Furanic Compounds: China at the Helm of Global Markets

A quantitative analysis of the link between Chinese and European prices, from furanic commodities to sucralose

Published by Luigi Bidoia. .

Organic Chemicals Specialty chemicals Chinese industryFuranic compounds are a family of chemicals characterized by the presence of the furan ring. In industrial practice, they are not produced from pure furan, which is toxic and highly volatile, but rather from furfural (or 2-furaldehyde), regarded as the true building block of furan chemistry. Furfural is obtained through hydrolysis and dehydration processes applied to lignocellulosic biomass, such as cereal bran, corn cobs, and other agricultural residues. This value chain is considered one of the earliest applications of green chemistry, transforming renewable raw materials into chemicals with high technological value.

To understand the markets and pricing of furanic compounds, it is useful to distinguish three main categories:

- Furanic commodities: including furfural, tetrahydrofuran (THF), and furfuryl alcohol. These are basic products used as solvents or intermediates in the production of resins and polymers, characterized by high volumes and relatively low unit prices.

- Sucralose: a zero-calorie sweetener derived from sucrose, about 600 times sweeter than sugar. Although not a commodity, it is often analyzed together with furanic compounds due to its value chain linkages.

- Furanic specialties: more complex and higher value-added molecules, produced in limited volumes and with specific purity requirements. They are mainly used in highly specialized sectors such as pharmaceuticals and agrochemicals.

Furanic commodities are a consolidated segment in which China holds a leading position on international markets. Sucralose, on the other hand, is a highly innovative product with strong growth rates, where the United States has attempted—so far unsuccessfully—to challenge China’s leadership. Furanic specialties have also been experiencing significant expansion for more than a decade, with double-digit growth rates. In this segment, competition is particularly strong between Chinese and German chemical companies: the latter, thanks to faster growth dynamics, are gaining increasing shares of international trade.

In this article, we will examine how Chinese prices influence—and in many cases determine—European prices, focusing on two furanic commodities—tetrahydrofuran (THF) and furfuryl alcohol—and on sucralose.

Impact of Chinese Prices on European Prices in the Furanic Commodities and Sucralose Markets

To analyze the influence of Chinese export prices on intra-EU price flows,

we applied a long-term model in which the European price is a function of the Chinese price

and a control variable, represented either by the average consumer price index of the Euro area

or by a simple trend.

The error term from the long-term equation is then used as a regressor in a short-term equation,

to estimate the speed at which the European price tends to adjust to Chinese price levels.

A second regressor in the short-term equation is a so-called shock variable,

constructed as the variation of the long-term levels of the European price.

Since the variables defining the long-term relationship are cointegrated,

the parameters of both the long-term and short-term equations were estimated using OLS

(Ordinary Least Squares).

All variables were expressed in logarithms,

allowing the estimated coefficients to be interpreted as elasticities.

The following table reports the estimated coefficients.

Estimated Values of the Equation Parameters

| Long-term Equation | Short-term Equation | ||||||

|---|---|---|---|---|---|---|---|

| Dependent Variable | Regressors | Regressors | |||||

| EU Price | Chinese Price | EU Consumer Price | Trend | Shock Effect | Adjustment Speed | ||

| Lag (months) | Coeff. | Coeff. | Coeff. | Coeff. | Coeff. | ||

| Tetrahydrofuran | 3 | 0.57 | 0.76 | 0.62 | -0.51 | ||

| Furfuryl alcohol | 1 | 0.97 | 0.65 | 0.83 | -0.43 | ||

| Sucralose | 2 | 0.62 | -0.003 | 0.93 | -0.78 | ||

All parameters are statistically highly significant. The explanatory power of both the long-term and short-term equations in describing the dynamics of European prices is overall very strong.

The analysis highlights a strong relationship between Chinese and European prices.

Changes in the equilibrium prices of the former tend to be reflected in the equilibrium prices of the latter,

with a lag ranging from 1 month for furfuryl alcohol to 3 months for tetrahydrofuran.

In the long run, the elasticity of European prices with respect to Chinese prices is relatively high:

around 0.6 for tetrahydrofuran and sucralose, with a peak of 0.97 for furfuryl alcohol.

European furanic commodity prices also adjust to average inflation,

with an elasticity close to 0.7.

In the case of sucralose, a very slow long-term trend is observed,

leading to a decrease in European prices of about 1% every three years.

In the short-term equation, the shock effect is moderately high:

over 50% of the variations in the long-term equilibrium price are transmitted into immediate price changes.

Adjustment for the portion of the shock not absorbed in the short run is also significant,

with a recovery in the following year of about half of the gap between the actual price and the equilibrium price.

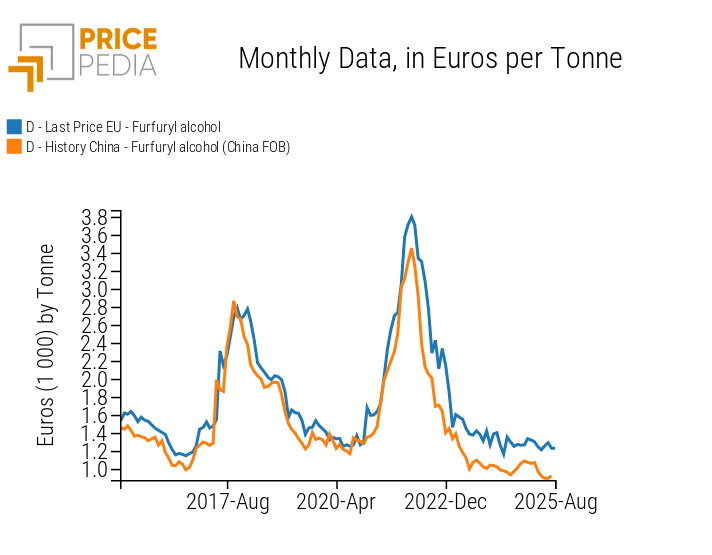

The link between Chinese and European prices is particularly evident in the case of furfuryl alcohol, as also confirmed by the direct comparison of the two price charts.

Furfuryl Alcohol: Comparison Between Chinese and European Prices

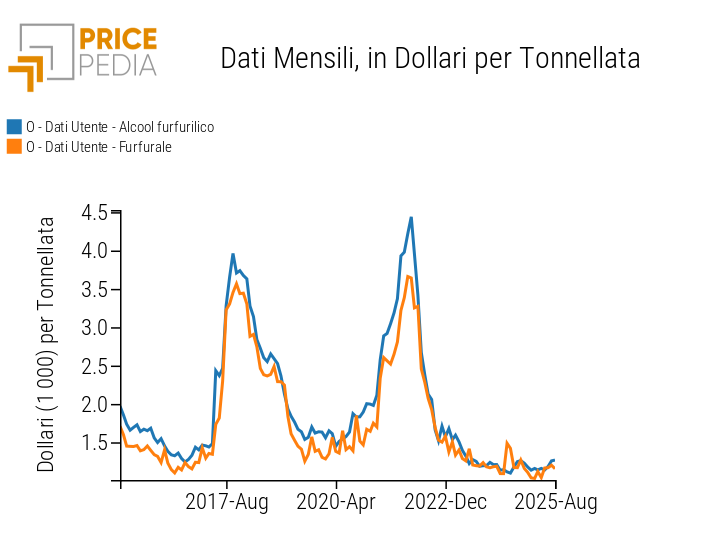

The Chinese price of furfuryl alcohol is in turn determined by the Chinese price of furfural, as shown in the following chart.

Price Pass-Through from Furfural to Furfuryl Alcohol in China

Summary

In this century, China has established its leadership in several segments of the chemical industry, including the furanic compounds sector. In the furanic commodities segment, China’s leadership is undisputed, to the extent that Chinese export prices serve as the main benchmark for furanic commodity prices in other parts of the world. In the case of furfuryl alcohol, the relationship with European prices is particularly strong: with a lag of just one month, changes in Chinese export prices are almost entirely transmitted to the prices recorded in intra-EU trade.

An equally strong link between Chinese and European prices is observed in the global sucralose market, where China continues to hold its leadership while facing increasing competition, especially from the United States.