LME aluminium price forecast 2026–2027

Is the rise in aluminium prices expected to continue over the next two years?

Published by Luca Sazzini. .

Non Ferrous Metals Aluminium ForecastSince the beginning of 2024, the financial prices of aluminum quoted on the London Metal Exchange (LME) have risen by 30% over two years, currently reaching levels close to $2900/tonne. This bullish trend is mainly attributable to the slowdown in Chinese production, due both to reaching the national production capacity limit set by the government at 45 million tonnes per year and to the inclusion of aluminum in the Chinese Emission Trading System (ETS), which has introduced new environmental restrictions on domestic aluminum production. The inclusion of aluminum in the Chinese ETS involves allocating each producing company a maximum CO₂ emission quota, beyond which the company must purchase additional permits on the market to continue production, resulting in higher production costs.

Against the backdrop of rising aluminum prices, the main question for analysts is whether the current trend will continue in the near future or if it is a temporary increase, destined to be absorbed by a new correction phase. In this article, we aim to provide an answer to this question by analyzing various forecast scenarios for aluminum prices, developed by different forecasters.

PricePedia Forecast

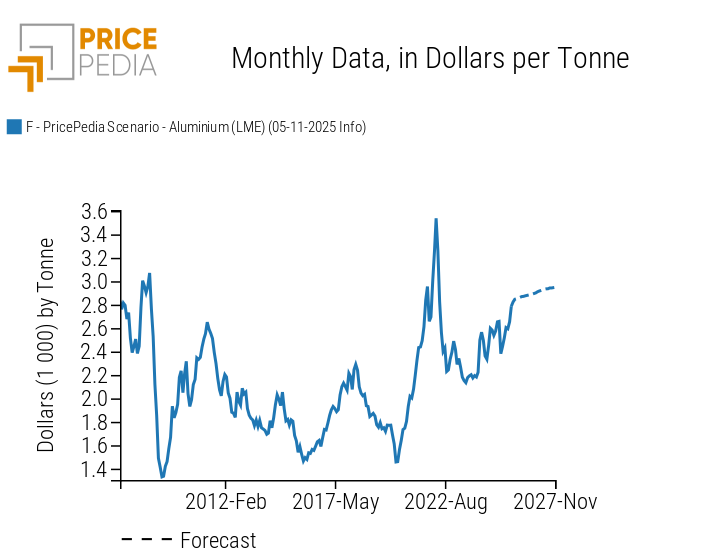

The following chart shows the PricePedia forecast scenario for LME aluminum financial prices, with information available up to December 4, 2025.

PricePedia Forecast Scenario for LME Aluminum Prices

Our forecast indicates that LME aluminum prices are expected to continue rising over the next two years, surpassing $2,900/tonne in 2027. On an annual average basis, the percentage change in dollar prices is estimated at around 10% in 2026 and 2% in 2027.

In euros, price changes are more moderate, with growth expected at 5.5% in 2026 and 2% in 2027, reaching levels close to €2500/tonne.

This price dynamic is consistent with expectations of growing aluminum demand driven by the energy transition, while supply is expected to remain largely stable, with China, the main global producer, maintaining the 45 million tonne cap in both 2026 and 2027. Additionally, China will further strengthen ETS restrictions on aluminum: in 2026, the CO₂ quota allocation method will be tightened, and in 2027 the first absolute emission limits will be introduced.

To better contextualize this forecast scenario, it can be useful to compare the PricePedia forecast with forecasts from other sources.

Forecast Implied in Futures Contracts

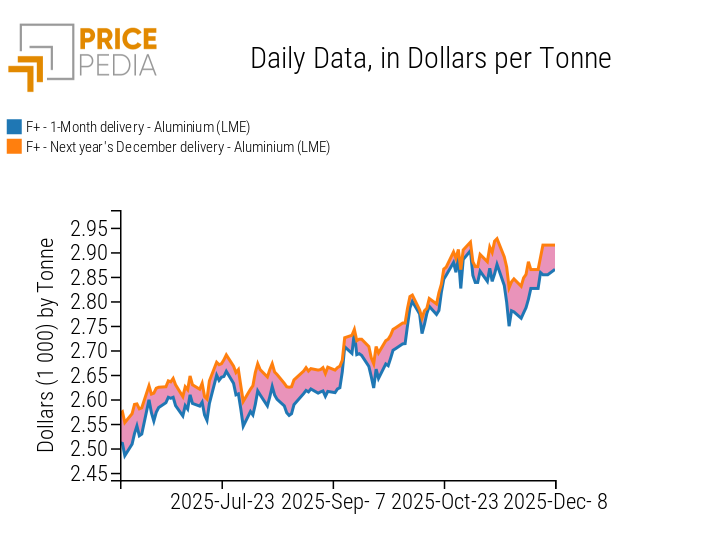

An alternative source, always useful for comparison in forecasting, is the information embedded in futures contracts. This source indicates the price at which sellers/producers are willing to deliver a commodity at a future date.

Comparison between LME Aluminum Spot and Futures Prices

The comparison between LME aluminum spot and futures prices shows that the market is in contango, a situation where the futures price is higher than the spot price. In particular, the LME aluminum futures price for December 2027 delivery is currently $2915/tonne, a level aligned with the PricePedia forecast, which estimates $2948/tonne for November 2027.

World Bank Forecast

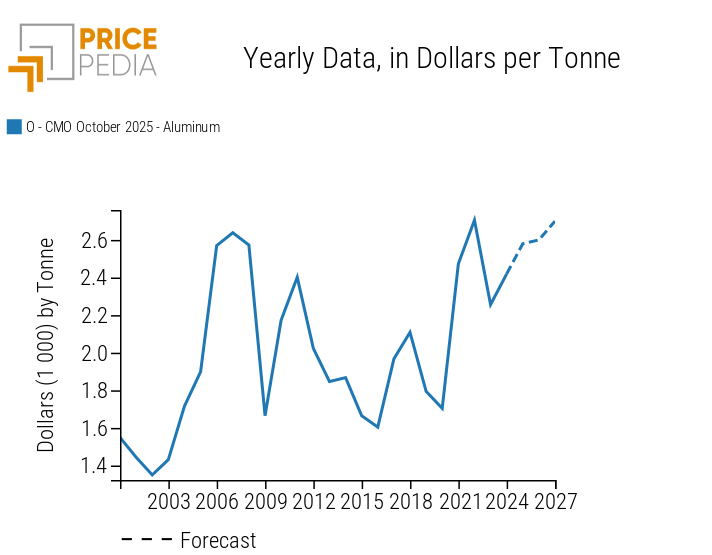

A second forecast source, accessible on the PricePedia website under the World Bank Forecasts section, is the World Bank, which updates its forecasts in April and October each year. Below is the latest available World Bank forecast for LME aluminum, updated in October 2025.

World Bank Forecasts for LME Aluminum

World Bank forecasts indicate that LME aluminum prices are expected to rise over the next two years, reaching an annual average price of about $2700/tonne in 2027. This trend is consistent with the PricePedia forecast, which also points upward and estimates a level over $200/tonne higher than the World Bank’s estimate for 2027.

Consensus Economics Forecast

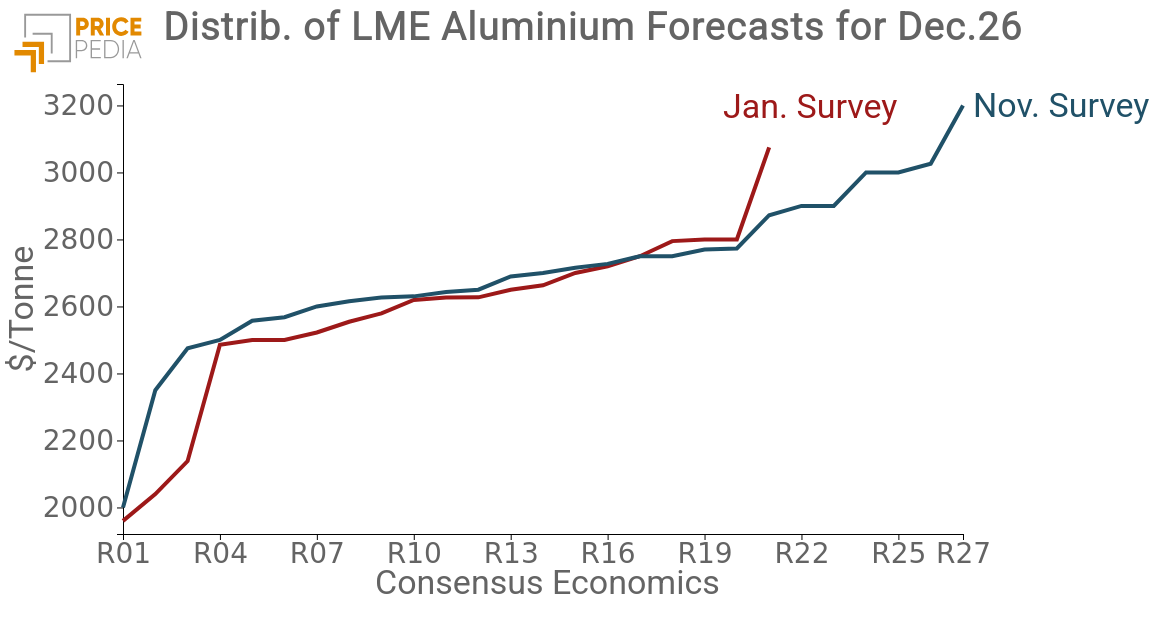

The final forecast source considered in this analysis is Consensus Economics, which allows building a forecast range and monitoring volatility changes between surveys.

The chart below shows the distribution of predicted prices for December 2026 from the January and November 2025 surveys, highlighting how the forecast range changed over the year.

The first survey conducted in January 2025, with a sample of 22 forecasters, indicated an LME aluminum price range for December 2026 between $1960 and $3075/tonne, with a mean forecast of $2577/tonne. In the November 2025 survey, based on a larger sample of 27 forecasters, the minimum price remained nearly unchanged at $2000/tonne, while the maximum estimated price rose to $3200/tonne, and the mean reached $2700/tonne.

These results reveal two main points: on one hand, a further widening of the forecast range, which was already over $1000/tonne in the first survey; on the other hand, a strengthening of price expectations for December 2026 compared to the forecasts made at the beginning of the year.

Both PricePedia and World Bank forecasts fall within the ranges outlined by the Consensus Economics surveys. These ranges indicate a high level of uncertainty in the aluminum market, with forecast ranges exceeding $1000/tonne. Despite this uncertainty, forecasters generally agree on a continued rise in aluminum prices relative to 2025 levels.

Conclusions

Expectations of rising aluminum demand, driven by the energy transition, against a supply strongly constrained in China by the 45 million tonne production cap and the gradual strengthening of the ETS, are consistent with the expectation of a further continuation of the aluminum price uptrend over the next two years. This dynamic is confirmed by all the forecasters considered, who expect further growth in LME aluminum prices in the next two years.

The PricePedia forecast is expected to reach slightly above $2900/tonne by the end of 2027, almost identical to current LME futures prices for December 2027, but slightly higher than the World Bank’s estimate of $2700/tonne. However, a high degree of uncertainty remains regarding aluminum price forecasts, particularly highlighted by the Consensus Economics surveys for December 2026, which show forecast ranges with dispersions exceeding $1000/tonne. Specifically, in the latest November survey, the minimum predicted aluminum price for the end of 2026 is $2000/tonne, while the maximum is $3200/tonne.