New expectations of rate cuts push metals higher

Fears of reduced tin and nickel supply from Indonesia

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekThis week, financial prices for Brent remained stable, fluctuating between 63 and 64 $/barrel, as markets await the next OPEC+ meeting scheduled for Sunday, 30 November. Expectations point to a slight increase in production in December, followed by a pause in the first quarter of 2026 due to excess supply.

While oil prices remained stable, those of gasoil and European natural gas declined, mainly supported by progress in peace negotiations regarding the war in Ukraine. A potential end to the conflict could increase global supply, which has already been abundant in the European gas market thanks to steady flows from Norway and rising LNG imports from the United States. This prospect pushed the TTF below 30 EUR/MWh during the week for the first time this year, further contributing to the decline in prices, also due to unusually mild weather that reduced heating demand.

In the metals sector, a broad-based increase was observed, affecting both precious and industrial metals. The main driver was the rise in expectations of a possible interest rate cut by the Federal Reserve (FED), following the publication of the Beige Book, the qualitative report that gathers economic assessments from the central bank’s twelve regional districts. The document highlighted a cooling of the labour market: in half of the districts, a drop in labour demand was reported, with several companies freezing hiring or reducing working hours.

Some FED officials stated that the weakening labour market could justify a rate cut as early as the short term.

Reinforcing expectations of an imminent reduction are reports indicating that Kevin Hassett is the leading candidate to head the FED: a close ally of President Trump, known for favouring more accommodative monetary policies.

Recent data on unemployment benefit claims, which unexpectedly declined, do not appear to be a sufficient obstacle to prevent the FED from proceeding with a cut in December. This prospect also contributed to the slight depreciation of the dollar over the week, further supporting the rise in financial commodity prices denominated in dollars.

Among precious metals, widespread increases were recorded, with silver reaching new all-time highs above 56 $/ounce, also benefiting from low stock levels in China.

In the industrial metals market, ferrous metals remained relatively stable, especially in Europe, with more modest weekly fluctuations, while non-ferrous metals showed sharper swings.

In the ferrous segment, a slight increase was recorded in the prices of Chinese iron ore, supported by declining exports from Australia and Brazil, potential changes to Chinese port fees, and the gradual improvement in China–US relations.

For non-ferrous metals, increases were noted mainly for tin, nickel, zinc, and copper.

The rise in tin was driven by supply issues: shipments from the Wa region in northeast Myanmar have not yet resumed, despite rising demand linked to the semiconductor industry. At the same time, in Indonesia, the world’s largest exporter of refined tin, the government is intensifying its crackdown on illegal mining activities, reducing available supply on the market.

The increase in nickel is also attributable to mounting supply risks from Indonesia, linked to stricter environmental controls on the mining sector and the temporary shutdown of a major plant due to its storage site nearing capacity.

The price of zinc on the London Metal Exchange (LME) surpassed 3,250 $/tonne, pushed by exceptionally low stock levels. The rise brought LME prices back above those of the Shanghai Futures Exchange (SHFE), which incorporate VAT and other taxes.

As for copper, the LME price again reached 11,000 $/tonne, supported by Codelco, which is proposing record annual premiums of up to 350 $/tonne for 2026 contracts, compared with 89 $/tonne for 2025, signalling possible supply-side tensions.

In the food commodity market, weekly price increases were recorded for grains, tropicals, and oils, with the sharpest rise in sugar prices.

NUMERICAL APPENDIX

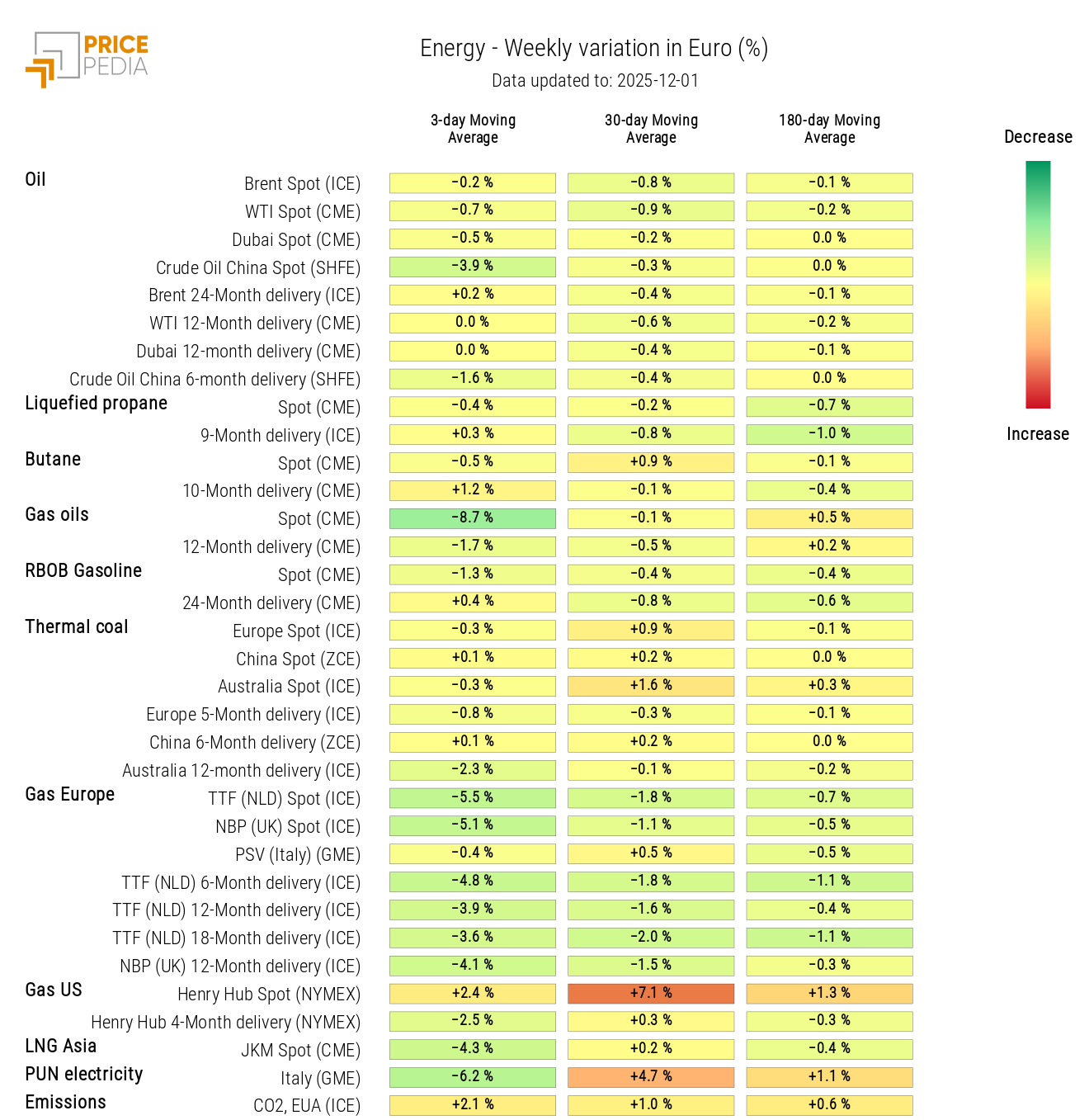

ENERGY

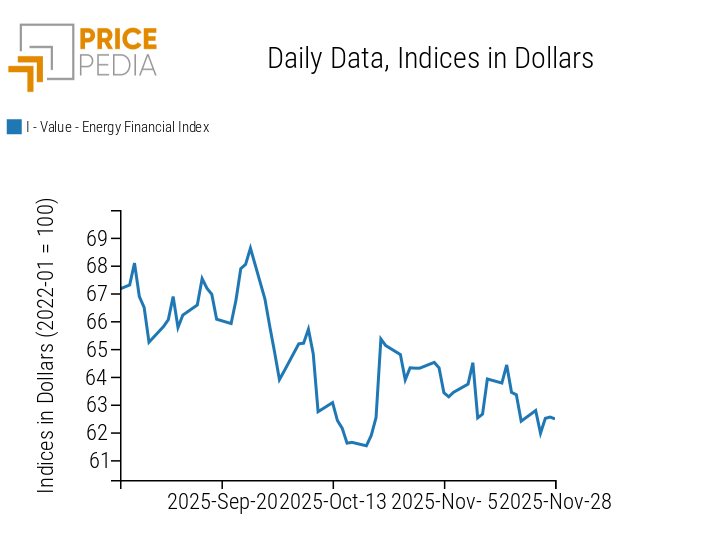

The PricePedia financial index of energy commodities shows mixed price movements, remaining relatively stable on a weekly basis.

PricePedia Financial Index of Dollar-Denominated Energy Prices

The analysis of the energy heatmap highlights a decline in gasoil, natural gas, and Chinese oil prices.

HeatMap of Euro-Denominated Energy Prices

PRECIOUS METALS

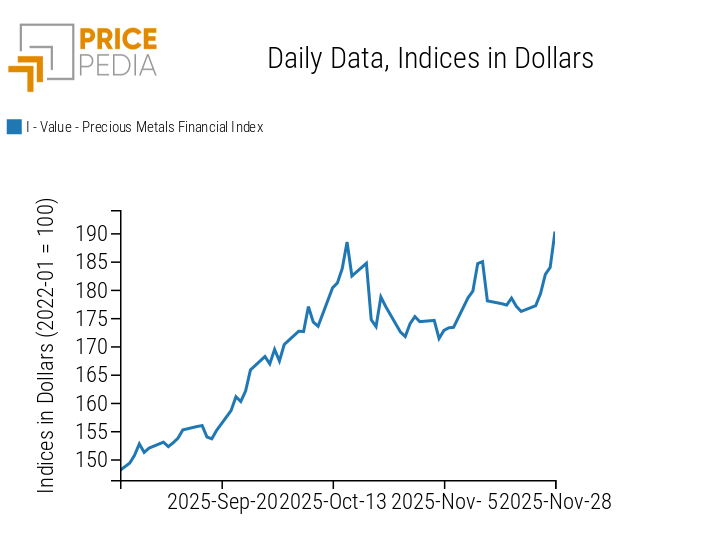

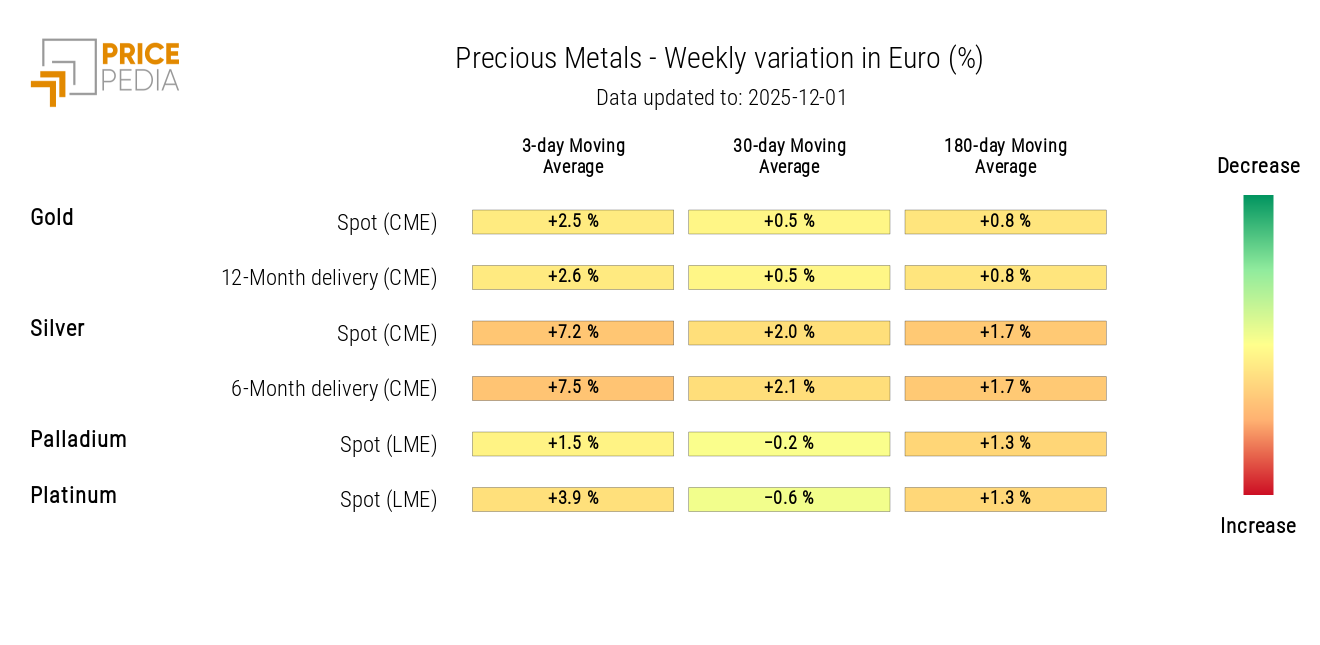

The financial index of precious metals reaches new all-time highs, driven by renewed expectations of FED rate cuts.

PricePedia Financial Index of Dollar-Denominated Precious Metal Prices

The precious metals heatmap shows a broad-based increase in prices, more pronounced for silver.

HeatMap of Euro-Denominated Precious Metal Prices

FERROUS METALS

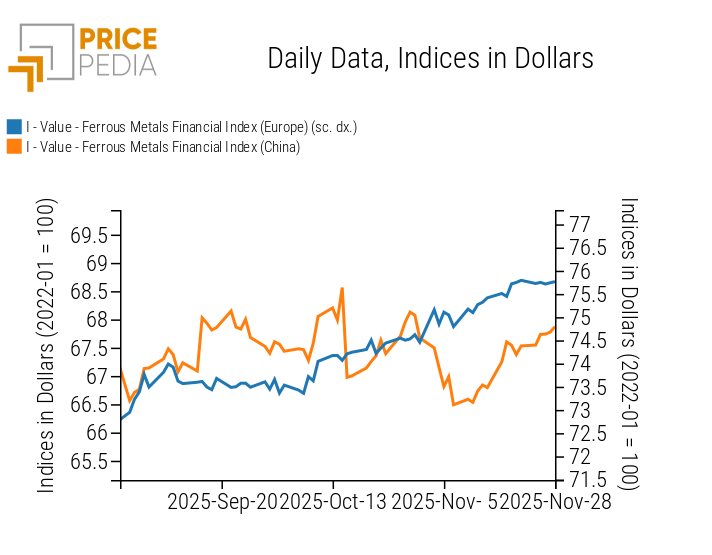

The European ferrous metals index shows a sideways weekly trend, while the Chinese index records an increase.

PricePedia Financial Indices of Dollar-Denominated Ferrous Metal Prices

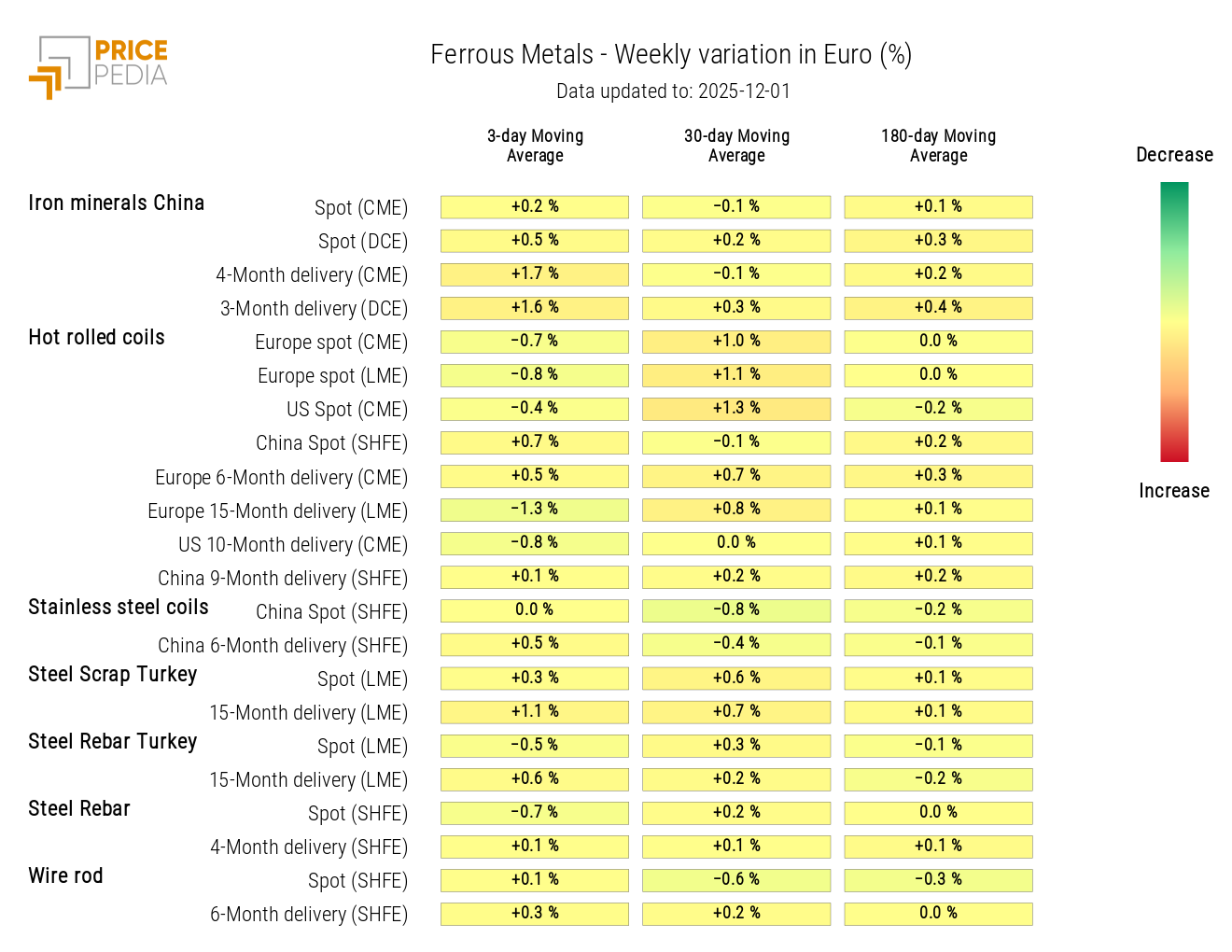

The analysis of the heatmap highlights relative stability in ferrous metal prices.

HeatMap of Euro-Denominated Ferrous Metal Prices

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

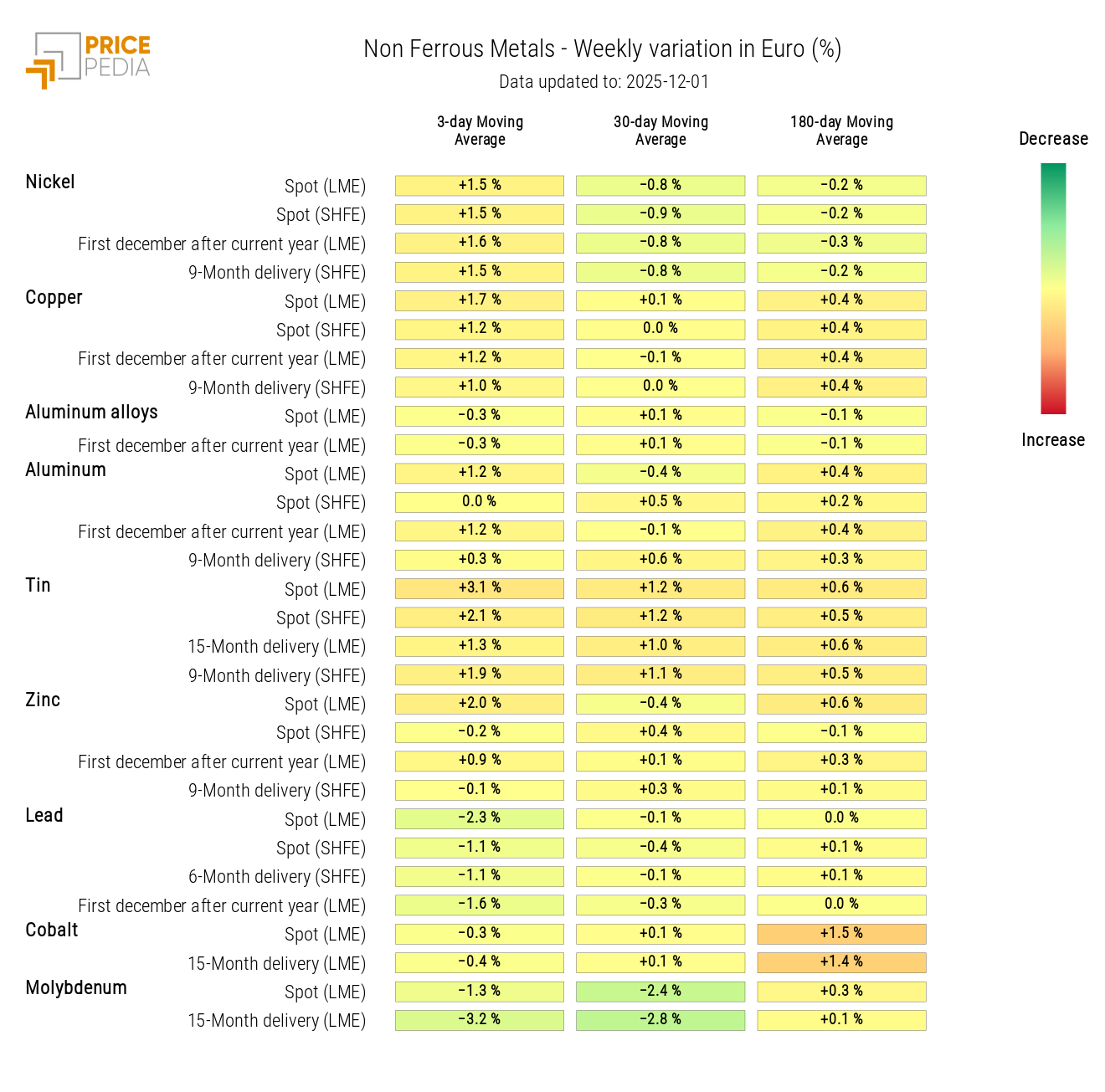

NON-FERROUS INDUSTRIAL METALS

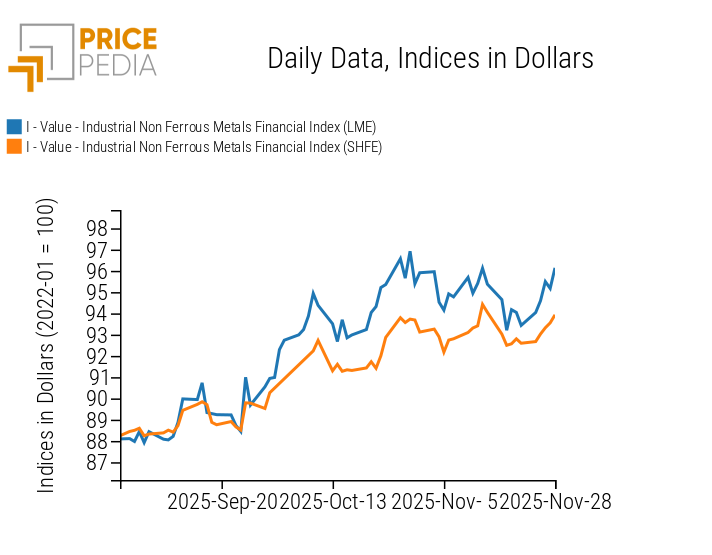

Both financial indices of non-ferrous metals show weekly price growth.

PricePedia Financial Indices of Dollar-Denominated Industrial Non-Ferrous Metal Prices

The non-ferrous metals heatmap highlights increases in nickel, copper, tin, and zinc prices, alongside declines in lead and molybdenum.

HeatMap of Euro-Denominated Non-Ferrous Metal Prices

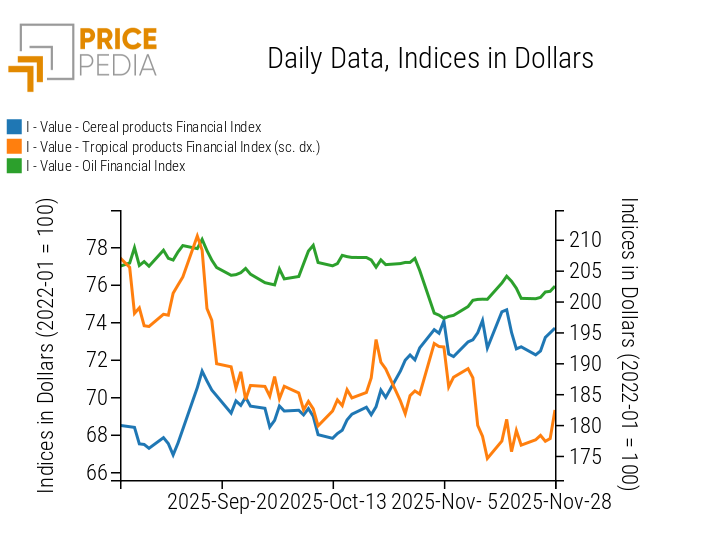

FOOD COMMODITIES

Despite strong fluctuations, all three financial indices of food commodities show weekly price increases.

PricePedia Financial Indices of Dollar-Denominated Food Commodity Prices

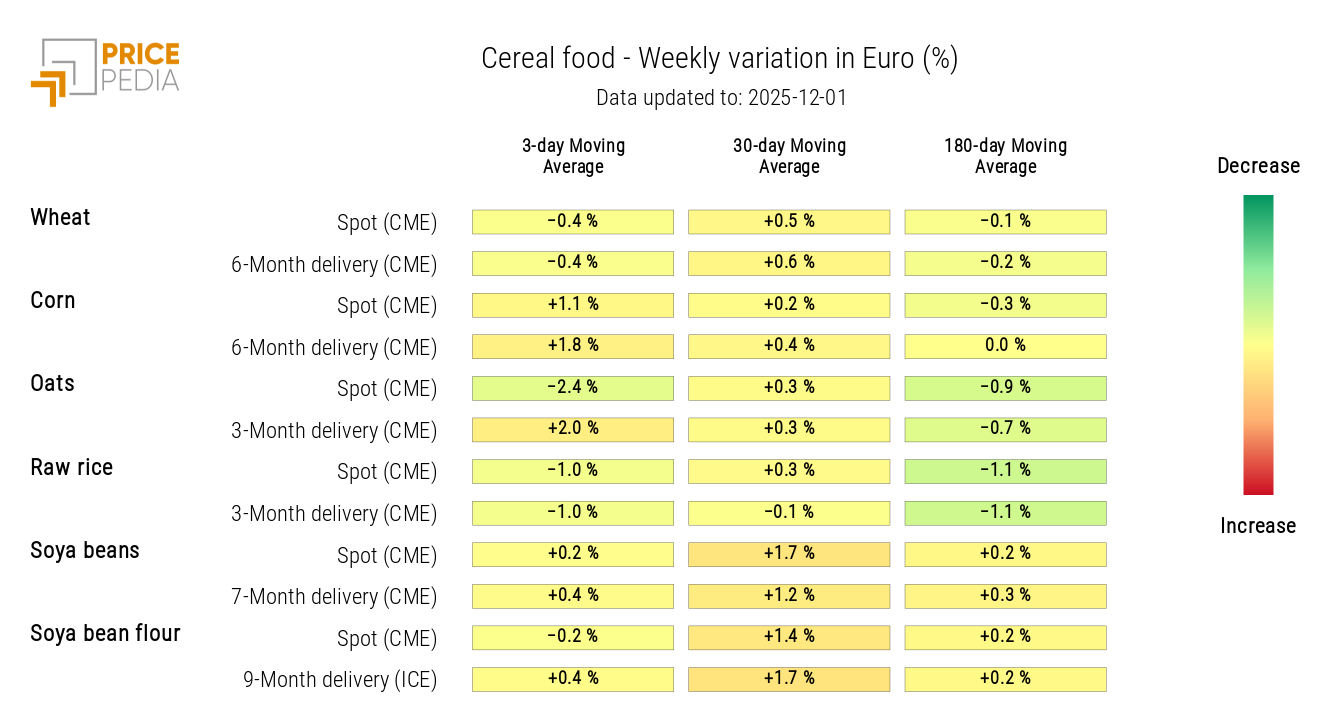

CEREALS

The heatmap analysis shows higher corn prices and a decline in oat prices.

HeatMap of Euro-Denominated Cereal Prices

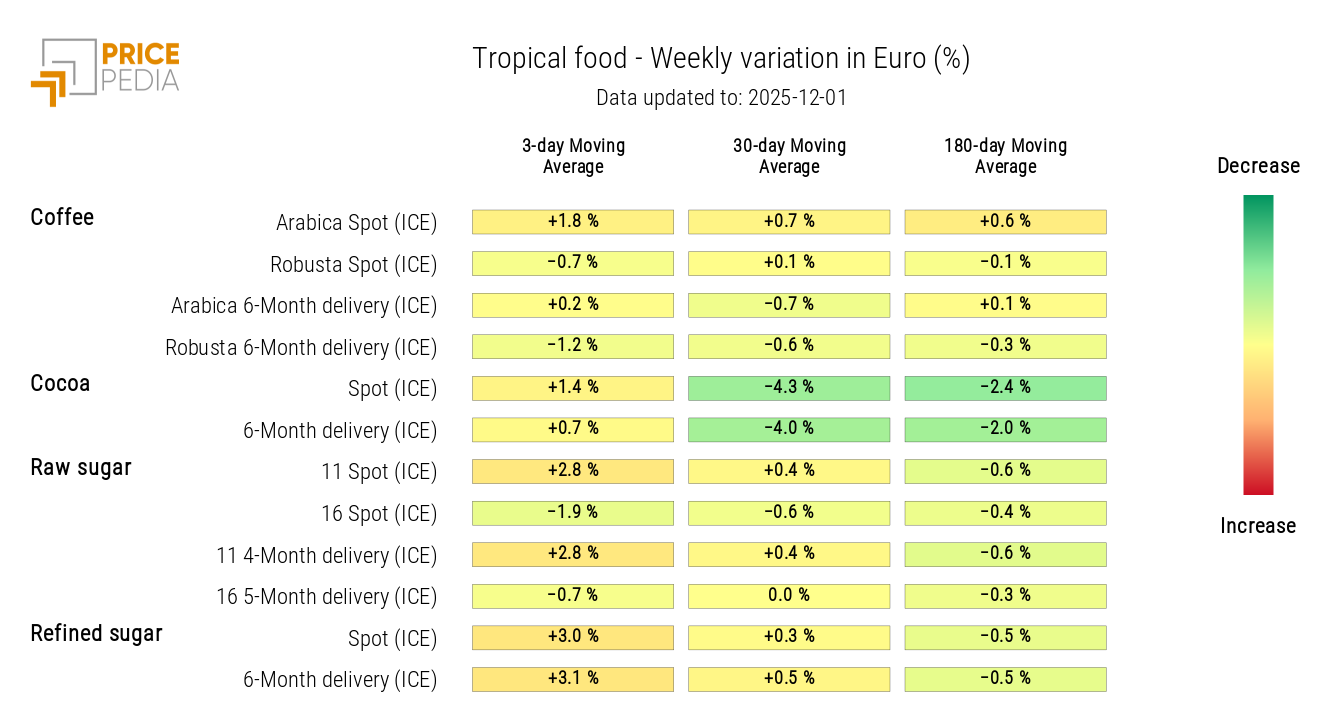

TROPICALS

The tropicals heatmap reveals an increase in both raw and refined sugar prices.

HeatMap of Euro-Denominated Tropical Food Prices

OILS

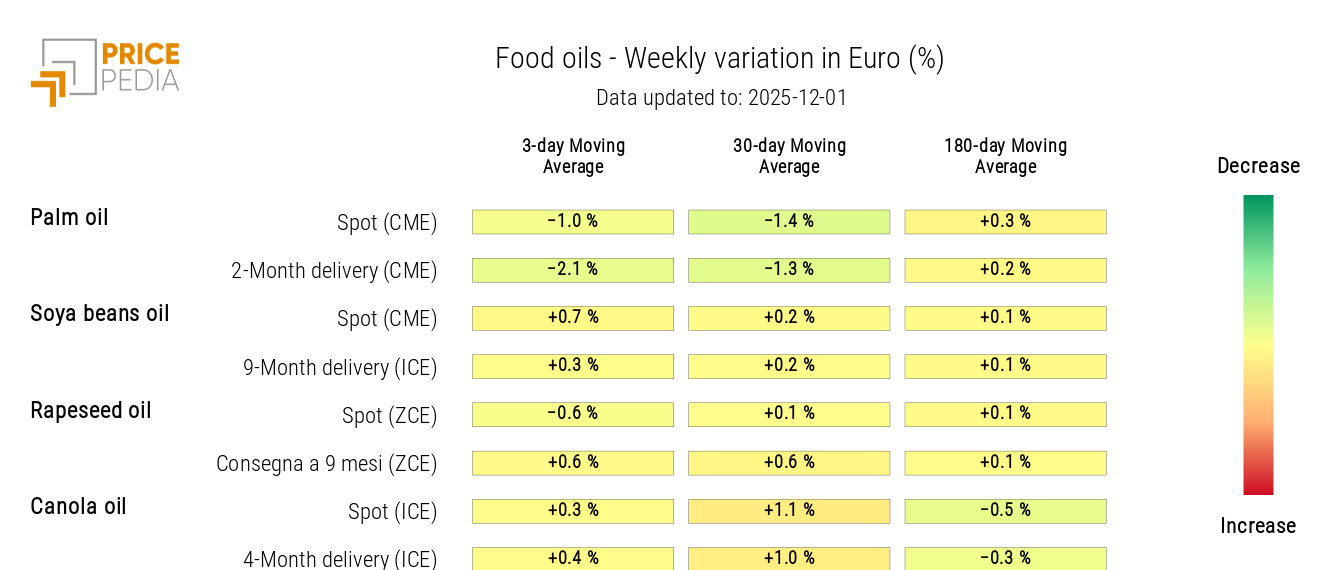

The edible oils heatmap shows a 1% weekly decline in the 3-day moving average of euro-denominated palm oil spot prices.

HeatMap of Euro-Denominated Edible Oil Prices