Antimony market on fire

Analysis of the effects of the ban on Chinese exports of antimony oxides

Published by Luca Sazzini. .

Antimony Price DriversAntimony is classified as a critical raw material by both the European Union and the United States, due to its economic importance and the high concentration of supply sources. Until last year, in terms of market value, the most widely traded form worldwide was antimony oxide, a key compound used both in the production of flame retardants—employed in plastics, textiles, and other materials—and as a clarifying agent in glass.

In the photovoltaic glass sector, antimony oxide helps improve the efficiency of solar panels by enabling greater light absorption and more effective energy conversion. In China, it is expected that, in the near future, the use of antimony oxides as a clarifying agent in photovoltaic glass will even surpass its use as a flame retardant, which in 2020 accounted for 43% of global antimony consumption.[1]

China is by far the world’s main producer and exporter of antimony oxides, but it has recently sharply reduced its exports, generating a full-blown market crisis.

In this article, we first analyse the collapse in Chinese exports, examining the factors behind the current tightening of global supply, and then assess the effects on price dynamics in Europe and China.

Analysis of Chinese Antimony Oxide Supply

The chart below shows the historical series of Chinese exports of antimony oxides from 1995 to 2025, expressed in quantity terms.

The chart highlights a sharp collapse in Chinese exports of antimony oxides, particularly pronounced in 2025.

In 2021, Chinese exports of antimony oxides amounted to 50200 tonnes, accounting for almost 58% of total global supply.

Over the last four years, Chinese production and exports of antimony oxide have been affected by several factors, including production suspensions due to force majeure, administrative export restrictions, and the inclusion of the sector by the Chinese government among the tools of retaliation in the trade war with the United States. Indeed, since December 2024, China has officially banned exports of antimony and rare earths to the United States, in response to U.S. restrictions on chip sales.

The effects of the latest restrictions emerged in 2025, with a drop in exports of more than 80% compared to 2024 levels. In fact, while in 2024 China still exported 34200 tonnes of antimony oxides, remaining the main global supplier and accounting alone for 47% of total exports, estimates for 2025 show a collapse to just 6,000 tonnes exported, less than 11% of global supply, placing China as the third-largest exporter after Belgium and France.

Since early 2025, Belgium has attempted to partially address the gap created by the reduction in Chinese exports of antimony oxides, becoming the main supplier to the United States, after China had traditionally covered this role until 2024. However, although Belgium is a producer of antimony oxides, it cannot remotely replace China’s role, as it lacks mining sites and its production depends entirely on the import of minerals and the recycling of lead batteries.

On 8 November, China suspended until 27 November 2026 the export ban to the United States on antimony, gallium, and germanium, following new compromises reached during the 30 October meeting between President Xi Jinping and Donald Trump.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Analysis of Antimony Oxide Prices

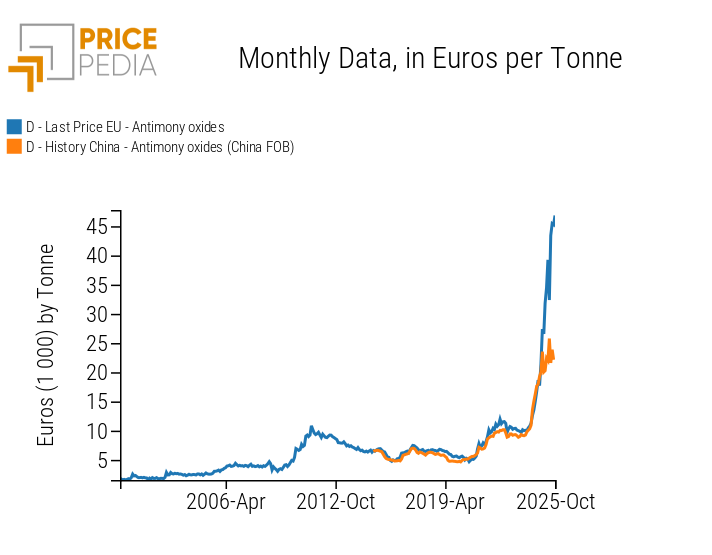

To analyse the effects of the Chinese export ban on antimony oxide prices, the chart below shows the historical series of European customs prices and Chinese FOB export prices.

European and Chinese customs prices of antimony oxides, expressed in euros/tonne

The chart shows a sharp increase in antimony oxide prices, especially in Europe, over the past two years. While in 2022 and 2023 the decline in Chinese exports had only a limited impact on prices, a first significant increase is observed in 2024: in both Europe and China, antimony oxide prices exceeded 20000 euros/tonne by the end of the year, more than double the levels of January 2024.

In 2025, the European market experienced a further acceleration: antimony oxide prices more than doubled compared to the end of 2024, reaching values close to 47000 euros/tonne. By contrast, Chinese export prices remained relatively stable, at around 22000 euros/tonne, about half of European levels. This divergence in prices since early 2025 appears consistent with Chinese customs declarations reporting a halt in antimony oxide exports to the European Union starting in October 2024.

Conclusions

Antimony is a critical raw material for both the European Union and the United States, whose supply has always been heavily dependent on Chinese exports. The recent Chinese export bans on antimony oxides have caused significant price increases in various global markets.

Until 2024, European and Chinese antimony oxide prices followed very similar paths, both in dynamics and levels. In 2025, however, the two markets diverged: in Europe, prices continued to rise, reaching levels twice those in China, while in China they remained relatively stable.

With the recent suspension of the Chinese export ban to the United States until November 2027, it is plausible that European prices may partially adjust downward, considering that the United States will once again be able to import from China rather than depend on the European market.

[1] Source: Factsheets 2025