Glycerol: a commodity under pressure – rising prices in China and Europe

China and Indonesia are reshaping the global market for a key product in bio-based polymer production

Published by Luigi Bidoia. .

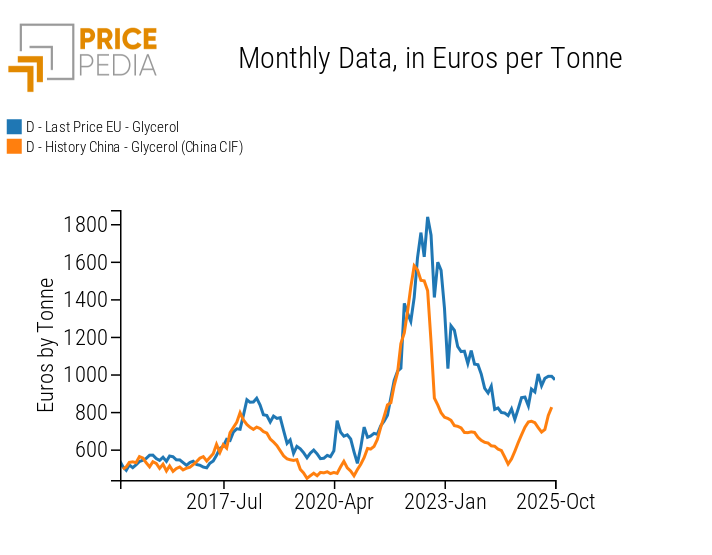

Organic Chemicals bioplastics Price DriversAmid a general weakening of commodity prices, glycerol (or glycerin) stands out as one of the few exceptions in the European market. As shown in the chart, in October 2025 the European price of glycerol recorded a year-on-year increase of 28% compared to October 2024. Even stronger was the rise in the CIF price of Chinese imports, which grew by 50% over the past twelve months.

Price of glycerol in the EU and China

The chart highlights a structural feature of the global glycerol market: European prices tend to follow Chinese import prices with a delay of a few months. This pattern indicates that the Chinese market acts as a global reference — or benchmark — for glycerol pricing. Therefore, any analysis of the mechanisms driving European glycerol prices must take into account the dynamics of the Chinese market.

How the glycerol market works

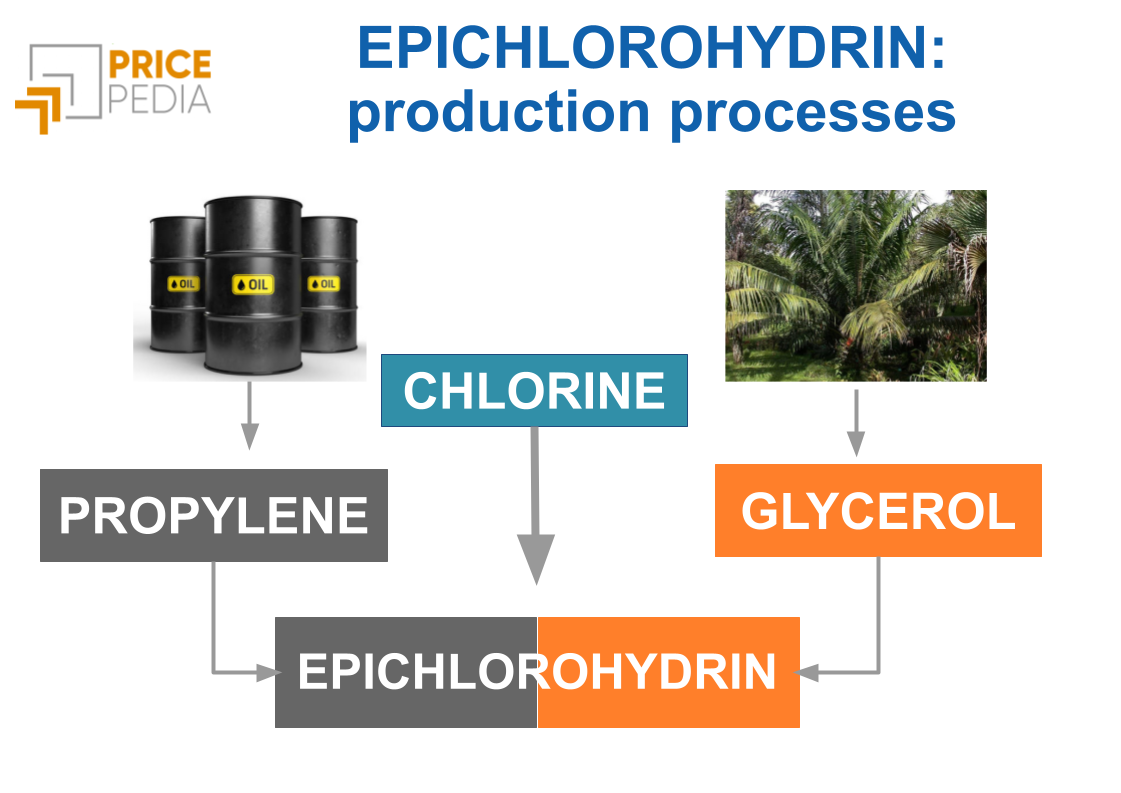

Glycerol is one of the main intermediates used in the production of bio-based polymers. In particular, it is an essential input for the production of bio-epichlorohydrin[1], bio-based alkyd and epoxy resins, bio-based polyesters, polyurethanes and polyacrylates.

From a production standpoint, glycerol is a by-product of biodiesel manufacturing from biomass. This link strongly influences the structure of its supply: the availability of glycerol does not depend on its own price but on the volume of biodiesel produced. In other words, changes in biodiesel production lead to proportional changes in glycerol output.

This feature is particularly significant because it means that glycerol prices cannot restore market balance through supply adjustments, but only through demand-side dynamics.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Global trade in glycerol

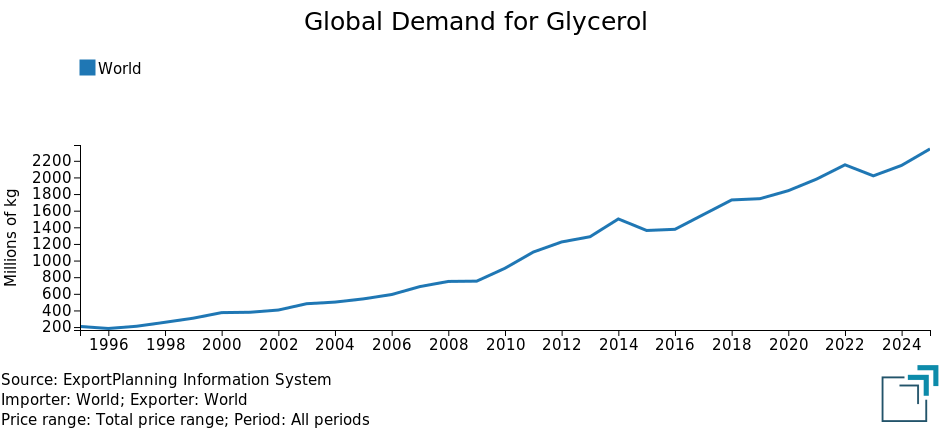

From a global trade perspective, glycerol is a clear success story. Between 2000 and 2025, international trade volumes of glycerol increased from less than 500 thousand tons to over 2 million, expanding nearly fivefold. The country that recorded the strongest export growth is Indonesia, whose shipments rose from 195 thousand tons in 2015 to more than 1 million estimated for 2025. With this expansion, Indonesia has become by far the world’s leading exporter, overtaking Malaysia and, above all, the major European chemical producers — Germany, the Netherlands, and Belgium — which had long dominated the international market. Further behind are the United States and Brazil, where the abundance of biomass enables high production levels of biodiesel and, consequently, of glycerol.

The shift from European exporters to the two main Southeast Asian producers originates in policies surrounding palm oil — the primary biomass used for biodiesel production. While European industrial and environmental policies have aimed to restrict palm oil consumption and production due to concerns about large-scale deforestation, Indonesia’s industrial and social policies have moved in the opposite direction. The Indonesian government has promoted biodiesel production from palm oil as a means to support smallholder farmers’ incomes. In line with this approach, over the past decade Indonesia has progressively increased the biodiesel blend in automotive diesel fuel, which currently stands at 40% and is expected to reach 50% in the coming years.

The rise in Indonesia’s domestic biodiesel production has led to a parallel increase in glycerol output, which has found a growing market in China’s expanding demand. This demand stems from China’s strategic shift to replace propylene with glycerol in epichlorohydrin production. As illustrated in the chart, Indonesia’s exports of glycerol to China have surged dramatically over the past ten years — from 64 thousand tons in 2017 to nearly 500 thousand tons projected for 2025.

The increase in Indonesia’s glycerol supply is evident not only from the growth of exports to China but also — although to a lesser extent — from the expansion of shipments to the United States and Europe.

In conclusion

The recent rise in glycerol prices in Europe is mainly driven by the sharper increase in the price of glycerol imported by China, which serves as the global benchmark. The upward movement in Chinese import prices reflects market tension, with demand growing faster than supply. Since supply is tied to biodiesel production dynamics, price increases cannot trigger an adjustment through higher output but only through a rebalancing on the demand side.

Only a slowdown or reduction in demand can therefore ease — or potentially reverse — the recent upward trend in glycerol prices in China and, consequently, in Europe.

[1] See the article Polymer Value Chain, China’s Growing Role: The Case of the Green Transformation of Epichlorohydrin