Monthly commodity prices update for December 2025

The 2025 Commodity Market: toward price normalization and diverging trends across sectors

Published by Pasquale Marzano. .

EU Customs Global Economic TrendsThe update of the PricePedia European monthly commodity prices for December 2025 has been released. In 2025, European prices of input materials declined overall by almost -6% compared to the average levels of 2024, continuing the downward trend that began in 2022 alongside the weakening of the global economic cycle. From a month-on-month perspective, prices also fell in December 2025, decreasing by -1.8% compared to the previous month.

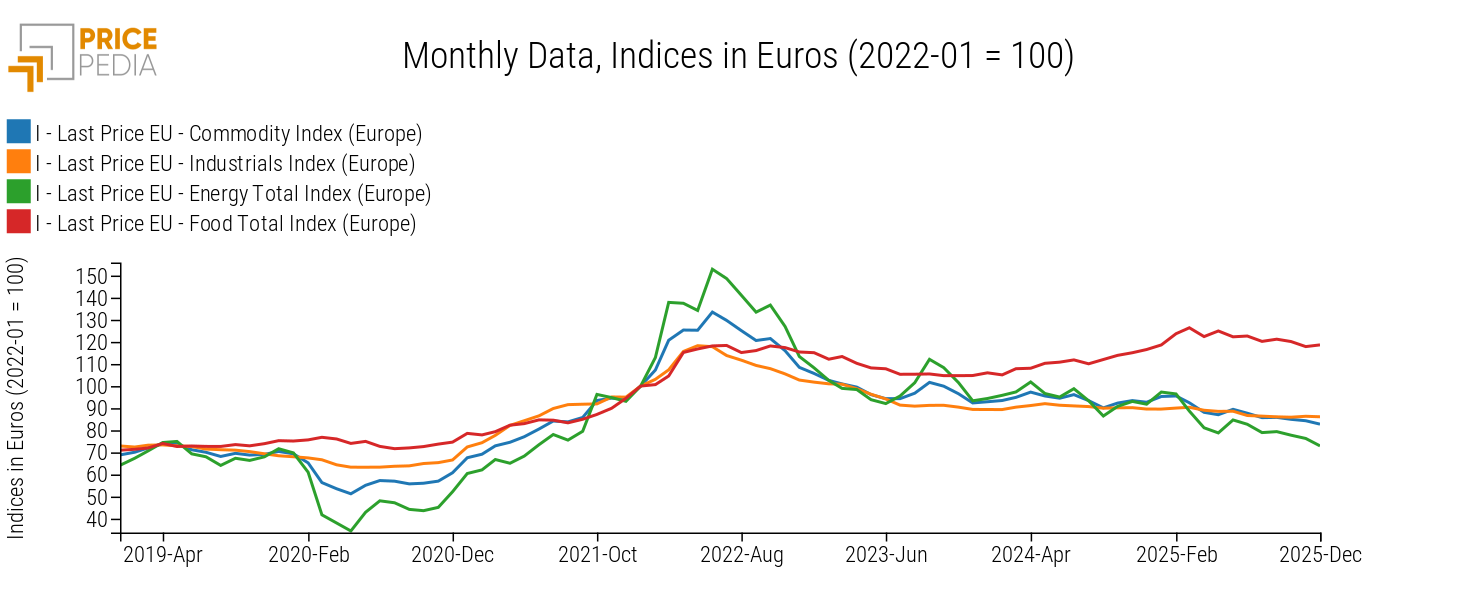

The chart below shows the price trends, in euros, of raw materials in the European market for the main PricePedia aggregates: Commodity[1], Industrial[2], Energy, and Food, with January 2022 levels set to 100.

Looking at the individual components of the total commodity aggregate index, the overall picture is mixed. In December, Food commodities recorded a month-on-month increase of +0.7%. However, this increase did not lead to a deviation from the downward trend that has been in place since the beginning of the year.

As for energy commodities, the downward trend in quotations continues: in the month just ended, prices declined by -4.4% compared to November 2025.

A phase of relative price stability for industrial commodities was also confirmed in December, with a slightly negative variation of -0.3% compared to November 2025.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Industrial commodity prices in December 2025

From a short-term perspective, price movements have been broadly sideways, with changes almost always contained and below one percentage point in absolute terms. From a year-on-year perspective, however, it is evident that industrial commodity prices have so far been subject to downward pressure stemming from the corresponding prices of industrial commodities exported by China, as also highlighted in the November 2025 price update. In December 2025, prices in euros for input materials were in fact -3.9% lower than in the same month of the previous year.

This dynamic is also confirmed at the level of the individual commodity categories included in the industrial commodity index, as shown in the chart below, which reports the corresponding year-on-year price changes in euros for December 2025.

Chart 2: December 2025, % changes in euros compared to December 2024

Source: PricePedia

For the vast majority of product categories, prices in December 2025 were lower than those recorded in the same month of the previous year. In the few cases where an increase occurred, namely for Non Ferrous Metals, Inorganic Chemicals, and Specialty Chemicals—this has always been modest and below 1.5%.

The sharpest decline was recorded for Pharmaceutical Chemicals, whose prices were more than -15% lower than in December 2024. This was followed by Organic Chemicals and Plastics and Elastomers, which are more strongly influenced by trends in energy feedstocks such as oil and natural gas, and which recorded decreases of -8.6% and -6.4%, respectively, over the same period.

A similar trend is observed for Ferrous Metals, among the categories most affected by Chinese competition, which were down by almost -6% in December 2025 compared to the previous twelve months.

Declining prices were also recorded for the Textile Fibres and Wood and Paper categories, at -4.8% and -3.6%, respectively.

Commodity prices in 2025: an overview

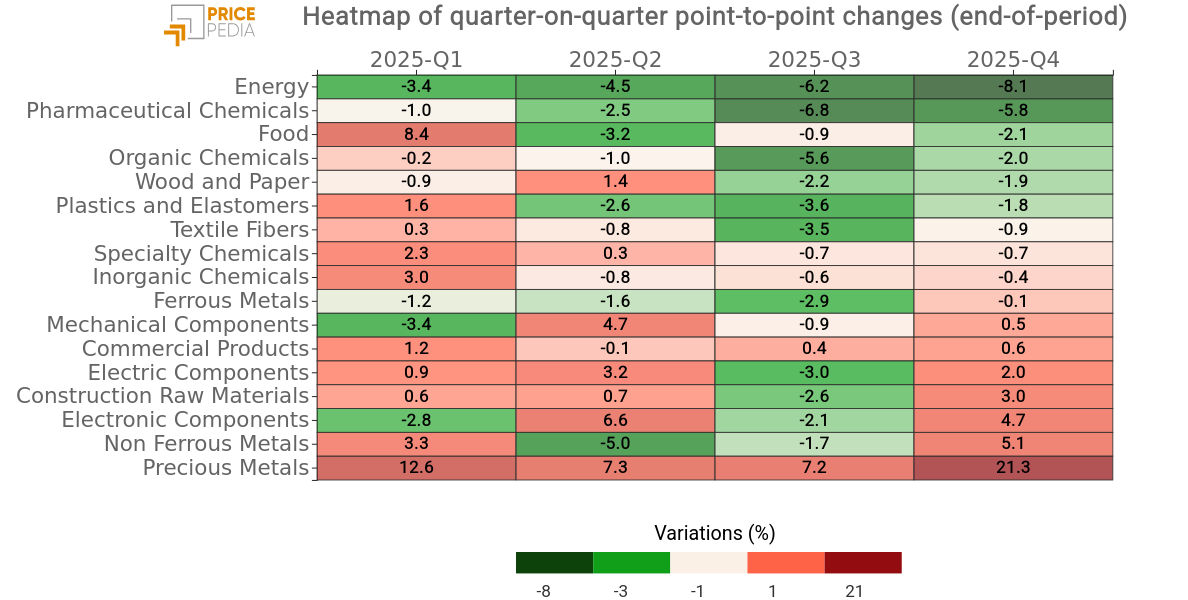

In order to summarize the evolution of commodity prices throughout 2025, capturing both the direction of movements and their intensity, the heatmap below shows, for each product category, the quarter-on-quarter point-to-point changes[3] observed over the past year.

In 2025, commodity price trends were heterogeneous. In particular, the heatmap confirms the overall downward trend of Energy commodities, which recorded increasingly large negative variations over the course of the year, culminating in -8.1% in the final quarter, as well as of related product categories such as Organic Chemicals and Plastics and Elastomers.

It is also interesting to note that, in the case of Food commodities, the downward trend that emerged from the second quarter onward was not sufficient to offset the sharp increase recorded in the first quarter, equal to +8.4%, mainly driven by Tropical products.

It is worth noting that 2025 was not a year of generalized declines: some downstream supply chains, such as mechanical, electrical, and electronic components, in fact showed higher volatility, as did non ferrous metals, which recorded growth of over +5% in the final quarter of 2025.

Finally, the role of precious metals as a safe-haven asset is confirmed. In a year marked by high uncertainty due to more restrictive trade policies implemented by the United States and ongoing geopolitical tensions, precious metals stand out as a clear exception compared to other product categories, recording progressive increases that culminated in a strong acceleration in the final quarter of 2025, amounting to +21.3%.

1. The PricePedia Commodity index is the aggregation of Industrials, Food and Energy indices.

2. The PricePedia Industrials index is the aggregation of indices related to the following categories: Ferrous Metals, Non-Ferrous Metals, Wood and Paper, Pharmaceutical Chemicals, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers, and Textile Fibers.

3. The quarter-on-quarter point-to-point variation considered in this article is calculated as the percentage change in the end-of-quarter value compared to the end of the previous quarter. It therefore measures the price variation that occurred over the course of the quarter.