Commodity prices diverging

Global metals and energy markets are moving in opposite directions, while in Italy the PUN is decoupling from the price of gas.

Published by Luigi Bidoia. .

Conjunctural Indicators Commodities Financial Week

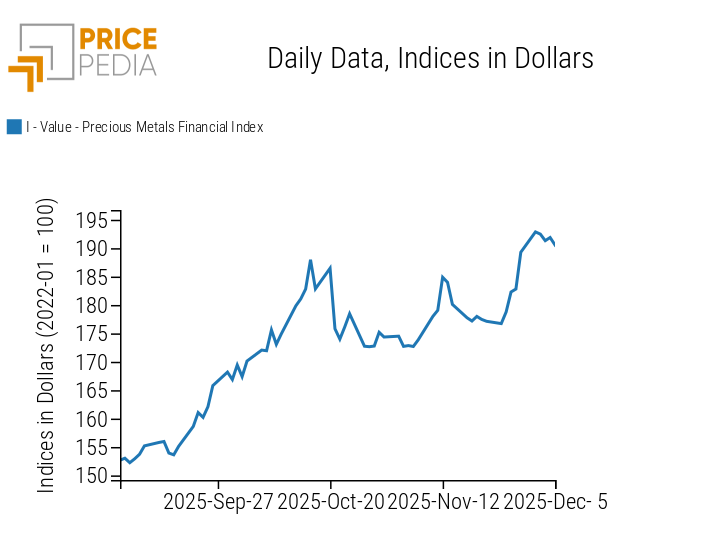

Week after week, an increasingly clear hierarchy is emerging in the growth cycles of financial commodity prices. At the top of this ranking are precious metals, which throughout the year have reaffirmed their status as the ultimate safe-haven asset. Within this group, silver stands out: thanks also to the recent rally, it is set to close the year with an increase close to 100%.

Over the course of the year, the price of silver has been supported by the same factors driving the rise of gold and other precious metals. In addition to these, however, stronger industrial demand, a persistent supply deficit, and greater attention from speculative investors — encouraged by the smaller size and liquidity of its market compared to gold — have also played a role.

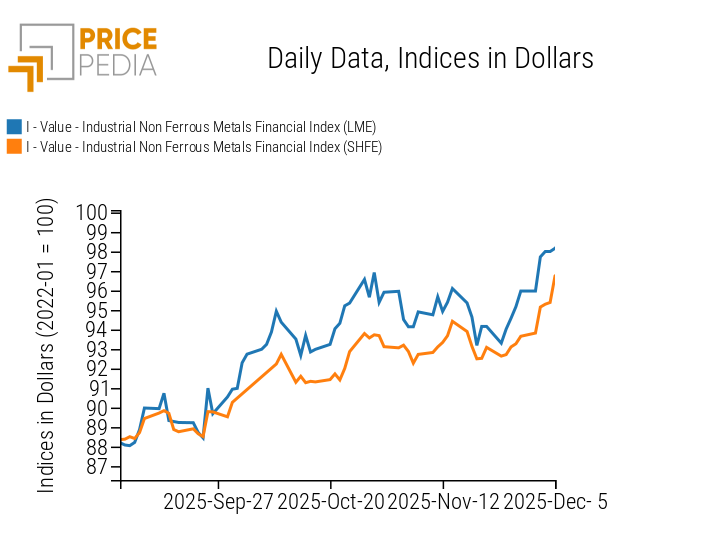

In second place are non-ferrous metals, which continued this week the upward phase that began after the sharp decline triggered by the April 2, 2025 announcement of reciprocal tariffs introduced by the Trump administration. With the strong growth of the past two weeks, copper reached a new all-time high on Friday, approaching 11,500 $/ton. At this pace, the price of copper appears set to close the year with an increase of more than 30%.

Even more dynamic is tin, whose increase over the past two weeks has approached 8%, bringing total year-to-date growth above 40%. More moderate, by contrast, has been the performance of aluminum and zinc, both up just over 10% since the start of the year.

A factor shared by all these metals is China’s dominant position in global production, with shares close to 50%, and an industrial policy launched in 2015 — and intensified this year — aimed at reducing the country’s excess production capacity. The most striking case is aluminum, among the metals most affected by restrictions, with the introduction of an actual production capacity cap, similar to what has already occurred for steel.

The continuation of this policy of reducing excess production capacity in China has been a constant source of support for non-ferrous metal prices. Additional short-term effects have also contributed, including news of temporary production cuts and expectations of higher future consumption linked to the energy transition.

In contrast, energy commodities remain weak, with Brent crude firmly below 65 $/barrel and Dutch TTF gas prices dropping 10% in the past two weeks, closing Friday at 27.1 euro/MWh.

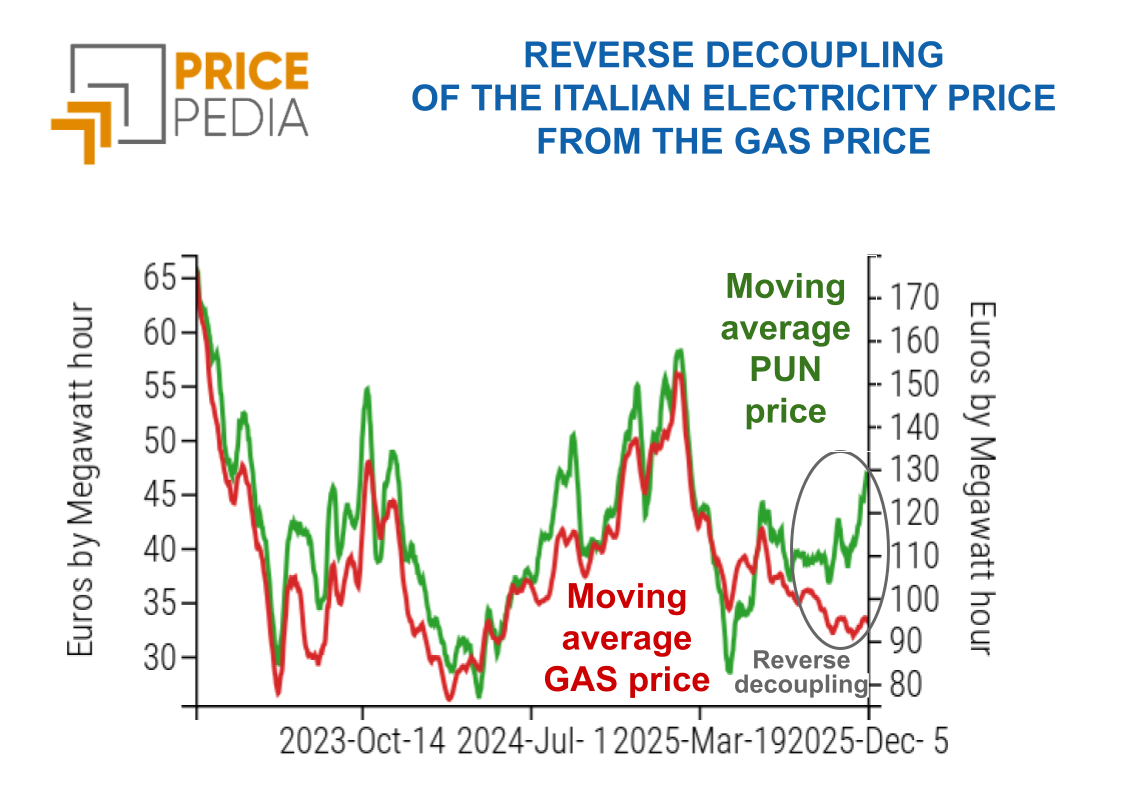

The sharp decline in TTF gas prices has highlighted an anomaly in the Italian energy market: instead of falling, electricity prices are rising. This inverse decoupling is evident in the chart below, which compares the 14-day moving average of the Italian PUN and the price of TTF gas.

Over the past two months, gas prices and electricity prices have moved in opposite directions, signalling a decoupling between the two markets — but in an inverse form compared to what would be desirable. This anomaly stems partly from a parallel misalignment between the Italian PSV gas price and the TTF price — in the past month, while the TTF dropped 15%, the PSV fell only 2% — and partly from greater intra-hour variability in electricity prices, which increased following the switch, in October of this year, from hourly to quarter-hourly price setting.

NUMERICAL APPENDIX

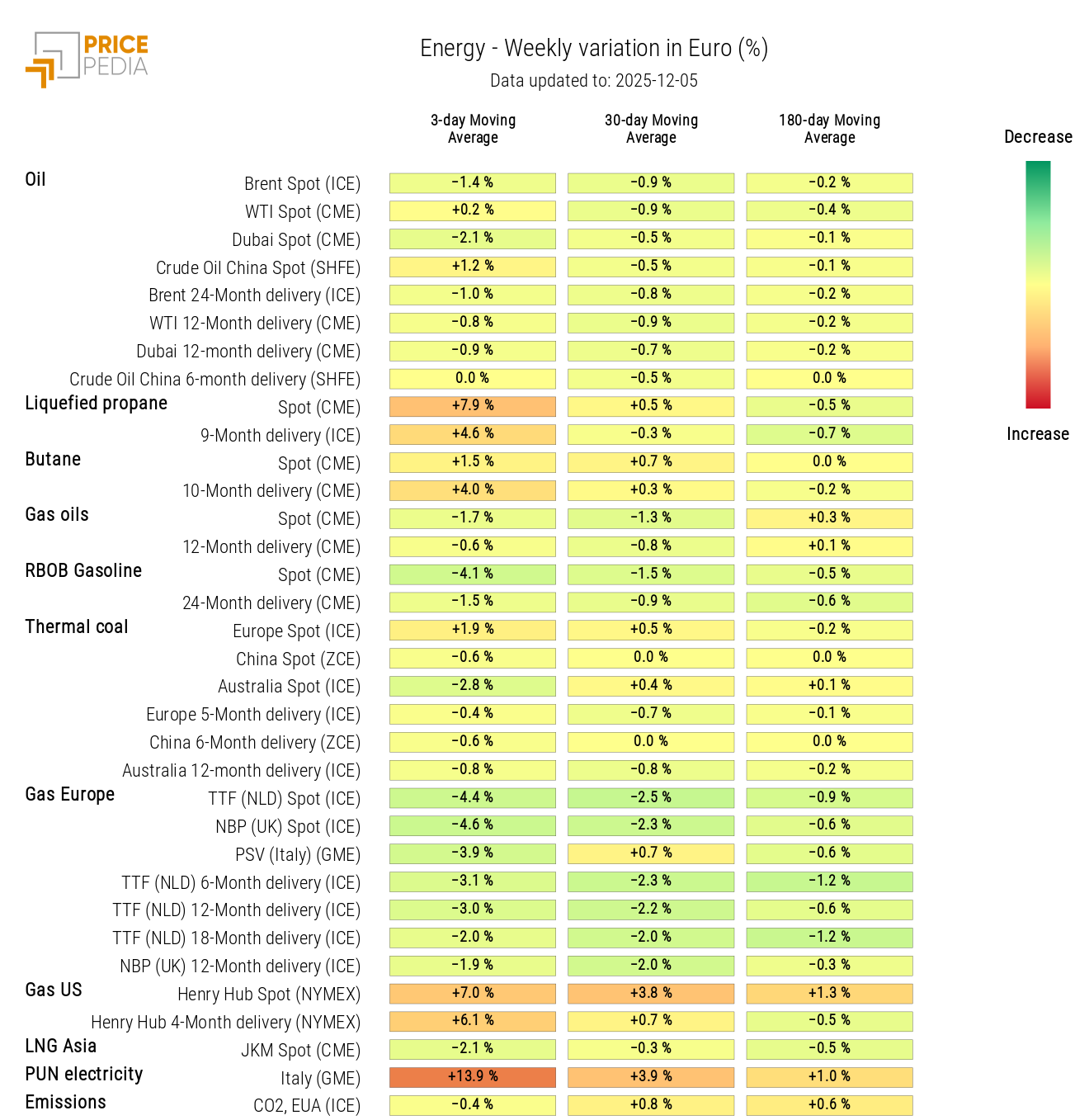

ENERGY

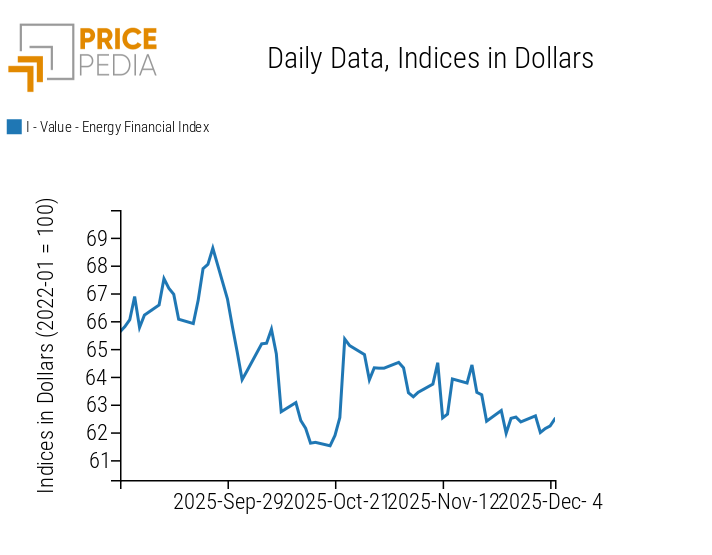

The PricePedia financial index for energy commodities continues its slow downward trend.

PricePedia Financial Index of Energy Prices in USD

The energy heatmap clearly highlights the sharp decline in European TTF natural gas prices, in stark contrast with the performance of US Henry Hub gas prices. The most notable variation shown in the heatmap, however, is the increase in the Italian PUN electricity price, which is undergoing an inverse decoupling relative both to TTF gas and to the Italian PSV.

HeatMap of Energy Prices in EUR

PRECIOUS METALS

The financial index of precious metals reaches new all-time highs, supported both by expectations of FED rate cuts and by speculative activity, especially on silver prices.

PricePedia Financial Index of Precious Metals Prices in USD

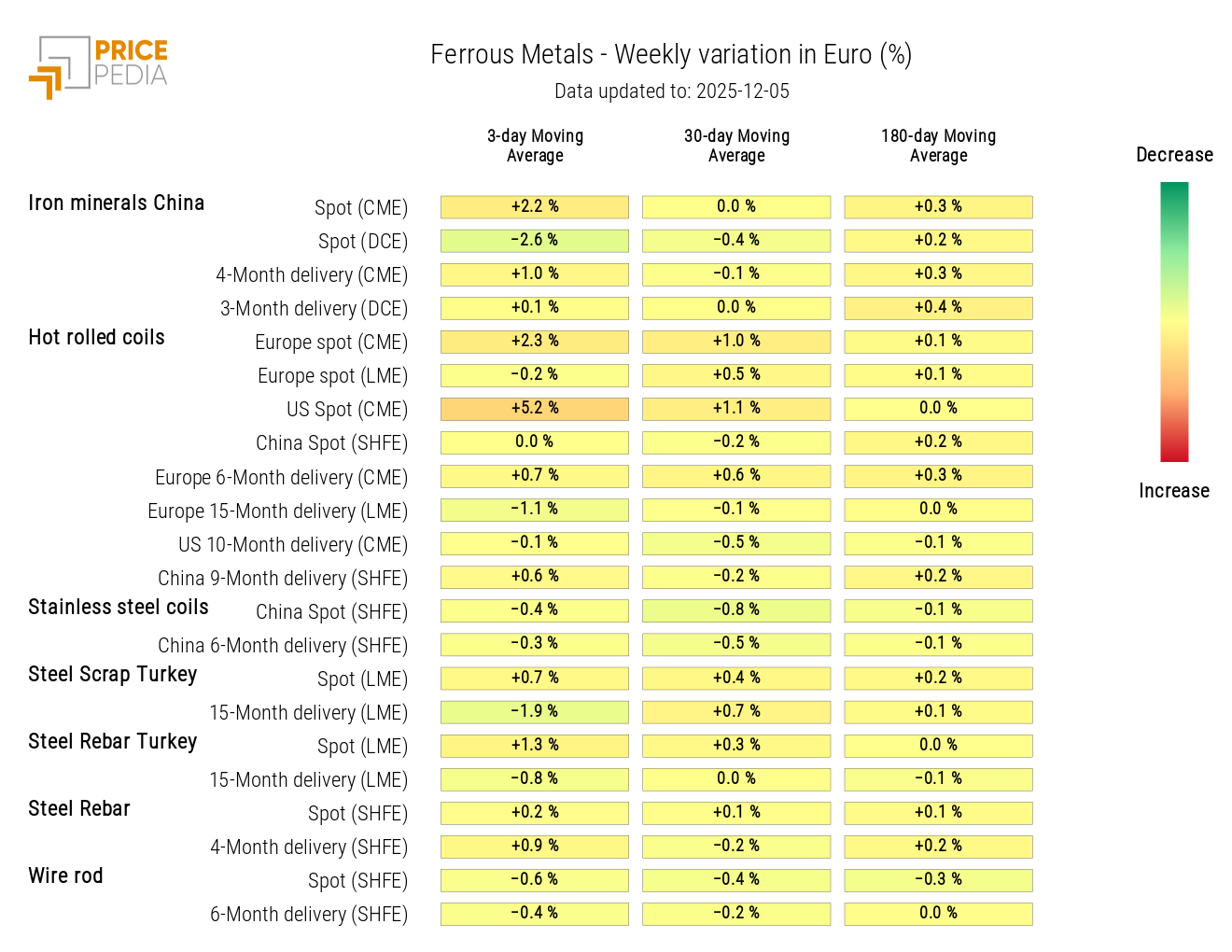

FERROUS METALS

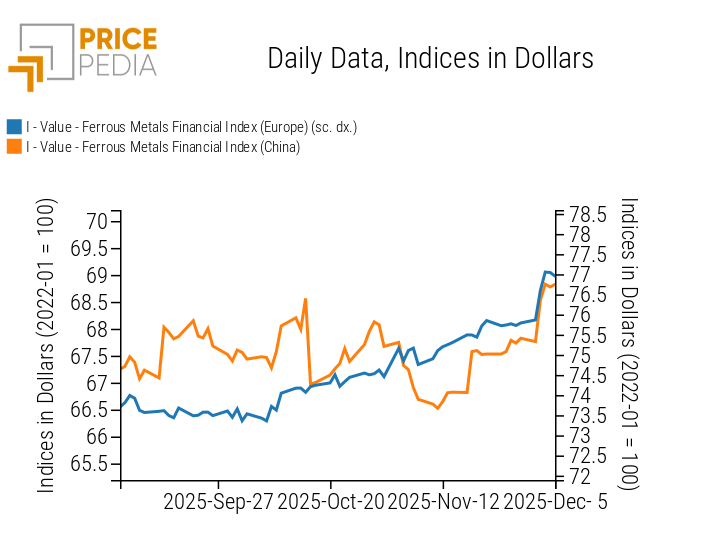

The European and Chinese ferrous metal indices show strong upward dynamics this week.

PricePedia Financial Indices of Ferrous Metal Prices in USD

The heatmap shows rises in iron ore prices and, above all, in US hot-rolled coil prices.

HeatMap of Ferrous Metal Prices in EUR

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

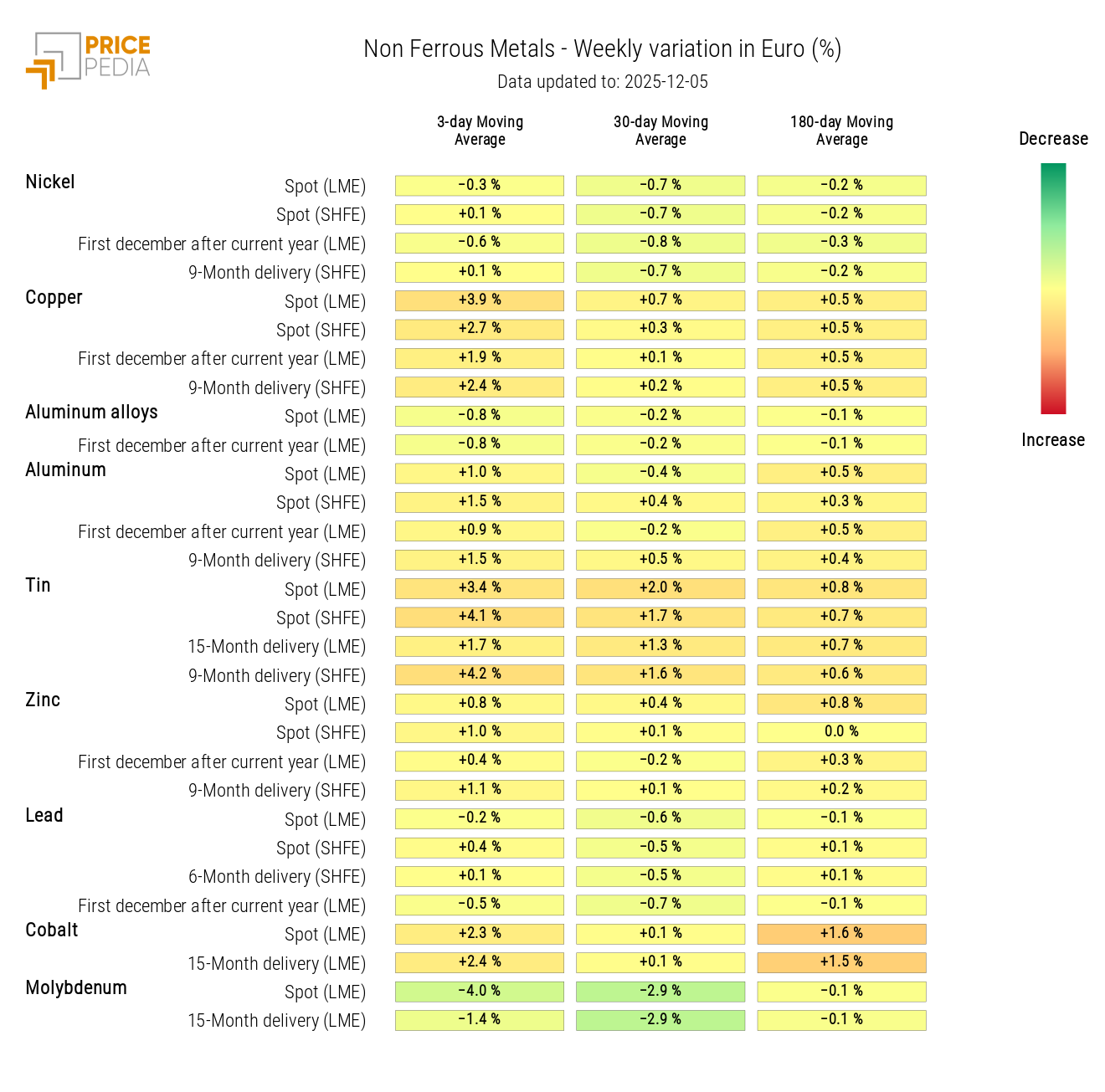

INDUSTRIAL NON-FERROUS METALS

Both financial indices for industrial non-ferrous metals show weekly price increases.

PricePedia Financial Indices of Industrial Non-Ferrous Metal Prices in USD

The non-ferrous metals heatmap shows increases in copper and tin prices.

HeatMap of Non-Ferrous Metal Prices in EUR

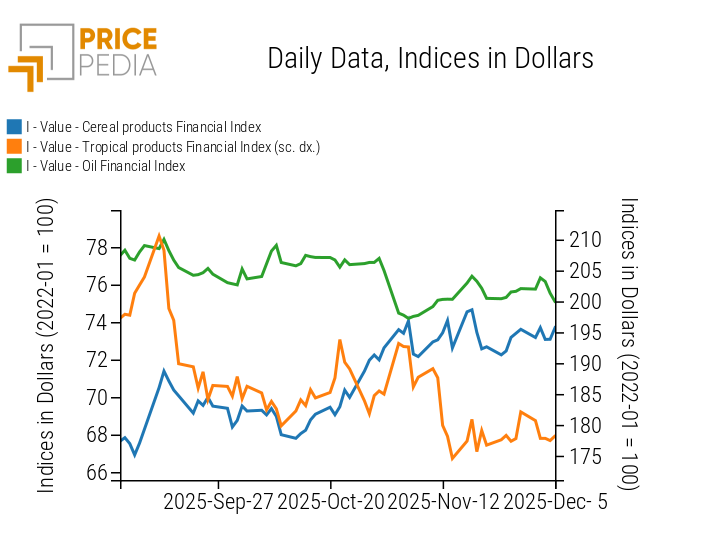

FOOD COMMODITIES

Net of normal daily fluctuations, all three financial indices for food commodities show essentially sideways movements.

PricePedia Financial Indices of Food Prices in USD

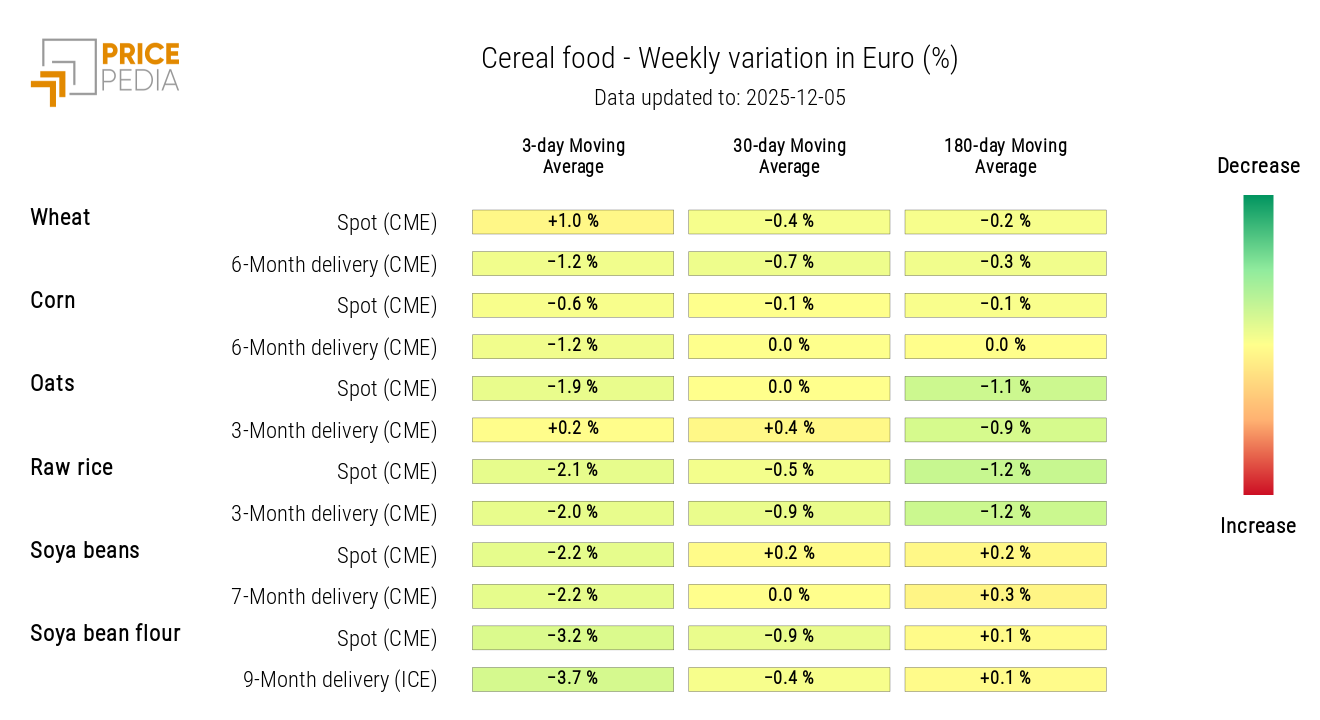

CEREALS

The heatmap shows a slight decrease in oat and soybean prices.

HeatMap of Cereal Prices in EUR

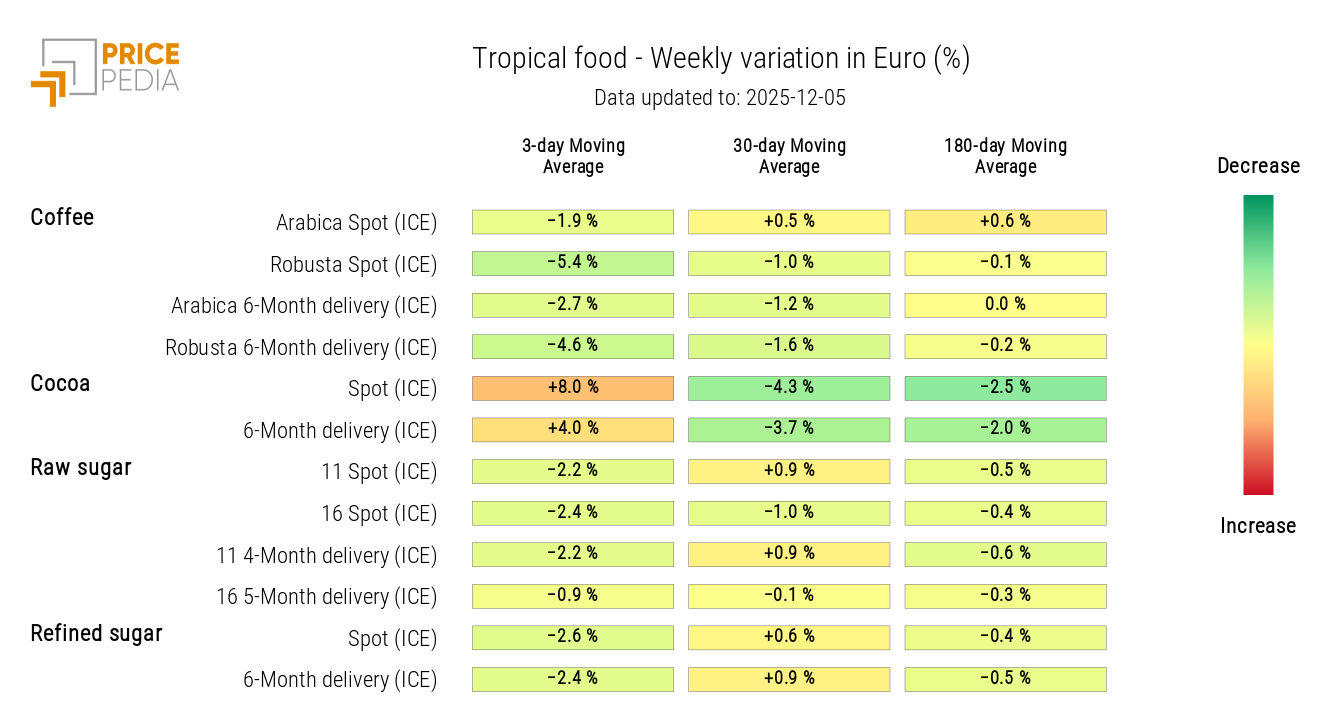

TROPICALS

The tropicals heatmap shows a strong divergence between rising cocoa prices and falling coffee and sugar prices.

HeatMap of Tropical Food Prices in EUR

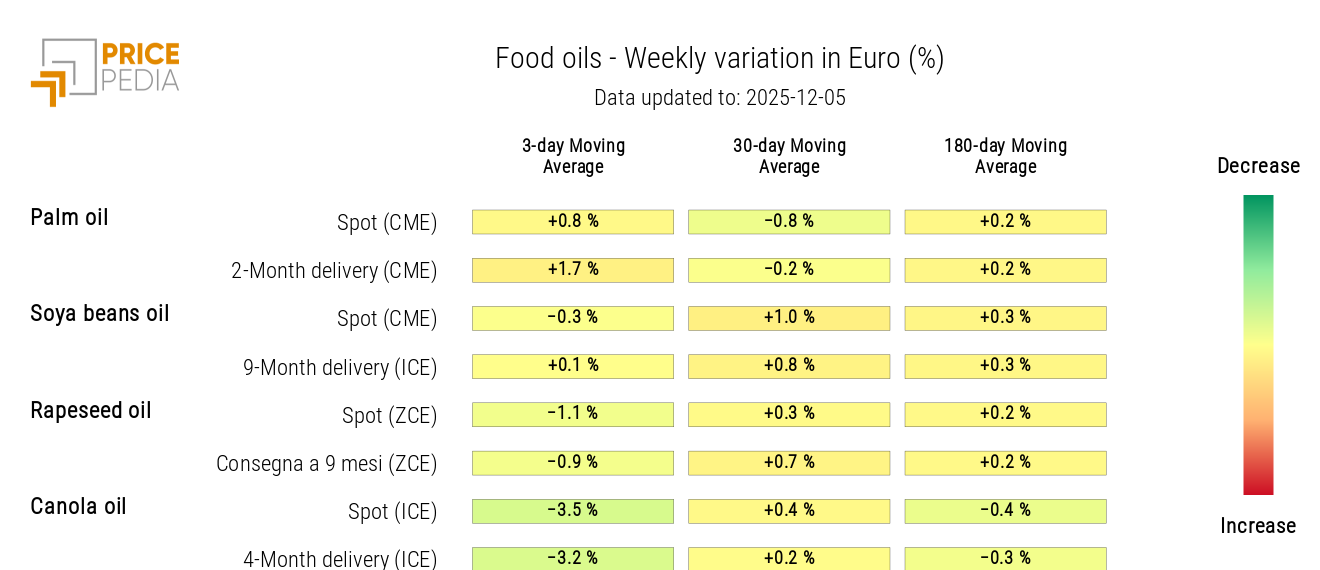

OILS

The heatmap of edible oils shows a decline in canola oil prices.

HeatMap of Edible Oil Prices in EUR