Cocoa prices: moving toward normalization?

What are the prospects for the next two years?

Published by Pasquale Marzano. .

Food Forecast Cocoa Price Drivers

Starting from the second half of 2023, the cocoa market experienced a sharp price surge, reaching new record highs in January 2025, exceeding 10000 US Dollars (USD) per ton.

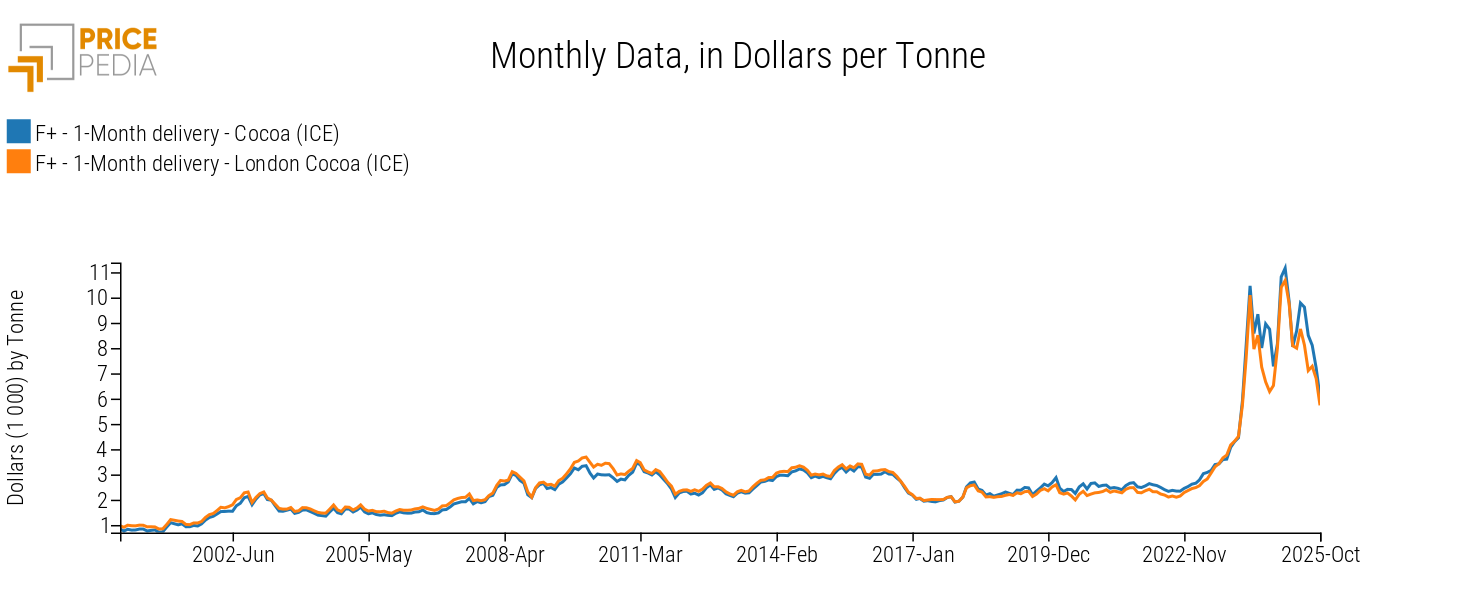

This trend is illustrated in the graph below, which shows cocoa futures prices quoted on the Intercontinental Exchange (ICE) for delivery in New York and London, expressed in USD per ton.

Cocoa Futures Prices, in USD per Ton

The chart shows how the past two years have been exceptional, with price levels far above the average of the last two decades. As reported in the article

Cocoa crisis and financial price spreads, this dynamic was driven by a severe supply deficit caused by poor harvests in Ghana and Côte d'Ivoire, which together account for around 60% of global cocoa production.

After the first peak in April 2024, futures prices showed high volatility: an initial downward phase - more pronounced for London-delivered cocoa - was followed by a new rally, reaching another record high in January 2025 due to harvests falling short of expectations under unfavorable weather conditions.

After reaching record highs at the beginning of the year, the improvement in harvest prospects for the 2025-2026 season, particularly in Côte d'Ivoire, led to a new price decline.

According to the International Cocoa Organization (ICCO), the weakening of global demand also contributed to the downward trend observed in the second half of 2025.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

What are the price outlooks for the next two years?

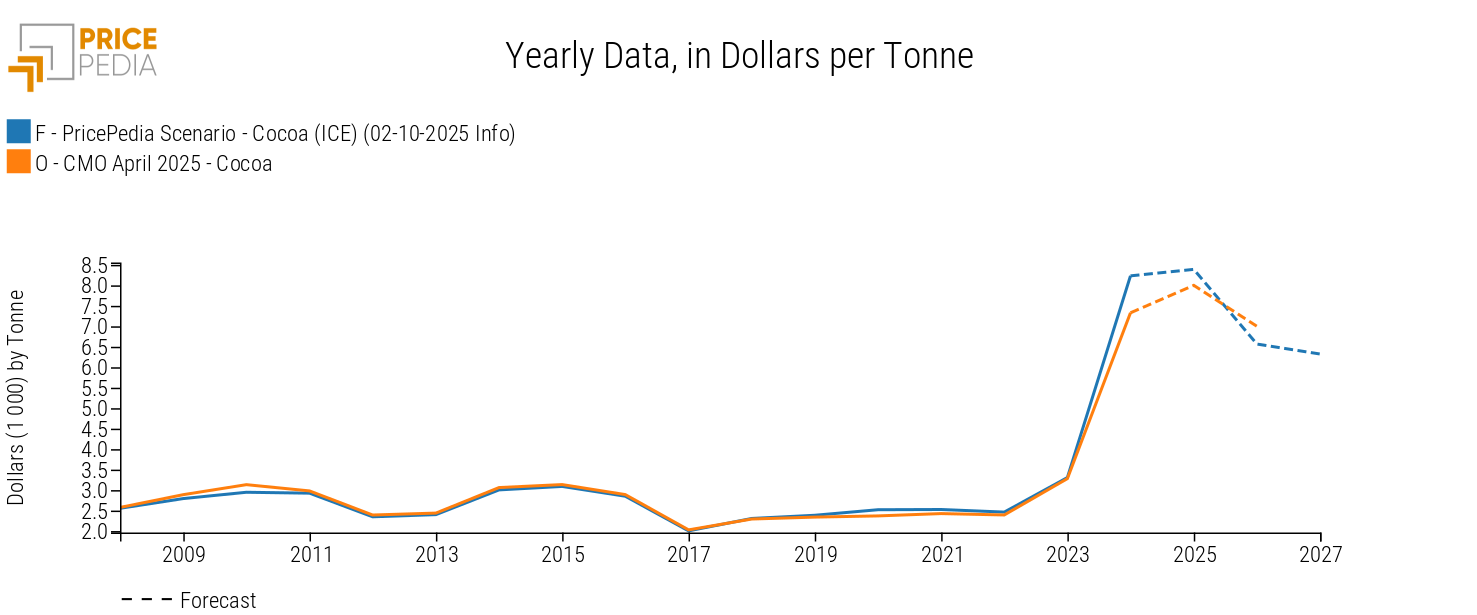

To understand whether the recent price decline represents a temporary correction or the beginning of a more stable phase, it is useful to compare forecasts from different sources:

- the PricePedia Scenario updated as of October 2, 2025, referring to the futures price for delivery on the New York Exchange;

- the World Bank forecast, included in the April 2025 Commodity Outlook, referring to the ICCO price representative of the London market.

The graph below shows the comparison of prices in USD per ton.

Cocoa: Forecast Comparison (USD per Ton)

Although both forecasts show higher average prices in 2025 compared to 2024, in 2026 cocoa prices for delivery in New York and London are expected to fall by -21% and -12.5% respectively. In 2027, the downward trend is expected to continue, with a further decrease of around -4% compared to the previous year.

The improvement in global supply, supported by rising production prospects in Ecuador and more favorable weather conditions in West Africa, is expected to lead to a gradual market rebalancing.

This trend is more pronounced in the PricePedia Scenario, which incorporates the most recent market information. It is likely that the World Bank will also reflect these developments in the October 2025 update of its Commodity Outlook.

However, what emerges clearly from both scenarios is that cocoa prices are expected to remain structurally above their long-term historical average.

Conclusions

After two years of exceptional tension in the cocoa markets, the outlook now points toward a gradual normalization, driven by improved supply and the resulting downward pressure on financial prices, which in turn influence physical market prices[1] along the entire value chain, from cocoa beans to derivatives such as cocoa paste and cocoa powder. Nevertheless, despite the expected price reduction, it is highly likely that industrial users will continue to face price levels in the next two years that remain above the historical averages of the past twenty-five years.

1. The relationship between financial and customs prices, which represent physical markets, was discussed in the section Relationship between financial and physical markets of the article Cocoa crisis and financial price spreads.