Trump's game on copper tariffs

US tariffs: why is copper different from steel and aluminium?

Published by Luca Sazzini. .

Copper Non Ferrous Metals USA customs duties Import tariffsDuring this second Trump presidency, U.S. trade policy has been characterized by a clear protectionist turn. The declared objective, in addition to increasing federal revenues, is to bring part of production back within national borders and reduce dependence on foreign suppliers. To achieve this goal, the Trump administration has introduced new barriers, mainly based on import tariffs, targeting both major partners with whom the United States recorded a trade deficit and metals considered essential for U.S. industry.

The first metals affected were steel and aluminum, two strategic metals that had already been subject to restrictive measures during Trump’s first term in 2018. Through proclamations 10896 and 10895: Adjusting Imports of Steel into The United States and Adjusting Imports of Aluminum into The United States, tariffs of 25% were imposed on all imports of steel and aluminum, including derivative products, relying on Section 232 of the Trade Expansion Act of 1962, which allows the President to impose import restrictions on goods deemed critical to national security. These tariffs were later doubled to 50% with proclamation 10947: Adjusting Imports of Aluminum and Steel Into the United States of June 3, 2025.

The additional tariffs on steel cover chapters 72, 73, 84, 85, 87, and 94 of the Harmonized System, while those on aluminum affect chapters 66, 76, 83, 84, 85, 87, 88, 90, 94, 95, and 96. They therefore apply both to primary metals and to derivative products containing steel and aluminum, for the portion of value attributable to the raw metal.

For imports of derivative products, it is mandatory to declare, in addition to the country of origin:

- the value of the steel and/or aluminum content;

- the value of the product net of the steel and/or aluminum content value;

- the weight of the steel and/or aluminum content;

In the absence of such information, the additional tariff will be collected on the total value of the product and not only on the value of the steel and/or aluminum content.

The third metal subject to a procedure aimed at imposing import tariffs is copper. The first phase of the procedure involved an investigation into the effects of copper imports on national security, launched in February by the U.S. Department of Commerce.

The results of this investigation highlighted that current import volumes and global excess production capacity are weakening the U.S. economy, increasing the risk of further closures of domestic plants, and reducing the ability to meet strategic needs. The analysis showed that copper is an essential metal for U.S. manufacturing and defense: it is the second most used material by the U.S. Department of Defense and is required in numerous military systems, including aircraft, land vehicles, ships, submarines, missiles, and ammunition. Thanks to its electrical conductivity and durability, copper is also crucial for critical infrastructure supporting the economy, national security, and public services, and often no adequate alternatives exist.

The United States was a world leader in copper production for much of the 20th century, but today domestic production has drastically declined. China dominates global smelting and refining, controlling over 50% of global capacity and four of the five largest refineries. Unfair foreign trade practices, combined with burdensome domestic environmental regulations, have weakened the U.S. supply chain, increased dependence on imports, and made corrective actions necessary to safeguard economic and national security. Today, in fact, about half of U.S. domestic copper demand is met by foreign imports, which are heavily concentrated in a single country. As reported in the analysis: US duties on copper: the reasons and expected effects on prices, in 2024 the United States imported 650 million tons of copper from Chile alone, equal to almost 70% of total copper imports.

With proclamation 10962 of July 30, 2025: Adjusting Imports of Copper Into the United States, President Trump, however, chose not to follow the recommendations of the U.S. Department of Commerce, imposing a 50% tariff only on certain copper derivative products and temporarily exempting refined copper along with some other derivatives. The codes subject to 50% U.S. import tariffs are in fact only those in chapter 74 from section 7406 to 7419, plus HS854442 and HS854449 for electric conductors.

The exemption of raw copper from tariffs clearly distinguishes the case of copper from that of steel and aluminum. It should be noted, however, that within 90 days of the proclamation, the President reserved the right to extend measures to raw copper and other products.

Want to stay updated on commodity market trends?

Subscribe for free to the PricePedia newsletter!

Effects on Copper Financial Prices of U.S. Trade Policy

Copper officially came under the spotlight of protectionist policy last February, when President Trump instructed the Department of Commerce to launch an investigation to assess whether imports could pose a threat to national security. Since then, copper quotations on the Chicago Mercantile Exchange (CME) have been repeatedly affected by developments and rumors on the trade front.

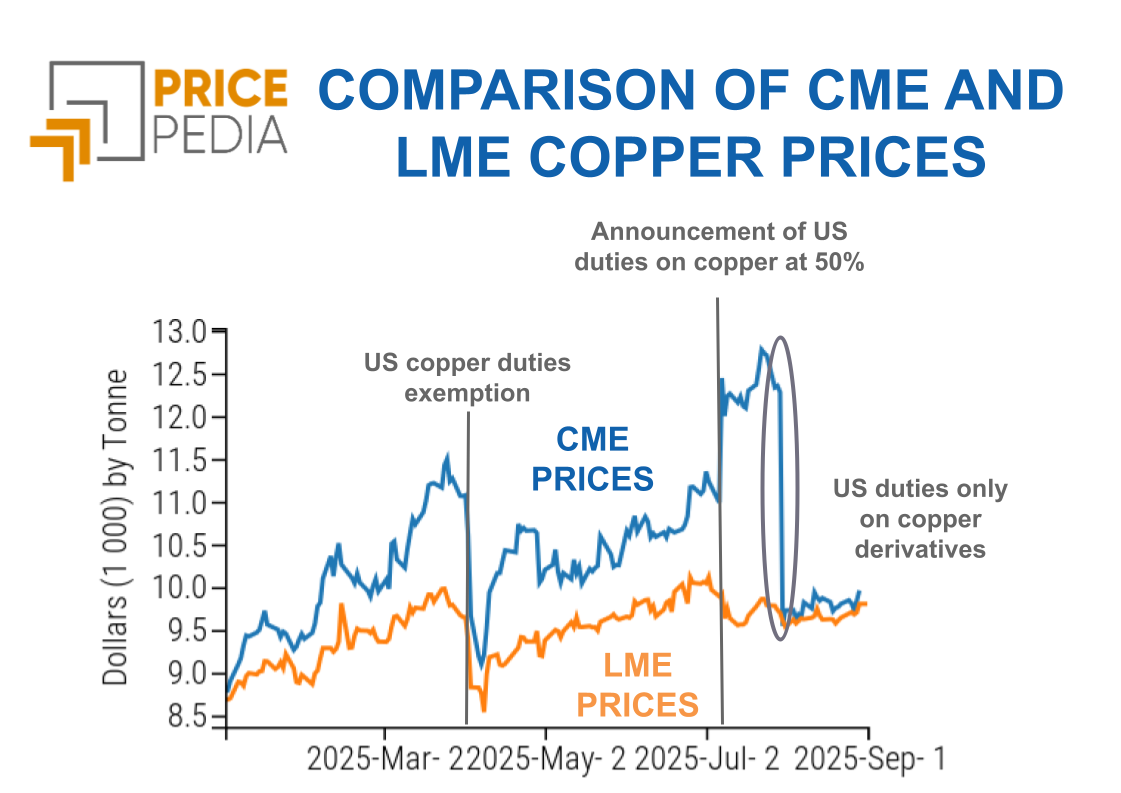

To assess the extent of these reactions, it is useful to observe a chart comparing the trend of copper prices on the CME with those on the LME. In the absence of tariffs, the two prices had always remained nearly identical, confirming the nature of copper as a global commodity characterized by a single global price. However, fears of possible U.S. tariffs, repeatedly informally announced by President Trump, repeatedly shook financial markets, pushing copper prices on the CME significantly above those on the LME.

The chart below shows the comparison between the two historical series, both expressed in dollars per ton.

After rising at a faster pace than LME copper, CME copper prices initially collapsed on April 2 when the customs code for copper cathodes was included in the list Annex II attached to the executive order of April 2, which exempts all codes on the list from additional U.S. tariffs. Despite this exclusion, the President continued to threaten new tariffs, and on July 8 he announced the introduction of 50% tariffs on copper starting August 1, causing an immediate price surge. However, this announcement turned out to be a "fake": in the July 30 regulation refined copper was in fact excluded from tariffs, leading to an immediate collapse of copper financial prices, which fell by 22% in a single day, realigning with London market values.

Currently, CME copper financial prices remain slightly higher than LME prices due to fears of possible future rates on cathodes. The gap between the two markets has nonetheless nearly disappeared compared to the wide spreads recorded in July.

What Effects to Expect on Physical Prices?

As reported in the article: US duties on copper: the reasons and expected effects on prices, all else being equal (ceteris paribus) an increase in U.S. tariffs on copper imports tends to push U.S. copper prices higher and international prices lower. This effect derives from the fact that tariffs lead suppliers to divert part of the exports originally intended for the U.S. toward other markets, reducing domestic supply while increasing competition in foreign markets.

As for copper cathodes, which were exempted from the new tariffs, it is reasonable to expect that, in the absence of further tariffs, U.S. prices will remain aligned with those in European and Chinese markets, as already observed in financial markets.

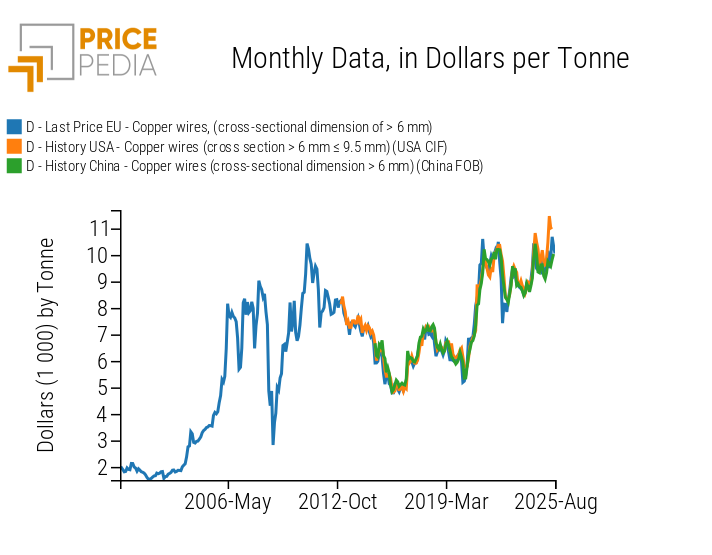

By contrast, for derivative products subject to tariffs, greater regionalization of prices is expected. In the case, for example, of copper wires, they have so far represented a global market with prices substantially aligned between the EU, U.S., and China, as shown in the chart below comparing the historical series of customs prices of copper wires with a section greater than 6 mm in the three main world economic areas: European Union, United States, and China.

Comparison of customs prices of copper wires with section greater than 6 mm, expressed in dollars/ton

For the near future, however, it is reasonable to assume that U.S. prices will be significantly higher than European and Chinese ones. This will lead to greater regionalization of the copper wire market.

Obviously, the analysis carried out in the case of copper wires can also be extended to any other copper derivative that was affected by the July 30 tariff regulation.

Summary

U.S. tariffs on copper have differed significantly from those on steel and aluminum. For copper, in fact, the base metal was exempted from tariffs, applying duties only to specific categories of derivative products.

The initial ambiguities in tariff announcements, which had raised fears of their application also to the primary metal as had occurred for steel and aluminum, caused strong volatility in financial markets, with CME prices reaching levels well above those of the LME. The gap between the two prices then narrowed once the tariff implementation regulation was officially published, affecting only certain categories of derivatives. For the latter, it is reasonable to assume that, all else being equal, U.S. prices will tend to rise, while international prices will show a downward trend.