Molybdenum: a potentially critical commodity for the EU

Analysis of the economic importance and concentration of molybdenum production and suppliers

Published by Luca Sazzini. .

Silicon Critical raw materialsMolybdenum is a critical metal for modern industry, thanks to its ability to enhance the mechanical strength, hardness, and resistance to corrosion and high temperatures of steels and alloys. Most of the global demand comes from the steel industry: construction steels account for the largest share, followed by stainless steels, tool steels, and foundry applications.

Outside the steel sector, molybdenum is used in the chemical industry, mainly as a catalyst in oil refineries and in the plastics industry, and in high-performance nickel superalloys, where it further increases resistance to corrosion and high temperatures.

Global demand for molybdenum is expected to grow, driven in particular by the increased use of molybdenum steel alloys in engines and applications related to renewable energy.

Global molybdenum supply is also expected to grow, although for reasons different from demand, as it largely depends on copper mining. Approximately 60% of world production comes from copper-molybdenum deposits, where molybdenum is recovered as a by-product of copper processing.

In the European Union, there is no molybdenum mining, so the entire demand must be met through imports. The high economic importance of molybdenum, combined with complete dependence on foreign supplies, has prompted the EU to closely monitor the molybdenum market, considering the possibility that it may in the future be included in the list of critical and/or strategic raw materials.[1]

Commodity Analysis and Trade Flows of Molybdenum

The main global producers of molybdenum minerals are China, Chile, the United States, and Peru. In 2024, Peru surpassed Chile and the United States, becoming the second-largest producer of molybdenum minerals with a production of 41 thousand tons, still significantly lower than China, which produced 110 thousand tons. These four countries, together with Mexico, accounted for over 90% of global molybdenum mineral production in 2024.

Among these five producing countries, only China and the United States extract molybdenum from primary molybdenum mines, while in all other countries production comes exclusively as a by-product of copper mining.[2]

From a commercial perspective, molybdenum is mainly traded in the form of minerals, classified as roasted and unroasted. Over 95% of unroasted minerals and concentrates are subsequently processed into roasted concentrate to produce higher value-added products, such as ferromolybdenum, which is the third most traded type.

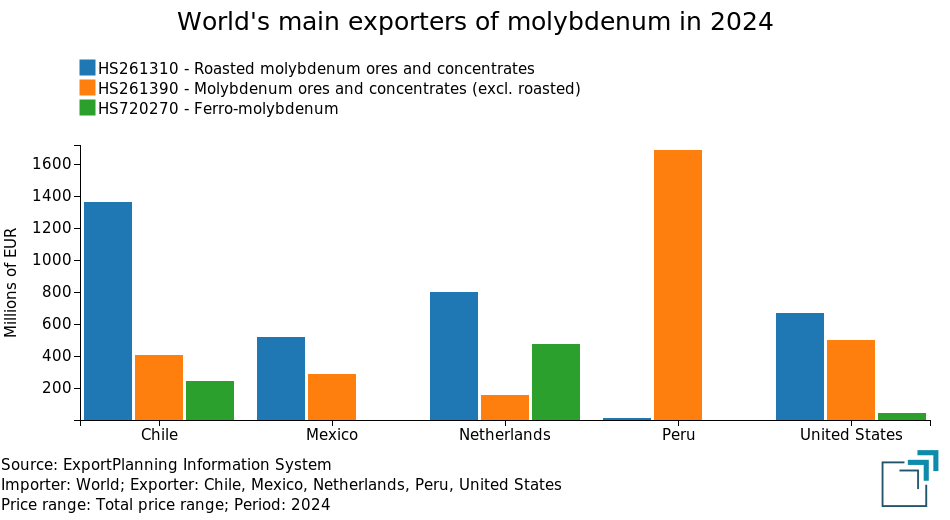

The chart below shows the main global exporters of molybdenum minerals, both roasted and unroasted, and ferromolybdenum in 2024, expressed in euros at current prices.

Analysis of the chart shows that in 2024, the main global exporters of molybdenum largely coincide with the main producing countries, except for the Netherlands, which replaces China. Both China and the Netherlands are net importers of molybdenum, but for different purposes: the Netherlands imports molybdenum to re-export it within the European market, while China imports it mainly to meet domestic demand. For this reason, although China is the world's largest producer of molybdenum minerals, it ranks “only” seventh among the largest global exporters.

Another aspect highlighted by the chart is the strong geographical specialization of molybdenum exports. In particular, Peru dominates in unroasted mineral exports, while Chile is the leader in roasted mineral exports.

Main European Molybdenum Suppliers

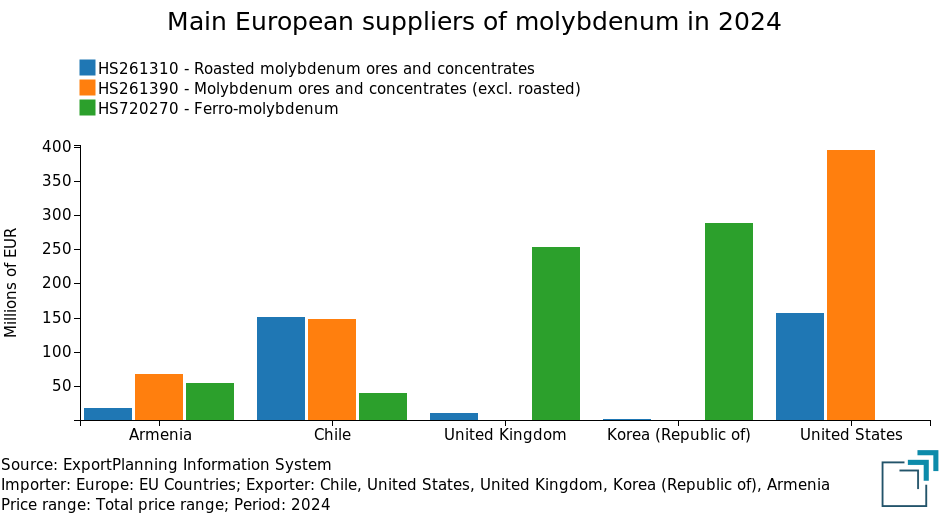

The following chart shows the main European exporters of molybdenum minerals and ferromolybdenum in 2024, expressed in euros at current prices. The Netherlands and Belgium were excluded as exporters because both act as intra-EU re-export hubs, importing molybdenum from external suppliers and then re-exporting it within the European market.

Analysis of the chart again shows a strong specialization based on the type of molybdenum exported. In particular, EU supplies of unroasted molybdenum minerals are heavily dependent on exports from the United States, while ferromolybdenum mainly comes from the United Kingdom and South Korea.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Molybdenum Price Analysis

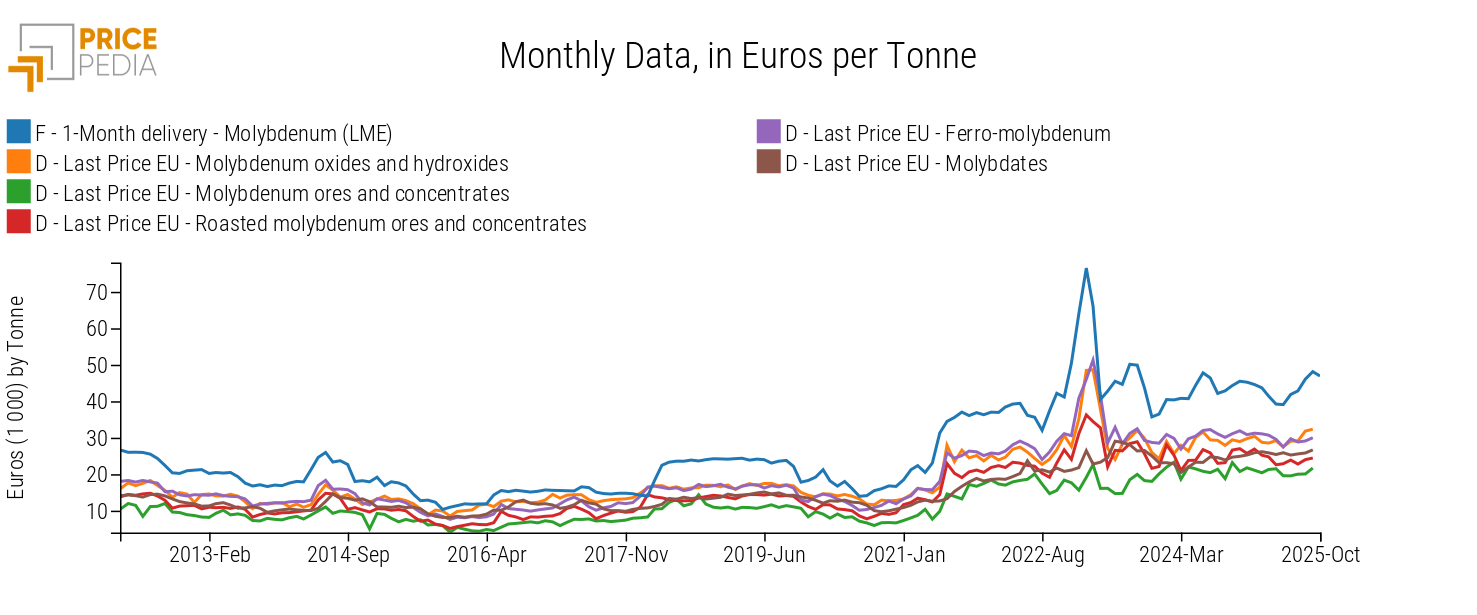

The analysis in the article: Update of molybdenum prices to July 2024 shows that prices of different types of molybdenum are highly interconnected globally. The markets in the European Union, the United States, and China show very similar trends in both price levels and dynamics. This common trend among major global regions is driven by the LME financial benchmark for molybdenum oxide, which influences not only oxide prices but also other types of commercialized molybdenum.

The chart below shows the LME molybdenum oxide price dynamics compared with European prices of the various types of commercialized molybdenum.

Analysis of European and Financial Molybdenum Prices, expressed in euros/tonne

Analysis of the chart confirms the close relationship between the different molybdenum price dynamics, which tend to be anticipated by the financial market of molybdenum oxides traded on the London Metal Exchange (LME). Correlation coefficients between the various types of molybdenum and the LME financial price of oxides are above 0.9 out of a maximum of 1, highlighting the strong link between molybdenum prices.

Summary

Molybdenum is a commodity to monitor for the European Union, both for its economic importance in the steel sector and for the lack of internal production.

90% of global production is concentrated in the top five producing countries, which are also the main exporters, except for China, which, despite being the largest producer, ranks only seventh among exporters because most of the molybdenum produced is consumed domestically.

The EU mainly imports molybdenum through the Netherlands, which serves as a re-export hub to the internal market. Excluding the Netherlands and Belgium, the main EU suppliers are: the United States, Chile, South Korea, the United Kingdom, and Armenia. In particular, the United States mainly supplies unroasted molybdenum minerals, while the United Kingdom and South Korea are the main suppliers of ferromolybdenum.

Price analysis shows that physical molybdenum prices follow the financial price of oxides on the LME, which influences not only oxide prices but also other types of commercialized molybdenum.

[1] The lists of critical and strategic raw materials are both reported in the EU Regulation 1252.

[2] Source: U.S. Geological Survey (USGS): Mineral Commodity Summaries 2025.