Vulnerability of the European steel industry to iron ore imports

The role of scrap metal as a substitute for iron ore

Published by Luca Sazzini. .

Ferrous Metals Critical raw materials

Iron ore is the main production input for the steel industry.

From a commercial point of view, it is divided into non-agglomerated ores—raw materials only subjected to crushing and screening (such as “fines” and “lumps”)—and agglomerated ores, which include pellets and sinter, obtained through processes that improve their quality and blast furnace yield. The most traded type worldwide is non-agglomerated ore, which in 2024 accounted for over 90% of the international iron ore market, both in terms of weight and value at constant prices.

Alongside iron ore, metal scrap represents a second key input for steel production. Its availability allows, in part, to replace the use of virgin ores, reducing dependence on imports and the environmental costs associated with extraction and transport. Precisely because of this partial substitutability, supply and demand dynamics for scrap are closely intertwined with those of iron ore, influencing the overall competitiveness and sustainability of the steel industry.

For the European Union, iron ore is a strategic raw material not only because of its economic importance but also due to the strong dependence on foreign supplies, exacerbated by the critical issues of the recycling market. In theory, steel is 100% recyclable and can have a virtually infinite life cycle, without loss of properties. In practice, however, several limitations arise. The main issue concerns the availability of scrap, reduced by the long average lifespan of steel products: generally between 35 and 40 years, but up to 60 years in the construction sector. Another obstacle is the recovery from electrical and electronic products, often difficult to dismantle and not designed for recycling. In these cases, recovery rates are around 50%, while for simpler products—such as packaging, construction, and vehicles—they exceed 85%.

This article will analyze the main production inputs of the steel industry, linking the trend of their world trade with global steel production. It will then examine the major international exporters and the main European suppliers of iron ore and scrap, before exploring the dynamics that influence price formation in the different markets.

Analysis of steel production and global trade in ore and scrap

Steel production analysis

To analyze the evolution of world trade in the main steelmaking inputs, it may be useful to first examine the dynamics of global steel production.

Data on world steel production are publicly available on the World Steel Association (WSA) website.

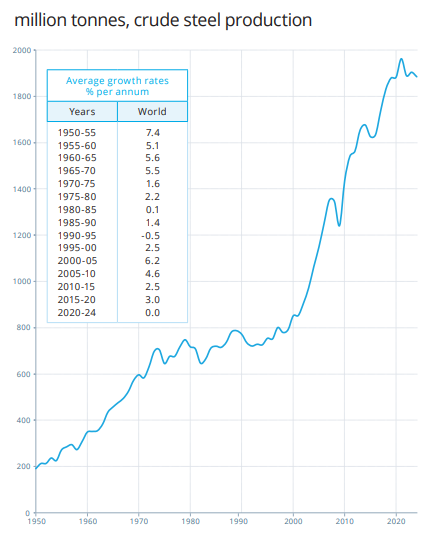

The following chart shows the trend in crude steel production, extracted from the 2025 Report of the World Steel Association.

Historical series of crude steel production

From 1950 to 2020, global crude steel production grew more than ninefold, rising from less than 200 million tonnes to over 1.8 billion tonnes. Between 2020 and 2024, growth virtually came to a halt, with production increasing by just 3 million tonnes to 1.835 billion tonnes. A slowdown of this kind had not been recorded since the 1990–1995 period, when production even contracted by -0.5%. In the last four years, the steel industry has been strongly penalized by the slowdown in Chinese demand, whose influence is particularly relevant considering that China produces more steel than the rest of the world combined, exerting a decisive impact on the global market.

Analysis of global trade in steelmaking inputs

Once the dynamics of global steel production are examined, we can move on to analyzing the evolution of global trade in steelmaking inputs (iron ore and scrap) to assess whether their world trade growth follows the trend of crude steel production.

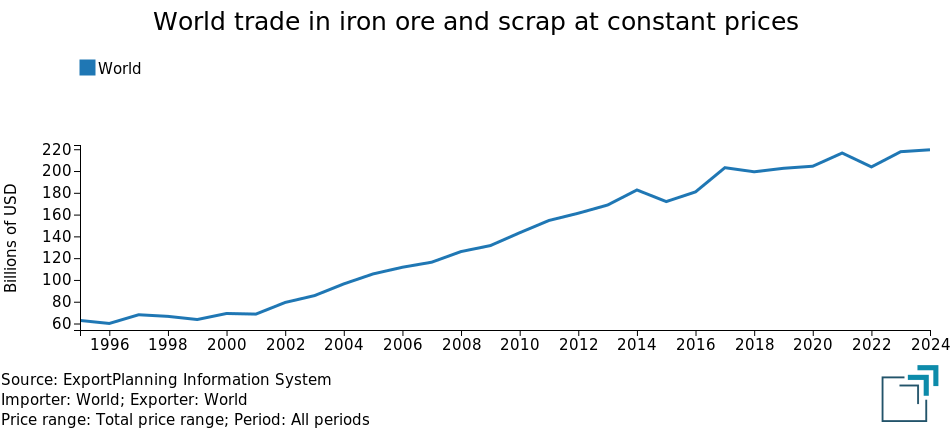

The following chart shows the trend of a constant-price index of world trade in iron ore and scrap, constructed by aggregating the quantities of the two main production inputs.

The analysis of the chart shows that the trend of world trade in iron ore and scrap at constant prices is closely correlated with that of crude steel production previously analyzed. In the final years of the last century, trade in iron ore and scrap also recorded modest growth, accelerating significantly in the early 2000s and continuing with sustained expansion until 2020, before stabilizing over the past four years.

This confirms that, in periods characterized by strong steel production, world trade grows in parallel, as happened in the early 2000s, while in periods of production slowdown, global trade also remains relatively stable.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Analysis of the main global and European suppliers

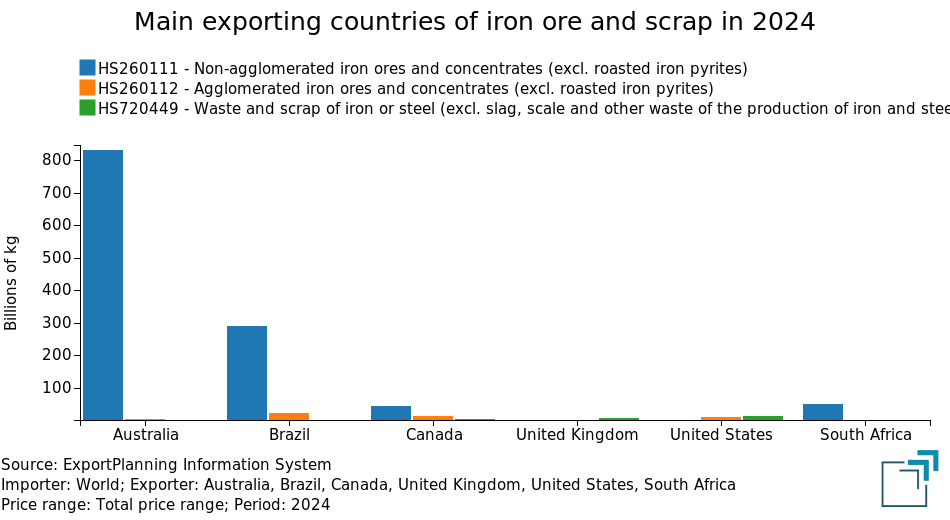

The chart below shows the main world exporters of iron ore and scrap in 2024.

The main exporters of iron ore are Australia and Brazil, which are also the two largest producers worldwide. In 2024, they accounted together for about 68% of global iron ore exports, far ahead of Canada and South Africa, the third and fourth largest exporters, respectively.

Brazil is also the leading exporter of agglomerated ore, but this type has a very marginal weight within ore exports. As for steel scrap, the main exporters are the United States and the United Kingdom, but with volumes also negligible compared to world trade in non-agglomerated iron ore.

Overall, the main international suppliers of the global steel industry are Australia and Brazil: an interruption in supplies from either of these two countries would be enough to generate a shortage of production inputs for the steel industry.

Main European suppliers

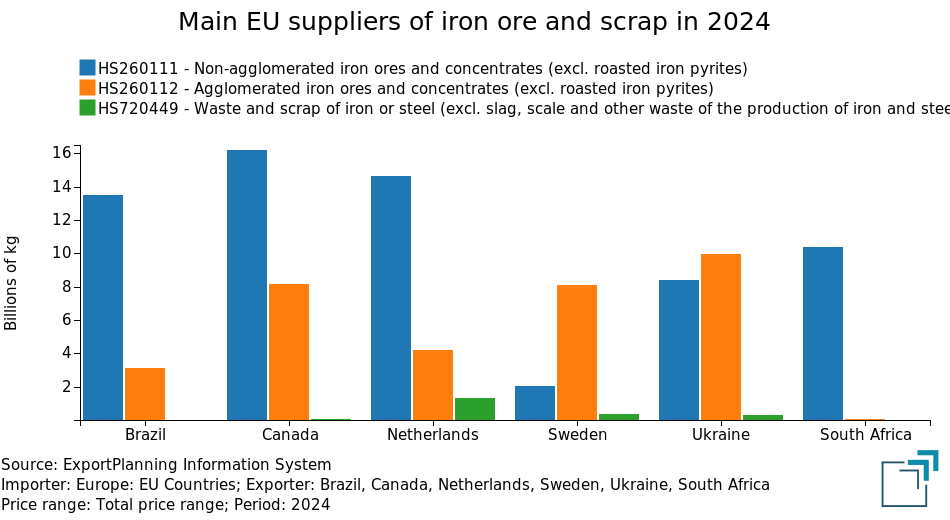

The chart below shows the main European suppliers of iron ore and scrap in 2024.

With the exception of the Netherlands and Sweden, which mainly operate as European trading hubs for re-exporting part of the imported ores, the main European suppliers of iron ore are: Canada, Brazil, Ukraine, and South Africa. Among these, Canada stands out as the leading supplier, covering 20% of total European imports alone.

Although largely dependent on ore imports, Europe has managed to diversify its supplies for the steel industry, seeking to minimize as much as possible the risk associated with dependence on a single exporting country.

Price analysis

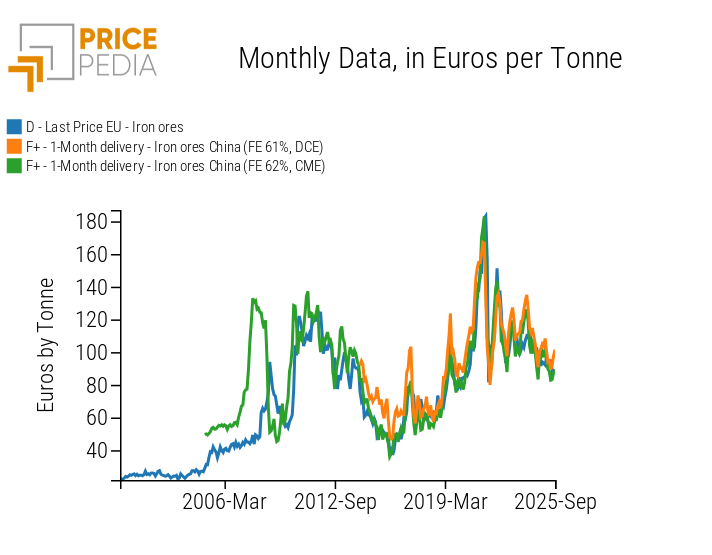

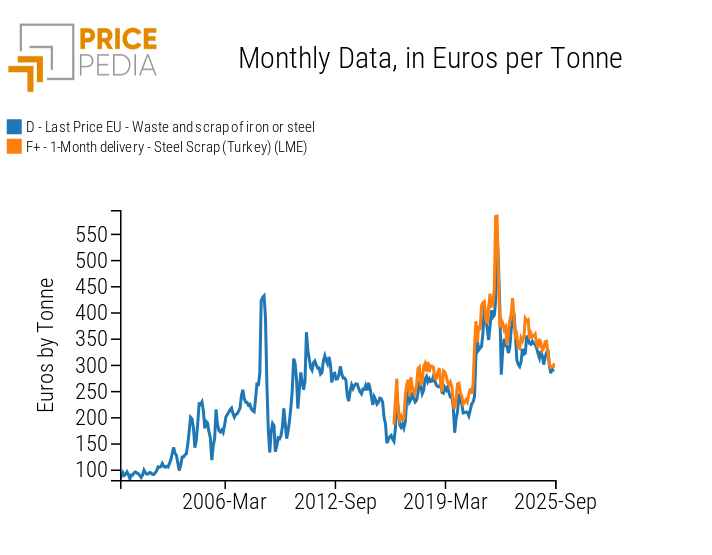

Both the iron ore and steel scrap markets are global markets, characterized by common price dynamics and levels across different world regions. Regional prices are in fact driven by their respective financial benchmarks: for iron ore, the reference is Chinese financial prices, while for scrap, the benchmark is the LME price for Turkish steel scrap.

The following chart shows European prices for iron ore and scrap, both compared with their respective financial benchmarks.

| Comparison between European customs prices and Chinese financial prices of iron ore | Comparison between European customs prices and financial prices of steel scrap |

|

|

The analysis of the two charts shows that European prices for iron ore and scrap tend to be anticipated by their respective financial benchmarks. This suggests a causal direction that starts from financial prices and subsequently transmits to European physical prices.

In summary

The evolution of global trade in steelmaking inputs tends to be strongly linked to the dynamics of steel production. In periods of strong production growth, such as the early 2000s, global trade in steelmaking inputs recorded significant increases, while in phases of global production stagnation, trade tends to stabilize without showing substantial growth.

The analysis of the main global exporters shows that Australia and Brazil account for the majority of the global supply of steelmaking inputs, almost entirely in the form of non-agglomerated iron ore. In Europe, on the other hand, international suppliers are more diversified, although the EU continues to depend significantly on foreign imports.

The prices of iron ore and scrap are largely determined at a global level, and their dynamics are driven by their respective financial benchmarks.