Tin price forecast

Analysts agree on future dynamics of tin prices

Published by Luca Sazzini. .

Tin Non Ferrous Metals ForecastIn the article: "Tin under pressure: decline in Indonesian supply pushes prices up", we analyzed the strong increase in financial tin prices during 2025, linked to the significant drop in supply from Indonesia, the world’s leading exporter of unrefined tin. In 2025, tin was the non-ferrous metal that recorded the largest price increase after cobalt, and at present its price dynamics are continuing with intensity also from the beginning of this new year.

According to market analysts, in 2026 tin production in Indonesia is expected to increase, potentially supporting a recovery in the country’s exports. Will expectations of an increase in global tin supply be sufficient to interrupt, or at least moderate, the current upward phase in prices? In this article, we attempt to answer this question by analyzing tin price forecasts produced by various market forecasters.

Implicit forecasts in futures contracts

The analysis of futures contract prices makes it possible to identify the current price at which sellers/producers are willing to sell a commodity at a future date.

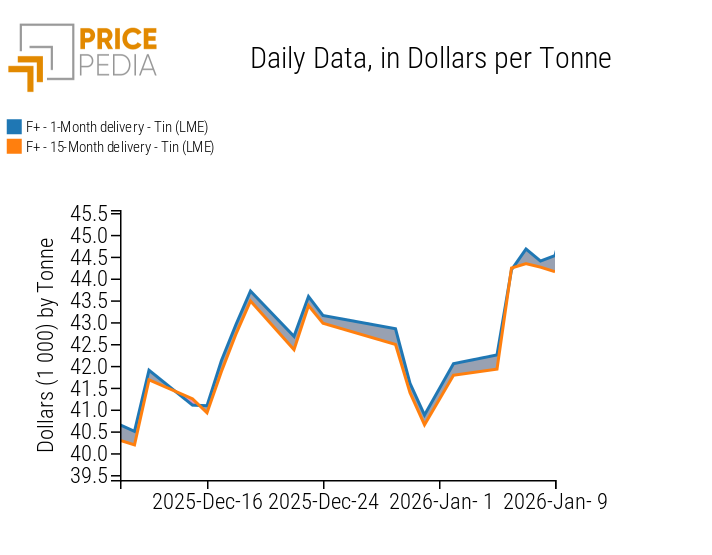

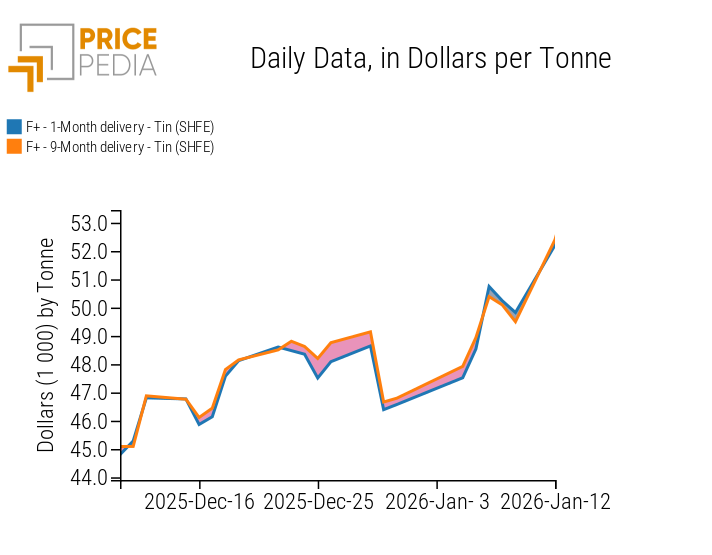

The charts below show comparisons between spot and futures prices for tin traded on the financial markets of the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE).

Comparison between spot and futures tin prices

LME prices

SHFE prices

The LME financial market is currently in a phase of backwardation, with the futures price for delivery in December 2027, equal to $44155/tonne, below the spot price, which stands at $44513/tonne. On the SHFE market, the contango phase has recently come to an end, showing a mild backwardation last week, with the nine-month futures contract currently trading at levels aligned with spot prices, around $52000/tonne (including VAT and other taxes).

Overall, both financial markets suggest that tin prices should not continue their upward phase, but could instead undergo a correction, especially on the LME market by December 2027. Otherwise, sellers would have no incentive to accept future deliveries at prices equal to or even lower than current ones, while at the same time bearing storage costs and associated financial charges.

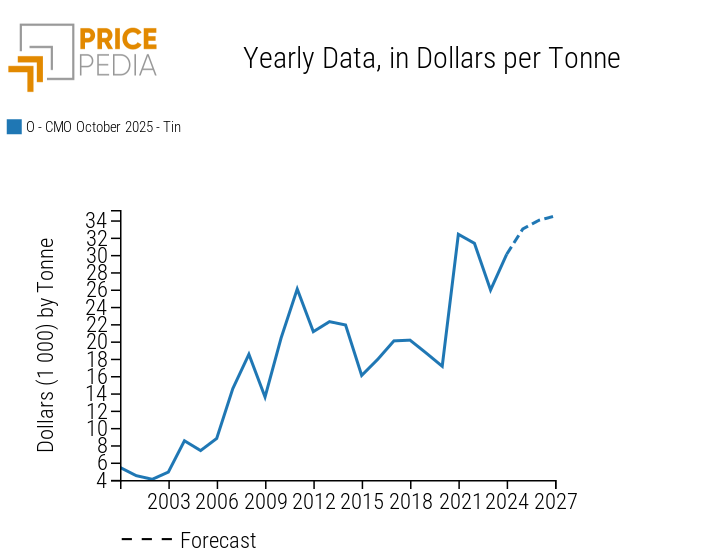

World Bank forecasts

The chart below shows the annual World Bank forecast for LME tin, updated as of October 2025.

World Bank forecasts of LME tin spot prices

The World Bank expects annual growth in LME tin spot prices over the next two years, with average levels estimated at $34000/tonne in 2026 and $34500/tonne in 2027. Although these figures indicate an upward annual trend, they are significantly lower than current spot prices, which stand at around $44500/tonne.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Consensus Economics forecast

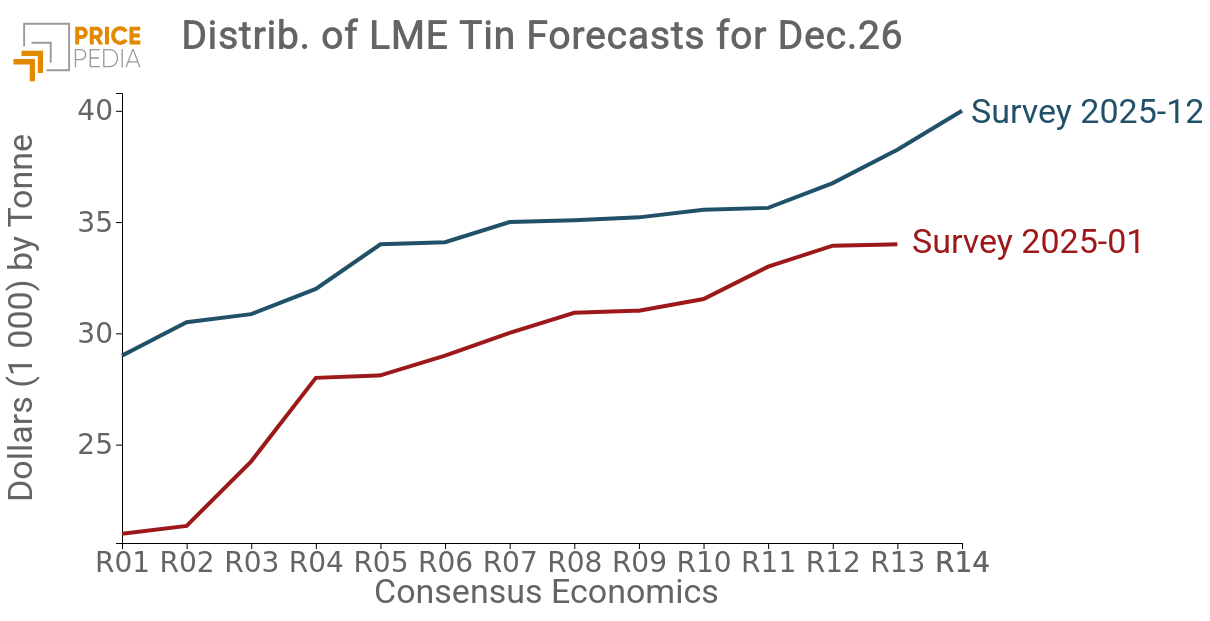

The third forecasting source considered in this analysis is Consensus Economics, which allows the construction of a forecast range for LME tin prices and the analysis of its evolution over time from one survey to the next.

The chart below shows the distributions of LME tin prices forecast for December 2026, collected in the January and December 2025 surveys, with the aim of highlighting how the forecast range changed over the course of last year.

Comparison between the surveys at the beginning and end of 2025 shows that, in the December survey, tin price forecasts for the end of 2026 increased significantly. In the January 2025 survey, conducted on a sample of 13 forecasters, the expected LME tin price for December 2026 ranged between $21000 and $34000/tonne, with an average forecast of nearly $29000/tonne. In the December survey, conducted on a sample of 14 forecasters, the forecast range widened to between $29000 and $40000/tonne, with an overall average above $34000/tonne. The latter survey also shows a reduction in volatility across forecasts, measured by the standard deviation, indicating greater convergence among analysts on future tin price trends for December 2026. In particular, all analysts agree on a decline in prices compared to current levels, with the maximum forecast price set at $40000/tonne, below the current spot price of around $44500/tonne.

PricePedia forecasts

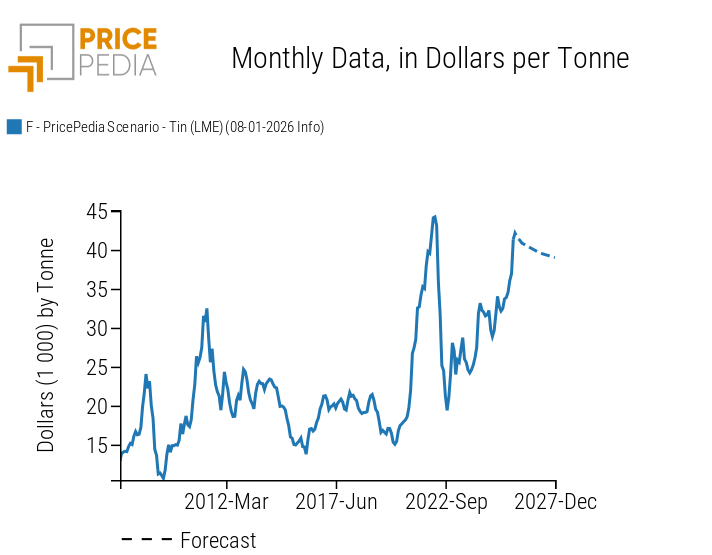

The LME tin forecasts published in the PricePedia scenario were derived as a synthesis of the forecasts described above, giving priority first to financial market expectations, then to Consensus Economics forecasts, and finally to those from the World Bank.

The chart below shows the PricePedia forecast scenario for LME tin spot prices, updated with information available as of January 8, 2026.

PricePedia forecast of LME tin spot prices

The PricePedia forecast scenario points to a gradual reduction in LME tin prices over the next two years. The PricePedia forecast for December 2026 is around $40000/tonne, a level that corresponds to the upper bound of the range identified by the consensus, in light of the still very high levels of futures contracts.

In terms of annual averages, PricePedia expects an average price slightly below $41000/tonne in 2026, followed by a correction in 2027, with an expected average just under $39500/tonne. Both levels are significantly higher than those of the latest World Bank forecast, which does not fully incorporate the continuation of the recent upward phase in tin prices observed in recent months.

Conclusions

All forecasters agree that the upward trend in tin prices is set to come to an end and that, over the next two years, prices will decline.

In the December 2025 survey produced by Consensus Economics, all analysts indicated a price for December 2026 below the current $44500/tonne, with a forecast range between $29000 and $40000/tonne. Within this range, the PricePedia forecast is positioned close to the upper bound, reflecting the still elevated levels of LME futures contracts, which for December 2027 stand at around $44000/tonne.

Analysis of World Bank forecasts can serve as a useful benchmark for assessing a potential equilibrium price between supply and demand. Estimates for 2027 indicate a potential equilibrium at a price of $34500/tonne. However, in light of market signals observed between October 2025 (the date of the World Bank forecast) and January 2026, we believe that even in 2027 the market may continue to show relative supply tightness. This scenario suggests, even over a two-year horizon, price levels close to $40000 per tonne.