China economic update November 2025

The recovery phase for Chinese non-ferrous metal prices continues

Published by Luca Sazzini. .

Conjunctural Indicators Global Economic TrendsThe PricePedia monthly update of Chinese commodity prices for November 2025 has been published.

Chinese commodity export prices continued the recent growth phase that started in October, albeit with a milder intensity. In aggregate terms, the increase in dollars was 0.37%, while in euros the growth reached 0.96%.

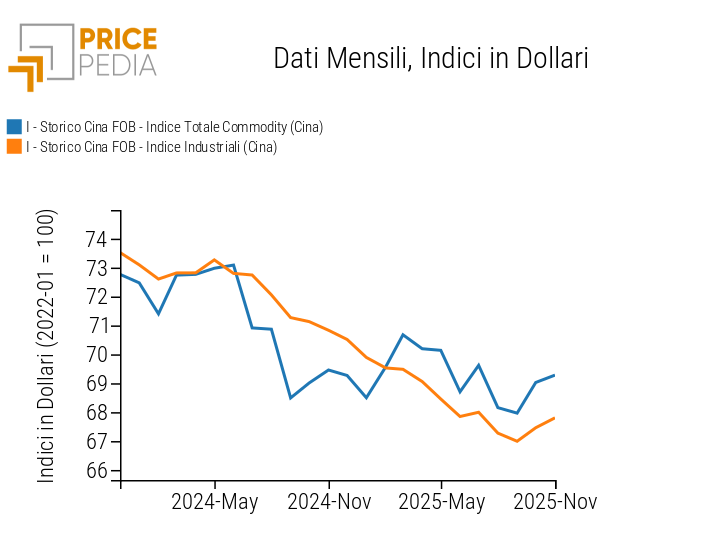

The chart below shows the two-year dollar trend of FOB export prices for the Chinese Total Commodity index[1] and the Chinese Industrial index[2].

In November, the industrial commodities aggregate recorded a month-on-month increase in export prices in dollars of 0.51%. The index’s rise confirms the hypothesis, formulated in the previous article on the Chinese market: China economic update October 2025, of an interruption of the price decline trend that started in July 2022.

The expansionary fiscal policies introduced by the Chinese government to stimulate the real estate sector, combined with production blocks in steel and aluminum aimed at containing excess supply, are expected to continue supporting industrial commodity prices. In particular, it is assumed that the recovery will start mainly in the industrial metals sector, with a leading role for non-ferrous metals, where many base metals are recording price increases often linked to news on potential global supply dynamics.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Analysis of industrial commodities by category

The table below shows the month-on-month changes in Chinese export prices in dollars for the categories included in the industrial commodities aggregate.

Month-on-month changes of industrial commodities by category, expressed in $/ton

| 2025-07 | 2025-08 | 2025-09 | 2025-10 | 2025-11 | |

|---|---|---|---|---|---|

| China FOB Historical-Total Ferrous Index (China) | +1.95 | −2.34 | −0.16 | +2.03 | +0.22 |

| China FOB Historical-Total Non-Ferrous Index (China) | +0.47 | −0.30 | +0.13 | +2.07 | +2.52 |

| China FOB Historical-Total Plastics and Elastomers Index (China) | −0.79 | −1.55 | −1.76 | −0.91 | −0.17 |

| China FOB Historical-Total Organic Chemicals Index (China) | −1.10 | −0.92 | −1.03 | −1.51 | −0.87 |

| China FOB Historical-Total Inorganic Chemicals Index (China) | −0.42 | +0.37 | +0.17 | −0.05 | −1.14 |

| China FOB Historical-Total Specialty Chemicals Index (China) | +0.27 | +0.13 | +1.73 | +0.11 | −1.33 |

| China FOB Historical-Total Textile Fibers Index (China) | −0.83 | +0.79 | +0.04 | −0.77 | +0.39 |

From the table analysis, it emerges that in November the dollar price growth of non-ferrous metals further accelerated compared to October, recording a month-on-month change of 2.52%. The largest increase concerns cobalt, whose price of cathode plates continued to rise, exceeding 13% in November, due to the introduction of a new quota system by the Democratic Republic of Congo[3].

The export prices of copper products also continued to increase, with FOB cathode prices up nearly 5%, reflecting the recent shortage of ore due to interruptions in major mines worldwide.

Other significant increases concern tin, which rose by about 4% due to lower exports from Indonesia, and aluminum products, supported by the reduction in Chinese primary aluminum supply.

On the other hand, ferrous metals prices stabilized, showing a month-on-month change in dollars of 0.22%, down from 2.03% in October.

The aggregate indices for textile fibers and plastics and elastomers remained largely stable, while the export prices of Chinese chemical product aggregates showed slight declines, due to weak domestic demand affecting the market.

[1] The PricePedia Total Commodity index results from the aggregation of indices related to industrial, food, and energy commodities.

[2] The PricePedia Industrial price index results from the aggregation of indices related to the following categories: Ferrous, Non-Ferrous, Wood and Paper, Pharmaceutical Chemistry, Specialty Chemicals, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers, and Textile Fibers.

[3] See the article: Cobalt Price Forecast.