Metals rise on growing expectations of FED cuts

Cocoa collapse: EU postpones approval of deforestation rules

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekFinancial prices of energy remained stable on a weekly basis, while continuing to show high volatility.

The oil market is supported by concerns over a possible decline in Russian exports, following sanctions imposed by Western countries and ongoing attacks on energy infrastructure. At the same time, however, it continues to be characterized by a significant oversupply. Both the American Petroleum Institute (API) and the Energy Information Administration (EIA) reported a further weekly increase in crude oil inventories in the United States. In its monthly report, the EIA also forecasts supply growth for next year, while demand is expected to remain largely stable.

Similarly, OPEC’s monthly report indicates a supply surplus in 2026 due to increased production by OPEC countries and other producers, including the United States, Canada, Brazil, and Argentina, in a context of stable demand.

These assessments initially exerted downward pressure on oil prices, which then recovered due to new Ukrainian drone attacks on the port of Novorossiysk, a strategic hub for Russian exports.

The price of the European natural gas TTF (Netherlands) fell for most of the week, supported by abundant inflows into the EU, before experiencing a sudden rise on Friday. The trend reversal was driven by a sharp deterioration in weather forecasts, with significantly lower temperatures expected.

The U.S. Henry Hub price, meanwhile, continues an upward trend, fueled by increased heating consumption due to harsh weather conditions.

The metals market recorded an increase in prices, supported by growing expectations of an imminent interest rate cut by the Federal Reserve, based on indicators and preliminary estimates of labor market weakness in the United States. Precious metals saw the strongest increases: gold once again surpassed $4200/oz over the past week, while silver reached new all-time highs, exceeding $53/oz. Price growth, however, slowed toward the end of the week, with profit-taking on Friday.

In the industrial metals segment, prices of both ferrous and non-ferrous metals posted increases.

Among non-ferrous metals, the largest weekly gains were registered by copper, tin, and aluminum. The increase in copper prices was particularly strong in the U.S. market, where the spread relative to the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE) widened. On Monday, copper prices on the Chicago Mercantile Exchange (CME) rose by 3%, compared with gains of less than 1% on the LME and SHFE.

The rise in tin prices was driven by new data from Indonesia’s Ministry of Trade, showing a significant year-on-year decline in exports of refined tin in October.

The increase in SHFE aluminum prices reflects concerns over potentially insufficient supply, with Chinese smelters nearing the capacity limits imposed by the government.

In the food commodity sector, cereal prices showed contrasting movements, edible oils saw a slight increase, while tropical products experienced a significant decline. Among these, cocoa recorded the sharpest weekly drop, due to the one-year postponement of the application of the new EU anti-deforestation rules, which will enter into force on December 30, 2026 for large companies and June 30, 2027 for smaller ones. Downward pressure was also reinforced by increased production in Côte d’Ivoire and improved harvest prospects after a slow start to the season.

Another price that saw a significant weekly decline was that of arabica coffee, following recent announcements that the Trump administration will soon introduce new tariff cuts on certain imported crops not produced in the United States, including coffee.

End of the U.S. Shutdown

After 43 days of paralysis, on November 12, 2025 the longest shutdown in U.S. history officially ended, with Congress approving the new funding bill. However, the measure provides government funding only until January 30, 2026, because it does not include the extension of health subsidies under the Affordable Care Act (ACA), which Democrats had requested in order to approve the funding bill.

The budget debate therefore remains unresolved, and the administration could face a new shutdown if agreements are not reached by January of next year.

NUMERICAL APPENDIX

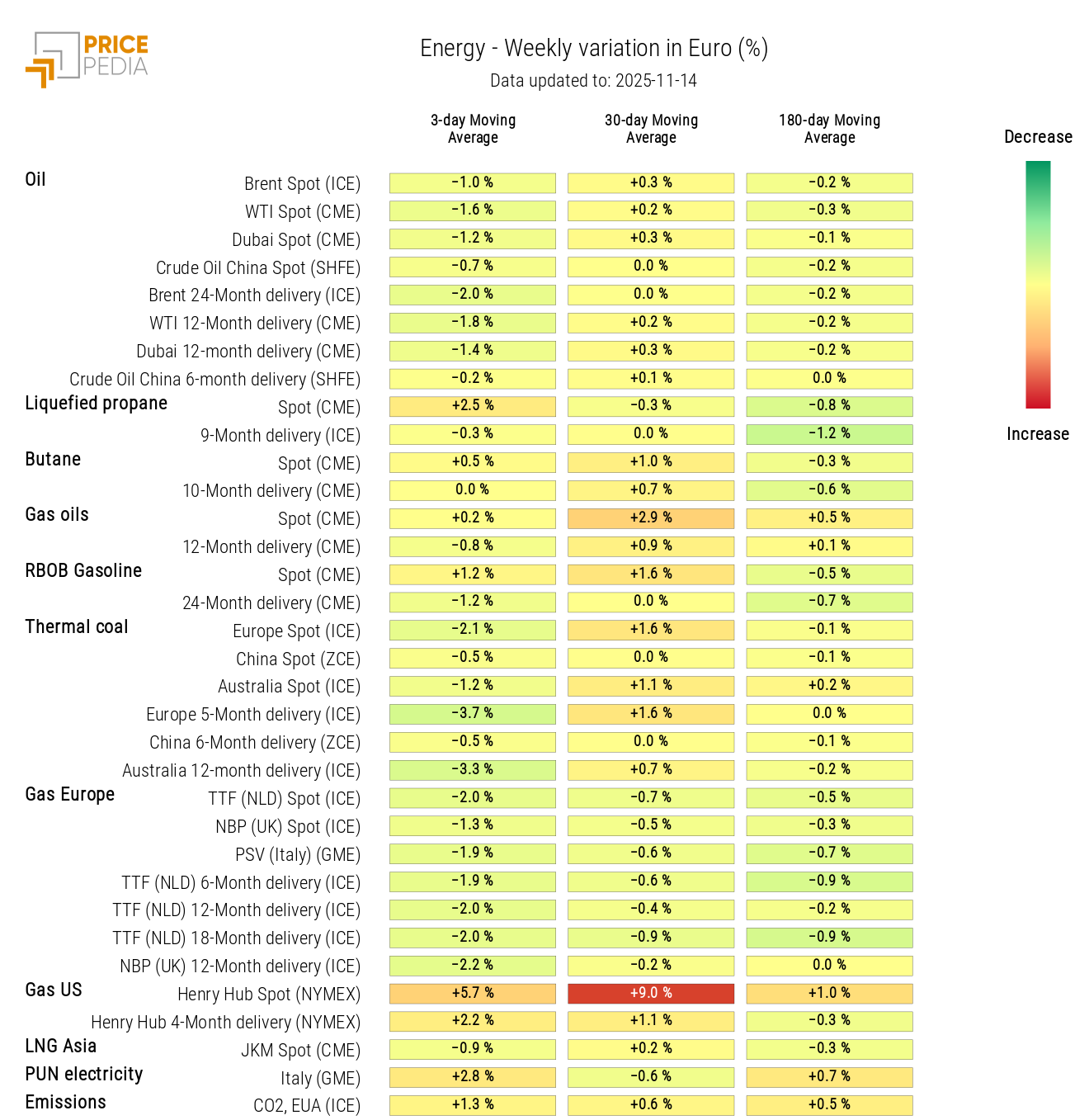

ENERGY

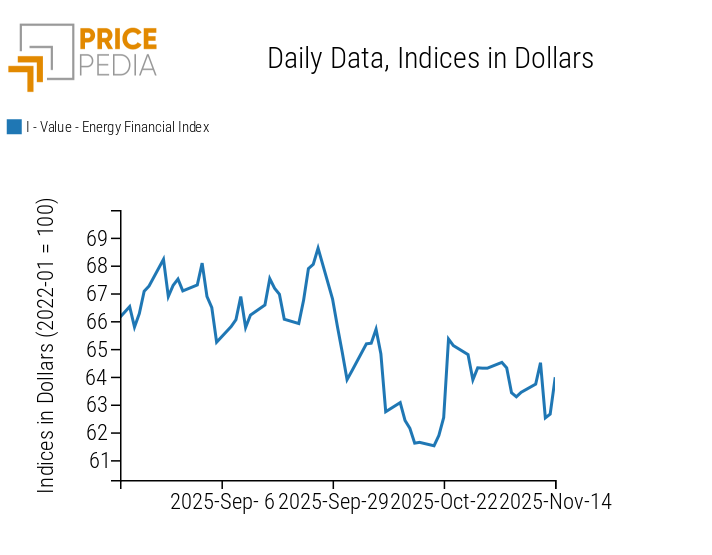

Net of fluctuations, the PricePedia financial index for energy remained stable on a weekly basis.

PricePedia Financial Index of Energy Prices in USD

Analysis of the energy heatmap shows a weekly decline in the 3-day moving average of euro-denominated oil and natural gas prices, with the exception of the U.S. Henry Hub.

HeatMap of Energy Prices in Euro

PRECIOUS METALS

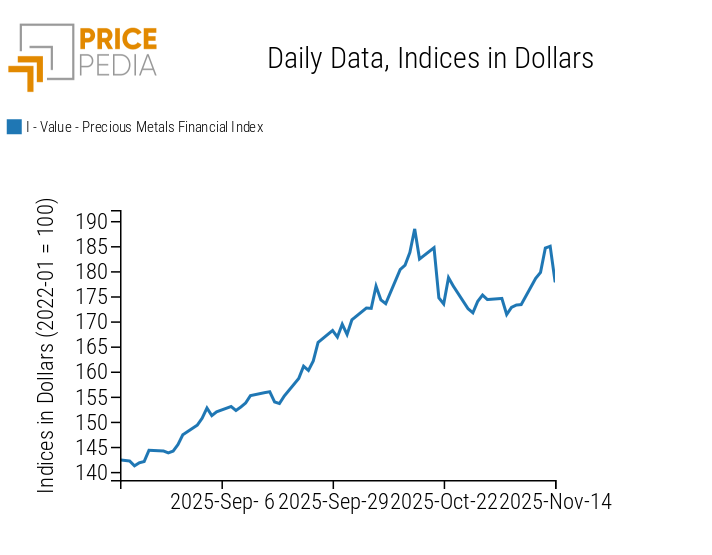

The financial index of precious metals shows a price recovery at the beginning of the week, followed by a renewed reversal.

PricePedia Financial Index of Precious Metals Prices in USD

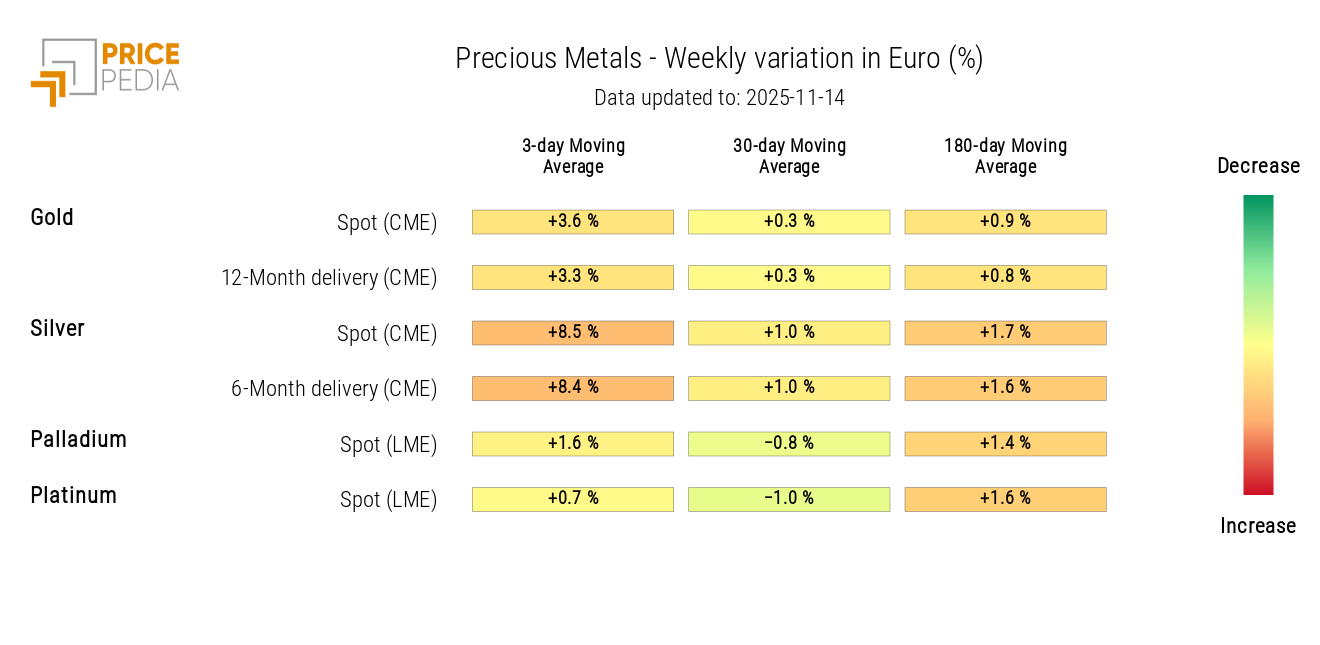

The precious metals heatmap indicates a general price increase, especially for silver.

HeatMap of Precious Metals Prices in Euro

FERROUS METALS

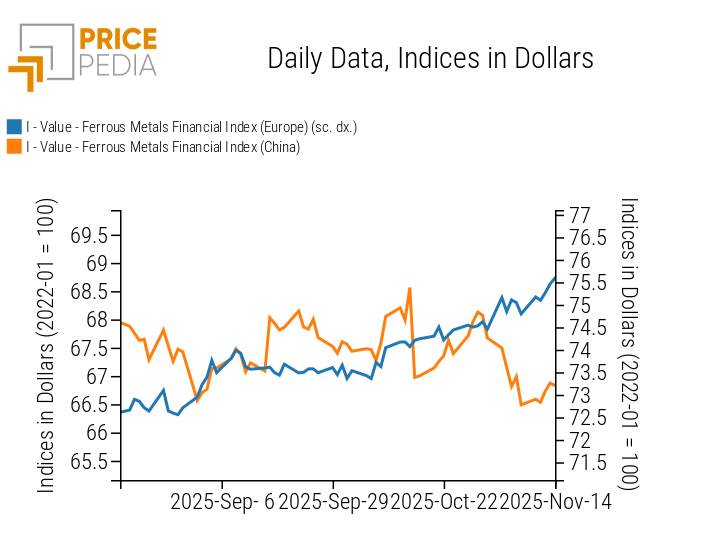

The two financial indices of ferrous metals show an increase in USD prices in both Europe and China.

PricePedia Financial Indices of Ferrous Metals Prices in USD

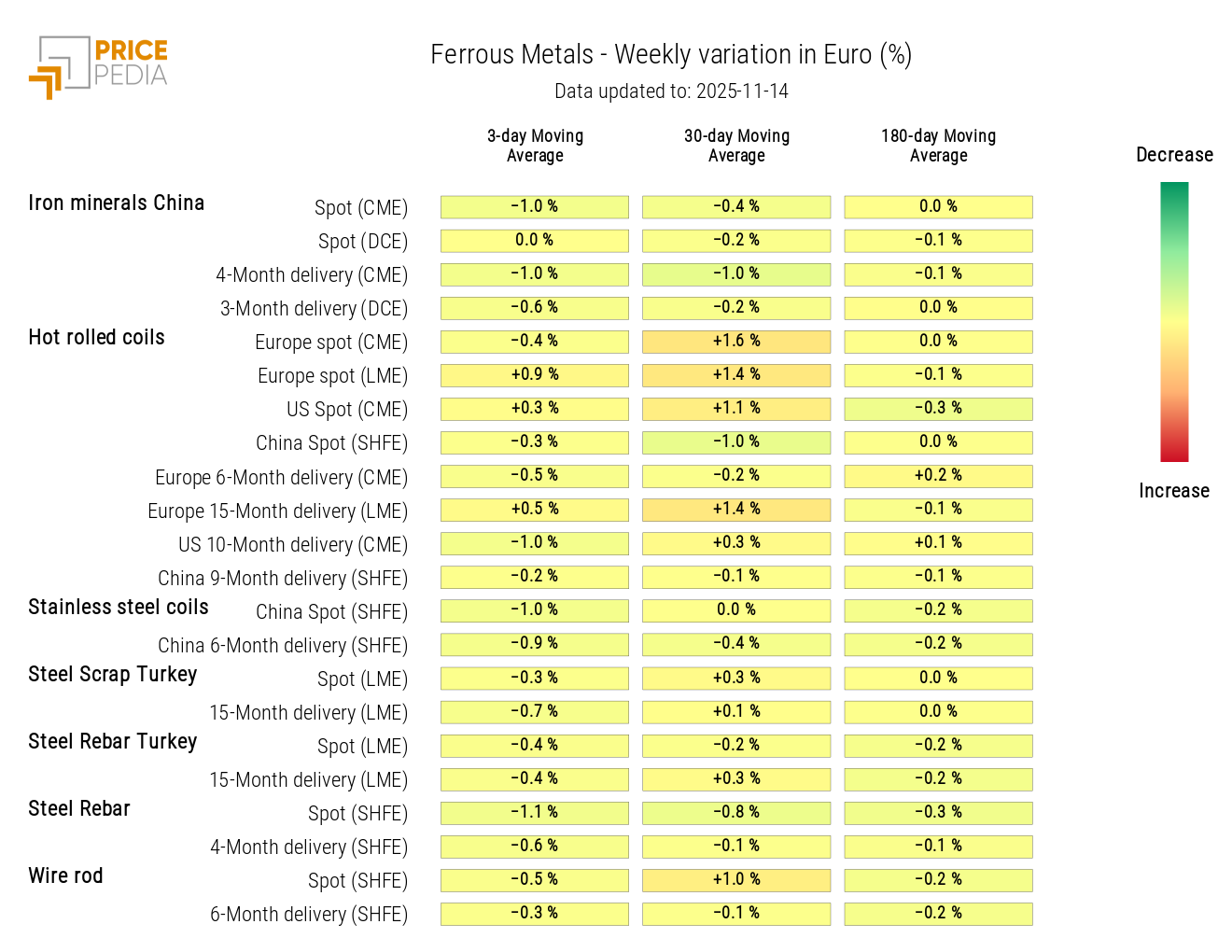

Analysis of the heatmap highlights relative stability in euro-denominated ferrous metal prices.

HeatMap of Ferrous Metal Prices in Euro

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

NON-FERROUS INDUSTRIAL METALS

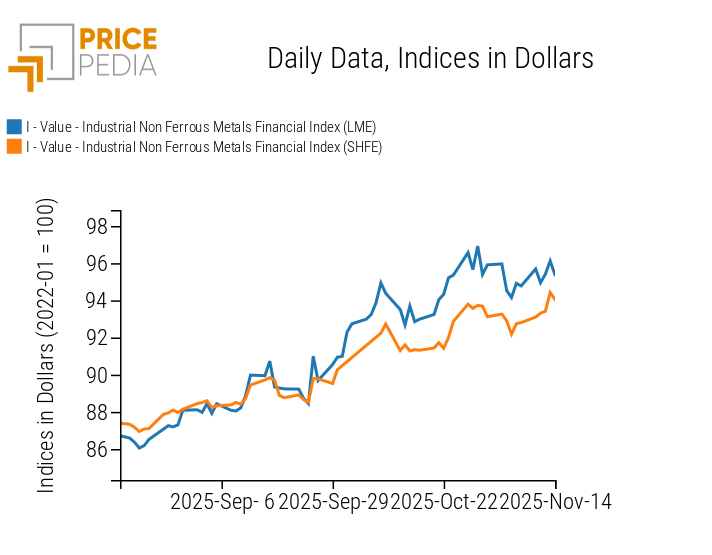

Both financial indices of non-ferrous metals show an increase in prices.

PricePedia Financial Indices of Industrial Non-Ferrous Metals Prices in USD

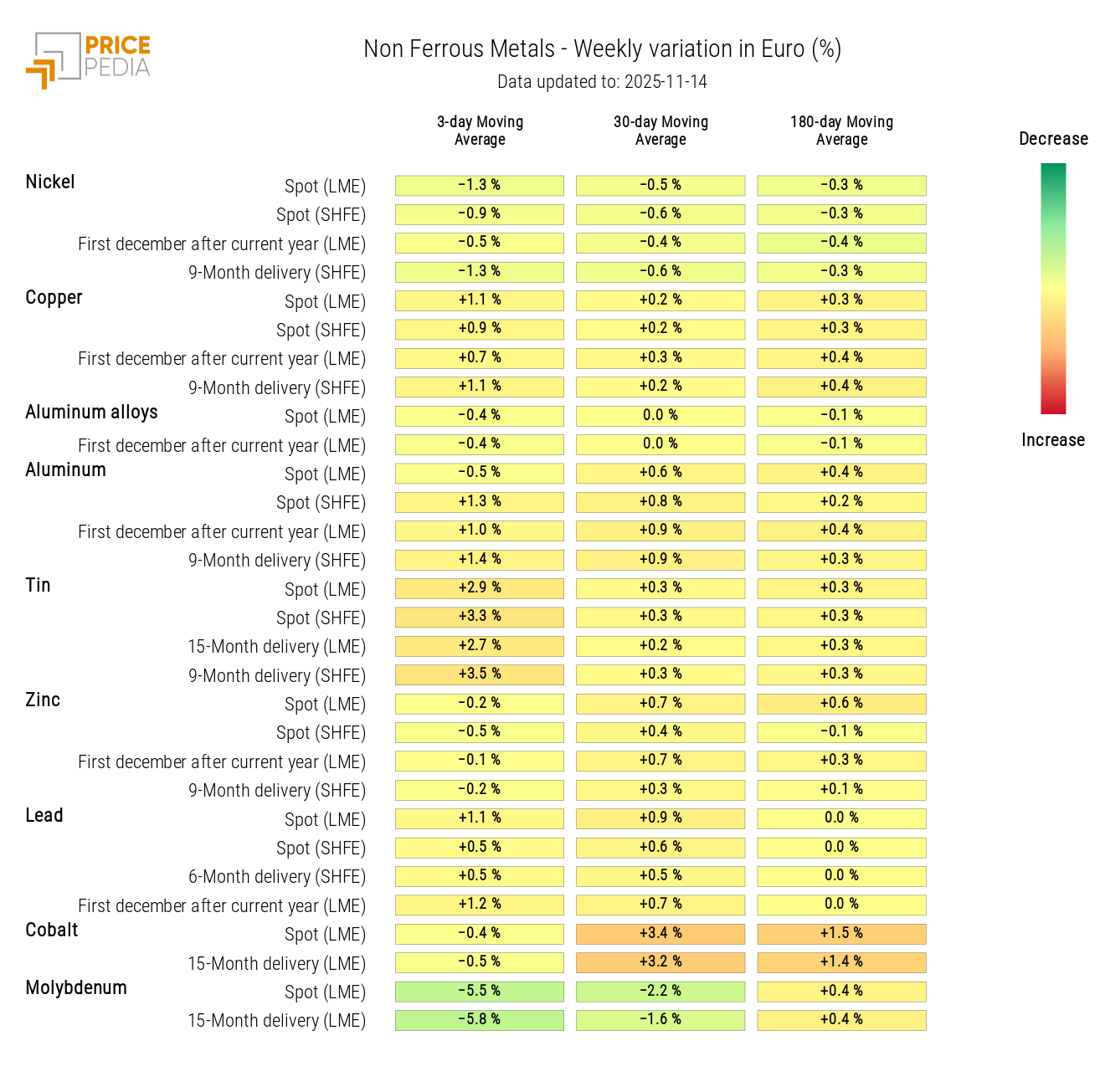

The non-ferrous metals heatmap indicates rising prices for tin, copper, and aluminum, alongside declines in nickel and especially molybdenum.

HeatMap of Non-Ferrous Metal Prices in Euro

FOOD

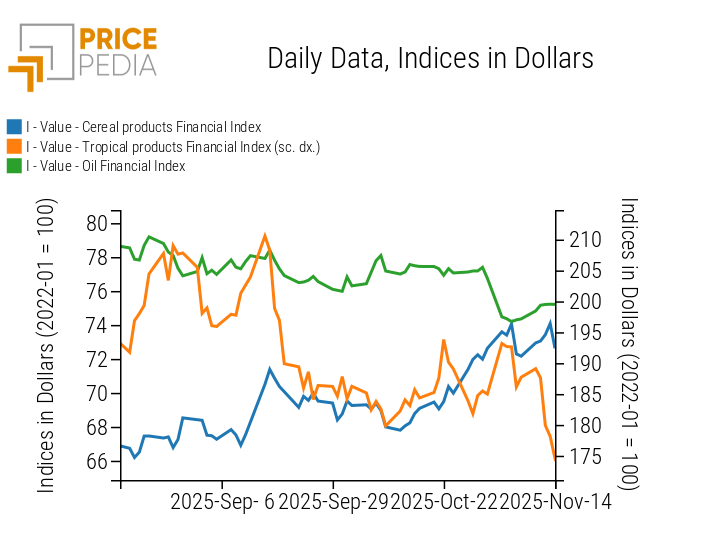

The financial index for tropical products shows a significant weekly correction, cereals display contrasting trends, and edible oils record a slight price increase.

PricePedia Financial Indices of Food Commodity Prices in USD

CEREALS

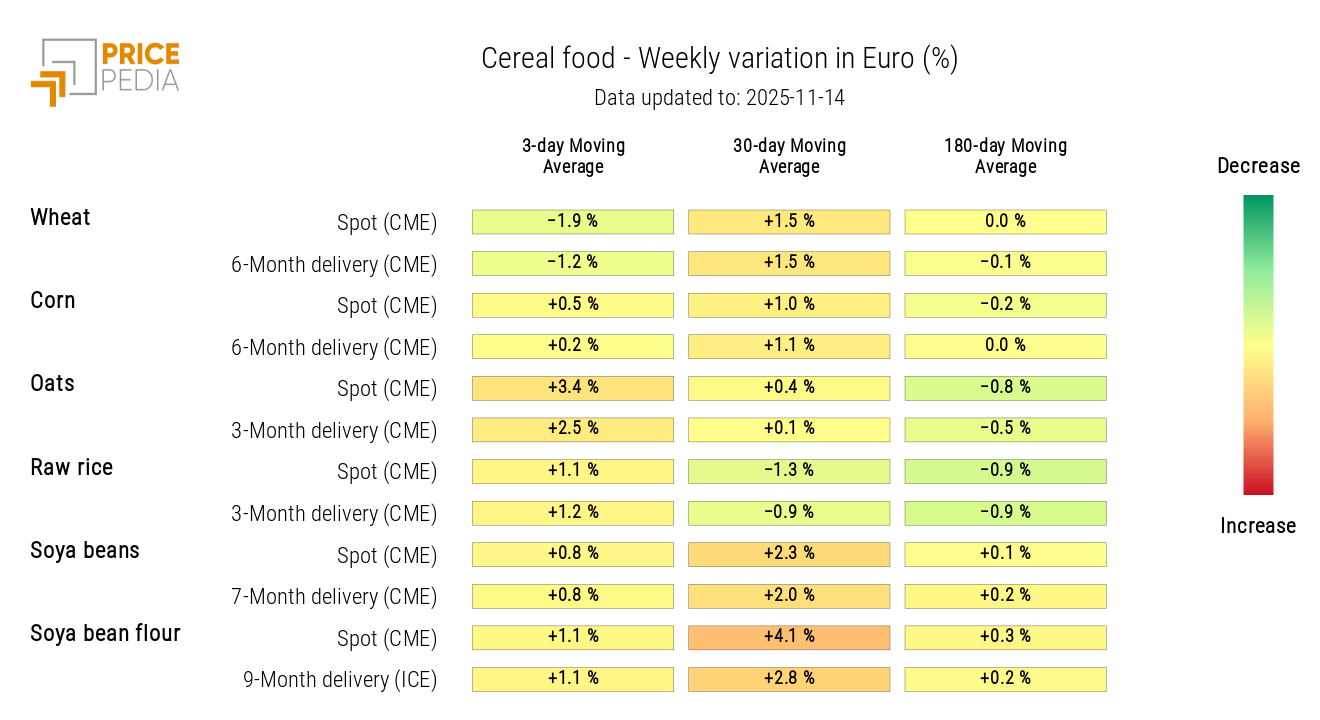

The cereals heatmap shows a weekly price increase for oats and a decline for wheat.

HeatMap of Cereal Prices in Euro

TROPICAL PRODUCTS

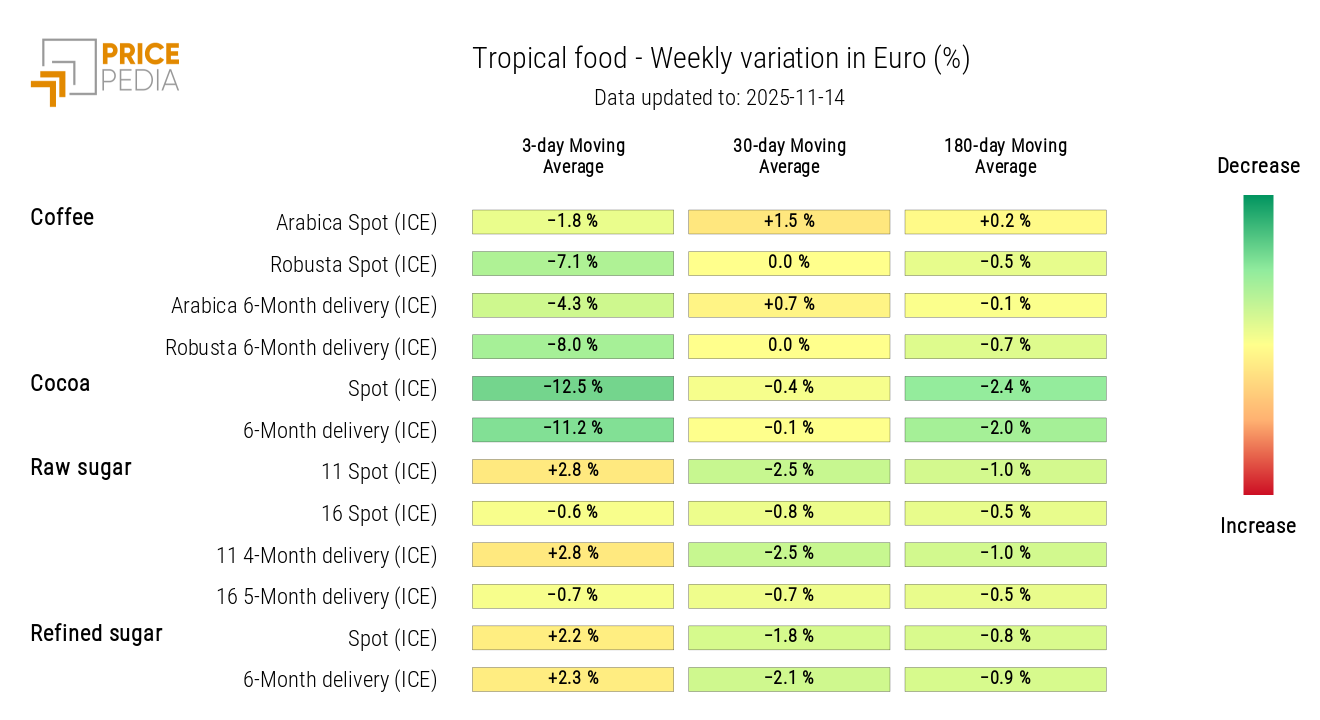

The tropical products heatmap shows a decline in arabica coffee prices and, especially, in cocoa.

HeatMap of Tropical Food Prices in Euro

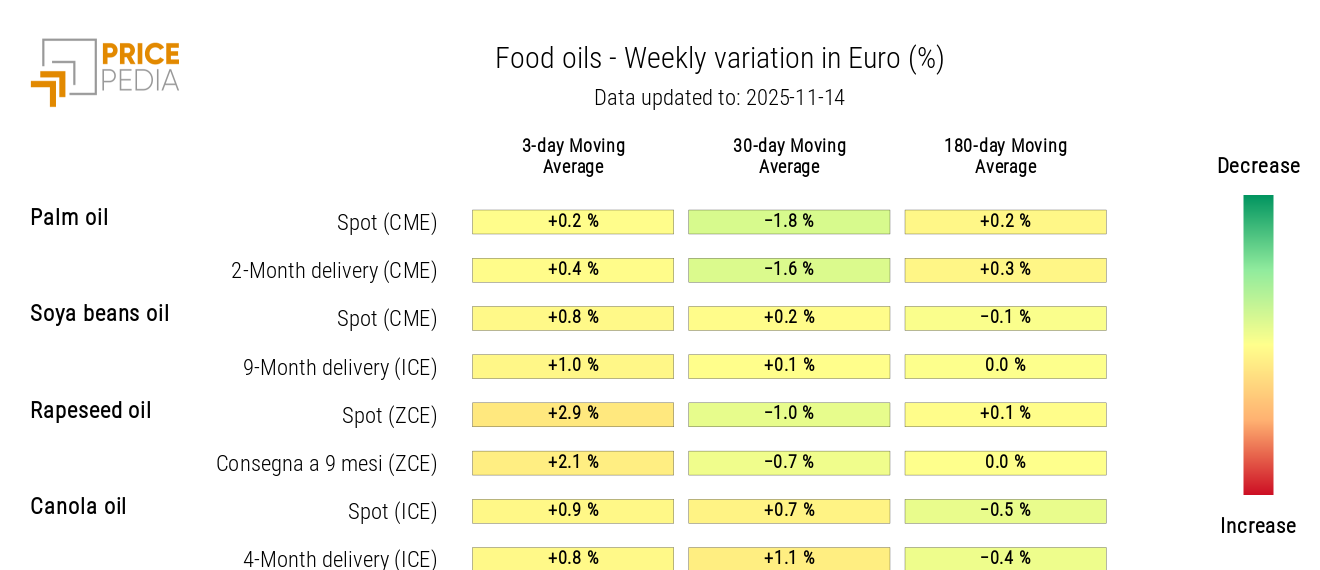

OILS

The edible oils heatmap highlights rising rapeseed oil prices.

HeatMap of Edible Oil Prices in Euro