The divergence between energy prices and metal prices continues

Supply, demand, and rate dynamics accentuate the gap between energy and metal commodities

Published by Luigi Bidoia. .

Conjunctural Indicators Commodities Financial WeekOver the course of the past week as well, the divergence between energy price trends and metal price trends has continued, a dynamic that has been progressively consolidating throughout 2025.

Energy

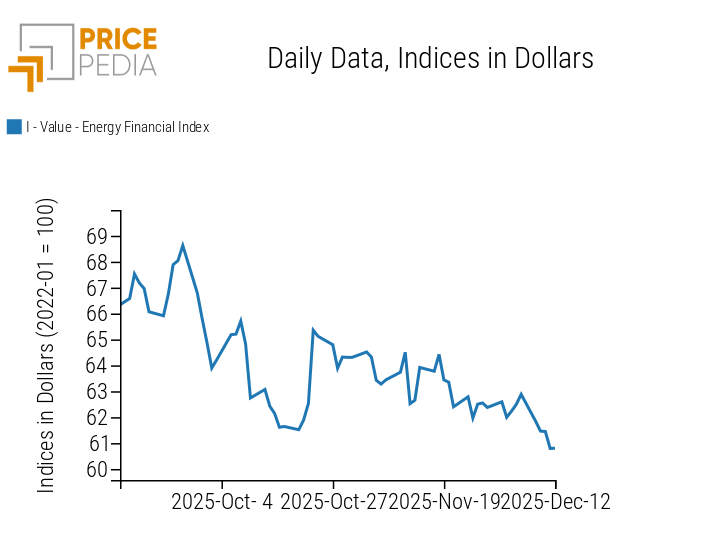

To find a PricePedia Index of energy prices in dollars at levels as low as those recorded in the last days of the past week, one has to go back to spring 2021. On a year-on-year basis, in December energy prices are 18% lower than a year earlier; the decline is even more pronounced (-26%) when measured in euros, due to the appreciation of the euro against the dollar.

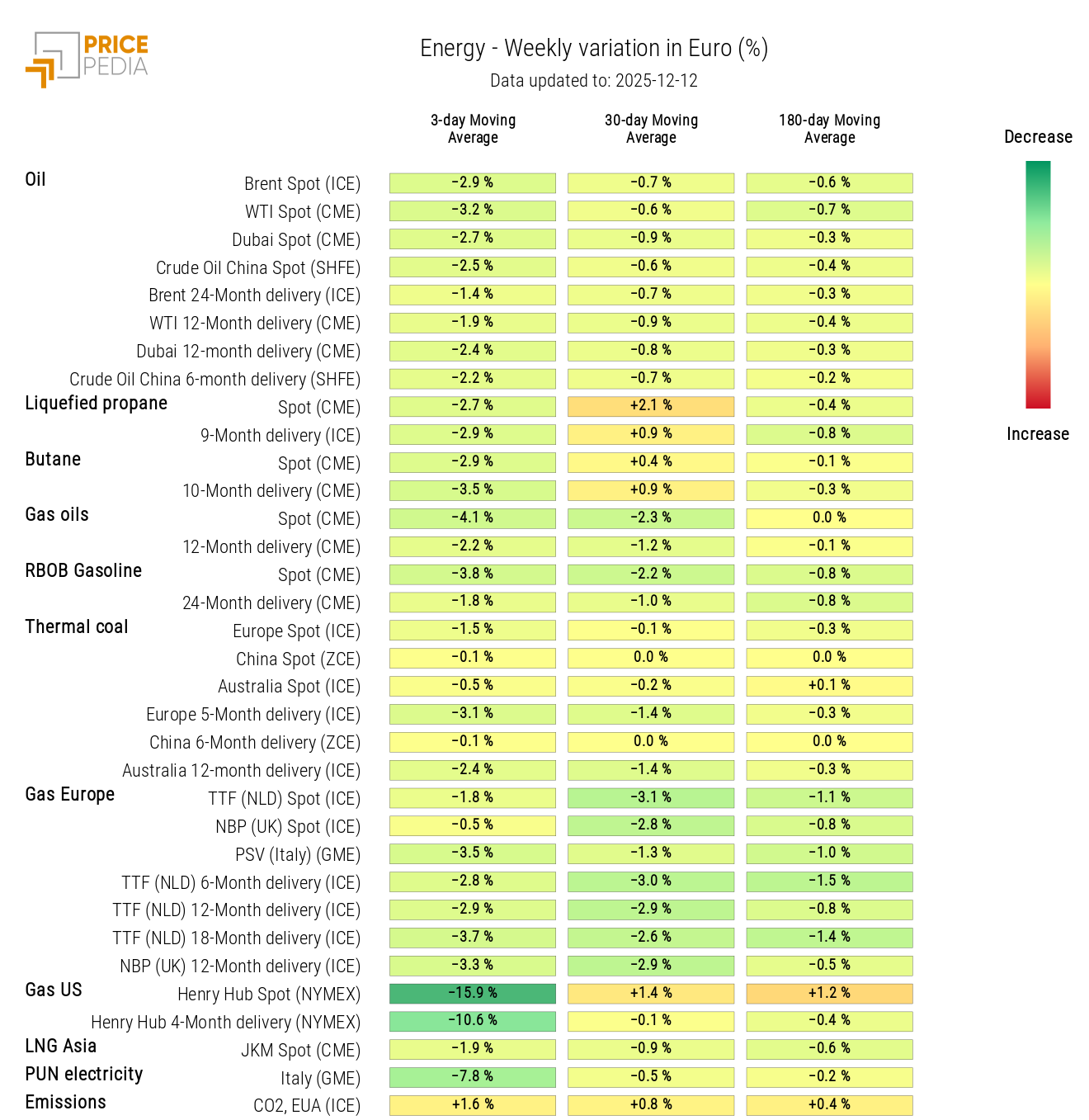

In detail, on Friday the price of Brent crude oil on the Intercontinental Exchange (ICE) fell for a few hours below the $61/barrel threshold, closing the session only slightly above that level at $61.2/barrel. In the first half of December, the price of gas at the Dutch TTF trading hub averaged 31 euros/MWh, down 39% compared to average prices in December 2024.

The sharpest decline this week was nevertheless recorded in the US market, where the price of gas traded at Henry Hub lost more than 20% in a single week, correcting in just a few days more than half of the increase accumulated over the previous two months.

Metals and the FED

By contrast, the upward phase in non-ferrous metals continued. In particular, copper recorded a new all-time high on Friday on the London Metal Exchange, approaching the threshold of 12,000 dollars per tonne.

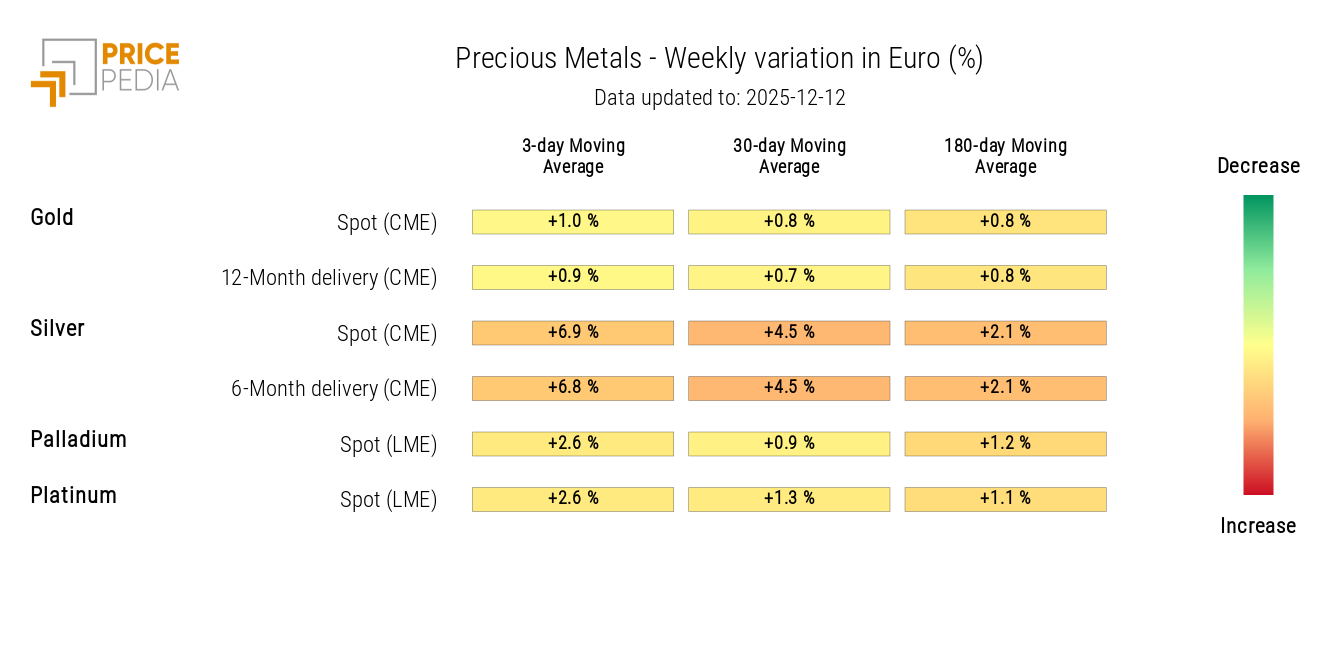

In the precious metals segment, a phase of strong growth continues, led by silver, which on Thursday touched a new all-time high at 63.9 dollars per troy ounce, before correcting to 61.4 dollars in the following session. The precious metals sector found further support in the recent interest rate cut in the United States: on Wednesday, the Federal Reserve cut benchmark rates by 25 basis points, bringing them into the 3.50–3.75% range.

Drivers

The second week of December 2025 therefore also confirms the presence of structural factors that are fueling a marked divergence between declining energy prices and rising metal prices. Energy markets continue to be affected by a condition of abundant supply, against a backdrop of still-uncertain demand. Metals, by contrast, are supported by long-term drivers: for non-ferrous metals, and copper in particular, the central role is played by the energy transition; for precious metals, the persistent search for financial hedging instruments in a highly unstable macroeconomic environment.

NUMERICAL APPENDIX

ENERGY

The PricePedia financial index of energy commodities has accelerated its downward phase.

PricePedia Financial Index of energy prices, in USD

From the analysis of the energy heatmap, a clear decline emerges in the prices of oil, European and Asian gas, to which this week US gas traded at Henry Hub has also been added.

Heatmap of energy prices, in EUR

PRECIOUS METALS

The financial index of precious metals reaches a new all-time high, supported both by the FED’s rate cut and by speculative activity, especially in the silver market.

PricePedia Financial Index of precious metal prices, in USD

The precious metals heatmap highlights the stronger increase in silver prices.

Heatmap of precious metal prices

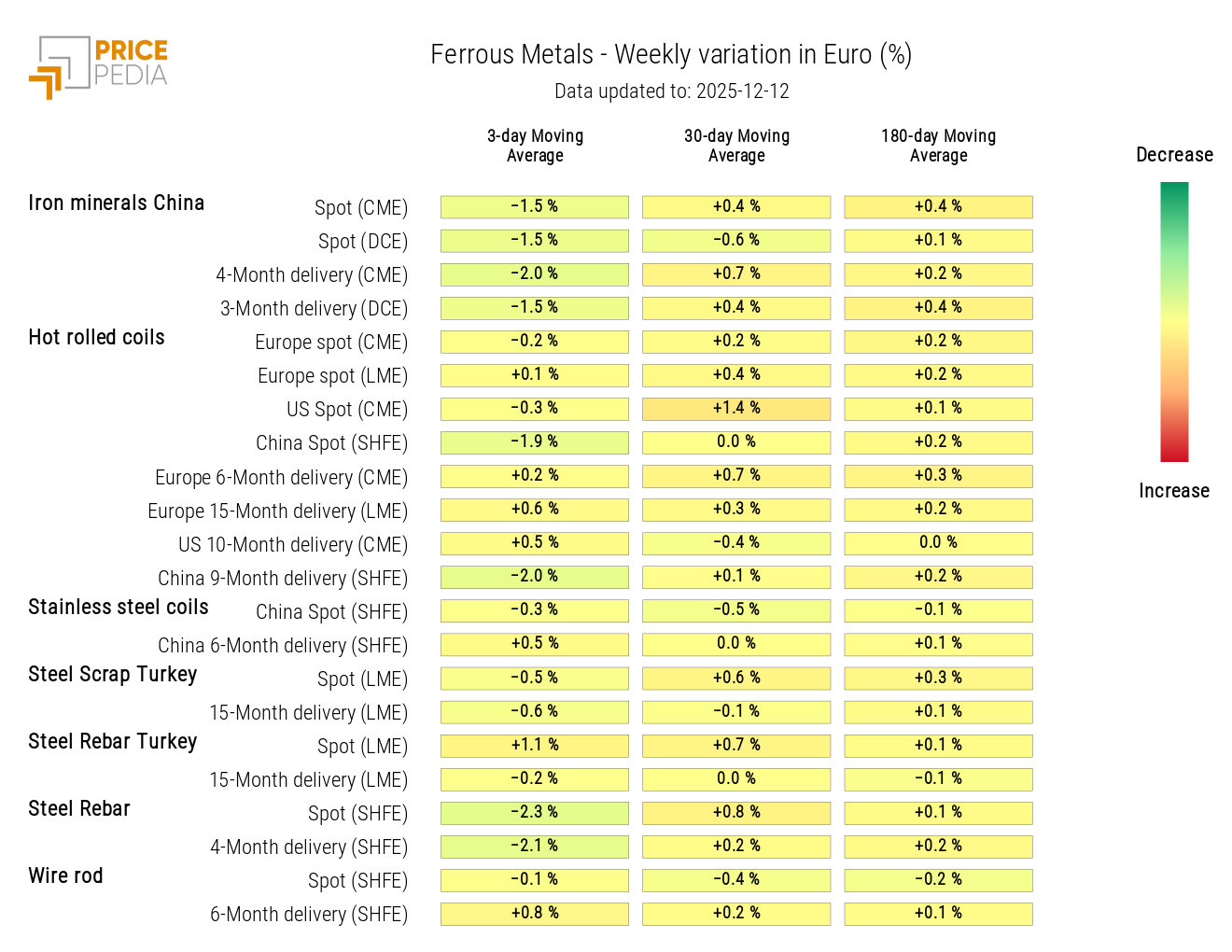

FERROUS METALS

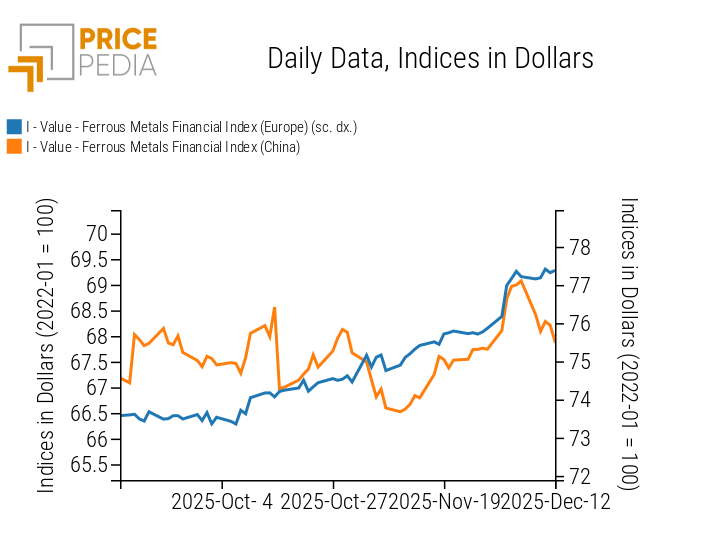

The European ferrous metals index is broadly stable this week, while the Chinese index shows a marked decline.

PricePedia Financial Indices of ferrous metal prices, in USD

From the heatmap analysis, a reduction emerges in the prices of iron ore, Chinese coils, and steel rebar.

Heatmap of ferrous metal prices, in EUR

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

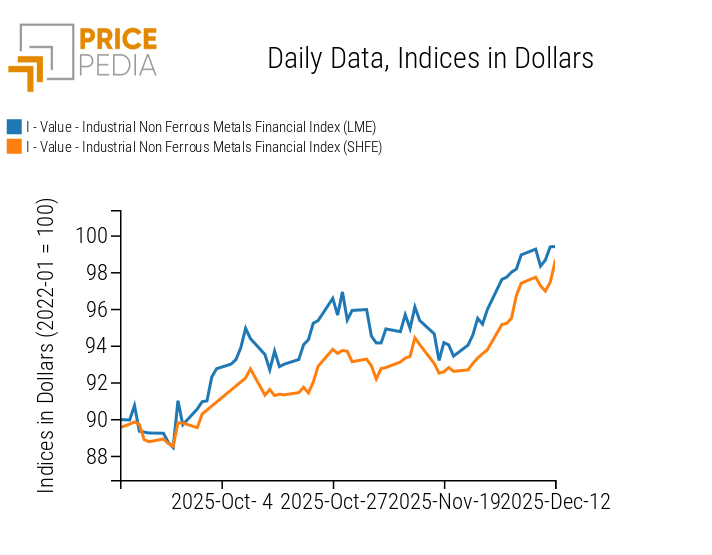

INDUSTRIAL NON-FERROUS METALS

Both financial indices (LME and SHFE) of non-ferrous metals continued to rise this week as well.

PricePedia Financial Indices of industrial non-ferrous metal prices, in USD

The non-ferrous metals heatmap confirms the continuation of the upward phase in copper and tin prices — the metals most directly linked to demand growth connected to the energy transition — together with cobalt, whose trend remains influenced by the battery cycle and supply-side factors.

Heatmap of non-ferrous metal prices, in EUR

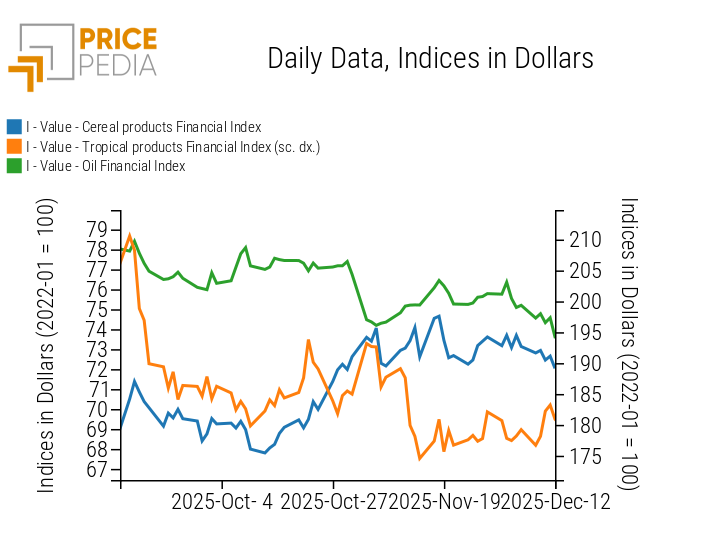

FOOD COMMODITIES

This week saw a continuation of the relative stability of the tropical food price index, while cereal and oil price indices recorded a downward trend.

PricePedia Financial Indices of food commodity prices, in USD

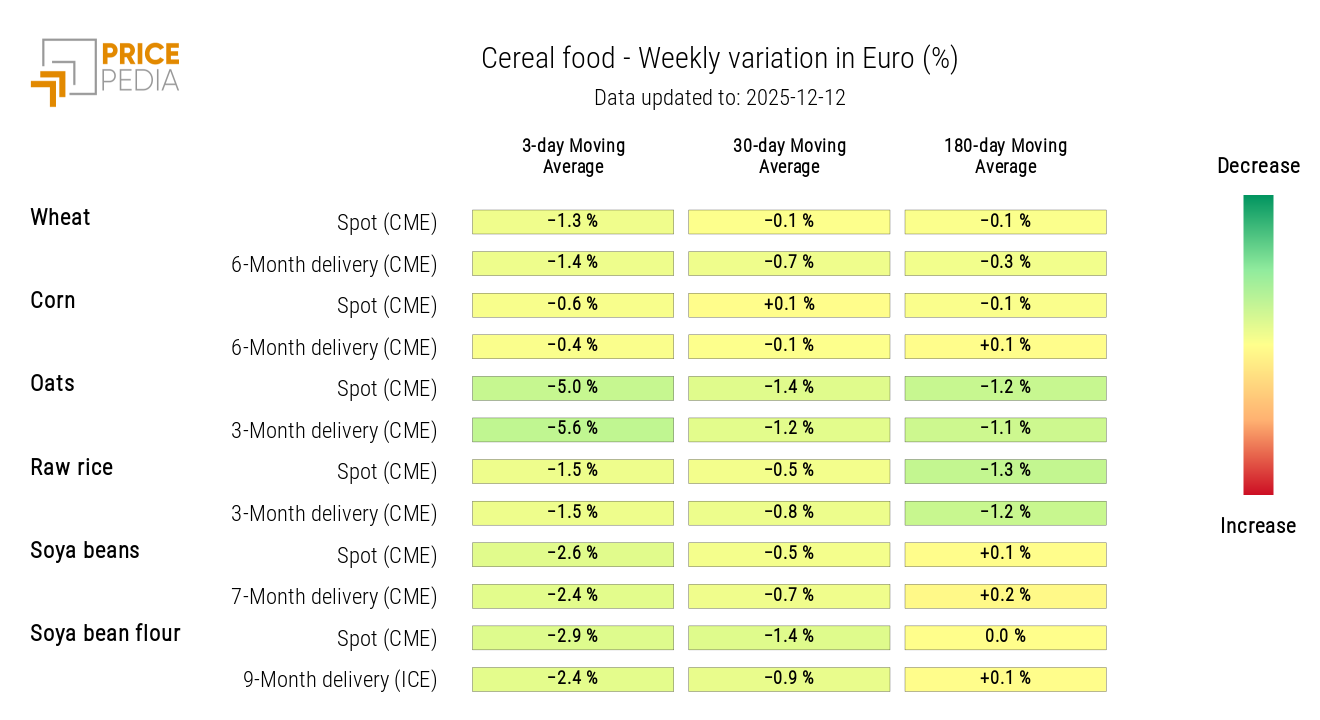

CEREALS

From the heatmap analysis, a decline emerges in oat prices, along a medium-term weakening trend, as also shown by the significant weekly reduction in the 180-day moving average.

Heatmap of cereal prices, in EUR

TROPICAL PRODUCTS

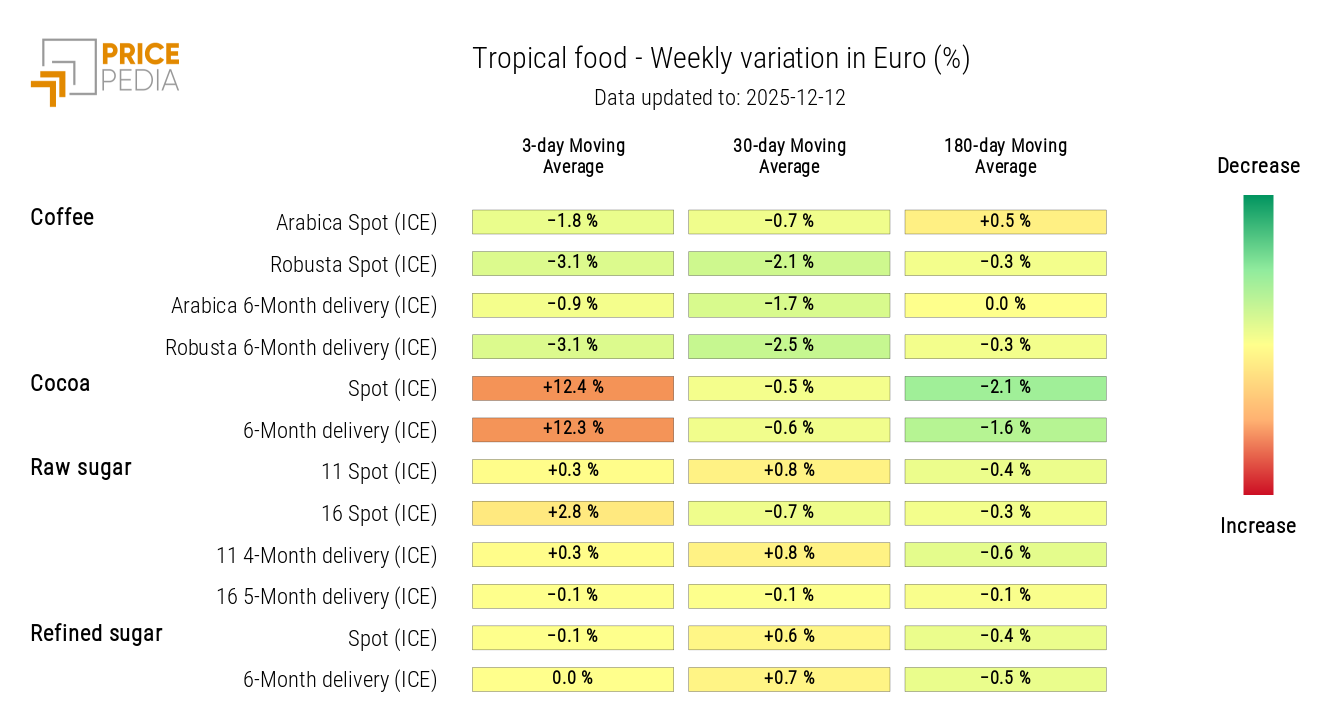

The tropical products heatmap highlights, for the second consecutive week, a divergence between sharply rising cocoa prices and declining coffee prices.

Heatmap of tropical food prices, in EUR

OILS

The edible oils heatmap is characterized by a generalized decline in oil prices.

Heatmap of edible oil prices, in EUR