Energy Price Forecasts

With July 2022, a semester that will be particularly difficult has begun

Published by Luigi Bidoia. .

Energy cost Coal Electricity's National Single Price Natural Gas Oil ForecastWhen uncertainty is high, making predictions is very difficult. On the other hand, it is precisely in situations where the future is very uncertain that it becomes particularly useful to explore the future. Generally, the need to explore the future associated with high degrees of uncertainty leads to the formulation of multiple alternative scenarios. In this way, the forecaster does not express an a priori assessment on the possible alternative basic hypotheses, but develops different forecast scenarios depending on the hypotheses considered.

At PricePedia we have preferred to proceed in a different way. The objective of monthly updating the forecast scenario allows, in fact, to consider at each forecast cycle only the hypotheses that are considered highly probable, leaving to the following months the possibility to gradually integrate (or modify if necessary) the previously considered hypotheses, as additional information becomes available.

International prices

As part of the PricePedia project, the dynamics of international energy prices are constantly monitored.

The scenario resulting from the analyzes of the last few weeks is characterized by:

- a price of oil that does not fall, except for short periods, below $ 100 a barrel, even if demand is slowing down sharply. In fact, the low domnada is associated with an equally low supply: within the OPEC + cartel some producers accuse it of difficulty in guaranteeing the levels of planned production;

- a European gas market held hostage by Gazprom, whose goal appears to be, day after day, to bring in the short term the maximum possible damage to the European economy. In this situation, the price, which reached levels unthinkable a few months ago, cannot decrease without a significant reduction in demand. The European Commission has recently launched a plan for a voluntary reduction of EU consumption by 15% between 1 August 2022 and 31 March 2023, compared to the average consumption of the last 5 years in the corresponding period;

- a price of coal which remains at maximum levels, given the greater demand in Europe to produce electricity to replace that produced with gas plants and the imminent zeroing of the Russian offer. Indeed, on August 10, the EU ban on importing Russian coal will come into effect.

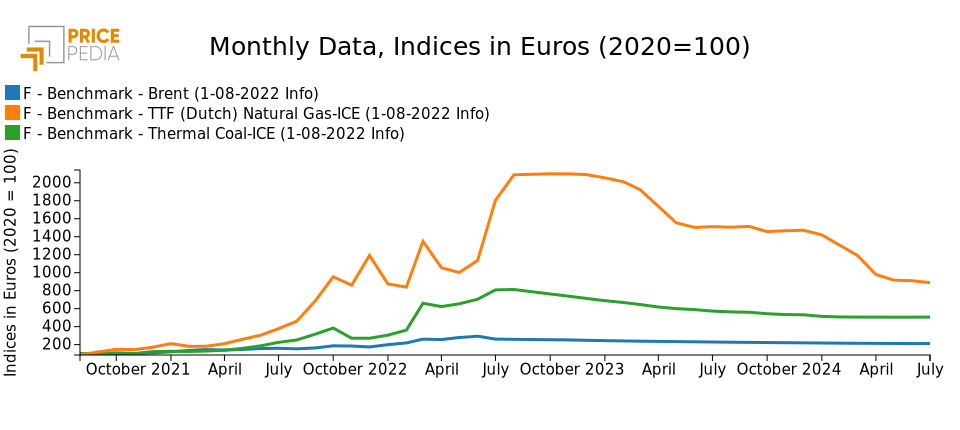

The graph below shows the dynamics of oil, gas and coal prices between 2021 and 2024.

Forecasts of Energy commodity prices

Technically, the forecast was developed considering the prices of the futures for the various future maturities of the three prices considered. This is possible because all three prices have a backwardation situation and have characteristics that lead the operators to converge towards a price given by the average of their forecasts[1].

The graph shows the strong growth in 2021-2022, especially accused by European gas and thermal coal, and the forecast of a very slow reduction in the near future. Again in 2024 the price of gas and coal will be higher than 100 euros / MWh and 200 euros / ton. If we consider that in the decade preceding the current energy crisis, the average prices of gas and coal were respectively 19 euros / MWh and 67 euros / ton, the intensity and length of this crisis is clear.

The price of oil is also expected to slowly decrease, falling below 85 euros / barrel only in the spring of 2024.

[1] For an analysis of this problem see the following article by William R. Emmons, Timothy J Yeager, The Futures Market as Forecasting Tool: An Imperfect Crystal Ball, pubblicato in Federal Reserve Bank of St. Louis The Regional Economist, January 2002.