Monthly commodity prices update for September 2025

Stagnant demand and pressure from Chinese prices drag down European commodity prices

Published by Pasquale Marzano. .

EU Customs Global Economic TrendsThe September 2025 update of PricePedia's monthly commodity prices has been published. From a short-term perspective, euro-denominated commodity prices deviated only slightly from August 2025 levels, recording a percentage change of -0.34%. However, the downward trend that has been characterizing European quotations for more than twenty-four months is evident when considering the year-on-year change in September 2025 compared to the same month last year, equal to -6.2%.

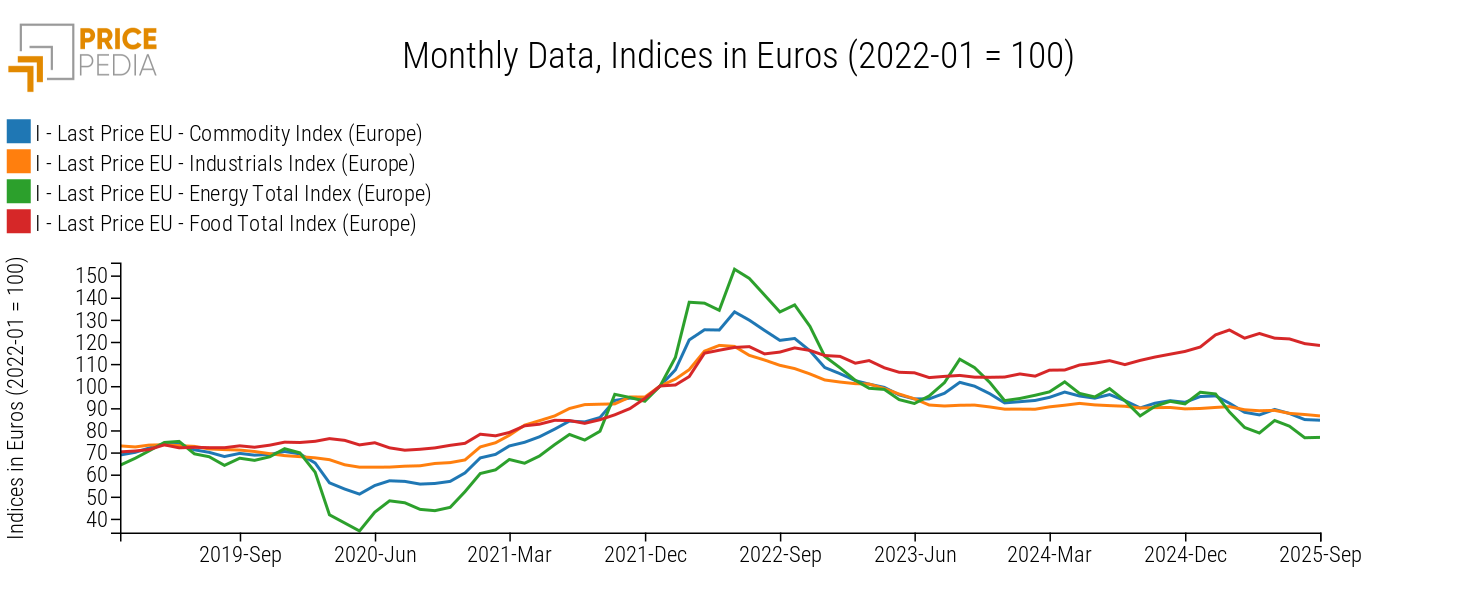

The following chart shows the trend in euro prices of raw materials in the European market for the main PricePedia aggregates: Commodity[1], Industrials[2], Energy, and Food, with January 2022 as the base 100 for each.

Among the main aggregates, over the past twelve months only food commodity prices have recorded year-on-year growth of +6.1%, mainly due to the performance of Tropical products, although more recently they have started to move back toward lower price levels compared to their recent peaks.

As for the other aggregates, energy commodities recorded a particularly sharp decline of -11.2% compared to September 2024, continuing along the downward path from the elevated price levels of 2021-2022.

Industrial commodities also recorded a year-on-year decrease in September 2025, equal to -4%, affected by the persistent weakness in European manufacturing since mid-2022 and, consequently, by lower raw material demand.

Another factor exerting downward pressure on European industrial commodity prices is linked to the dynamics of Chinese commodity prices. Considering Chinese FOB prices, which represent the price at which Chinese firms sell on international markets, in August 2025, euro-denominated prices recorded a particularly steep year-on-year drop of -11%, due partly to lower prices in yuan and partly to the appreciation of the euro against the Chinese currency.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Industrial raw material prices in September 2025

The following chart shows the year-on-year percentage changes in euro-denominated prices for the categories belonging to the industrial commodity aggregate in September 2025.

Chart 2: September 2025, % change in euro compared to September 2024

Source: PricePedia

In year-on-year terms, the sharpest declines were recorded for commodities most influenced by Chinese market dynamics: Textile Fibres and Ferrous Metals fell by almost -8%, while Organic Chemicals and Plastics and Elastomers decreased by nearly -7%.

The decline in euro prices was slightly less pronounced for the Wood and Paper and Pharmaceutical Chemicals sectors, down -2.8% and -1.5%, respectively.

As for Non-Ferrous Metals, euro-denominated prices were, on average, unchanged compared to September 2024.

By contrast, moderate year-on-year growth was observed in Specialty Chemicals and Inorganic Chemicals, up +1.6% and +3%, respectively. In both cases, European prices appear particularly sticky and less responsive to the downward pressures observed in Chinese markets.

1. The PricePedia Commodity index is the aggregation of Industrials, Food and Energy indices.

2. The PricePedia Industrials index is the aggregation of indices related to the following categories: Ferrous Metals, Non-Ferrous Metals, Wood and Paper, Pharmaceutical Chemicals, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers, and Textile Fibers.