Packaging paper prices rise in 2025

An updated comparison with cost dynamics

Published by Pasquale Marzano. .

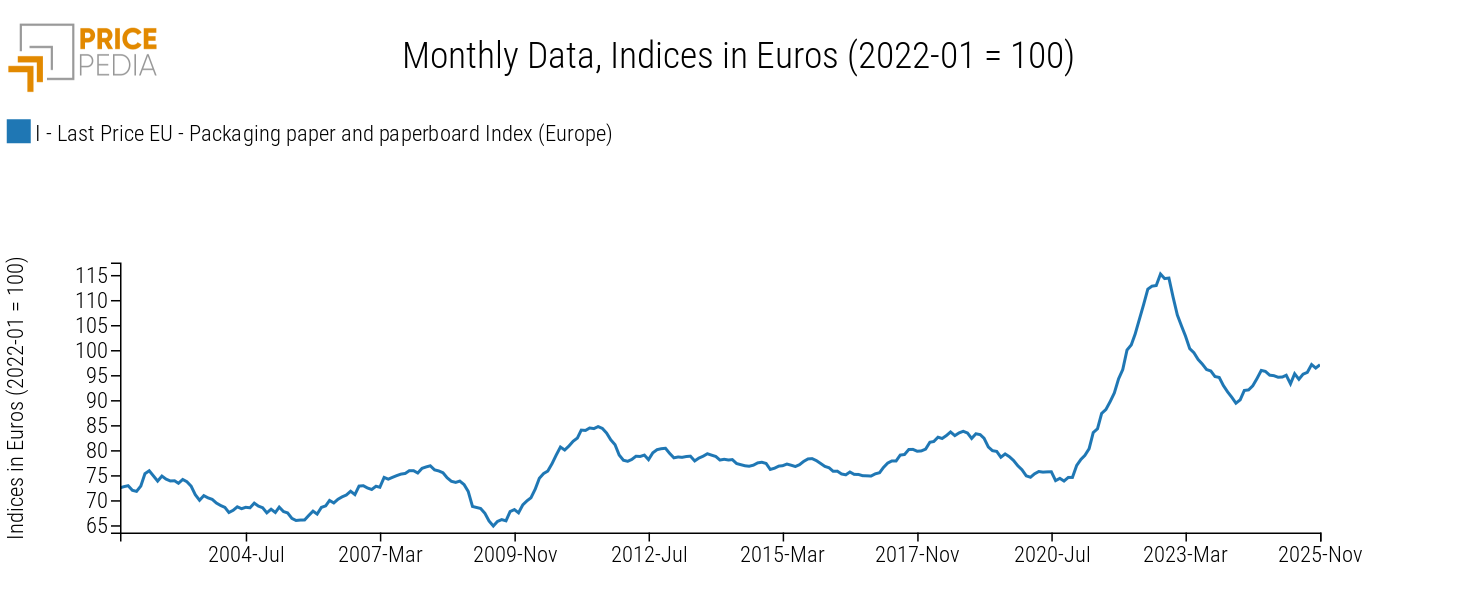

Packaging Paper Cost pass-throughAfter more than two years of decline, in 2025 packaging paper prices have resumed an upward trend, recording, on average over the first eleven months of the year, an increase of +2.6% compared to the average levels of 2024. The current level is also almost +20% higher than pre-Covid values.

The chart below shows the long-term dynamics of aggregated packaging paper prices included in PricePedia.

Starting from early 2021, European packaging paper and paperboard prices were characterized by an upward trend, driven both by the recovery in demand for packaging (especially from e-commerce) and by rising raw material costs, including energy.

This phase was followed, up to March 2024, by a downward trend due to the slowdown in global manufacturing activity levels, particularly in Europe.

In the most recent phase, from March 2024 to November 2025, prices recorded cumulative growth of +8.6%.

In order to assess which factors appear to have the greatest impact in the current phase, it is useful to compare packaging paper prices with their main cost components.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Cost drivers of packaging paper

In the article Price differentiation along the packaging paper supply chain, it was shown how pulp prices are one of the cost components that directly affect packaging paper prices.

Another important factor to consider is recovered paper (the main source of fiber for many product types), as well as energy costs (electricity and natural gas).

The chart below compares the trends of price indices for the European packaging paper market with those of pulp and recovered paper.

Comparison of prices along the packaging paper supply chain

As shown in the chart, pulp and recovered paper exhibit greater price volatility than packaging paper, which instead is characterized by a more rigid dynamic and by gradual adjustments over time.

In particular, in the most recent period a divergence can be observed between the two main raw materials: while recovered paper prices increased by +4.5%, pulp prices recorded a decline of around -10.8%.

Despite these opposite movements upstream in the supply chain, packaging paper prices show a more limited and delayed adjustment, consistent both with greater product differentiation and with the prevalence of recovered paper in the fiber mix within the production process.

Conclusions

In summary, the analysis highlights how price trends upstream in the supply chain - such as those of pulp and recovered paper, as fundamental determinants of the production process - can provide an indication of movements in packaging paper prices. Given the degree of product differentiation, cost dynamics are not transmitted simultaneously but tend to be absorbed with a delay of several months.