Mercati finanziari guidati da offerta e aspettative, più che dalla domanda reale

Financial markets driven by supply dynamics and expectations, rather than by real demand

Published by Luigi Bidoia. .

Conjunctural Indicators Commodities Financial WeekFrom the perspective of financial commodity prices, 2025 has been a highly unusual year, marked by strongly divergent dynamics across the different commodity groups. On the one hand, metals recorded a pronounced upward trend. On the other hand, prices of energy commodities – and of plastics and elastomers linked to them – experienced a clear downward trend. In an intermediate position are financial prices of agricultural commodities, with broadly stable levels for the cereals and oils complex. Tropical foods are a completely separate case, with their sharp decline in 2025 reflecting the equally strong growth recorded in 2024.

The table below reports the rate of change recorded in 2025 by the various PricePedia indices for the main families of financial commodity prices.

Among these, the performance of precious metals stands out, with prices rising overall by more than 100%. Within this group, silver and platinum, with increases exceeding 130%, compete for first place. More moderate, though still significant, was the growth of palladium (+76%) and gold (+63%).

Price increases were also particularly strong for non-ferrous metals, driven by cobalt, which also doubled its price levels over the course of 2025. Very robust growth (above 40%) was also recorded for copper and tin.

More moderate, by contrast, was the increase in ferrous metal prices, led by coils in Europe and the United States, whose prices rose by more than 25%. Much more limited, if not negligible, was the price variation for other ferrous metals.

Change in 2025 of PricePedia indices for financial commodity prices

| PricePedia Financial Price Indices | Period Change |

|---|---|

| January 1 – December 31, 2025 | |

| Precious Metals | +101.36% |

| Non-Ferrous Metals (LME) | +26.46% |

| Ferrous Metals (Europe) | +8.19% |

| Food Commodities: Oils | +1.39% |

| Food Commodities: Cereals | -2.94% |

| Plastics and Elastomers | -13.06% |

| Energy Commodities | -22.53% |

| Food Commodities: Tropical Products | -25.82% |

The area of declining prices is dominated by energy commodities and by the related plastics and elastomers. The sharpest reduction affected natural gas prices, which fell by more than 30% across all major international markets, with the sole exception of gas traded at the U.S. Henry Hub, which remained broadly stable between the beginning and the end of the year, albeit within a context of high volatility.

More moderate was the decline in oil prices and their derivatives, ranging between -15% and -20%. Diesel prices recorded an even smaller decrease, close to 10%, reflecting the reduction in Russian supply on the global market. On international markets, coal prices declined by around 15%, while remaining broadly stable on the Chinese market.

Within the plastics and elastomers group, products more closely linked to oil recorded the largest price declines, reaching more than 30% in the case of monomers. By contrast, the contraction in prices along the rubber value chain was more limited, at around 10%.

The food commodities group is the one that exhibits the greatest dispersion in price dynamics, confirming the central role played by current or expected supply variations in shaping prices within this sector. Among cereals, the sharp decline in rice prices at the Chicago Mercantile Exchange (CME) stands out, exceeding 30%.

By contrast, within the oils complex, a notable increase was recorded in soybean oil prices, which rose by more than 20% in CME quotations, but by only around 8% in quotations at China’s Dalian Commodity Exchange.

Among tropical food commodities, the decline in cocoa prices approached 50%. Coffee prices also displayed divergent dynamics, with arabica prices still rising by 6%, against a decline of nearly 20% for robusta coffee.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

NUMERICAL APPENDIX

PRECIOUS METALS

The chart below highlights the long growth phase recorded by the PricePedia index of financial prices for precious metals, which reached its all-time historical high on December 26, before posting a slight decline in the following days. The trend of these prices clearly underscores the role played by precious metals as safe-haven assets, in response to the geopolitical tensions that characterized 2025.

PricePedia Financial Index of precious metal prices in U.S. dollars

INDUSTRIAL NON-FERROUS METALS

The two indices for industrial non-ferrous metals – the first based on average prices at the LME, the second on average prices at the SHFE – show the strong growth phase that characterized this segment over the course of the year, interrupted only in April. During that period, the announcement of so-called “reciprocal tariffs” by the Trump administration fueled fears of a possible global economic crisis.

PricePedia Financial Indices of industrial non-ferrous metal prices in U.S. dollars

FERROUS METALS

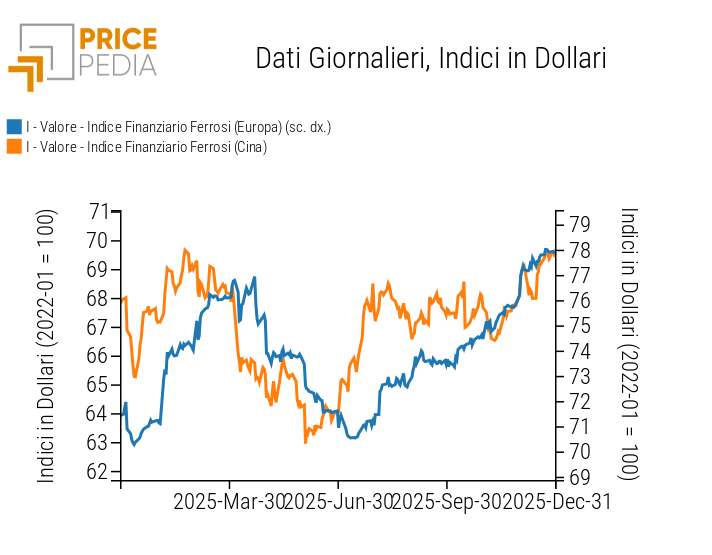

The ferrous metal price indices instead reflect the different phases that characterized 2025, which were strongly influenced by expectations regarding the evolution of the Chinese economy. The trade war initiated by the Trump administration, particularly against China, initially generated expectations of weaker economic growth in the country, with the risk of a contraction in global demand for ferrous metals. Subsequently, on the one hand, the gradual emergence of potential agreement scenarios and, on the other hand, above all, the concrete evidence of the resilience of Chinese exports to U.S. tariffs progressively eased fears of a slowdown in the Chinese economy, supporting a gradual recovery in ferrous metal prices. As shown by the comparison between the two indices, all major turning points during 2025 first emerged in the Chinese price index and only later in the European price index.

PricePedia Financial Indices of ferrous metal prices in U.S. dollars

ENERGY

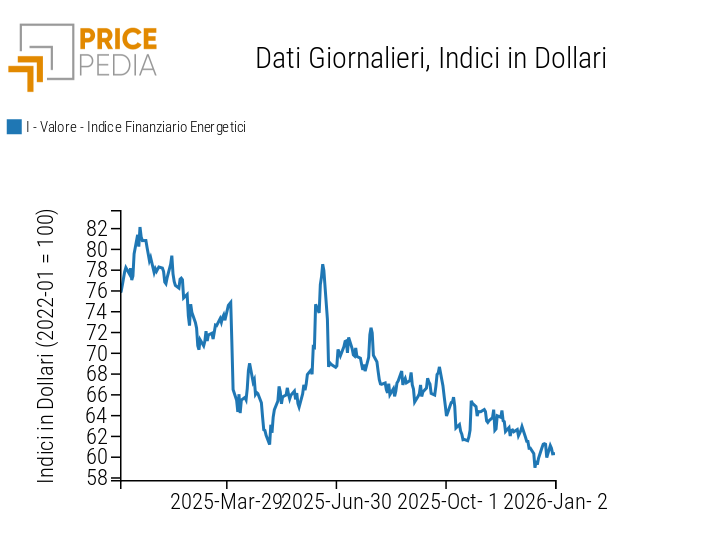

During 2025, the PricePedia index of financial energy prices showed a clear downward trend, mainly driven by the increase in supply that characterized global energy markets. This underlying trend was nevertheless punctuated by phases of temporary deviation, induced by the geopolitical tensions that marked the year. In particular, a sharp price surge emerged in June 2025, when Israel’s attack on Iranian nuclear targets reignited fears of a military escalation in the Middle East. In the days immediately following the attack, Brent crude prices approached the threshold of 80 dollars per barrel, driven above all by concerns over a potential blockade of the Strait of Hormuz. Even before the end of June, however, the willingness – or necessity – on the part of Iran not to respond militarily became apparent, leading to a significant de-escalation of tensions in the region.

PricePedia Financial Index of energy prices in U.S. dollars

PLASTICS AND ELASTOMERS

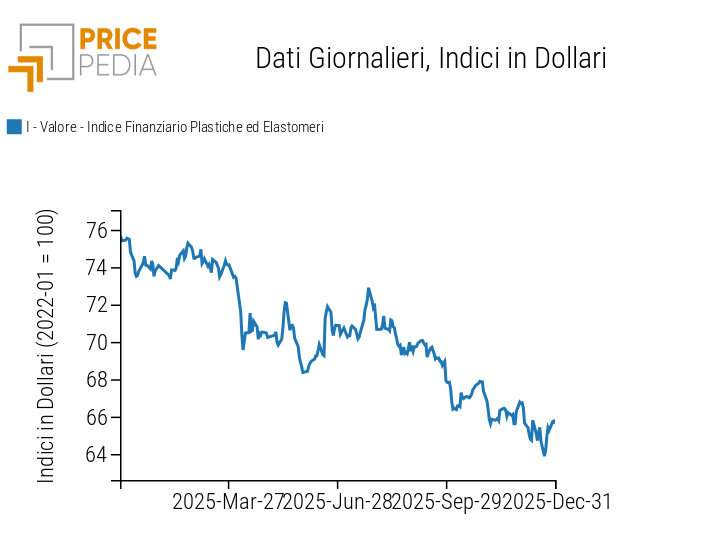

The dynamics of the energy price index were mirrored in a corresponding downward trend in plastics and elastomer prices, which are strongly influenced by movements in the underlying energy commodities.

PricePedia Financial Index of plastics and elastomer prices in U.S. dollars

FOOD COMMODITIES

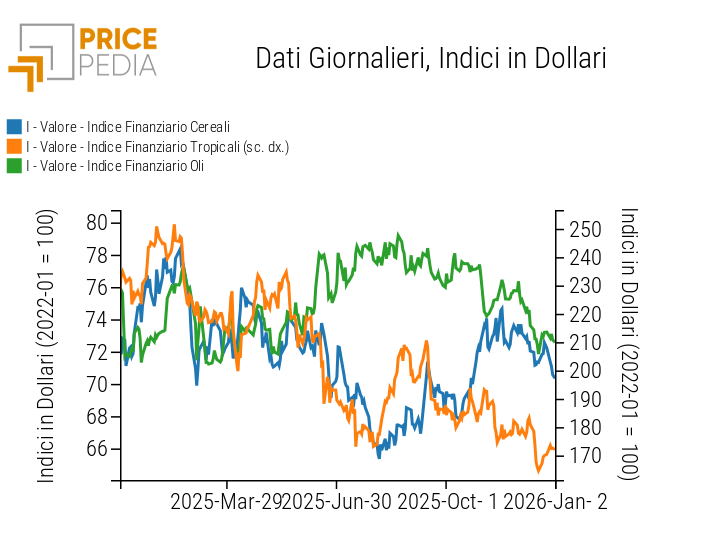

The three food commodity price indices highlight the different dynamics recorded by the various food commodity groups during 2025. After sharing a phase of marked decline in the first part of the year, cereals and tropical products moved in opposite directions in the second half of the year: the former increased, while the latter continued along a downward trend. The oils price index followed its own distinct trajectory, characterized by phases of increase and decline that were overall less pronounced than those observed for the other food commodity groups.

PricePedia Financial Indices of food commodity prices in U.S. dollars