The competitiveness of Chinese prices is affecting the European market for electrical steel

Electrical Steel G.O.: Chinese Exports Penetrate the EU Market Despite Anti-Dumping Duties

Published by Luca Sazzini. .

Electrical Steel ForecastIn the PricePedia scenario, updated monthly[1], price forecasts for electrical steel are included, distinguished based on:

- grain orientation: grain-oriented (G.O.) or non-grain-oriented (N.G.O.);

- rolling process: hot-rolled or cold-rolled;

- sheet width: less than 600 mm or greater/equal to 600 mm.

The table below shows the PricePedia forecast scenario for the average annual European prices of electrical steel, updated with information available as of September 3, 2025.

European average prices, expressed in euros per ton, are ordered from the most expensive type to the least expensive.

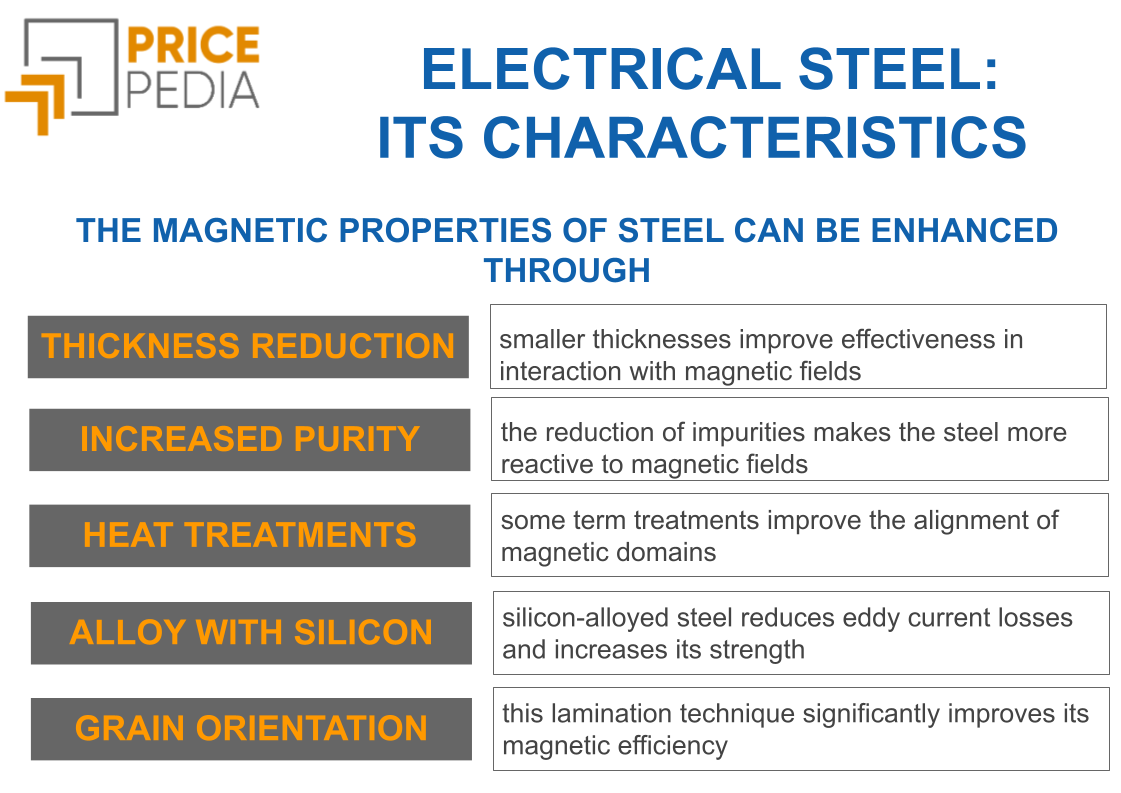

The category with the highest price levels is that of cold-rolled grain-oriented (G.O.) electrical steel with a width of less than 600 mm, which have values more than double those of the corresponding non-grain-oriented (N.G.O.) sheets. In grain-oriented sheets, the steel's crystal structure is treated to be aligned along a single dominant direction. This gives the material better magnetic properties and lower energy losses, which are particularly important in electrical transformers. These benefits, however, require more complex and costly production processes, which justify the price gap compared to non-grain-oriented sheets.

The second most expensive type among those analyzed is N.G.O. sheets with a width of less than 600 mm, whose price is higher than wider formats because additional coil cutting is required. Next are non-grain-oriented sheets with a width of 600 mm or more, which fall within standard production and do not require further cutting operations.

The last type considered in this scenario is N.G.O. sheets wider than 600 mm obtained solely by hot rolling. Unlike the previously described sheets, these have not undergone a subsequent final cold rolling.

Average annual European prices of electrical steel, expressed in €/ton

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | |

|---|---|---|---|---|---|---|---|

| D-PricePedia Scenario - Grain-Oriented (G.O.) electrical steel (<600mm) (Info as of 3-09-2025) | 1773 | 2138 | 3519 | 3994 | 2974 | 2671 | 2394 |

| D-PricePedia Scenario - Non-Grain-Oriented (N.G.O.) electrical steel (<600mm) (Info as of 3-09-2025) | 767 | 1043 | 1777 | 1860 | 1462 | 1329 | 1137 |

| D-PricePedia Scenario - Non-Grain-Oriented (N.G.O.) electrical steel (≥600mm) (Info as of 3-09-2025) | 693 | 970 | 1513 | 1477 | 1161 | 992 | 977 |

| D-PricePedia Scenario - Hot-rolled Non-Grain-Oriented (N.G.O.) electrical steel (≥600mm) (Info as of 3-09-2025) | 596 | 845 | 1039 | 948 | 867 | 828 | 766 |

From the table analysis, it appears that European electrical steel sheet prices are following a common dynamic. Since early 2020, there has been a strong growth phase, peaking in 2023, followed by a downward trend expected to continue in the coming years.

For G.O. sheets under 600 mm, from record 2023 prices of around €4,000/ton, a decline to approximately €2,400/ton is estimated by 2026, a variation of -40%.

For the two types of cold-rolled N.G.O. sheets, the expected reduction is around €750/ton compared to 2023 peaks, with absolute percentage changes exceeding -50%.

The price decrease for hot-rolled sheets is less pronounced, with expected greater stability: by 2026, prices should be just above €750/ton, a drop of “only” 30% compared to the 2022 maximum.

Overall, the recent downward trend in European electrical steel sheet prices is expected to continue through 2026.

What dynamics drive European electrical steel sheet prices?

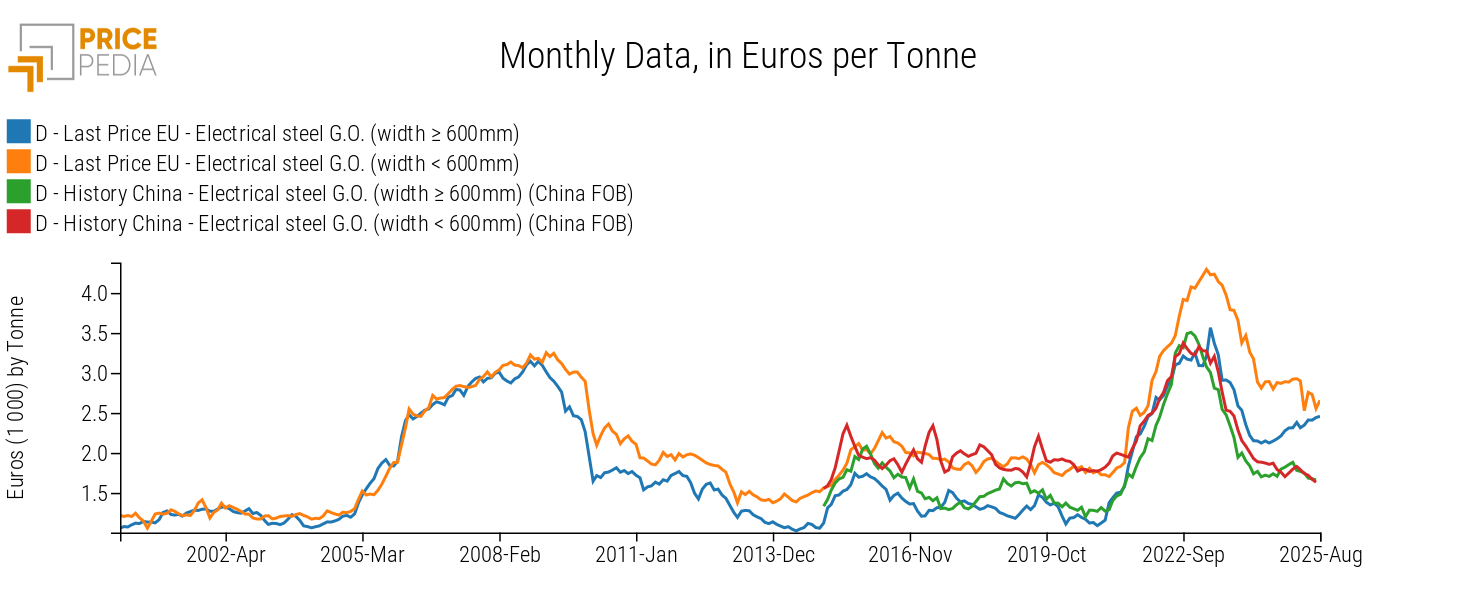

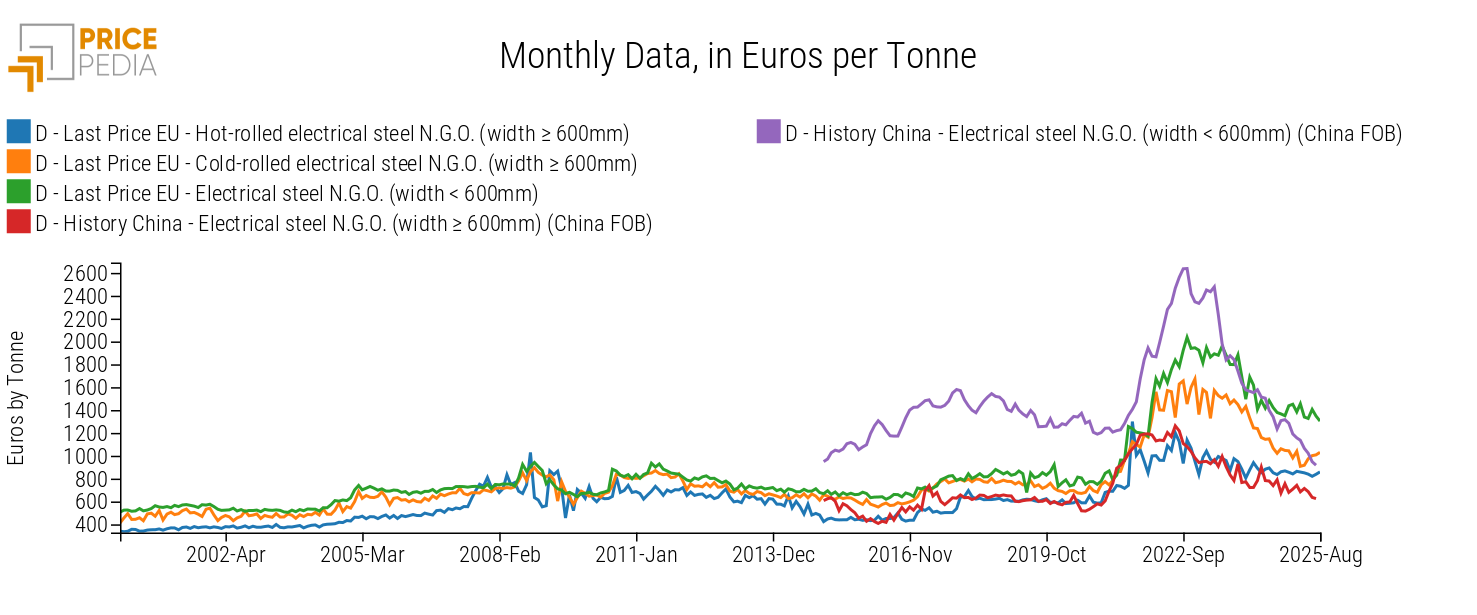

The European price trend of electrical steel, in addition to being influenced by the evolution of its production inputs, is closely linked to the Chinese market. European prices tend to follow, with a slight lag, the corresponding price dynamics in China.

The chart below shows a comparison between the customs prices of electrical steel in the 27 EU countries and the corresponding export (FOB) prices recorded at Chinese customs.

| Comparison of EU and Chinese customs prices for G.O. electrical steel | Comparison of EU and Chinese customs prices for N.G.O. electrical steel |

|

|

Significant reductions in Chinese export prices for electrical steel over the past two years have influenced European price dynamics, exerting downward pressure.

In 2022, the EU sought to protect domestic G.O. sheet production through the Commission Implementing Regulation (EU) 2022/58. This regulation introduced new anti-dumping duties on imports from China, as well as Japan, Korea, Russia, and the USA, with rates always above 20%, up to a maximum of 37% and 39% for Chinese and Japanese companies, respectively. These measures partially protected European prices, significantly widening the gap with Chinese levels, although they were not sufficient to prevent the price decline that began in 2023.

With the entry into force of the new anti-dumping duties on Chinese imports, it may be useful to check whether European import flows have changed their structure by country of origin.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Effects of anti-dumping duties on EU trade flows

The chart below shows the dynamics of EU imports of G.O. electrical steel from China.

From the chart analysis, it emerges that despite the introduction of anti-dumping duties in January 2022, EU imports of G.O. electrical steel (both under and over 600 mm) from China have grown sharply despite the new trade barriers. In 2024, the quantity of electrical steel imported into the EU from China more than quadrupled compared to 2021 levels, the last year without duties, rising from around 24,000 tons to over 97,000 tons.

Thanks to the increase in their exports to the EU market, China has become the main EU supplier of G.O. electrical steel.

Conclusions

European electrical steel sheet prices are following a downward trend expected to continue through 2026. The sharp decline in Chinese prices continues to exert pressure on European prices, which, although remaining at higher levels, follow the same downward trajectory.

The anti-dumping duties introduced by the EU at the beginning of 2022 were not sufficient to protect the European market from international competition from China. Since 2021, Chinese exports of G.O. electrical steel to the EU have more than quadrupled, strengthening their presence in the European market and contributing to the price decline.

[1] In a forecast scenario update, a monthly frequency is essential to promptly capture unexpected changes in the economic context that affect the prices of the considered commodities. For further details, see the article: The advantage of having timely updated forecasts.