Uncertainty prevails over short-term financial commodity prices

The upward trend in precious and non-ferrous metals continues

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekThe escalation of geopolitical tensions and persistent supply-side concerns continue to be the main short-term drivers of financial commodity prices.

In the energy sector, oil prices are predominantly influenced by geopolitical tensions between the United States and Iran, mainly related to the risk of a potential military intervention against Tehran. Market pressures are further reinforced by statements from President Trump, who announced the United States' intention to impose secondary 25% tariffs on countries that maintain trade relations with Iran. Among the main buyers of Iranian oil is China, which in the past has ignored similar threats concerning Venezuelan and Russian oil. It remains to be seen whether, in light of the recent U.S.-China trade truce, the Trump administration intends to reignite tensions by imposing new tariffs on Beijing.

Additional support for oil prices came from Ukrainian attacks on Russian energy infrastructure and a drop in Kazakh exports from the CPC terminal. According to Bloomberg, exports were about 45% below initial forecasts due to maintenance, damage caused by Ukrainian drones, and adverse weather conditions.

The correction in oil prices observed on Thursday was instead due to a reduction in fears of an immediate U.S. intervention against Iran. In the short term, the oil market is expected to remain turbulent, while in the long term, bearish fundamentals should prevail.

While oil prices experienced a partial correction on Thursday, European natural gas (Dutch TTF) showed a continuous rise throughout the week. The cold wave in Europe, interruptions at the French Flamanville nuclear plant, and geopolitical tensions in Iraq and Turkey contributed to supporting a price recovery, with current quotations at €37/MWh.

The precious metals sector continues its upward trend, supported by geopolitical tensions and concerns about the independence of the FED in the face of political pressure from the Trump administration. Silver prices exceeded the historical record of $90/oz, while gold reached $4600/oz.

In the industrial metals market, a divergence was observed between ferrous metal prices and a rise in non-ferrous metals, still supported by persistent supply concerns. In particular, among ferrous metals, prices declined in Europe while rising in China, supported by the increase in stainless steel coils in Shanghai.

Regarding non-ferrous metals, the most significant increase was in tin, reaching levels close to $55000 per ton. The price rise is partly due to the temporary halt of Indonesian exports at the beginning of the new year, linked to the seasonal renewal of export permits, and to increased speculation by Chinese investors. Supply concerns remain high, amplified by increasingly strict Indonesian authorities, who this week intercepted and seized a shipment of smuggled tin bound for Malaysia.

However, in 2026, a recovery in Indonesian production and an increase in exports are expected, which should gradually reduce tin prices. As highlighted in the article

"Tin price forecast",

analysts agree on a decline in financial tin prices by December 2027.

Other metals that recorded weekly growth include zinc, lead, aluminum, copper, and nickel. In particular, copper surpassed the record of $13300/ton, still supported by persistent supply concerns.

In the food commodities sector, except for vegetable oils, which increased, there was a weekly decline in cereal and tropical commodity prices. The most significant drop affected cereals, following the latest USDA WASDE report, which forecasts an increase in U.S. and global production of corn, soybeans, and wheat. Tropical commodities also showed a weekly decline, mainly driven by cocoa, which corrected following the release of lower-than-expected European grinding data.

NUMERICAL APPENDIX

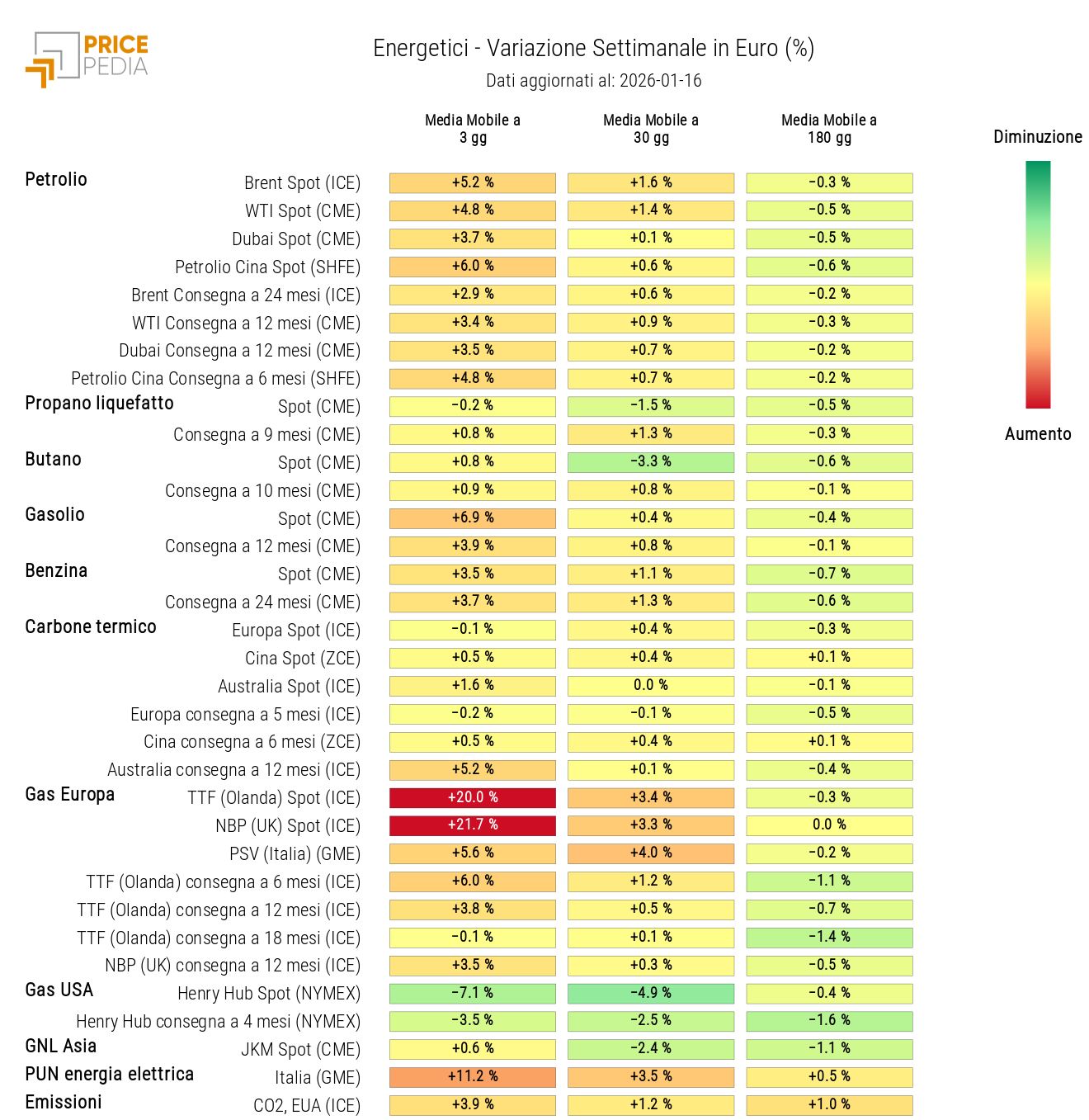

ENERGY

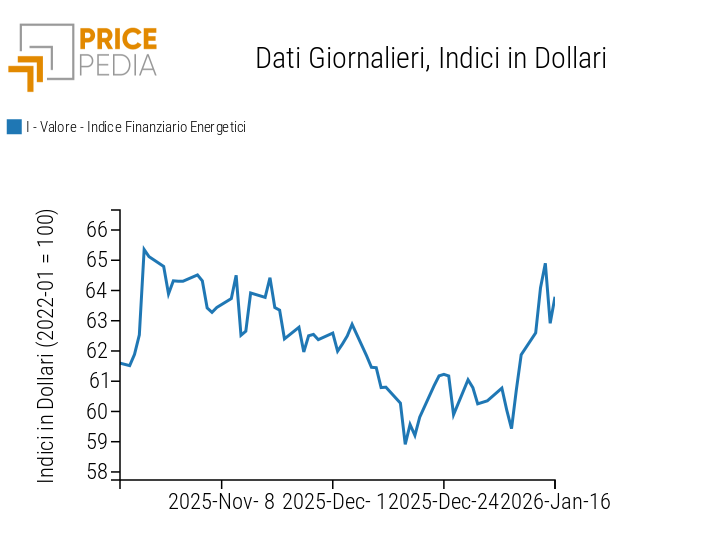

Despite mixed fluctuations, the PricePedia financial index for energy products shows growth this week as well.

PricePedia Financial Index of Energy Prices in Dollars

The energy heatmap highlights a rise in European natural gas, oil, and oil derivatives prices.

HeatMap of Energy Prices in Euros

PLASTICS

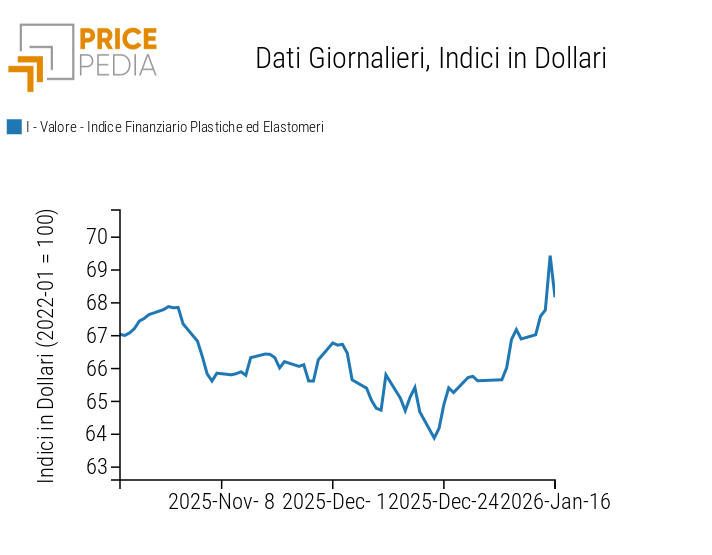

The Chinese financial index for plastics and elastomers follows an upward trend at the start of the week, then shows a decline.

PricePedia Financial Index of Plastics Prices in Dollars

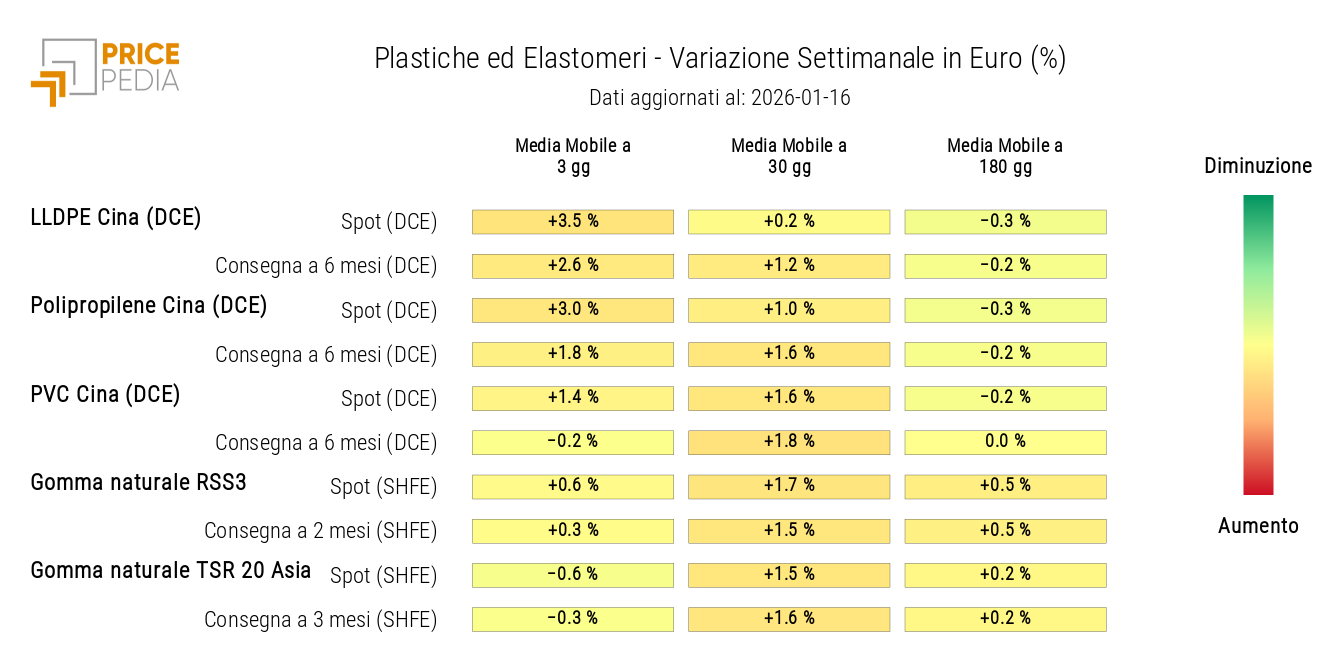

The heatmap analysis shows weekly growth in plastics prices and relative stability in elastomers.

HeatMap of Plastics and Elastomers Prices in Euros

PRECIOUS METALS

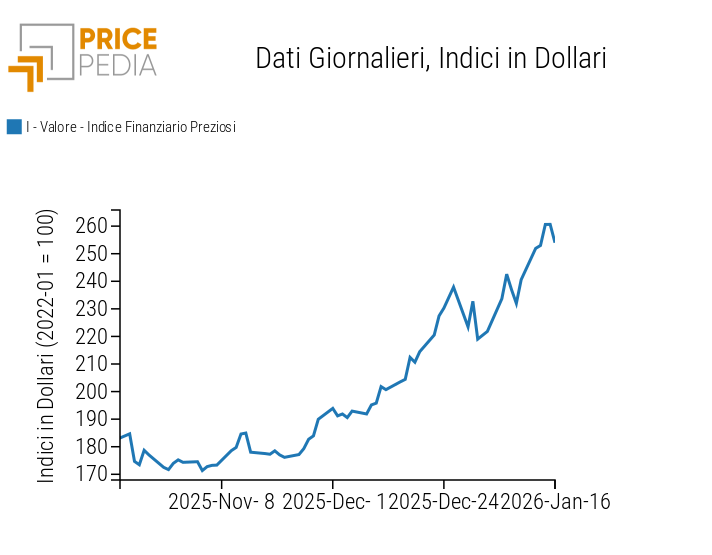

The precious metals financial index continues to reach new all-time highs, driven by geopolitical tensions and U.S. government pressure on the Federal Reserve.

PricePedia Financial Index of Precious Metals Prices in Dollars

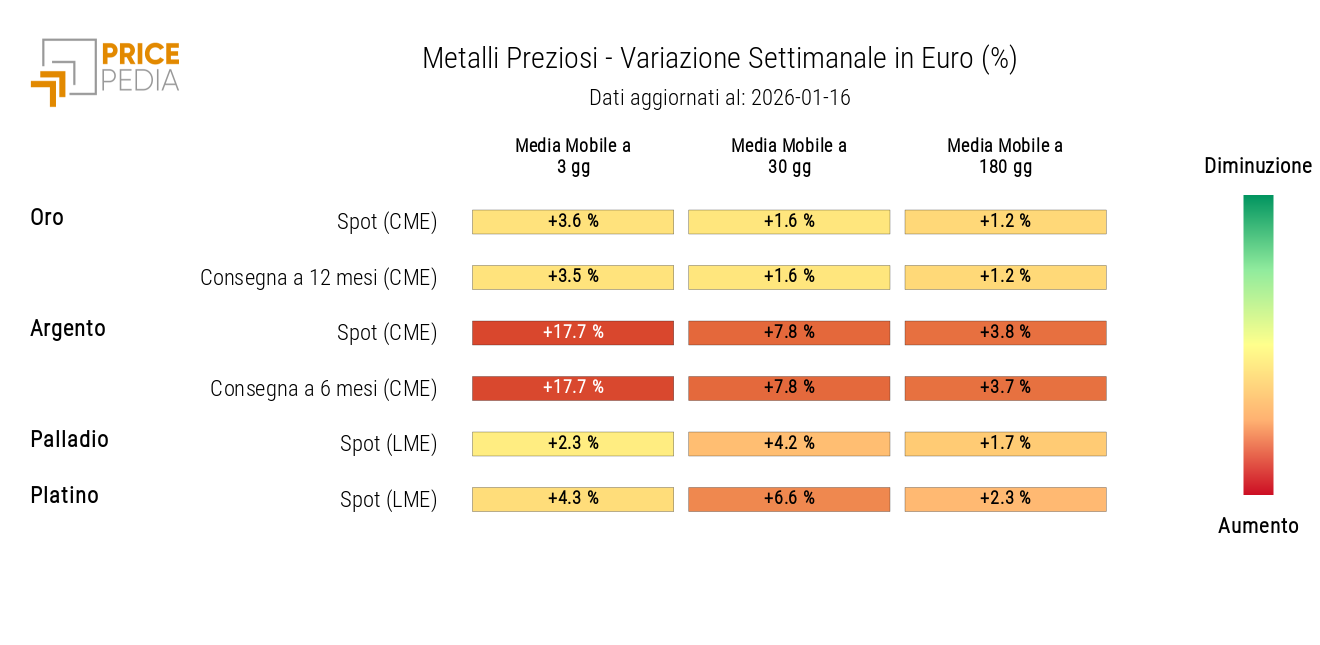

The precious metals heatmap shows a particularly strong rise in silver prices.

HeatMap of Precious Metals Prices in Euros

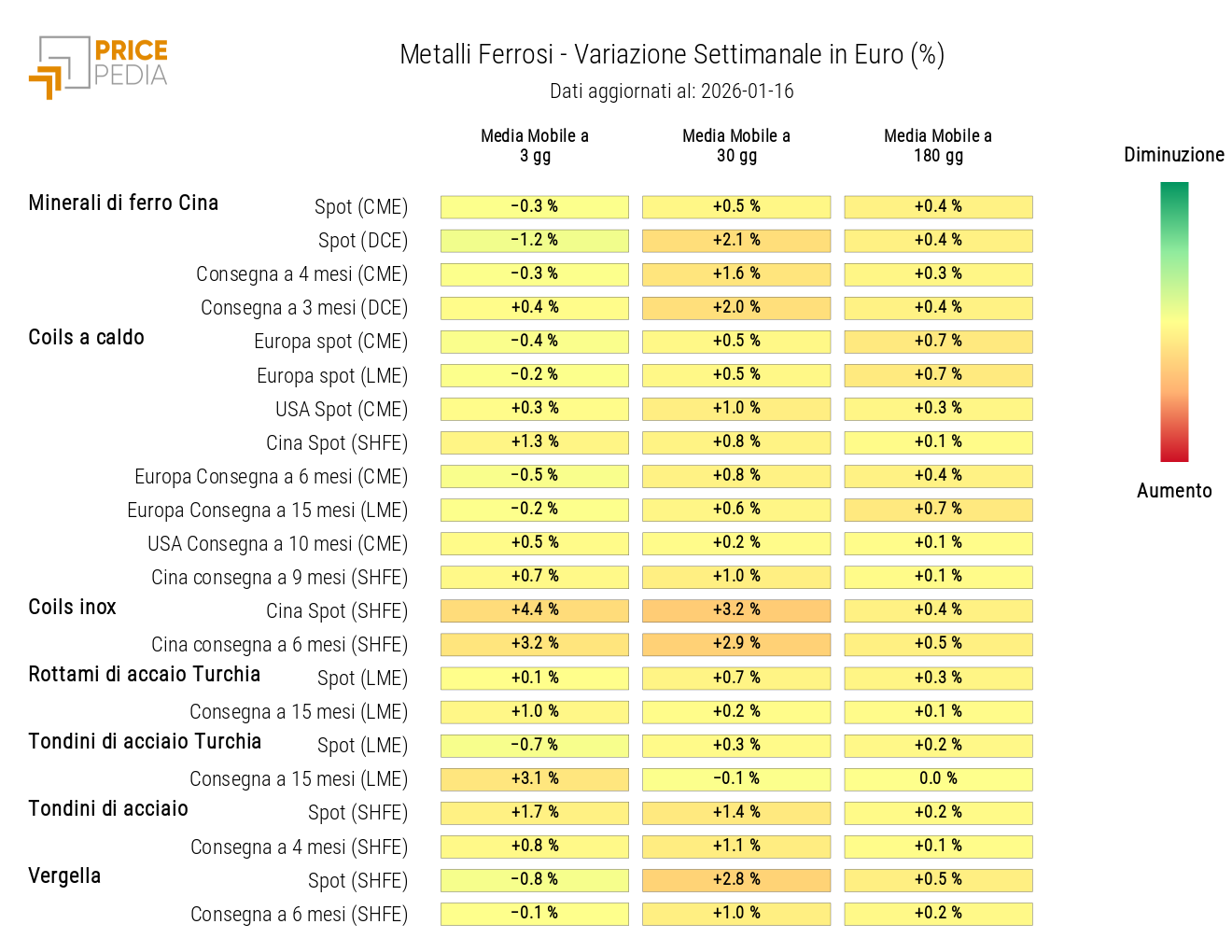

FERROUS METALS

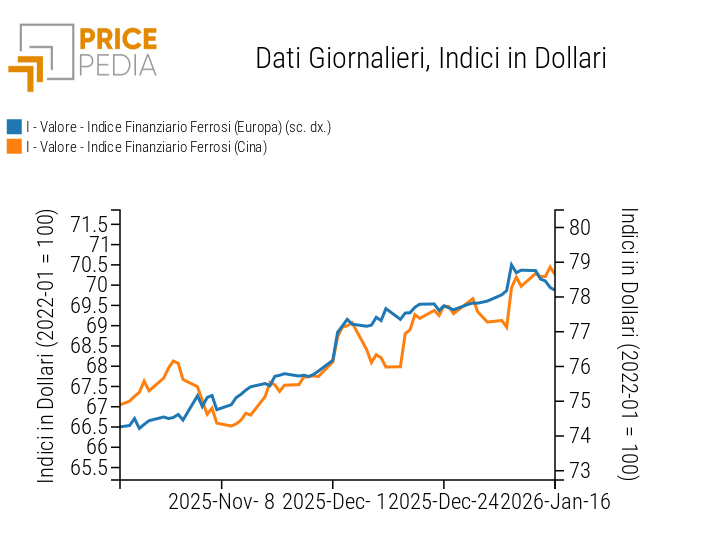

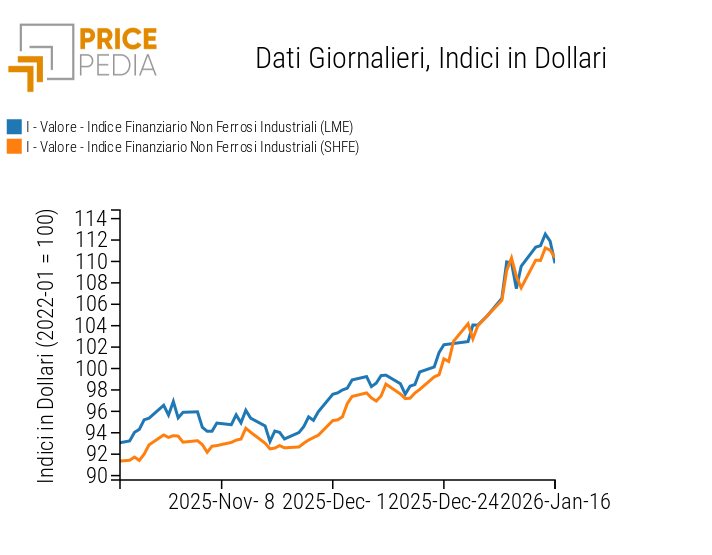

The two financial indices for industrial metals show divergent weekly dynamics, with the European index down and the Chinese index up.

PricePedia Financial Indices of Ferrous Metals Prices in Dollars

Heatmap analysis shows an increase in Chinese stainless steel coil prices.

HeatMap of Ferrous Metals Prices in Euros

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

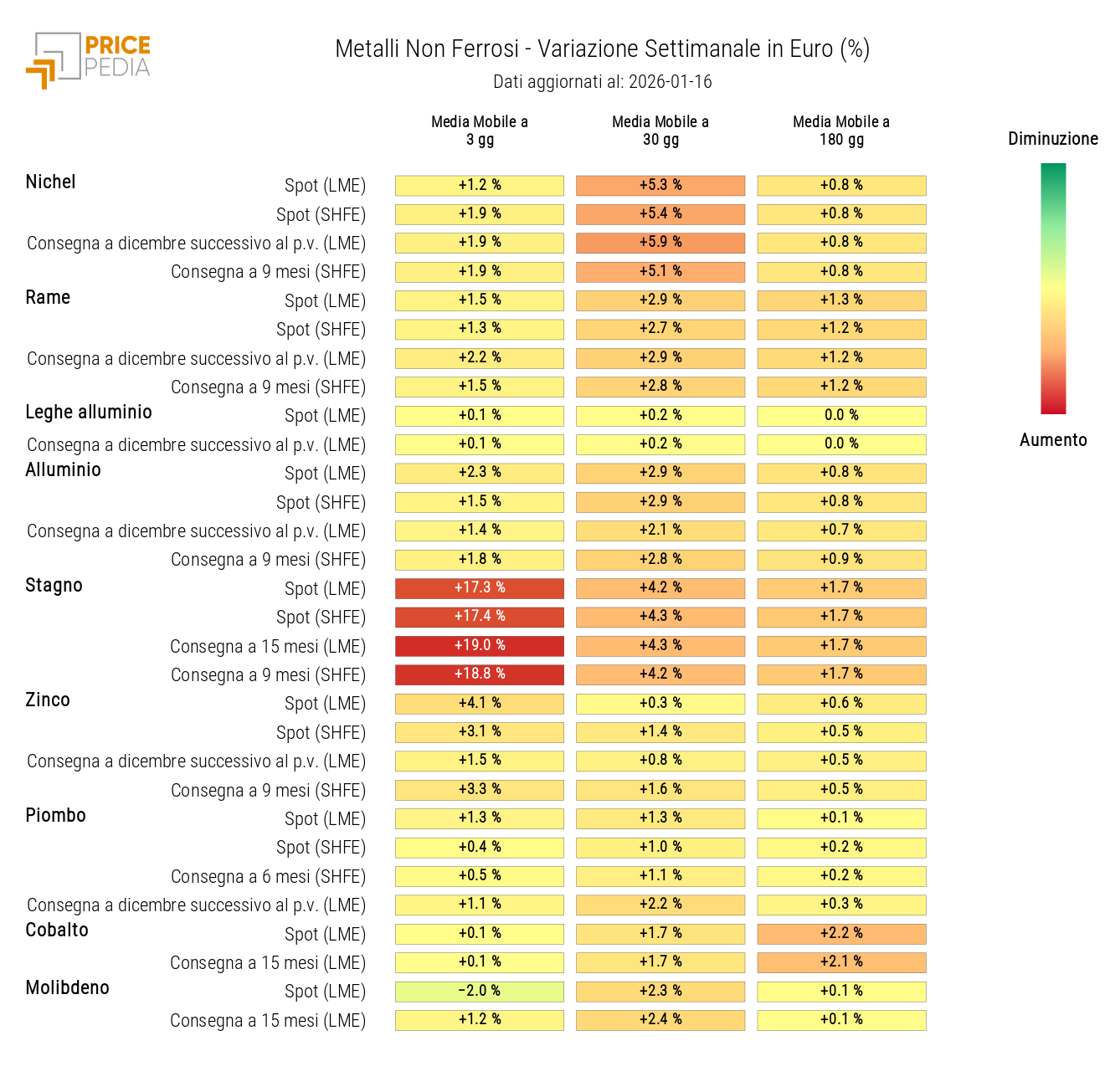

NON-FERROUS INDUSTRIAL METALS

This week too, financial indices of non-ferrous metals continue their upward trend, supported by current supply tensions.

PricePedia Financial Indices of Non-Ferrous Industrial Metals Prices in Dollars

Heatmap analysis of non-ferrous metals shows a particularly pronounced increase in tin prices.

HeatMap of Non-Ferrous Metals Prices in Euros

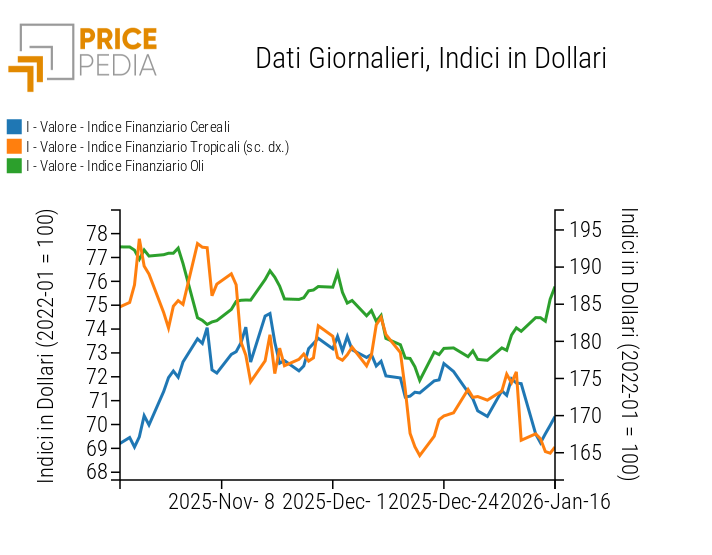

FOOD COMMODITIES

The vegetable oil index follows an upward trend, while the cereal and tropical indices show a decline.

PricePedia Financial Indices of Food Prices in Dollars

CEREALS

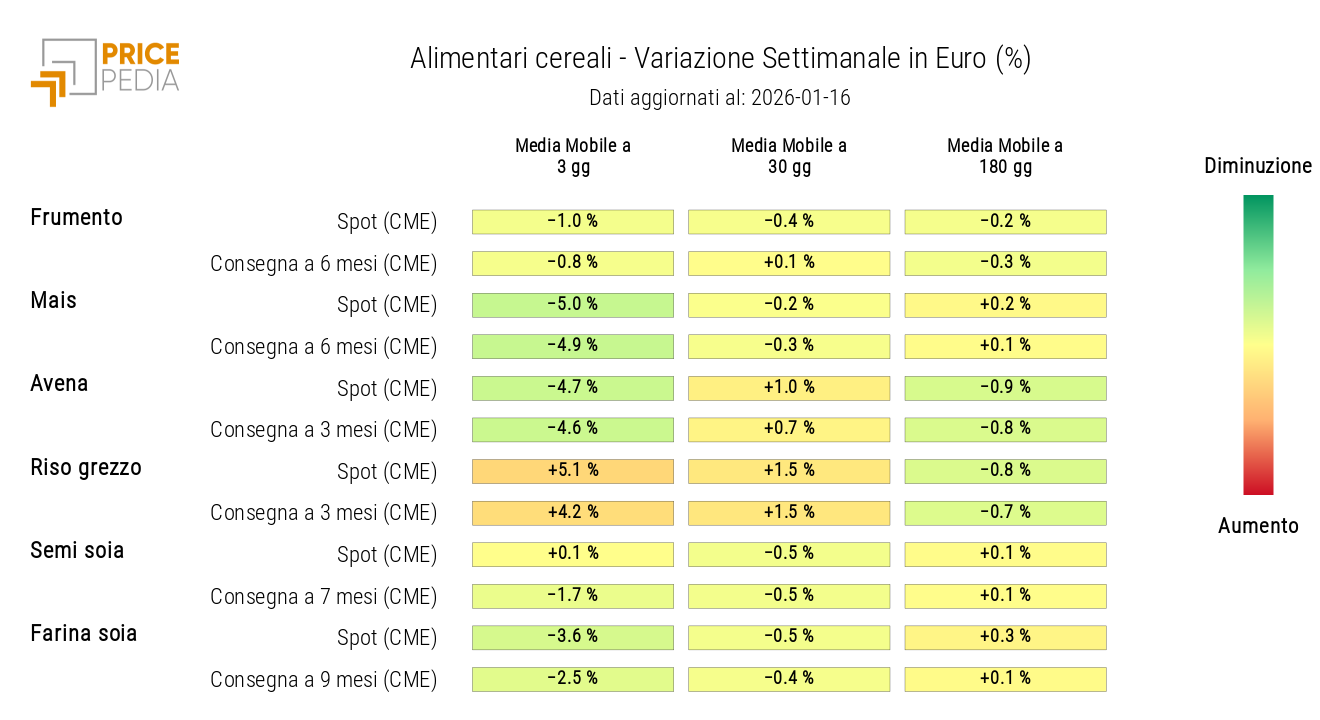

Heatmap analysis shows a decline in the prices of corn, oats, and soybean meal.

HeatMap of Cereal Prices in Euros

TROPICALS

The tropical commodities heatmap shows a significant drop in cocoa prices.

HeatMap of Tropical Food Prices in Euros

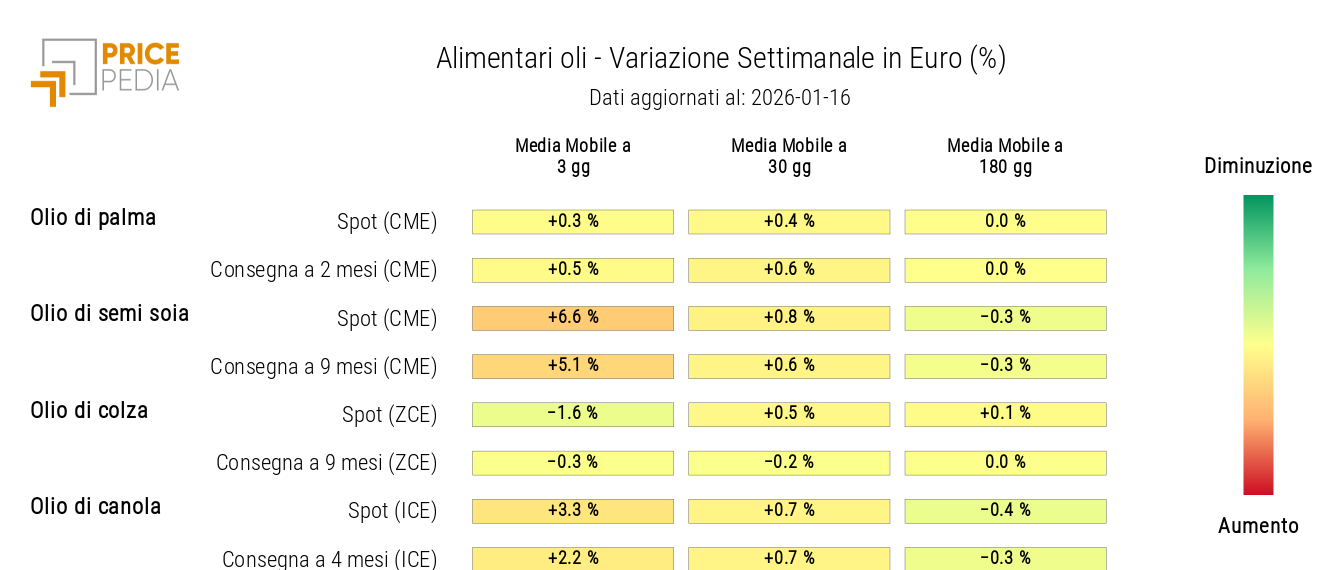

OILS

The vegetable oils heatmap shows an increase in soybean oil and canola oil prices.

HeatMap of Vegetable Oil Prices in Euros