Cobalt price forecasts

What price dynamics can be expected for cobalt in 2026?

Published by Luca Sazzini. .

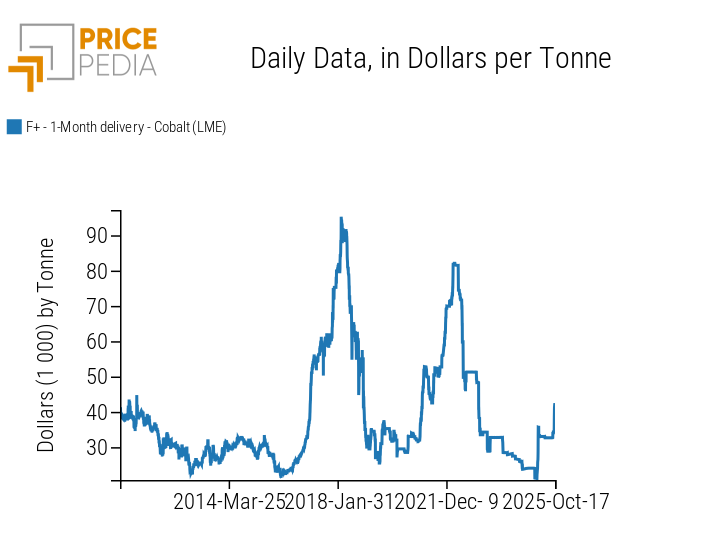

Non Ferrous Metals Cobalt ForecastIn the article “Metals rise amid supply shortages and US government paralysis”, a significant increase in LME cobalt spot prices was reported, which have risen from below $35000/ton at the beginning of October to over $42000/ton today, marking an increase of more than 20%.

The following chart shows the trend of LME cobalt financial prices, expressed in $/ton.

Historical series of LME cobalt prices, expressed in $/ton

At the beginning of February 2025, LME cobalt prices had reached a low of around $21000/ton, closing a long downward trend that began in April 2022, when values exceeded $80000/ton. The market oversupply prompted the Democratic Republic of the Congo, the world’s main producer and exporter, to completely suspend exports starting in February, with the aim of supporting prices.

The export ban by the Congo, which in 2024 alone accounted for 75% of global cobalt mattes supplies, led to a rapid price surge: in just three weeks, cobalt rose by almost 70%, exceeding $35000/ton in early March.

After several extensions, the total export suspension was replaced by a new quota system, announced on October 6 and officially implemented on October 16, 2025.

The announcement of the new binding quotas, accompanied by stricter penalties for violations, pushed LME cobalt prices above $42000/ton. The mechanism introduced by the Congolese government aims to regulate export flows in a more structured manner: for the last quarter of 2025, the maximum exportable volume is set at 18125 tons, divided into 3625 tons in October and 7250 tons in both November and December.

The system will also be extended to 2026 and 2027, with an annual ceiling of 87000 tons for direct exports from mining companies, plus an additional 9600 tons of “strategic quotas” allocated at the discretion of Arecoms, the national regulatory authority.

To ensure compliance with the new regulation, the government of the Democratic Republic of the Congo plans to implement new electronic tracking systems for all mineral exports, aiming to increase transparency and traceability. It has also introduced strict compliance requirements with severe penalties for violations: companies must fully use their allocated volumes, under penalty of immediate revocation of quotas, which would then be reassigned within the strategic quota system. Furthermore, revocation may also occur in cases of environmental violations, tax irregularities, or unauthorized transfers of quotas to third parties.

This export control policy risks exerting further upward pressure on cobalt prices, which are already expected to rise according to the latest PricePedia forecast scenario.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

PricePedia Forecast Scenario

The forecast of the customs price of cobalt mattes, developed by PricePedia with information available as of October 2, 2025, incorporates financial operators’ expectations implicit in the futures contracts for cobalt on the London Metal Exchange (LME). As highlighted in the article “Cobalt: world price formation driven by LME price”, the prices of cobalt mattes tend to follow both the dynamics and levels of their corresponding financial benchmark listed on the LME.

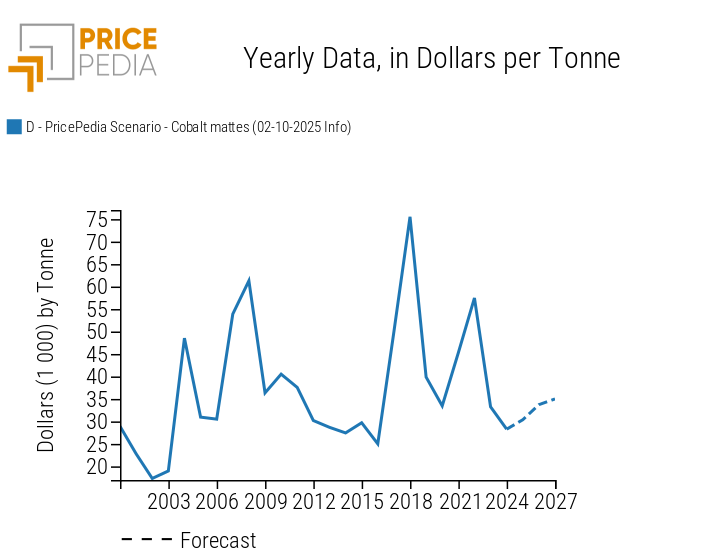

The following chart shows the PricePedia forecast scenario for cobalt mattes prices, expressed in $/ton.

PricePedia forecast scenario for cobalt mattes prices, expressed in $/ton

In 2025, the average price of cobalt mattes is expected to increase by more than 7%, rising from about $28000/ton to over $30000/ton. This upward trend is projected to continue in 2026 and 2027, with prices expected to reach $34000/ton and $35000/ton respectively.

Consensus Economics

The forecasts of rising prices are also confirmed by surveys conducted by Consensus Economics, involving numerous institutions and international organizations specializing in commodities.

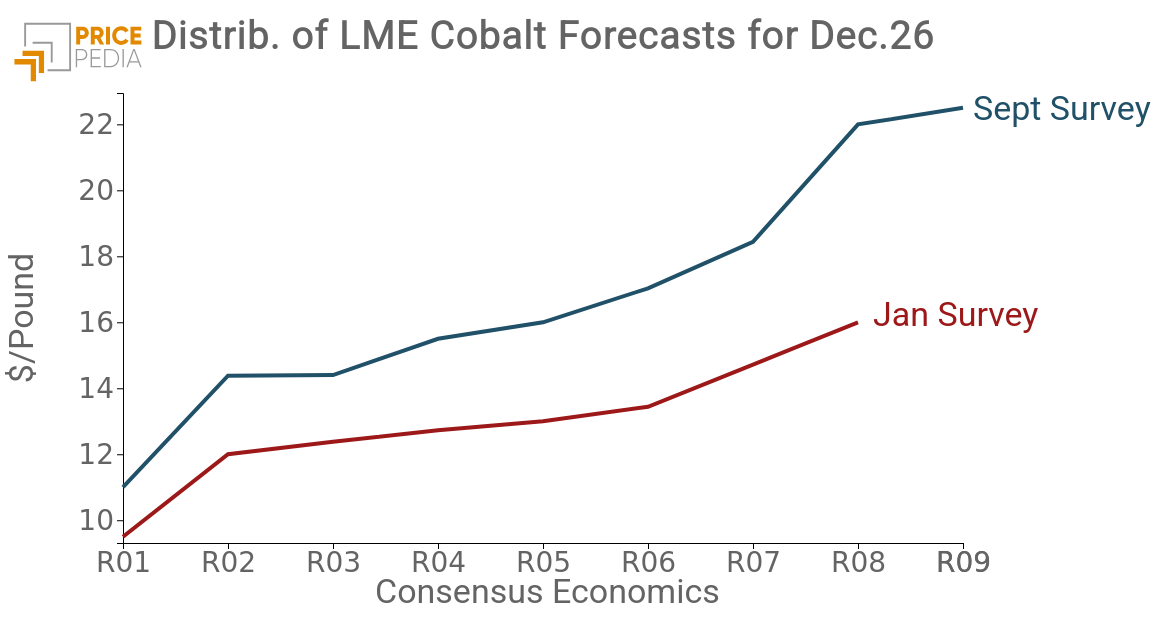

The following chart shows the forecast range from the January and September 2025 Consensus Economics surveys for LME cobalt prices in December 2026.

By comparing surveys conducted at different times, it is also possible to assess how the risk associated with forecasts varies, measured by the standard deviation of estimates from different forecasters.

The first survey conducted on January 20 by Consensus Economics, based on a sample of eight forecasters, indicated a price range for cobalt in December 2026 between $9.5 and $16/lb, with an average forecast of $12.97/lb, higher than the spot price at the time ($11/lb).

In the subsequent survey conducted on September 15, the estimated range rose to between $11 and $22.5/lb, with an average of $16.81/lb, compared to a spot price of $15.72/lb at the time of the survey. Compared to the beginning of the year, the average forecast for December 2026 has therefore increased significantly, as has the forecast risk, measured by the standard deviation, which rose from 1.92 to 3.71.

The results of this latest survey are consistent with the most recent PricePedia forecast scenario.

When converting the range into $/ton, it results in an interval between approximately $22000 and $48500/ton, with an average of $37000/ton for LME cobalt, a value very close to the roughly $35000/ton forecast by PricePedia for cobalt mattes in December 2026.

Conclusions

Since the beginning of October, LME cobalt prices have risen by about 20%, following the introduction of the new export quota system by the Democratic Republic of the Congo, the world’s leading cobalt supplier.

The tighter control of cobalt supply by the largest global exporter further increases the upside risks for LME-traded metal prices and, consequently, for physical prices, which tend to reflect both the levels and dynamics of the financial benchmark.

Forecasts published by both Consensus Economics and PricePedia point to a bullish outlook for the coming year.

In particular, the latest Consensus Economics survey shows a price range for December 2026 LME cobalt between $22000 and $48500/ton, with an average of $37000/ton, a value very close to PricePedia’s forecast for cobalt mattes, set at $35000/ton.