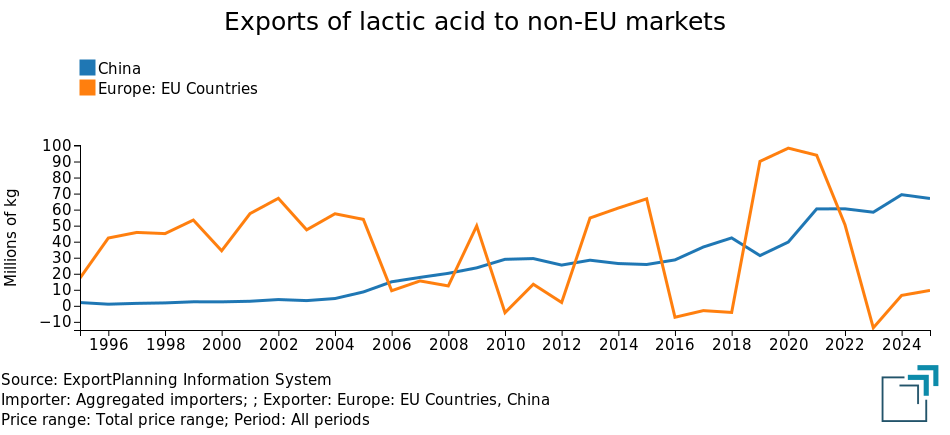

The reversal of glucose cost differentials has translated in recent years into a strengthening of China’s competitive advantage in lactic acid production, for which glucose represents a key input. The European Union has historically been one of the leading players in global lactic acid trade; however, a significant share of EU exports takes place within the intra-EU market. When these intra-EU flows are excluded and only exports to extra-EU markets are considered, the comparison with Chinese exports takes on a markedly different profile.

Against a backdrop of continuous and systematic growth in Chinese exports of lactic acid to extra-EU markets, European exports appear far more irregular, reaching an absolute low in 2023 and recovering only marginally in subsequent years. In 2025, Chinese exports to markets outside the European Union are estimated to be more than six times higher than EU exports directed toward the same markets.

It is reasonable to assume that a relevant factor behind this competitive reversal can also be found in the change in relative glucose prices between the European and Chinese markets, which has had a direct impact on lactic acid production costs.

Transmission of imbalances in the global polylactic acid market

Changes in competitive conditions in the lactic acid market are leading to a significant reconfiguration of market dynamics in its main downstream derivative, polylactic acid (PLA), which represents a key raw material for the production of biodegradable bioplastics.

Until a few years ago, the leadership of the United States and Europe in this sector appeared largely unchallenged. In recent years, however, the position of the Thai industry has emerged strongly. This development can be attributed to a combination of structural factors, including the abundant availability of agricultural feedstocks, a highly skilled workforce, a sizeable petrochemical industry, and strong governmental support for the decarbonisation process.

Within this framework, the Bio-Circular-Green (BCG) Economy strategy launched by the Thai government aims to increase the contribution of the bioeconomy to national gross domestic product from an estimated 2% in 2022 to 37% by 2037. The effects of this policy are already visible in the global PLA market.

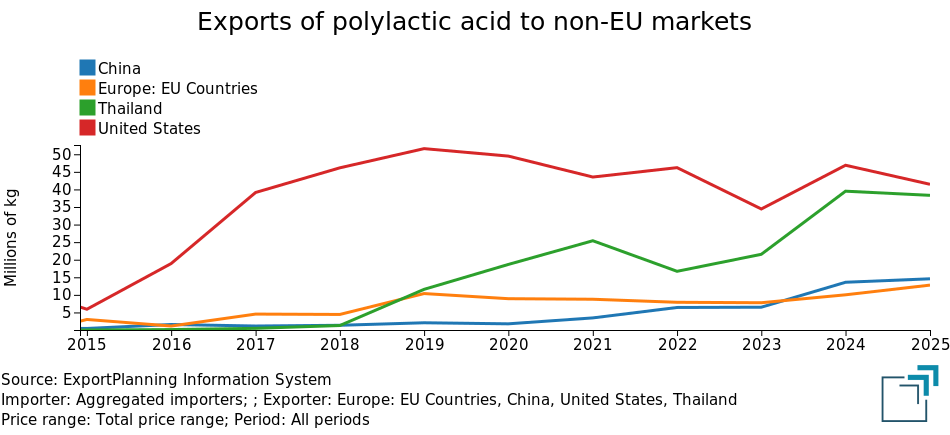

As shown in the figure below, in 2019 Thailand’s share of global trade in extra-EU markets surpassed that of the European Union and is now challenging the United States’ position. From 2024 onwards, EU exports have also been overtaken by those of China.

Asia is therefore emerging as a new strategic region in global PLA production, a sector expected to play a central role in future global bioeconomy value chains, with Thailand in a leading position and China acting as a follower.

Reconfiguration of the global bio-chemical value chain

The shock associated with the increase in white sugar prices in the European Union at the end of 2022 contributed to reinforcing a reorientation process of the global bio-chemical value chain that was likely already underway. In particular, this dynamic accelerated the shift of the centre of gravity of the global market for the main raw material used in biodegradable bioplastics from the Atlantic area towards Asia.

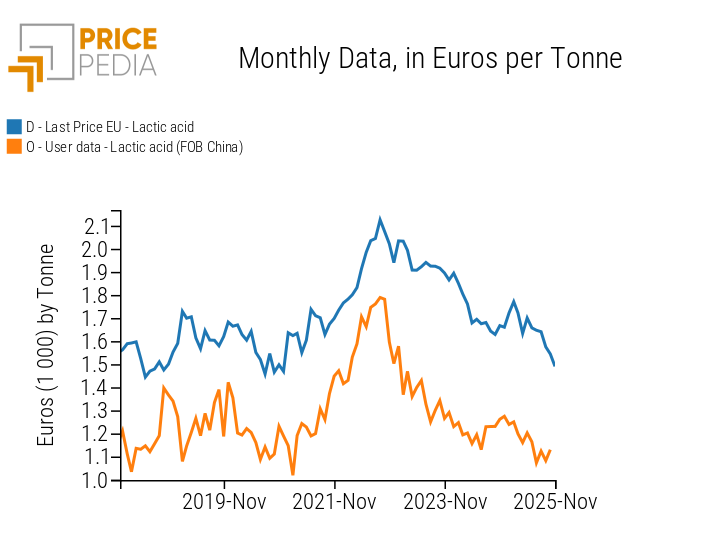

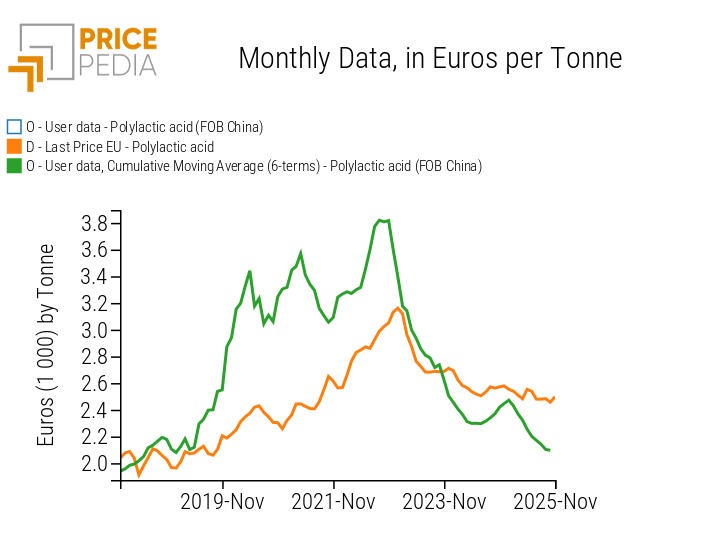

After having gained a competitive advantage over the European Union in lactic acid production during the previous decade, China has progressively extended this advantage to the higher value-added segment of polylactic acid. This evolution clearly emerges from the comparison between intra-EU customs transaction prices and the FOB prices of Chinese exports of the two acids, reported below.

Comparison between intra-EU customs trade prices and FOB prices of Chinese exports

| Lactic acid | Polilactic acid |

|

|

[1] In the text, the generic term sugar refers to white sugar for food use, mainly composed of sucrose (a disaccharide formed by the combination of glucose and fructose), obtained from sugar beet or sugar cane. It should be distinguished from glucose, which is also a sugar but of the simple type (a monosaccharide) and which, in the context of the present analysis, is considered primarily as an industrial input. Industrial glucose is produced mainly from starchy feedstocks (such as maize) or from other biomass sources and is used as a raw material in several processes, including fermentation for lactic acid production.

[2] In the text, the term glucose does not refer to the monosaccharide in its pure form, but to glucose traded on international markets, which may exhibit a variable fructose content. In this broader sense, the term also encompasses isoglucose, a product that is often commercially distinct, in which a share of glucose is converted into fructose through a controlled isomerisation process, resulting in a defined and standardised fructose composition.