Growing global imbalances: the commodity price outlook becomes more uncertain

Rising tensions in global markets lead to greater risks being incorporated into PricePedia forecasts

Published by Pasquale Marzano. .

Forecast ForecastThe PricePedia Scenario has been updated with information available as of 4 December 2025. The new outlook is broadly in line with that published in previous months. On the one hand, the phase of declining energy prices continues, with a drop of over 10% expected in 2026 and a further 4% in 2027; on the other, industrial commodity prices are forecast to remain broadly stable in 2026, before recording a slight increase (+1.5%) in 2027.

Table 1: Annual Growth Rates (%) of PricePedia Aggregate Indices, in Euro

| 2024 | 2025f | 2026f | 2027f* | |

|---|---|---|---|---|

| I-PricePedia Scenario-Commodity Index (Europe) (04-12-2025 Info) | −4.57 | −5.98 | −5.73 | −1.51 |

| I-PricePedia Scenario-Energy Total Index (Europe) (04-12-2025 Info) | −5.89 | −12.39 | −11.59 | −4.10 |

| I-PricePedia Scenario-Industrials Index (Europe) (04-12-2025 Info) | −4.59 | −2.50 | −0.03 | +1.49 |

| I-PricePedia Scenario-Food Total Index (Europe) (04-12-2025 Info) | +2.82 | +8.46 | −3.83 | −1.33 |

Within this overall calm reflected in the industrial commodity aggregate, price movements at the level of individual families are much more varied. Among those expected to record reductions close to -5% are lumber, nickel, and stainless steels. Conversely, some families of non-ferrous metals – such as zinc, copper, brass, and bronze – are expected to increase by around 5%. Even stronger growth is expected for hot-rolled coils, whose physical prices for thicknesses between 3 and 10 millimetres are forecast to approach 700 euros/tonne by the end of 2026.

While the scenario published in recent days shows little difference from previous months’ forecasts in terms of specific expected price levels for individual commodities, the risk outlook appears more affected. A growing awareness is emerging that this scenario represents a relatively narrow path through a volatile environment that could feature both sudden steep climbs and equally unexpected drops. The main source of uncertainty concerns the evolution of Chinese supply on international markets and the degree of protection the EU decides to adopt to counter the impact of lower Chinese export prices on internal European price levels.

For many commodity families, the supply available on the European market depends significantly on imports from China. If Chinese policies to reduce production capacity prove effective, domestic firms’ pressure to export may ease, favouring conditions of relative scarcity in the European market and, consequently, a rise in prices — potentially a sharp one, should fears of shortages prompt user firms to rapidly increase inventory levels.

Conversely, if the current conditions of excess supply in China persist, the push to increase exports could intensify, exerting downward pressure on European prices and generating even sudden declines.

It is highly likely that prices for different commodities will move in different directions, giving rise to marked divergences between categories experiencing increases and those experiencing declines.

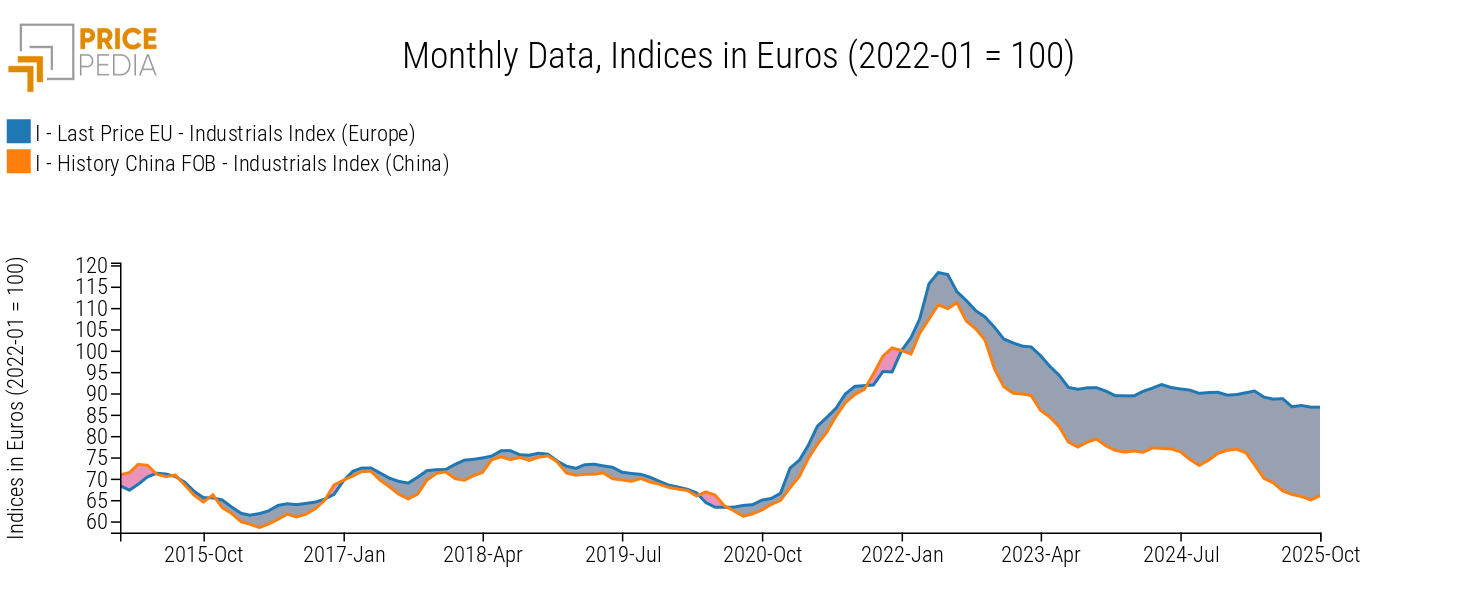

The information currently available clearly highlights the need to consider these risks carefully, but it is not yet sufficient to precisely distinguish which commodities face higher upward pressures and which, instead, present predominant risks of price reductions. The current gap between Chinese export prices and corresponding intra-EU customs prices is entirely unprecedented in its magnitude, as shown in the chart below. The latter compares the index of average FOB prices for industrial commodities exported from China with the corresponding intra-EU customs price index.

Comparison between China FOB prices and European prices for industrial commodities

From early 2015 to mid-2022, the two indices moved almost in parallel, following broadly the same pattern of rises and declines. Starting from the second half of 2022, both started to fall, though at markedly different speeds. Between July 2022 and October 2025, while FOB prices of Chinese exports fell by over 40%, EU prices fell by 23%, resulting in a gap of over 30% by October 2025.

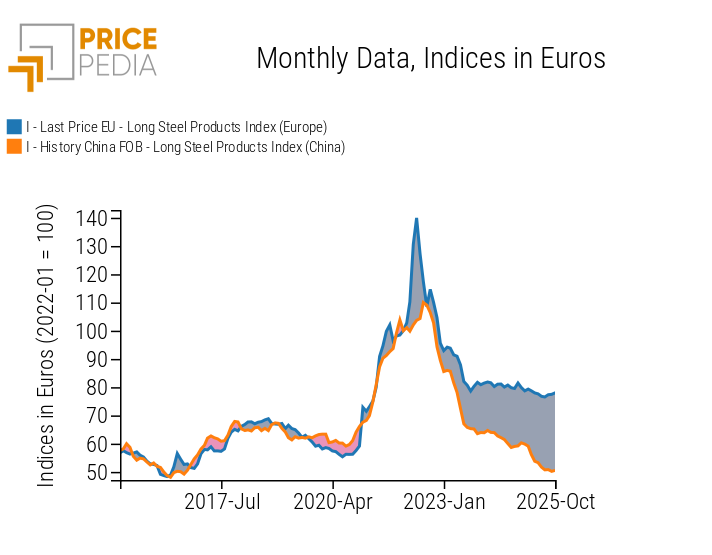

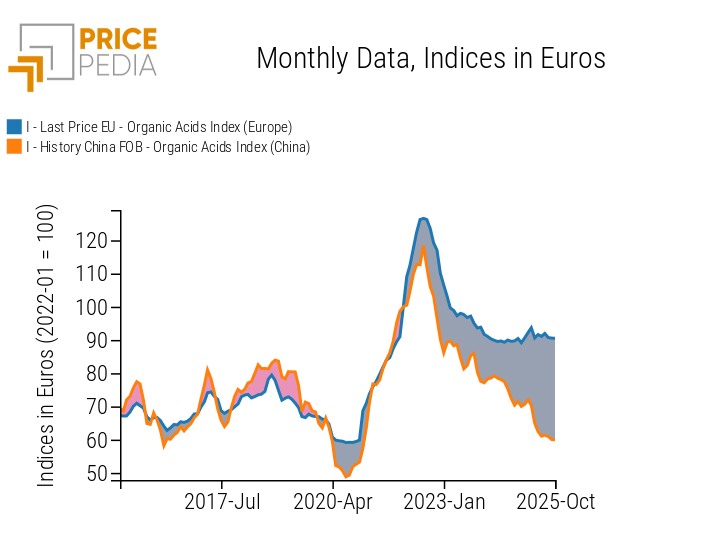

It is important to recall that the aggregate index reflects an average of very heterogeneous situations, some of which display even more pronounced gaps between Chinese and EU prices. Examples include the families of non-alloy long steels and organic acids, which at the end of 2025 show a gap exceeding 50%.

Comparison between China FOB prices and European prices for individual product categories

Long steel products

Organic acids

Within these two product families, some commodities naturally show even larger price differentials.

The studies currently underway within PricePedia aim to distinguish, based on the evolution of historical series, the commodities whose European prices are directly and significantly influenced by Chinese prices from those that instead show weaker or indirect relationships. The analysis is far from simple, as it requires isolating effectively causal relationships from spurious ones, which may reflect production cost dynamics or the effects of financial prices. It is clear, however, that for commodities presenting a direct link between Chinese prices and EU prices, the current significant differential makes it crucial to understand how and when this gap may close in the near future.

Conclusions

The forecast scenario published in recent days by PricePedia presents only slight differences compared with those released in previous months. With the continuation of the phase of declining energy commodity prices, euro-denominated prices for the average of industrial commodities appear set to remain broadly stable in 2026, before entering a moderate growth phase in 2027.

At the level of individual commodities, the scenario highlights both upward and downward risks. These depend on the strength of the relationship linking Chinese export prices to EU domestic prices and on the degree of success of the policies currently being implemented in China to limit production capacity and, consequently, export pressure.

In this context, only timely and continuous monitoring of developments in the Chinese market will make it possible to anticipate potential phases of significant price increases or sharp declines in the European market.