PUN price: neither inverse decoupling nor a CO2 effect

The share of electricity generation from renewable sources largely explains the recent increase in power prices

Published by Luigi Bidoia. .

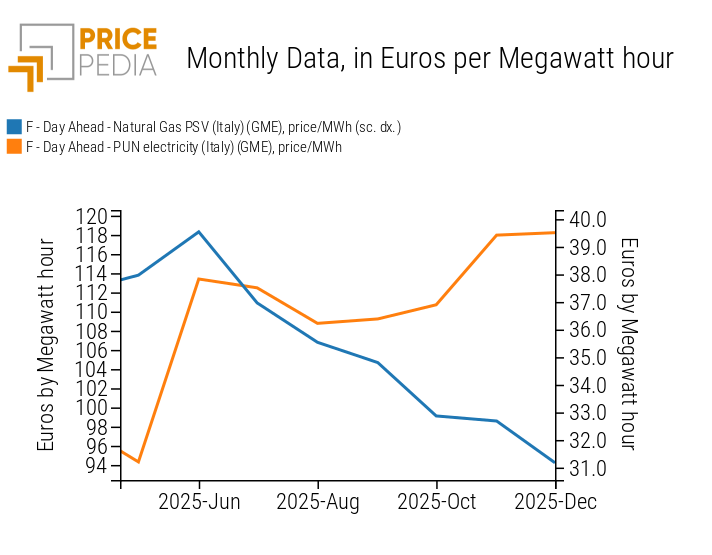

Electricity's National Single Price Analysis tools and methodologiesSince last May, analysts of the Italian power market have observed a price dynamic for the National Single Price (PUN) of electricity that differs from that of natural gas traded on the Italian PSV market. This divergence is clearly visible in the chart shown below.

Electricity PUN price and gas price

Between May and the first half of December, the price of natural gas declined from 38.0 euro/MWh to 31.2 euro/MWh, marking an overall decrease of -18%. Over the same period, the price of electricity rose from 94.3 to 118.2 euro/MWh, corresponding to an increase of 25%.

The magnitude of this phenomenon has led some analysts to hypothesize the start of a decoupling process between electricity prices and gas prices, albeit one that is inverse to what has been sought in recent years. Other commentators have instead attributed the different price dynamics to the increase in the cost of CO2 emission allowances, which rose between May and December from 83.4 to 98.0 euro/tonne.

Given the interpretative uncertainty generated by this price divergence, it is useful to rely on the hourly PUN model developed by PricePedia[1] in order to quantify the contribution of the different fundamental drivers and to verify whether an inverse decoupling process has actually begun.

CO2 price effect

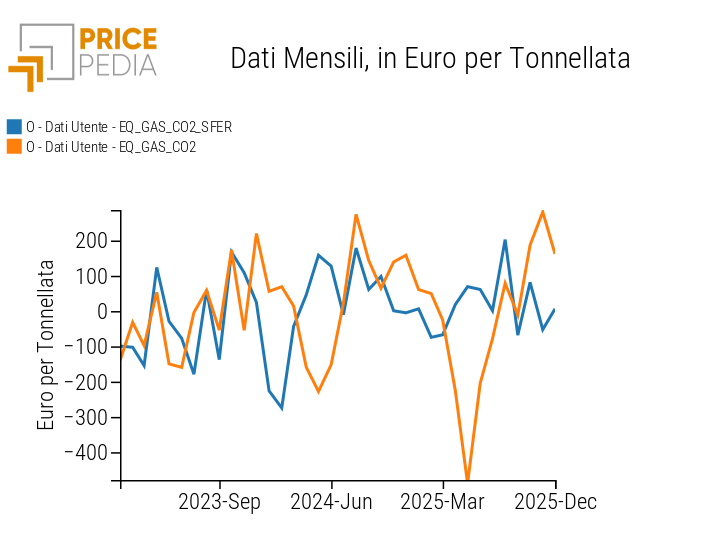

To assess the impact of the increase in CO2 emission allowance prices on the PUN, we analysed the estimation error produced by the PricePedia PUN model when the CO2 price is either included or excluded from the set of regressors.

In a first specification, the regression is estimated using only the natural gas price and electricity demand levels as explanatory variables, in order to capture the effect whereby, as demand increases, progressively less efficient thermoelectric plants are brought online. Based on this specification, the estimation error is then computed as the difference between the observed PUN and the PUN estimated by the model.

The chart reports the monthly average of these errors (EQ_GAS). For comparison purposes, it also shows the monthly average error obtained from a model specification that includes the CO2 emission allowance price among the regressors. In both specifications, all coefficients are highly significant and take values consistent with the economic and technical parameters that characterise a gas-fired thermoelectric power plant [2].

Estimation errors: model with and without CO2 price among regressors

The analysis of the chart shows that the monthly average error increases sharply between May and November 2025, and then remains elevated in December, in line with the divergent dynamics observed between the PUN and natural gas prices. In other words, when only the gas price is considered, the model tends to estimate a PUN level that is significantly lower than the one actually observed, highlighting the need to consider additional explanatory factors.

However, when the CO2 price is also included, the reduction in monthly average errors over the May–December period is limited and only marginal. This indicates that CO2 prices do contribute to explaining PUN dynamics, but only to a small extent and not nearly enough to account for the observed increase on their own.

It therefore becomes necessary to consider other structural factors in order to explain the evolution of the PUN observed since May.

Renewables effect

We therefore extended the analysis by including among the regressors the share of electricity generated, in each hour of the day, from renewable sources. As in the previous cases, the model estimation error was computed. The monthly average of this error is shown in the chart below, where it is compared with the average estimation error of the specification that includes the gas price and the CO2 emission allowance price among the regressors, but excludes the share of electricity generation from renewables.

Estimation errors: model with and without share of electricity from renewable sources

The analysis of the chart clearly shows that including the share of renewable generation among the explanatory variables leads to a significant reduction in the estimation error and, most importantly, eliminates the sharp increase observed between May and December 2025.

This evidence indicates that there is no sign of the onset of an inverse decoupling process between the Italian electricity PUN and natural gas prices. On the contrary, the observed divergence is explained by a direct decoupling between the two prices, which translated into an apparent inverse decoupling in the presence of a sharp decline in the share of electricity generation from renewable sources.

Over the period considered, this share fell from 61.6% to 26.5%.

Conclusions

The divergence in the dynamics of wholesale electricity prices (PUN) and natural gas prices in Italy between May 2025 and the end of the year led some analysts to point to a possible effect stemming from the increase in CO2 emission allowance prices, while others hypothesised the onset of an inverse decoupling process between the two prices, opposite to what is generally expected.

However, neither of these explanations is fully supported by the data. The increase in CO2 allowance prices did contribute to PUN dynamics, but only marginally and not nearly enough to explain the observed divergence between gas and electricity prices. Likewise, there is no evidence of the start of an inverse decoupling process.

On the contrary, the developments observed reflect the existence of a direct decoupling between natural gas prices and electricity prices, driven by the growing role of electricity generation from renewable sources. The subsequent sharp decline in this share, which had reached a peak in May, produced an apparent inverse decoupling between the two prices, despite the absence of any structural change in their underlying relationship.

If this interpretation is correct, the Italian electricity PUN is likely to record a significant decline as soon as electricity generation from renewable sources increases again from the exceptionally low levels currently observed.

[1] For a description of the structural hourly PUN model developed by PricePedia, see: [2] A combined-cycle gas turbine (CCGT) power plant typically has an efficiency slightly above 50%, meaning that less than 2 MWh of natural gas are required to generate 1 MWh of electricity. From an emissions perspective, a gas-fired plant generally produces between 300 and 400 kg of CO2 per MWh.