Polymer Value Chain: China’s Growing Role

The Case of the Green Transformation of Epichlorohydrin

Published by Luigi Bidoia. .

Organic Chemicals Petrolchimica bioplastics basic thermoplastics technopolymers Chinese industryChina’s Gain in Global Trade Shares Along the Polymer Value Chain

The polymer value chain encompasses the set of industrial activities and chemical processes that, starting from fossil-based raw materials (such as oil and natural gas) or renewable sources (including biomass, vegetable oils, and cellulosic waste), lead to the production of polymers and finished polymeric materials – including thermoplastics, thermosets, and elastomers – used in a wide range of industrial and consumer applications.

This sector accounts for more than 80% of the entire chemical industry worldwide, representing its most extensive and strategic component.

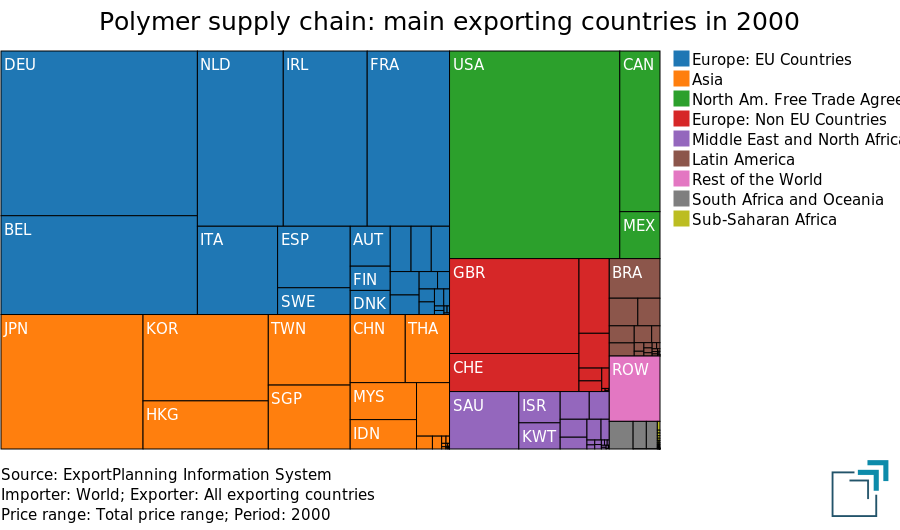

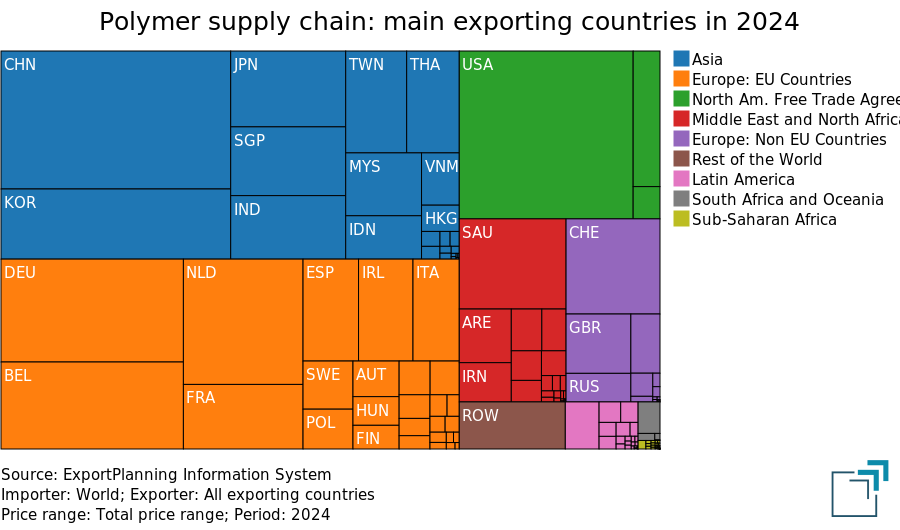

Over the course of this century, China has steadily advanced through the various stages of the value chain, becoming one of its key global players. The two treemaps below clearly illustrate this evolution, showing the distribution of the main exporting countries in the polymer value chain in 2000 and 2025. The expansion of China’s share highlights a long-term structural shift in the global trade balance of polymer products.

Polymer supply chain: main exporting countries

| Nel 2000 | Nel 2024 |

|

|

In 2000, China was one among many Asian countries beginning to enter the polymer industry, still far behind several European nations, the United States, and even other Asian economies. By 2024, however, China had become not only the leading Asian exporter but also the world’s largest exporter, having surpassed both the United States and Germany.

The success of China’s polymer industry has been the subject of extensive analysis. The main drivers are generally identified in the rapid expansion of China’s domestic chemical market and the comparatively less stringent environmental regulations faced by its chemical sector. In contrast, the chemical industries of developed countries – particularly within the European Union – appear to have focused on green innovation and technological upgrading, while delegating (or even relocating) less advanced production to China.

Although comprehensive data on the global evolution of innovation processes in the chemical industry are not available, it is useful to present a case study that challenges – if not entirely reverses – the common view of a highly innovative, green-oriented European industry versus a Chinese industry less attentive to sustainability.

The Case of Epichlorohydrin

Epichlorohydrin is a key chemical intermediate used in the production of specialty polymers, including epoxy resins.

Until the first decade of this century, epichlorohydrin was produced exclusively through the “chlorohydrin process,” which combines chlorine with propylene.

Over the past fifteen years, however, the increasing availability of glycerol from biodiesel production [1] has led to the development of an alternative, glycerol-based process, regarded as “green” and significantly more sustainable than the traditional propylene-based route.

Since the customs code CN291030.00 covers all epichlorohydrin regardless of the production process, it is not possible to directly measure the share produced via each route. However, this transformation can be inferred indirectly by examining the correlation between the price of epichlorohydrin and the prices of its two main feedstocks: propylene and glycerol. When partial correlations – that is, correlations adjusted for indirect effects – are calculated between European prices of epichlorohydrin, glycerol, and propylene before and after 2015, a clear structural change emerges over the past decade.

Partial correlations: Epichlorohydrin, Glycerol, Propylene

| January 2000 - December 2014 | January 2015 - October 2025 |

|

|

During the first fifteen years of this century, the price of epichlorohydrin was strongly correlated with that of propylene, indicating a clear cost pass-through effect between the two variables.

Conversely, over the same period, there was no significant correlation between the prices of epichlorohydrin and glycerol.

In the last decade, however, the situation has almost completely reversed: a strong correlation has emerged between the prices of epichlorohydrin and glycerol, while the correlation with propylene has nearly disappeared.

The growing demand for “green” products in developed countries, combined with the greater availability of glycerol in Asian markets, created the conditions for the rapid expansion of China’s glycerol-based epichlorohydrin production over the past ten years.

This expansion received a decisive boost in 2017, when the Chinese government ordered the closure of several epichlorohydrin plants operating via the chlorohydrin process, in order to reduce uncontrolled discharges of chlorinated wastewater.

The evidence of this success is reflected in the speed with which China – and Asia more broadly – climbed the global ranking of epichlorohydrin exporters.

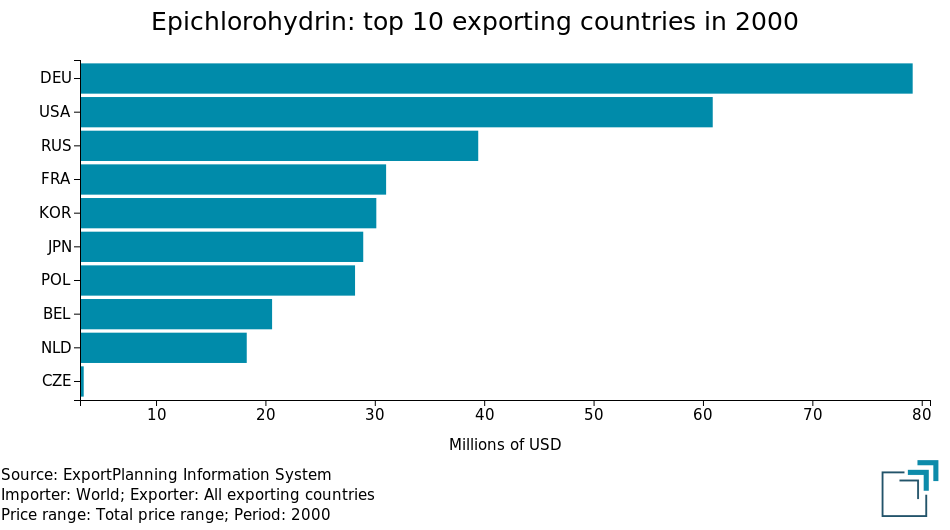

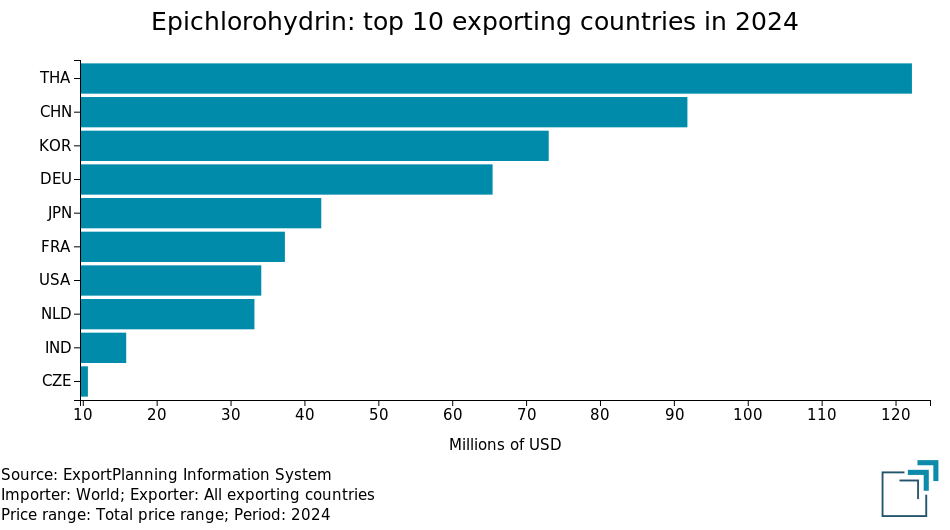

As shown by the two rankings below, which list the top ten exporting countries, in 2000 China did not yet appear among the leaders, with South Korea being the only Asian country in fifth place.

By 2024, the picture had completely changed: the top three positions were occupied by Asian countries, with China ranking second.

Epichlorohydrin: top 10 exporting countries

| In 2000 | In 2024 |

|

|

Conclusions

One of the key drivers of the environmental transition in the chemical industry is the increasing use of natural raw materials for polymer production.

Differences in national innovation systems can lead to substantial shifts in the competitive positioning of their chemical industries.

A notable example is the growing use of glycerol – a byproduct of biodiesel production – for the synthesis of epichlorohydrin.

This innovation, introduced and supported in China also through administrative measures, has enabled the Chinese chemical industry to climb rapidly in the global ranking of epichlorohydrin exporters, reaching second place behind Thailand and surpassing several countries that once led the market when production was based on propylene.

[1] Glycerol is a by-product of biodiesel production from vegetable oils or animal fats.