Commodity prices driven by geopolitical uncertainty and supply news

New record highs for copper, silver and platinum prices

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekThis week, financial oil prices were marked by several contrasting fluctuations, driven mainly by uncertainty over developments in Venezuela.

The state-owned oil company Petróleos de Venezuela SA stated that it is in talks with Washington to sell crude oil through channels controlled or supervised by the United States, with agreements similar to those already in place with Chevron. The U.S. Secretary of Energy also announced that the United States has already begun marketing Venezuelan oil globally.

The objective of the Trump administration is to increase Venezuela’s oil sales by leveraging the country’s vast reserves through new investments. This increase in supply could exacerbate the surplus already present on the market, exerting downward pressure on crude oil prices.

However, toward the end of the week, oil prices recorded a new and significant increase, driven by expectations of tighter U.S. sanctions against Russia and by further threats from the Trump administration to strike Iran hard—an important global exporter—should the country be deemed responsible for the deaths of protesters during periods of unrest.

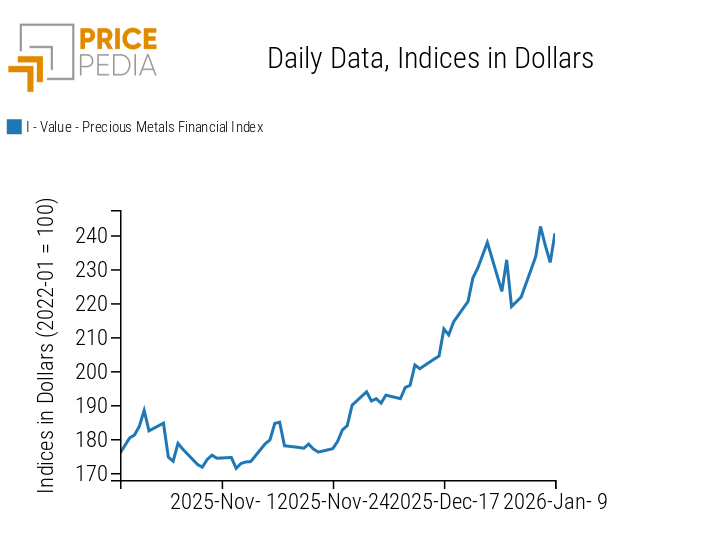

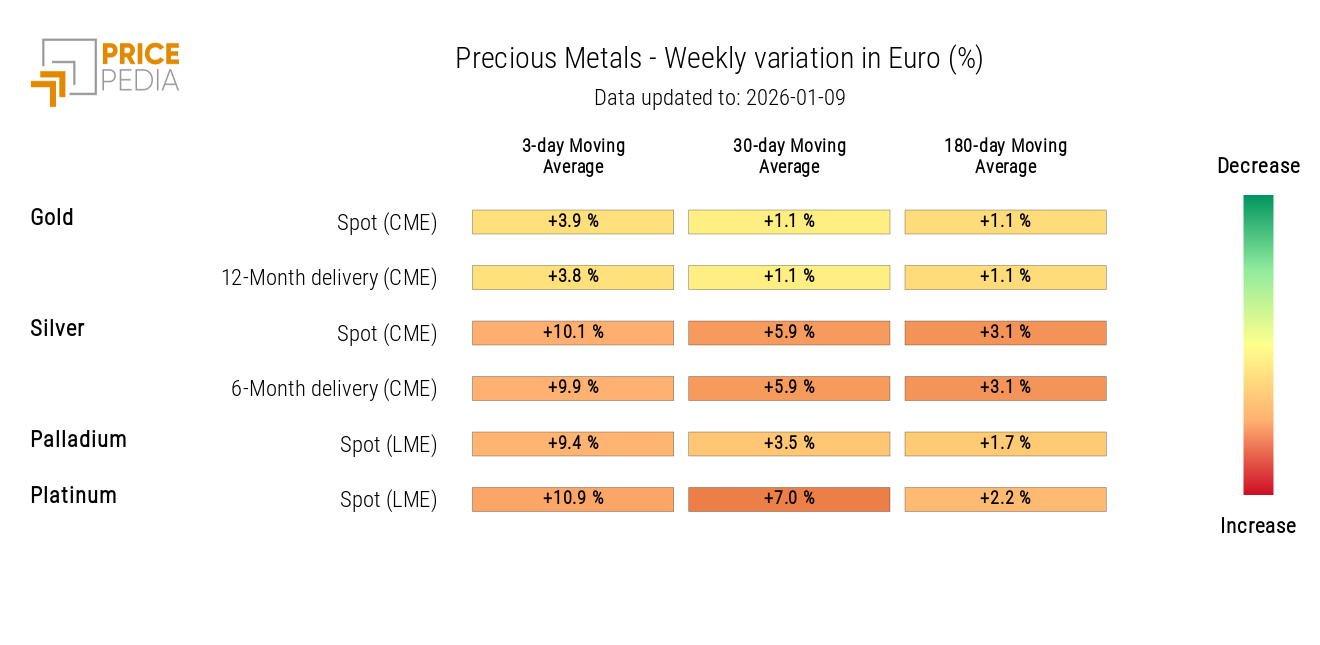

Another sector that has been strongly influenced by rising geopolitical risks is that of precious metals, which posted significant gains at the beginning of the week. In particular, silver and platinum both reached new all-time highs, with silver prices on the CME hitting $80/ounce and platinum prices on the LME exceeding $2,300/ounce. As for gold, prices quoted on the Chicago market moved back toward $4,500/ounce, supported by safe-haven demand.

The industrial metals sector was also characterized by bullish weekly dynamics, both in ferrous and non-ferrous metals.

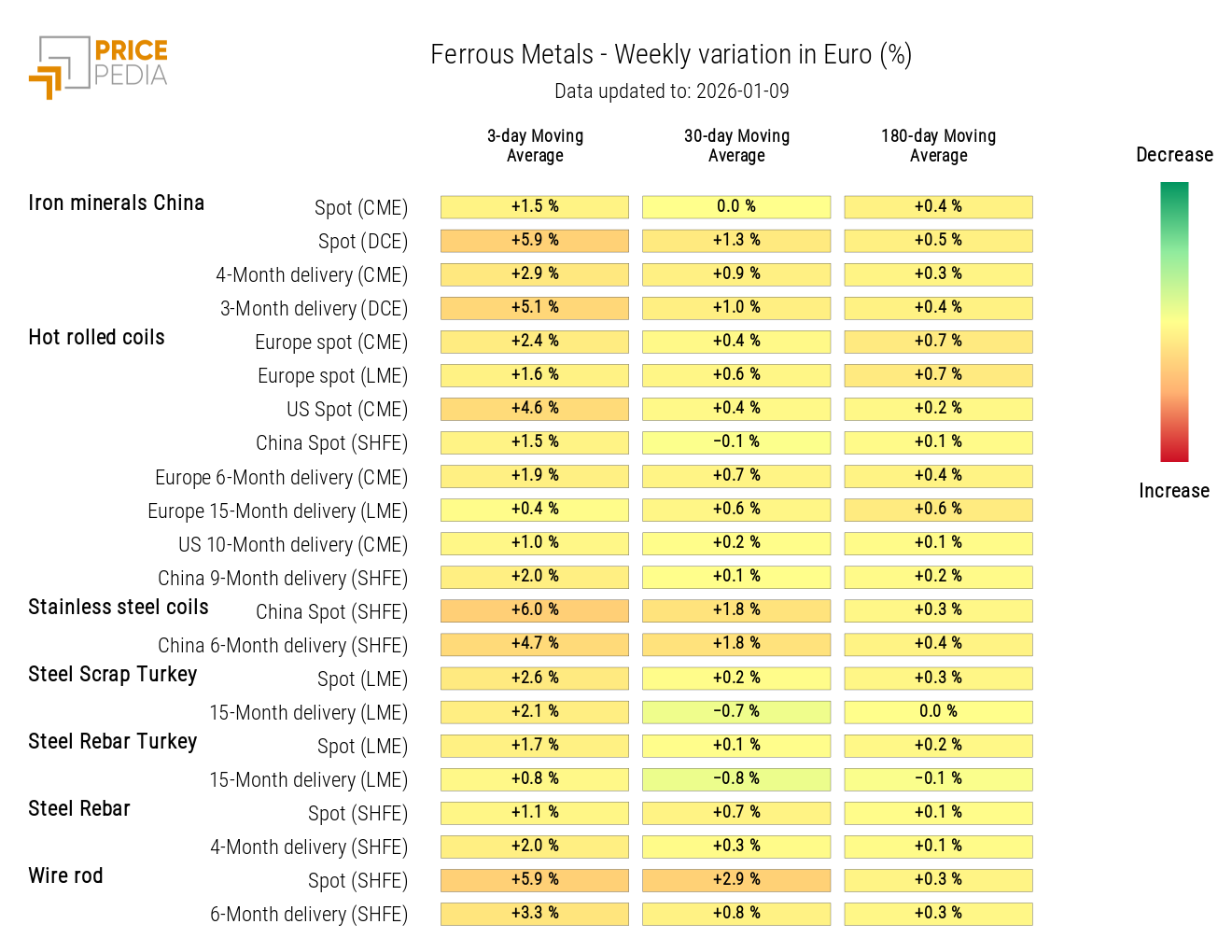

The strongest gains in ferrous metals were recorded mainly in China due to expectations of a recovery in Chinese demand. On January 6, the People’s Bank of China announced that it intends to cut interest rates during 2026 in order to stimulate demand and support the country’s economic growth.

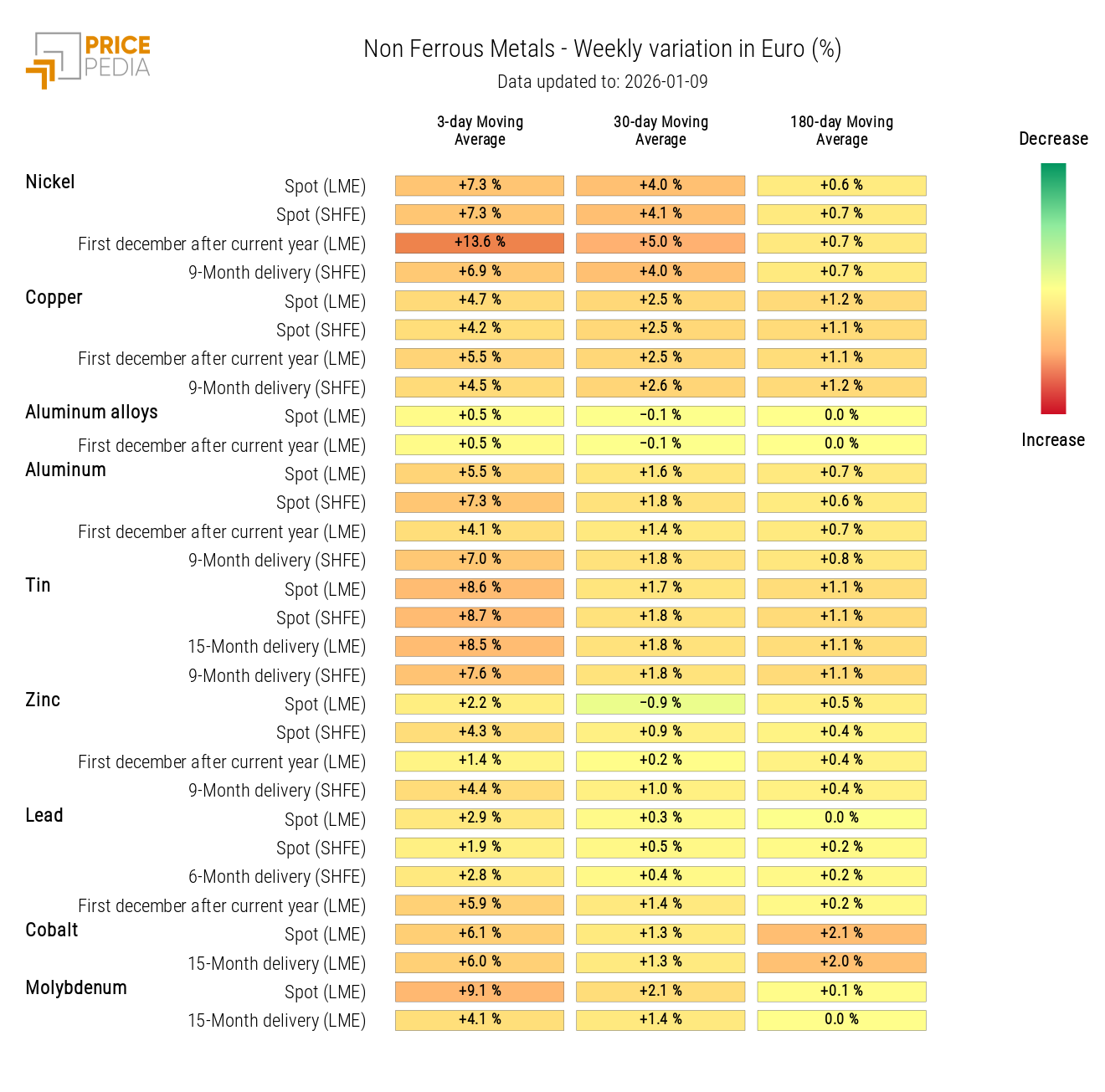

The increase in prices of non-ferrous metals is instead mainly attributable to new supply-side concerns.

Copper reached a new all-time high on the LME, exceeding $13,000/tonne, driven by persistent concerns over declining inventories and the start of a strike at the Mantoverde mine in Chile.

Nickel, quoted in Shanghai, once again rose above $20,000/tonne due to fears of a decline in Indonesian supply, the world’s largest producer.

Other metals also recorded significant gains, including aluminum, tin, cobalt, and molybdenum, driven by the continued reduction in inventories.

In the agricultural commodities segment, a significant drop in cocoa prices was recorded on Friday, alongside slight weekly increases in grain and edible oil prices.

US Labor Market

The U.S. employment report for December highlights slow growth in the labor market, with only about 50,000 new jobs created in December, below analysts’ expectations. The unemployment rate edged down slightly to 4.4%, also supported by a decline in labor force participation, while weekly jobless claims increased less than expected, still suggesting a degree of resilience in the labor market despite weak employment growth.

These data, showing a labor market that is slowing but not deteriorating sharply, could lead the Federal Reserve to maintain a cautious stance in monetary policy, slowing any rate cuts until clearer signs of a weakening in the U.S. economy and inflation emerge.

Euro Area Inflation

Euro area inflation data for December 2025 signaled a slowdown in consumer prices, with the annual rate falling by one-tenth of a percentage point to 2% y/y, reaching the ECB’s target after months above target. Core inflation also fell by one-tenth of a percentage point to 2.3% y/y, slightly below analysts’ expectations (2.4% y/y).

Overall, a gradual normalization of inflationary pressures in the euro area is observed.

NUMERICAL APPENDIX

ENERGY

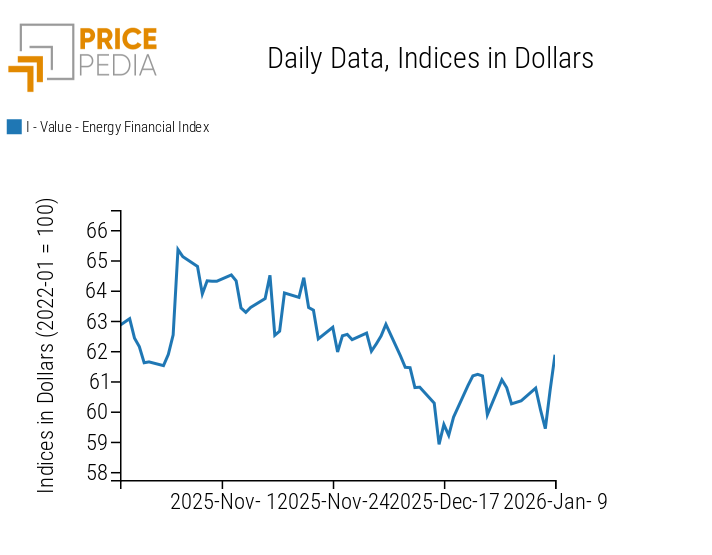

Net of contrasting fluctuations, the PricePedia financial index of energy products records a weekly increase.

PricePedia Financial Index of Energy Prices in Dollars

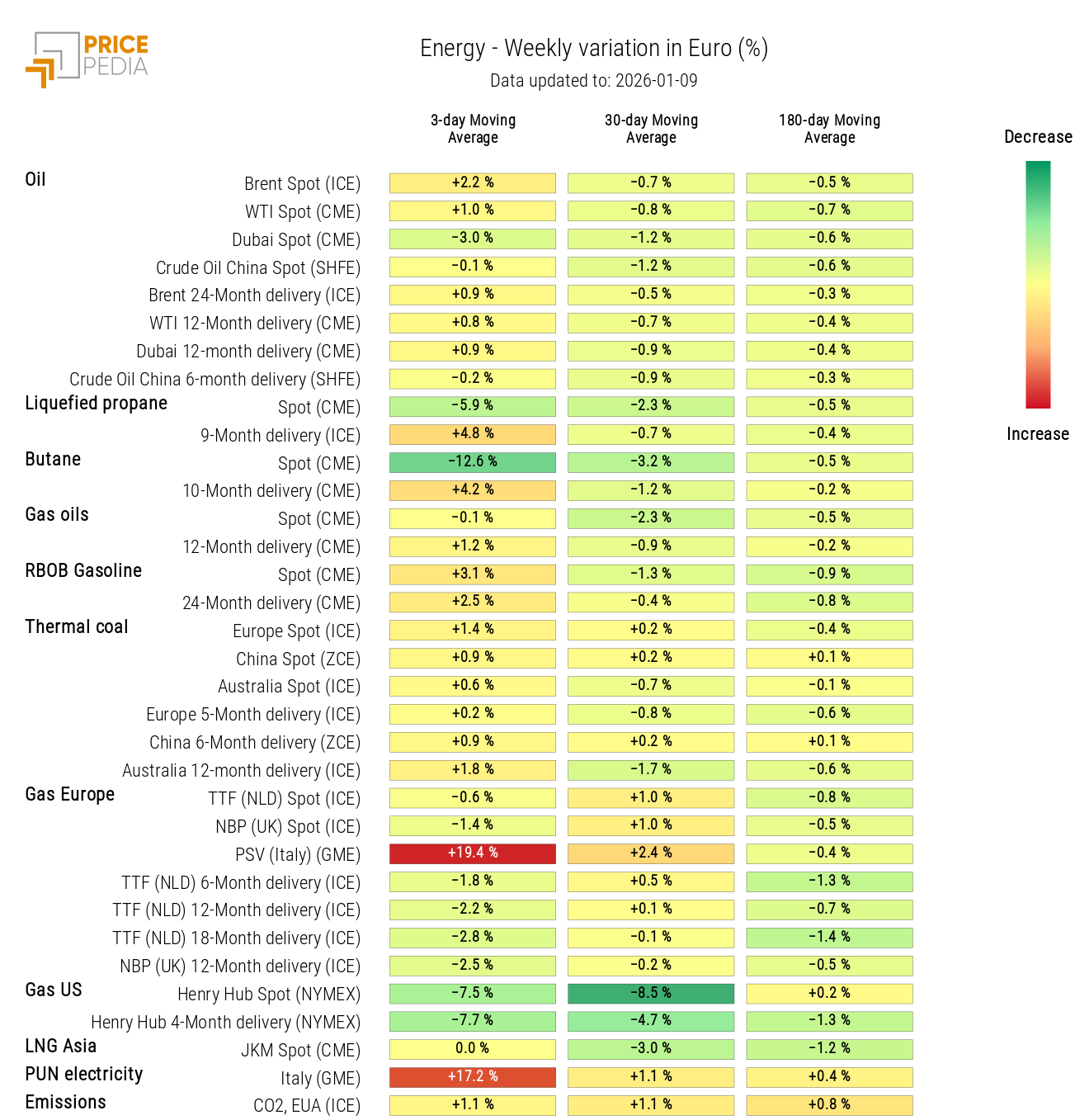

Analysis of the energy heatmap shows a decline in liquefied propane, butane, and U.S. natural gas, against an increase in PSV and PUN.

Energy Price HeatMap in Euros

PLASTICS

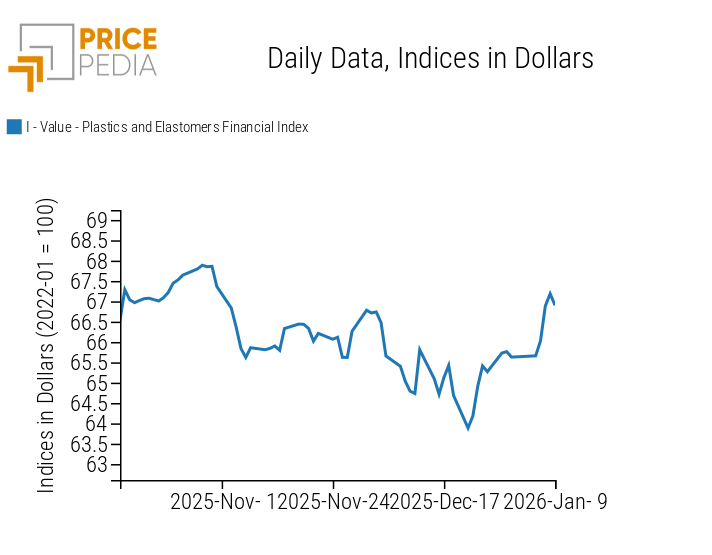

The Chinese financial index of plastics and elastomers follows a weekly increase in prices.

PricePedia Financial Indices of Plastics Prices in Dollars

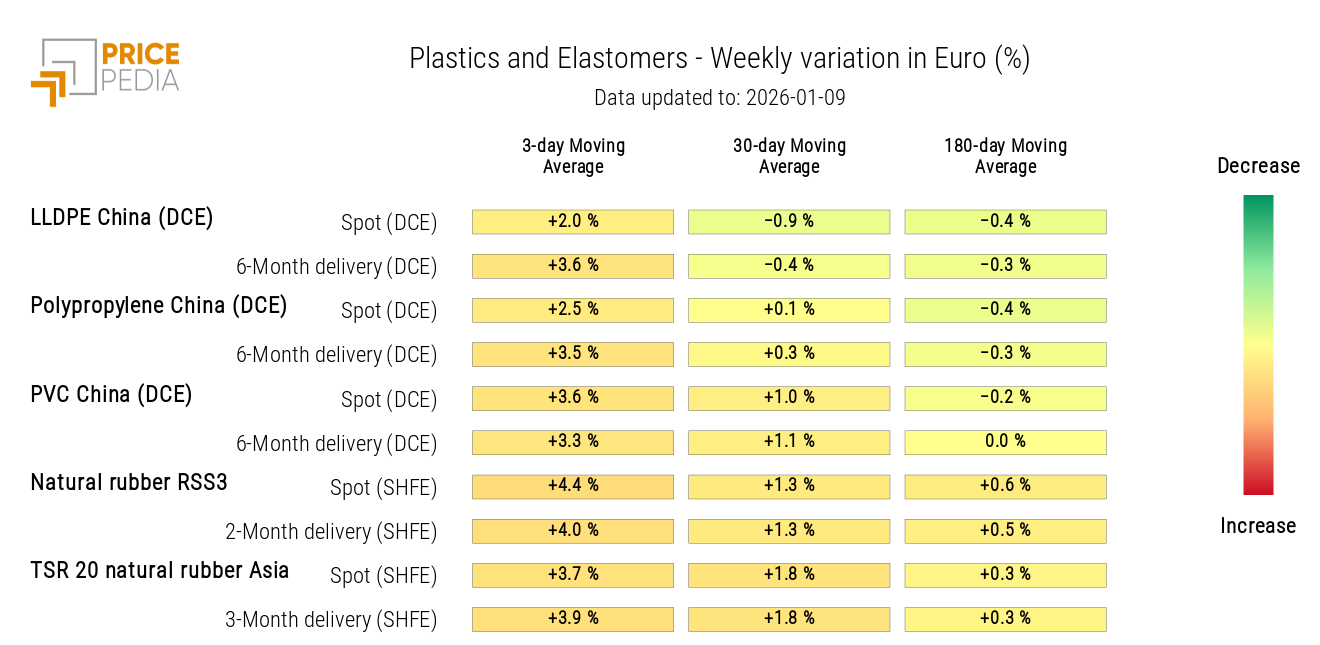

All plastics and elastomer prices shown in the heatmap record a weekly increase.

HeatMap of Plastics and Elastomers Prices in Euros

PRECIOUS METALS

The precious metals financial index reaches new all-time highs due to geopolitical tensions.

PricePedia Financial Index of Precious Metals Prices in Dollars

The precious metals heatmap highlights particularly strong weekly gains for platinum, silver, and palladium.

HeatMap of Precious Metals Prices in Euros

FERROUS METALS

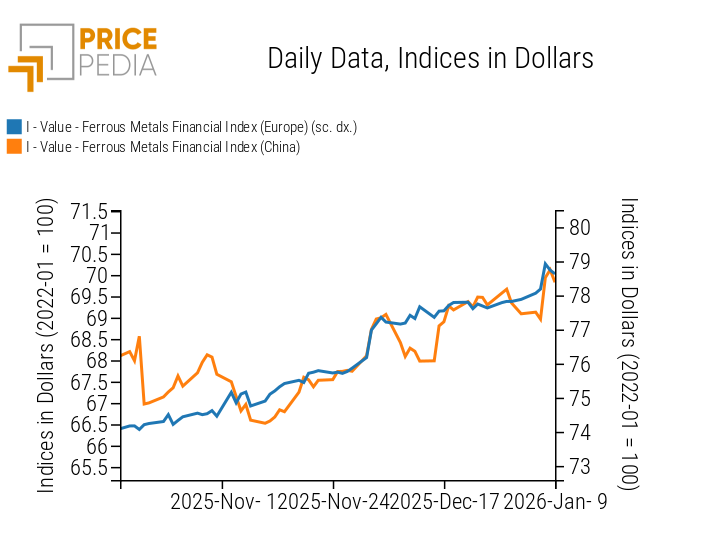

Both industrial metals financial indices indicate rising prices, more pronounced for the Chinese market index than for the European one.

PricePedia Financial Indices of Ferrous Metals Prices in Dollars

Heatmap analysis shows a more marked price increase in the Chinese DCE and SHFE markets.

HeatMap of Ferrous Metals Prices in Euros

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

INDUSTRIAL NON-FERROUS METALS

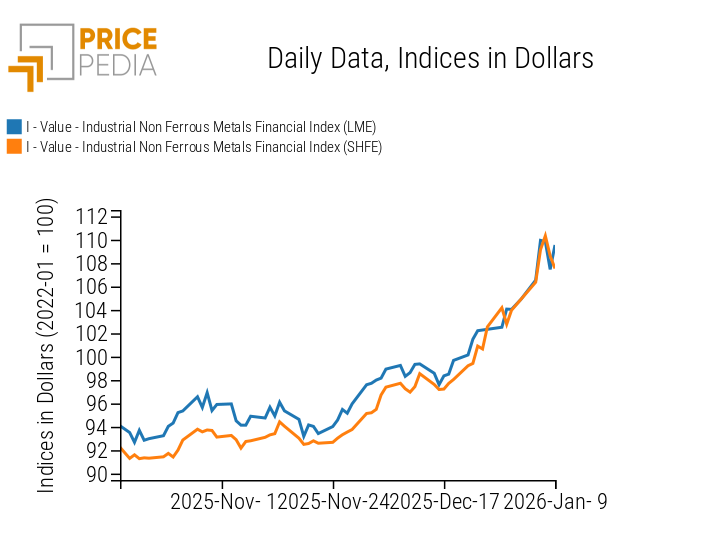

Both non-ferrous metals indices continue their upward phase, with a slight pullback toward the end of the week.

PricePedia Financial Indices of Industrial Non-Ferrous Metals Prices in Dollars

The non-ferrous metals heatmap turns red, signaling significant gains for the main base metals.

HeatMap of Non-Ferrous Metals Prices in Euros

AGRICULTURAL COMMODITIES

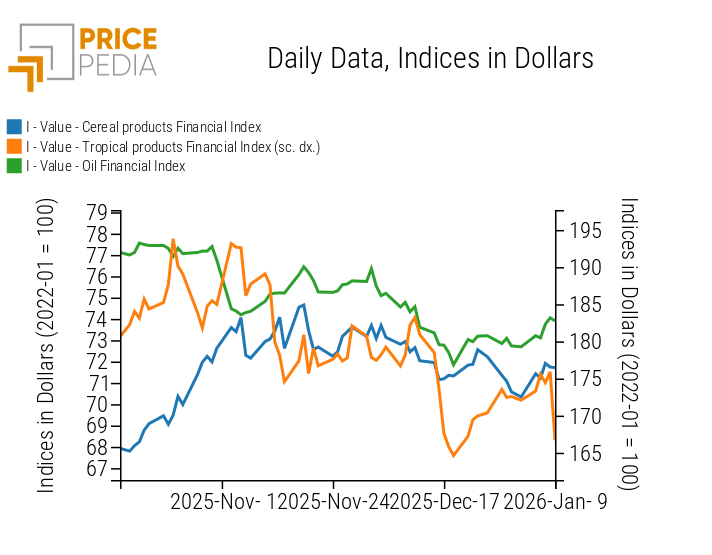

The tropical products index shows a sharp drop on Friday, linked to the decline in cocoa prices, while grain and edible oil indices record weekly price increases.

PricePedia Financial Indices of Agricultural Commodity Prices in Dollars

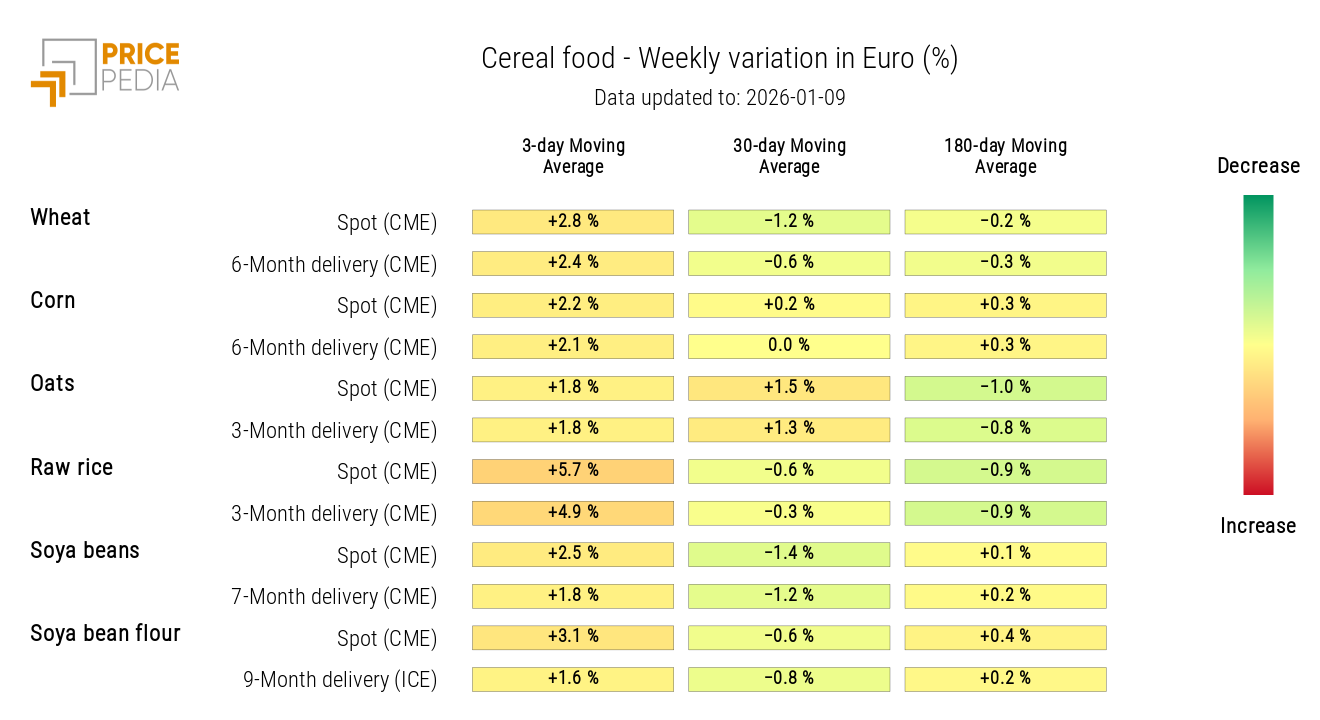

CEREALS

Heatmap analysis shows a generalized increase in cereal prices.

HeatMap of Cereal Prices in Euros

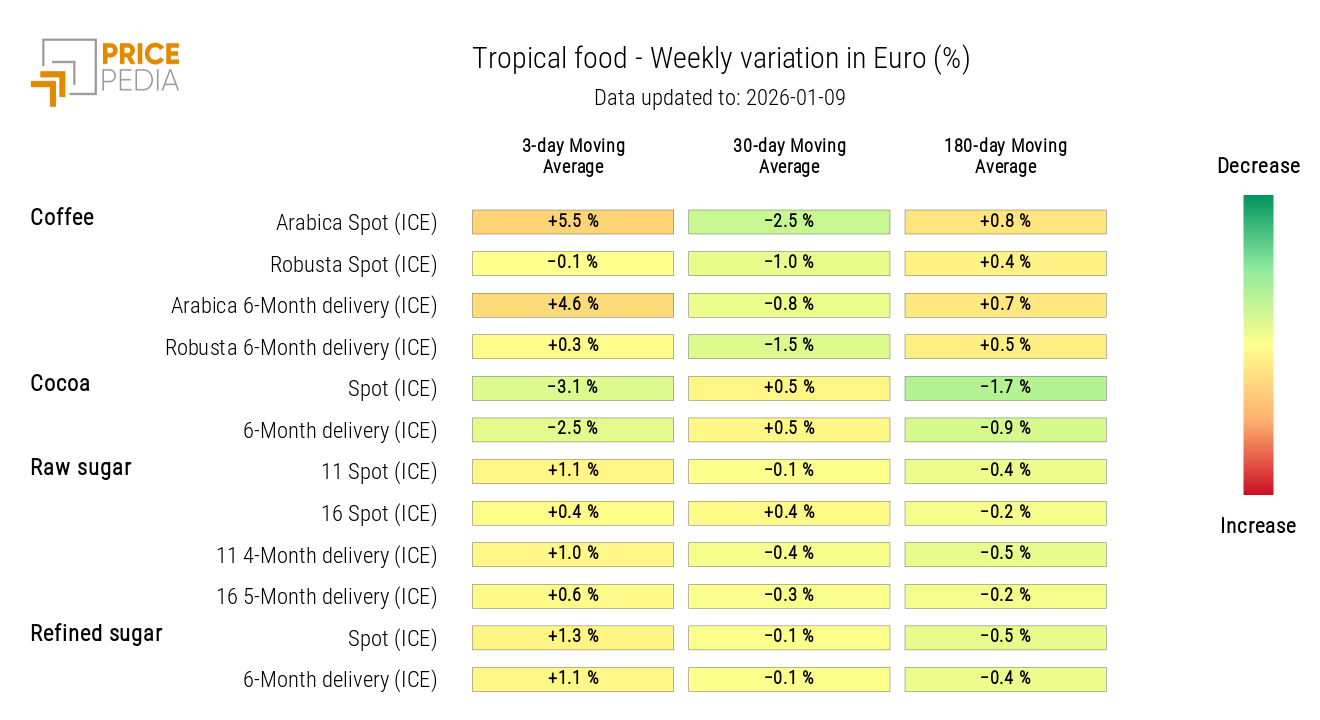

TROPICAL PRODUCTS

The tropical products heatmap highlights an increase in Arabica coffee prices and a decline in cocoa.

HeatMap of Tropical Food Prices in Euros