Metallic silicon: a critical and strategic commodity for the EU

China's leadership in the metallic silicon market

Published by Luca Sazzini. .

Silicon Critical raw materialsMetallic silicon is a shiny, grayish material obtained through high-temperature metallurgical processes. The term “metallic” refers both to its lustrous appearance and to its production method, although it is actually a semimetal (or metalloid) rather than a true metal.

Two main types of metallic silicon can be distinguished:

- Metallurgical-grade silicon (also called metallurgical silicon), with a purity of about 99%, used in the production of aluminum alloys and chemical applications;

- Polysilicon (or polycrystalline silicon), characterized by much higher purities (starting from 99.99% but, in some applications, exceeding 99.999999999%), obtained through additional refining processes. This material is essential for the production of photovoltaic cells and electronic microchips, key components of the energy and digital transitions.

The production of metallic silicon starts from quartz, the second most abundant mineral in the Earth’s crust. However, only a few deposits have the purity, chemical composition, and volume required to obtain high-quality silicon.

In Europe, there are both suitable mineral resources and advanced industrial facilities with established technologies, which would allow producers to quickly increase production capacity, even for higher purity grades. The real European constraint is not the availability of resources, but the very high energy cost of the metallurgical process, which has a decisive impact on production competitiveness. For this reason, it is often more convenient to import metallic silicon from non-EU countries, where energy costs are lower, making the European Union dependent on foreign supplies to meet its internal demand.

The high production cost, combined with the strategic role of metallic silicon in many industrial sectors, has led the European Union to classify it as both a critical and strategic raw material, despite the presence of suitable mineral resources within Europe.

Commodity and Trade Flow Analysis of Metallic Silicon

In 2024, the top three producers of metallic silicon were China, Brazil, and Norway.

Global production is highly concentrated in China, which holds a dominant position in both the metallic silicon and ferrosilicon supply chains. In 2024, China accounted for about 85% of global metallic silicon production and 68% of ferrosilicon production. China’s leadership is also evident in global exports of metallic silicon, as it is the world’s largest supplier.

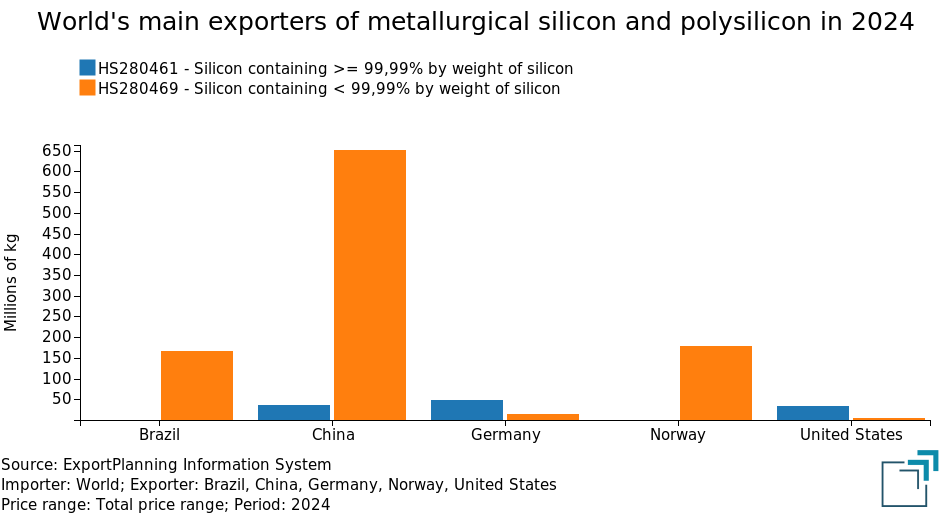

The chart below shows the top three global exporters of metallurgical silicon and polysilicon in 2024, expressed in quantity terms.

In 2024, the top three exporters of metallurgical silicon also corresponded to the top three producers of metallic silicon: China, Brazil, and Norway. Together, they exported about 1 million tons—over 60% of global metallurgical silicon exports—with China alone accounting for 40% of the world supply.

Among these three countries, only China plays a key role in the polysilicon supply chain, ranking as the second-largest exporter after Germany. The latter, the fifth-largest global producer of metallic silicon, is highly specialized in polysilicon and in 2024 exported nearly 50 thousand tons, or about 35% of global supply.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Main EU Suppliers of Metallic Silicon

Within Europe, the top three producers of metallic silicon are France, Germany, and Spain. Among them, France holds the lead: it is the fourth-largest global producer of metallic silicon and the fourth-largest exporter of metallurgical silicon, excluding the Netherlands, which mainly operate as an intra-EU re-export hub and are, in fact, a net importer.

In the polysilicon supply chain, leadership instead belongs to Germany, the world’s leading supplier. Thanks to this role, the European Union is a net exporter of polysilicon, while remaining a net importer of metallurgical silicon, which represents the predominant share of global metallic silicon trade.

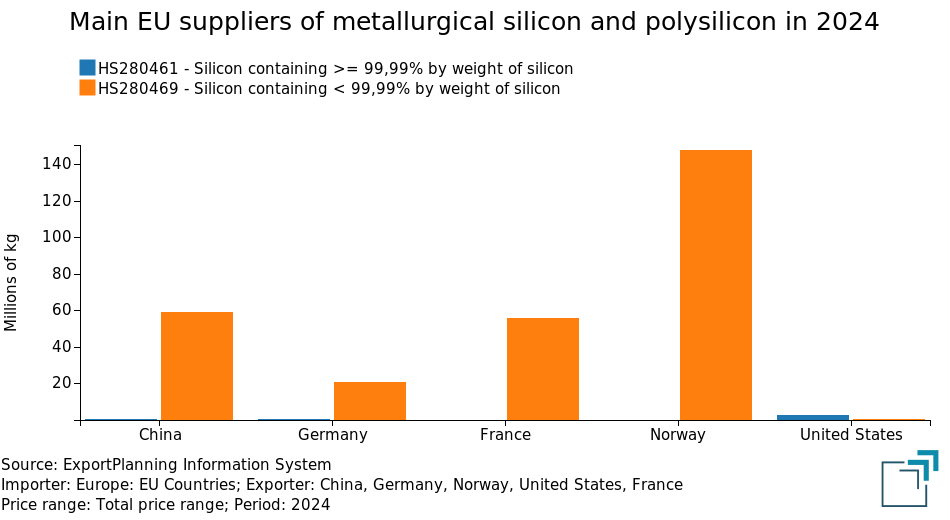

The chart below shows the top three European suppliers of metallurgical silicon and polysilicon in 2024, expressed in quantity terms. The Netherlands are excluded from the chart since, although they are the second-largest European exporter, they mainly act as a re-export hub within the EU market—importing metallurgical silicon from non-EU countries and redistributing it within Europe.

The chart shows the near absence of polysilicon imports into the EU. Interestingly, the main EU supplier of polysilicon is the United States rather than Germany, even though Germany is the world’s largest producer. Germany, despite its large production capacity, exports almost all its output to non-EU markets, limiting intra-European flows.

China remains the only country capable of supplying both types of metallic silicon. However, for metallurgical silicon, Norway is the leading supplier to the EU, thanks to its geographical proximity and long-standing trade relationships.

Analysis of EU Prices of Metallurgical Silicon

At the customs level, metallurgical silicon prices are statistically more robust and comparable than those of polysilicon, which vary widely depending on purity levels. For this reason, a price analysis based on metallurgical silicon is proposed, comparing customs prices recorded in the European Union, the United States, and China.

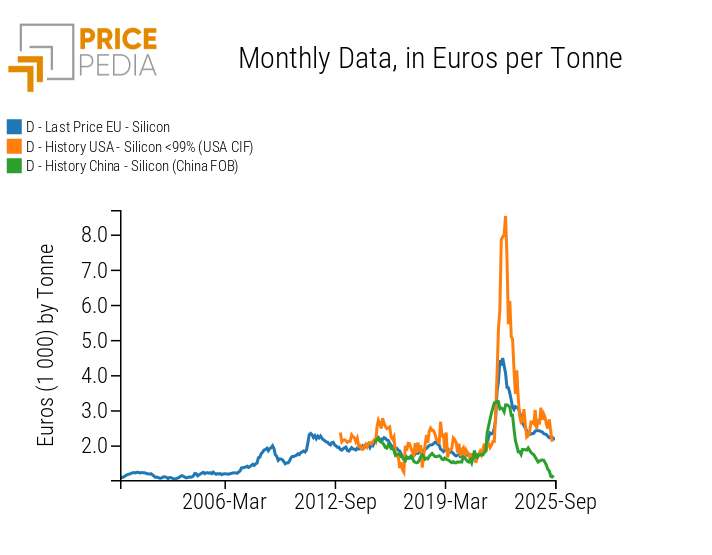

The chart below shows a comparison of the three customs prices of metallurgical silicon, expressed in euros per ton.

Comparison of customs prices of metallurgical silicon, expressed in euros per ton

The chart highlights a common trend among the three regional prices of metallurgical silicon, though with diverging price levels starting from mid-2022. At the 2022 peak, Chinese prices were less than half those of the United States and over €1,000/ton lower than European prices. Subsequently, Chinese production increased significantly, and domestic prices kept falling, now standing at just over half the levels recorded in the United States and the European Union. China’s leadership in the metallurgical silicon market has caused its price dynamics to influence other regional markets, which have tended to follow its trend with a certain time lag.

Summary

Metallic silicon is a critical and strategic commodity for the European Union, both for its use in key industries and for the high energy cost required for its production. There are two main types of metallic silicon: metallurgical-grade silicon, with a purity level of about 99%, and polysilicon, with a higher purity starting from 99.99% but reaching levels above 99.999999999%.

From a trade perspective, the EU depends on Norwegian and Chinese supplies of metallurgical silicon, while it is self-sufficient in polysilicon production—a sector in which it is a net exporter, thanks in particular to Germany’s contribution.

The analysis of metallurgical silicon prices shows that the international benchmark is represented by Chinese prices, which in recent periods have exerted downward pressure on European and U.S. markets.