Tin under pressure: decline in Indonesian supply pushes prices up

Indonesia: hub of global tin supply

Published by Luca Sazzini. .

Tin Non Ferrous Metals Price DriversTin is the second non-ferrous metal with the highest price increases since the beginning of the year. The recent price dynamics reflect current supply-side tensions, with production highly concentrated in a limited number of producing countries. Although tin is not currently included among either the critical or strategic raw materials for the European Union, the high concentration of supply and its relevance in key sectors such as electronics and the chemical industry make it a metal of primary importance for European industry, which is considering the possible inclusion of tin in the list of critical and/or strategic commodities.

In this article, we analyze global tin trade, identifying the main producing and exporting countries and highlighting how, in a highly concentrated market, a reduction in supply by the world’s leading supplier can cause a deficit on the international market and generate an increase in international prices.

Analysis of the main tin producers and exporters

Tin is traded mainly in the form of unalloyed crude metal and only partially in the form of minerals.

In 2024, the world’s main producers of tin minerals were China, Indonesia, Myanmar (Burma), Peru, Brazil, and the Democratic Republic of the Congo (Kinshasa). China and Indonesia alone accounted for more than one third of total global production.

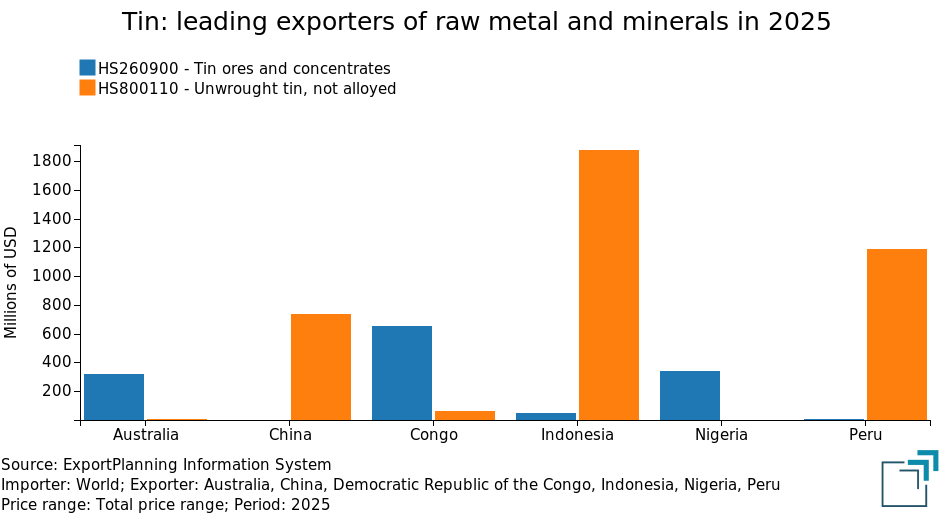

Considering exports instead, the three main exporters of unalloyed crude tin are Indonesia, Peru, and China, while the leading exporters of tin minerals are the Democratic Republic of the Congo, Nigeria, and Australia. [1]

The chart below shows the exports of the world’s leading suppliers of tin minerals and unalloyed crude tin in 2025.

Analysis of the chart highlights Indonesia’s leadership in global trade of unalloyed crude tin. In 2025, China, despite being the world’s leading tin producer, ranked only third among the main exporters of crude metal. Historically, China has primarily been a net importer of tin and only in recent years has strengthened its role as an international supplier, while maintaining export volumes significantly lower than those of Indonesia, which confirmed its leading position again in 2025.

Over the year, Indonesia exported tin worth USD 1.87 billion, equivalent to 28% of the total value of global crude tin exports, estimated at USD 6.61 billion in 2025. Although this figure is significantly higher than that of other major suppliers, Indonesian exports remain relatively limited in quantity compared with volumes exported in previous years.

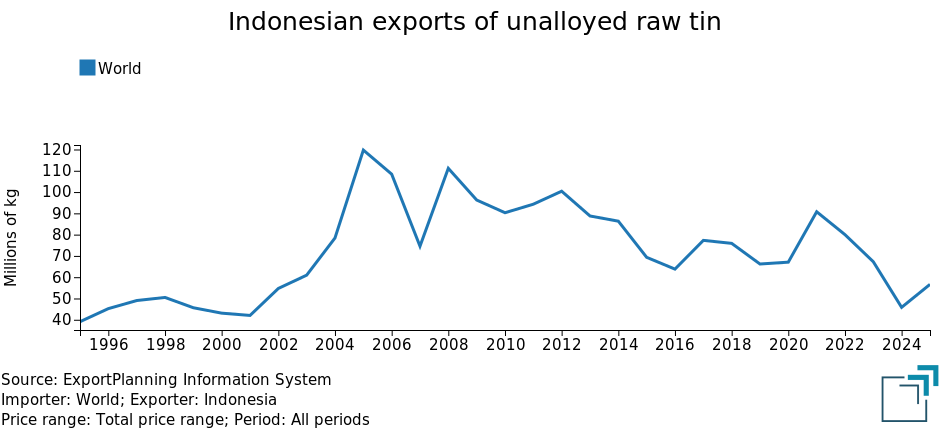

The chart below shows the trend of Indonesian crude tin exports, expressed in terms of quantity.

In recent years, Indonesian authorities have launched a series of crackdowns against illegal practices in the mining sector and in the tin trade, confiscating numerous private smelting facilities. These measures have led to a significant reduction in domestic production, which translated into a decline in exports of unalloyed crude tin. In 2024, Indonesian exports amounted to 45.8 thousand tonnes, the lowest level in more than 20 years. Also in 2025, ongoing disruptions at mining sites severely limited supply from Indonesia, with exports estimated at 56.6 thousand tonnes, a figure well below the more than 90 thousand tonnes recorded in 2021 and less than half of the historical peaks reached in 2005.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Analysis of tin prices

The decline in tin supply from Indonesia, the world’s leading producer, has supported the strong growth of international tin prices in recent years.

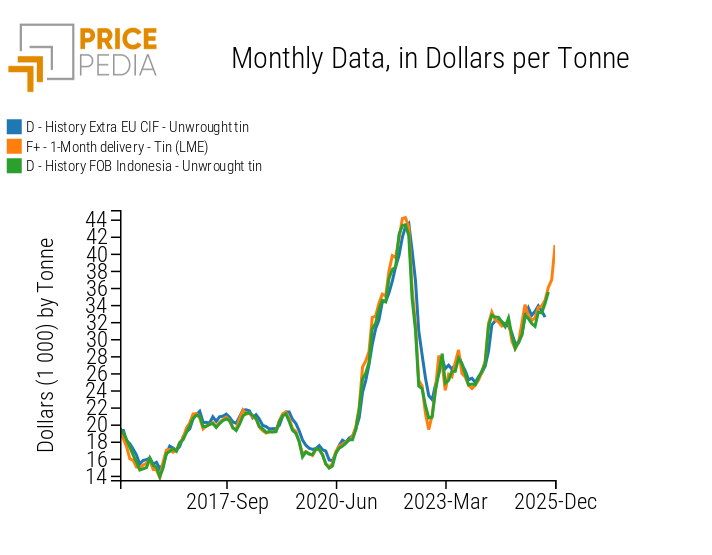

The chart below shows the dynamics of the European CIF import customs price, compared with the LME financial benchmark and the Indonesian FOB customs price, from the world’s leading tin exporter.

Comparison of financial and customs tin prices, expressed in $/tonnallata

Analysis of the chart shows that tin prices follow a common trend, currently experiencing strong growth. Over the past three years, amid the decline in Indonesian supply, global tin prices have recorded significant increases, with quotations on the London Metal Exchange (LME) once again approaching the 2022 peaks. Since the beginning of December, the average LME price has returned above USD 40000 per tonne, not far from the historical peak of around USD 44000 per tonne. On an annual basis, 2025 has already recorded a new record, with the average price so far standing at USD 34000 per tonne.

Conclusions

The tin market is highly concentrated, with more than a quarter of global supply dependent on Indonesian exports.

The contraction of Indonesian supply recorded in recent years, caused by repeated production disruptions linked to measures against illegal practices in the mining sector, has driven up global tin prices.

Since the beginning of the year, tin has been the second non-ferrous metal with the highest growth. Since early December 2025, average LME prices have exceeded USD 40000 per tonne, close to the monthly historical peak of USD 44000 per tonne. On an annual basis, tin prices have already reached a new record, with an average value in 2025 of around USD 34000 per tonne.

[1] Source: U.S. Geological Survey (USGS): Mineral Commodity Summaries 2025.