August on standby for commodities

With the exception of coffee and JKM gas, there weren't significant changes on the commodity financial markets

Published by Luigi Bidoia. .

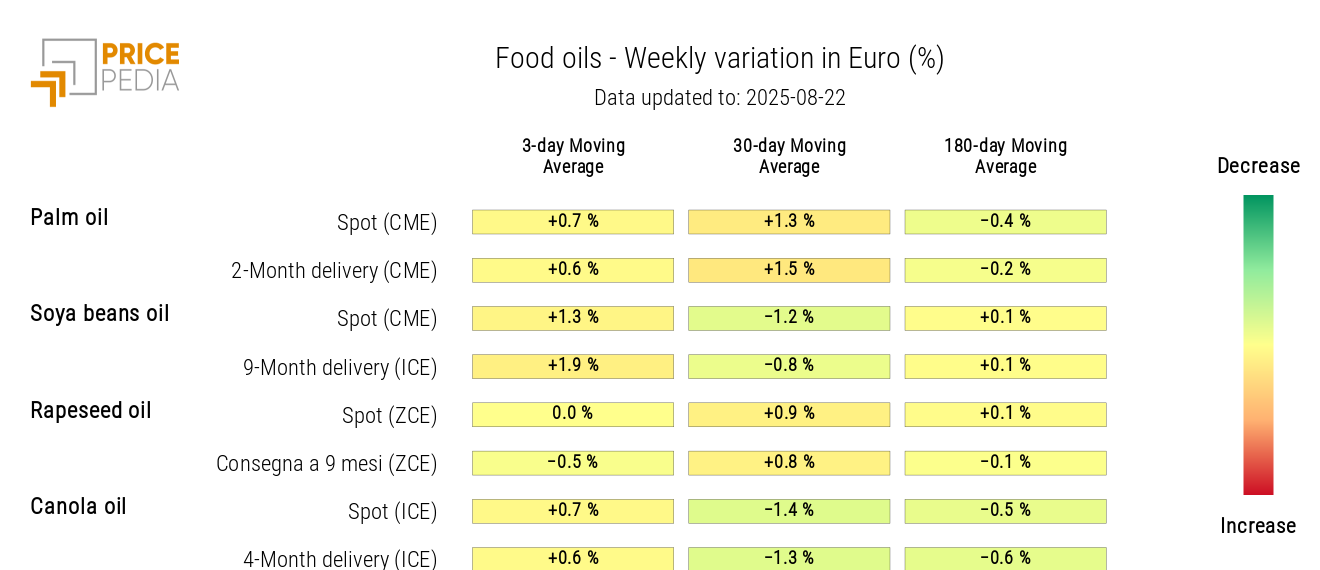

Conjunctural Indicators Commodities Financial WeekWith the exception of liquefied gas in Asia and, above all, ICE quotations for arabica (Coffee C) and robusta coffee, August confirms itself as a month of substantial stability for commodity prices on financial markets. The JKM gas price continued to fall even in the last week, while on the opposite side the strong growth of coffee quotations on the Intercontinental Exchange (ICE) continued, as shown in the chart below.

Financial price index of JKM liquefied gas and arabica coffee

The increase in coffee prices

From August 1 to 22, the price of arabica (Coffee C) and robusta coffee quoted on the Intercontinental Exchange (ICE) increased by 37% and 46%, respectively. Unlike the sharp rises recorded during 2024, due to adverse weather conditions in major producing countries such as Brazil and Vietnam, leading to supply disruptions and lower yields, the August increases seem mainly linked to the sharp tariff hikes imposed by the United States. The 50% tariff introduced by the Trump administration on Brazilian coffee starting August 6 has made exports to the United States impractical, disrupting markets.

It should be noted, however, that ICE quotations for arabica and robusta coffee futures refer to deliveries to ICE warehouses and do not include import tariffs, which are applied only at the time of customs clearance. As a result, the price of coffee on the U.S. market is experiencing even sharper increases compared to ICE quotations, with peaks of up to 50% for coffee imported from Brazil.

The effect of tariffs on U.S. coffee imports is manifesting through several channels:

- for arabica coffee, the increase in ICE premiums on lots originating from countries other than Brazil, toward which U.S. importers are shifting;

- the uncertainty that is encouraging the entry of speculative funds into the market, especially on the buy side;

- the higher demand from roasters not located in the United States, for example in the EU, whose exports of roasted coffee to the U.S. are subject to a tariff of “only” 15%.

The decline in Asian JKM gas prices

The spot price in dollars of LNG in Northeast Asia (Japan-Korea Marker, JKM) has fallen by more than 10% since early July, due to weak demand caused by high inventories in China, and a supply that remains abundant. This decline has closed the gap between the Asian gas price and the price quoted on the Dutch TTF. As of Wednesday this week, the two prices are aligned, with a slight margin in favor of the TTF.

NUMERICAL APPENDIX

ENERGY

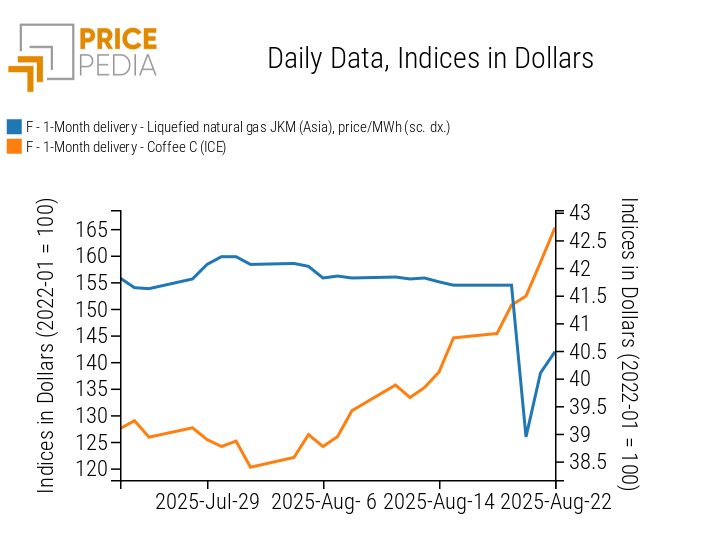

The PricePedia index of financial energy prices recorded an almost unchanged trend in August, remaining within a downward trend that has now been consolidated over the past five years. The most recent week also confirms this phase of stability, although in recent days prices have shown an increase.

PricePedia Financial Index of energy prices in dollars

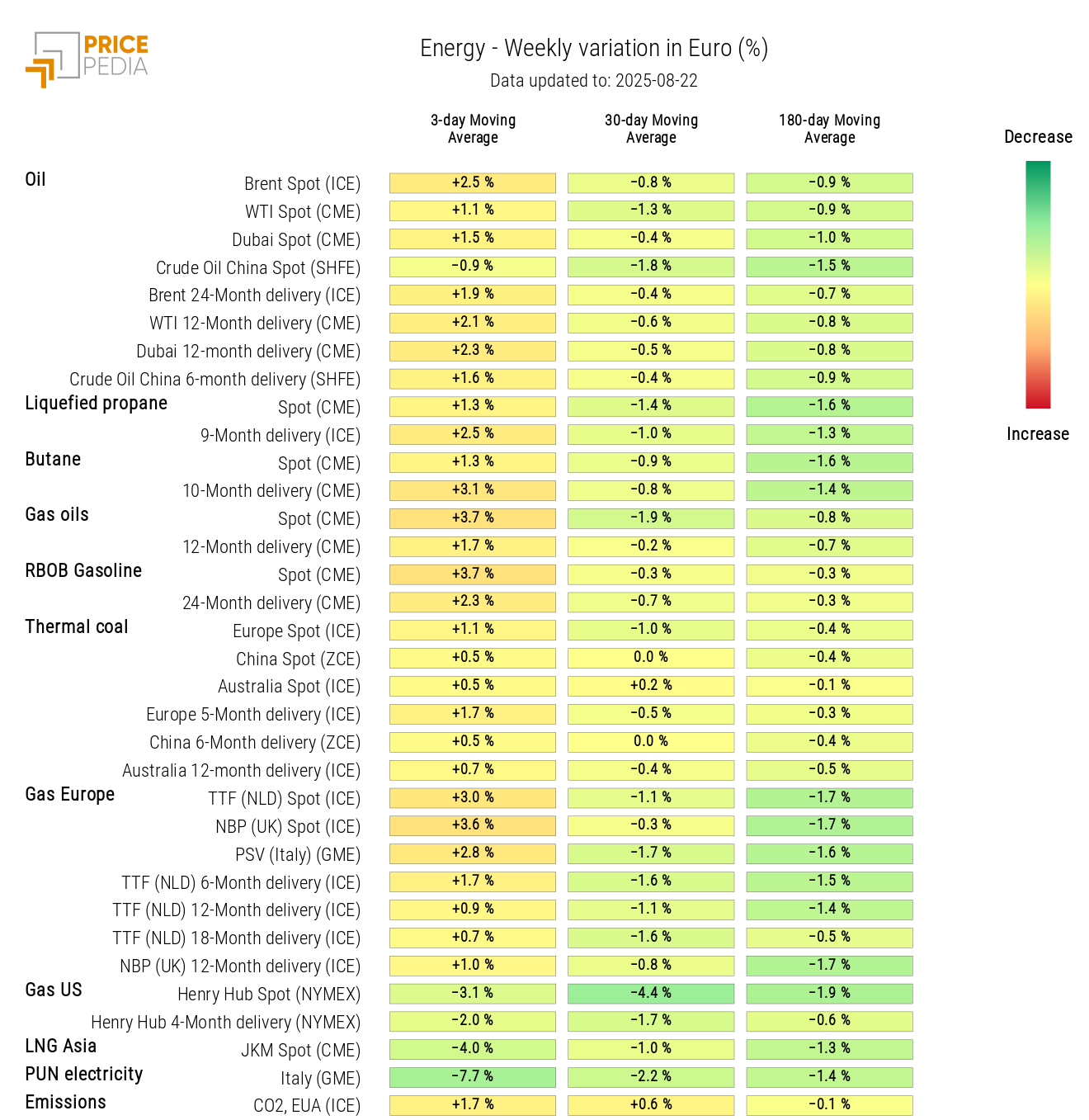

As shown in the Heatmap below, the slight increases in recent days have affected almost all energy commodities, with the exception of liquefied natural gas on the Japan-Korea market (Asian LNG JKM).

HeatMap of energy prices in euros

PLASTICS

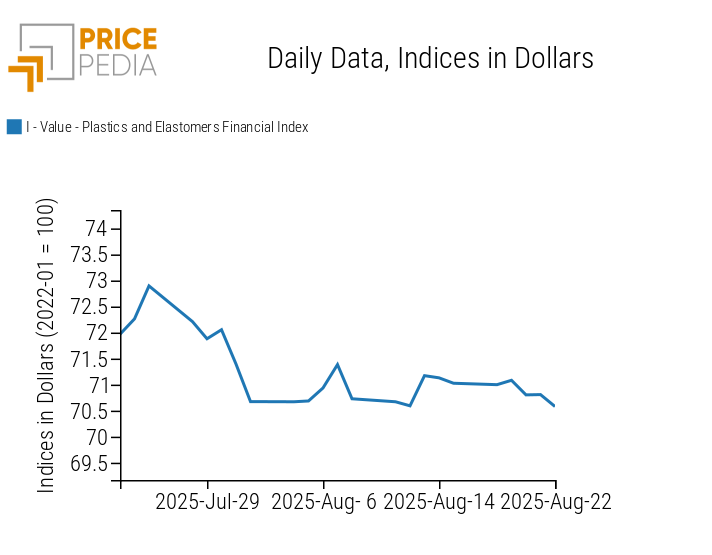

The increase recorded at the end of July was fully reabsorbed, bringing the PricePedia index of financial prices of plastics and elastomers back to levels close to the lows of the last ten years. In August, prices remained substantially unchanged.

PricePedia Financial Indexes of plastics prices in dollars

FERROUS

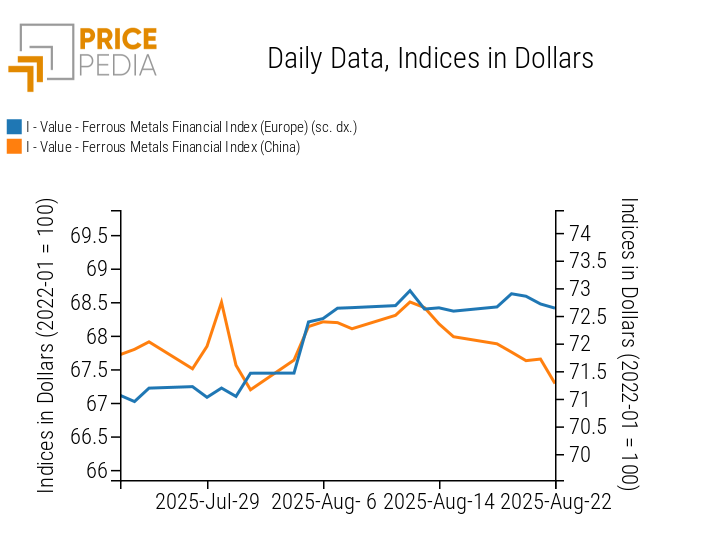

The growth phase that began in late June has come to a halt, giving way to substantial stability. A slight decline is observed in the past week.

PricePedia Financial Indexes of ferrous metal prices in dollars

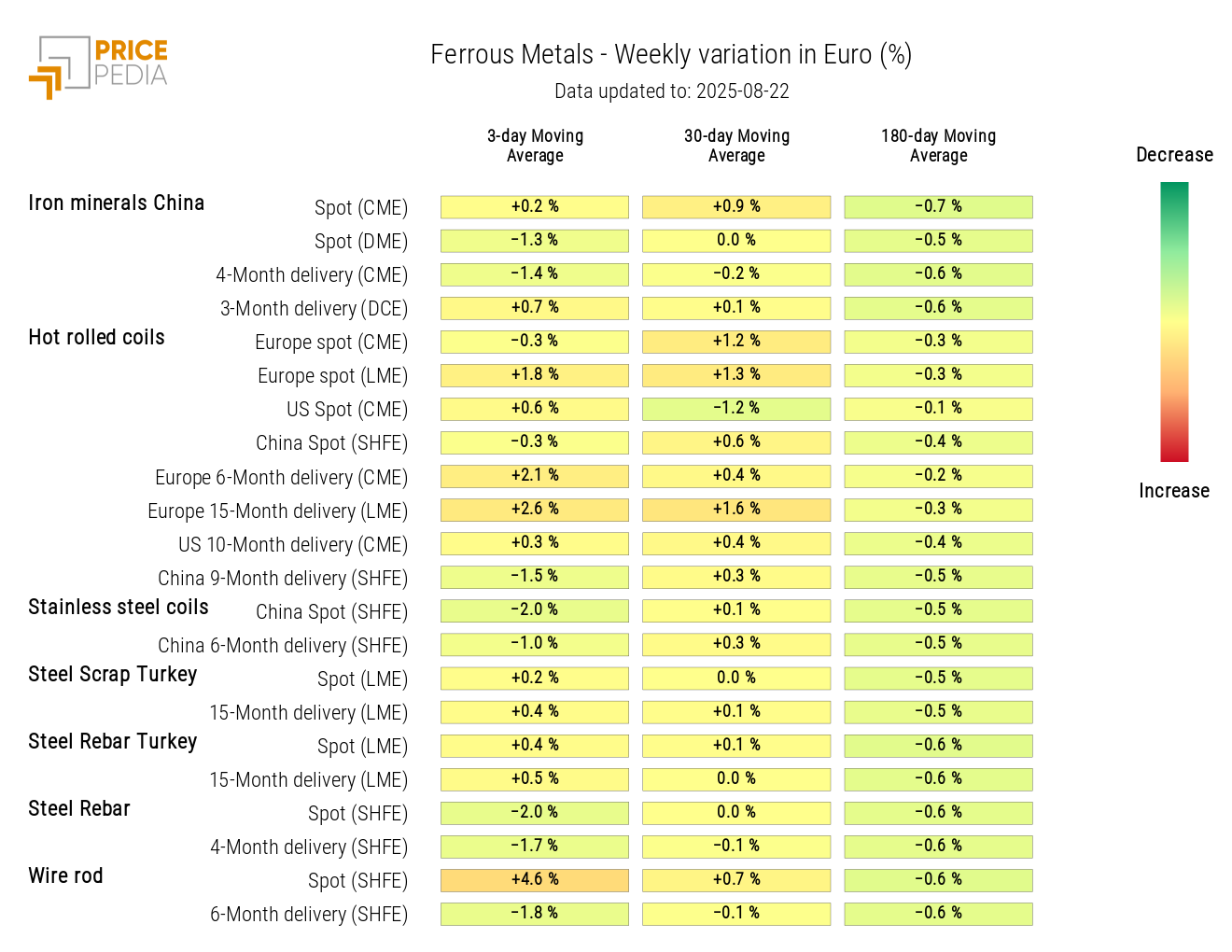

From the heatmap analysis, a weekly increase in the 3-day moving average of wire rod prices is noted, while other prices remain stable or declining.

HeatMap of ferrous prices in euros

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

INDUSTRIAL NON-FERROUS

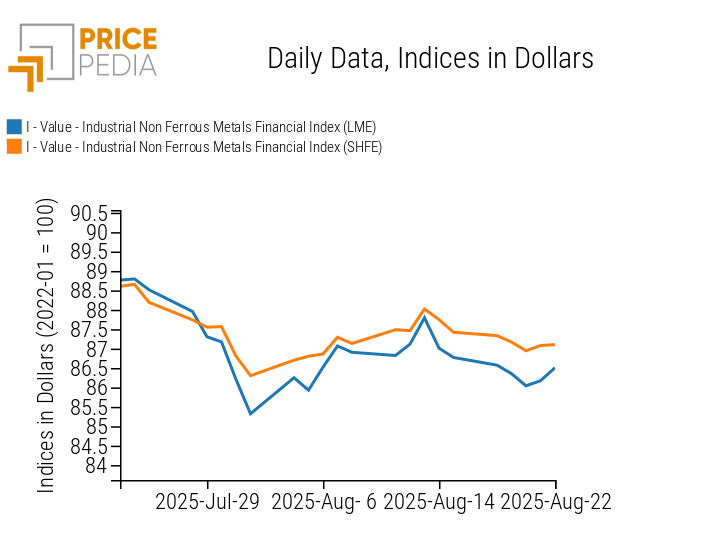

The non-ferrous metals index has shown in recent months short cycles around substantially stable levels, with a downward trend in the past week.

PricePedia Financial Indexes of industrial non-ferrous metals prices in dollars

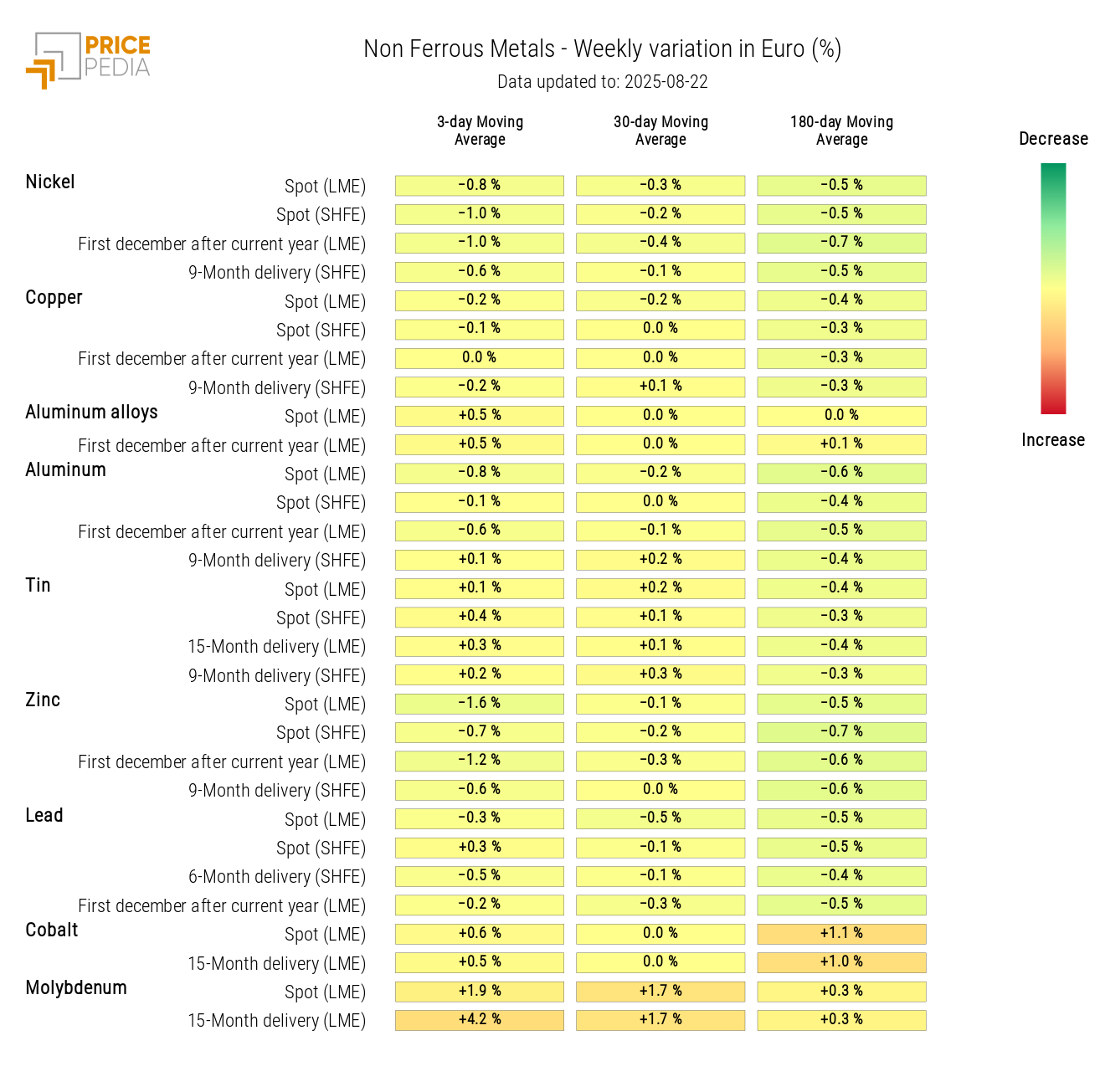

The non-ferrous metals heatmap highlights the substantial stability characterizing the prices of all non-ferrous metals.

HeatMap of non-ferrous prices in euros

FOOD

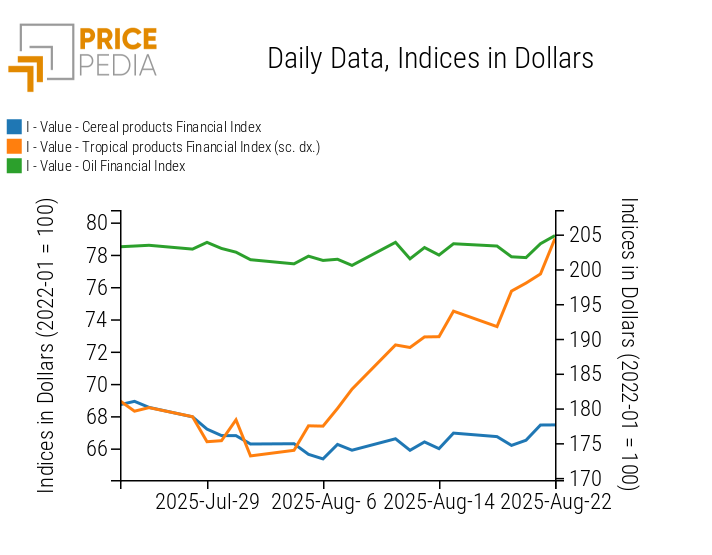

Food indexes are characterized by strong price growth for tropical products, alongside very limited growth in cereals and oils.

PricePedia Financial Indexes of food prices in dollars

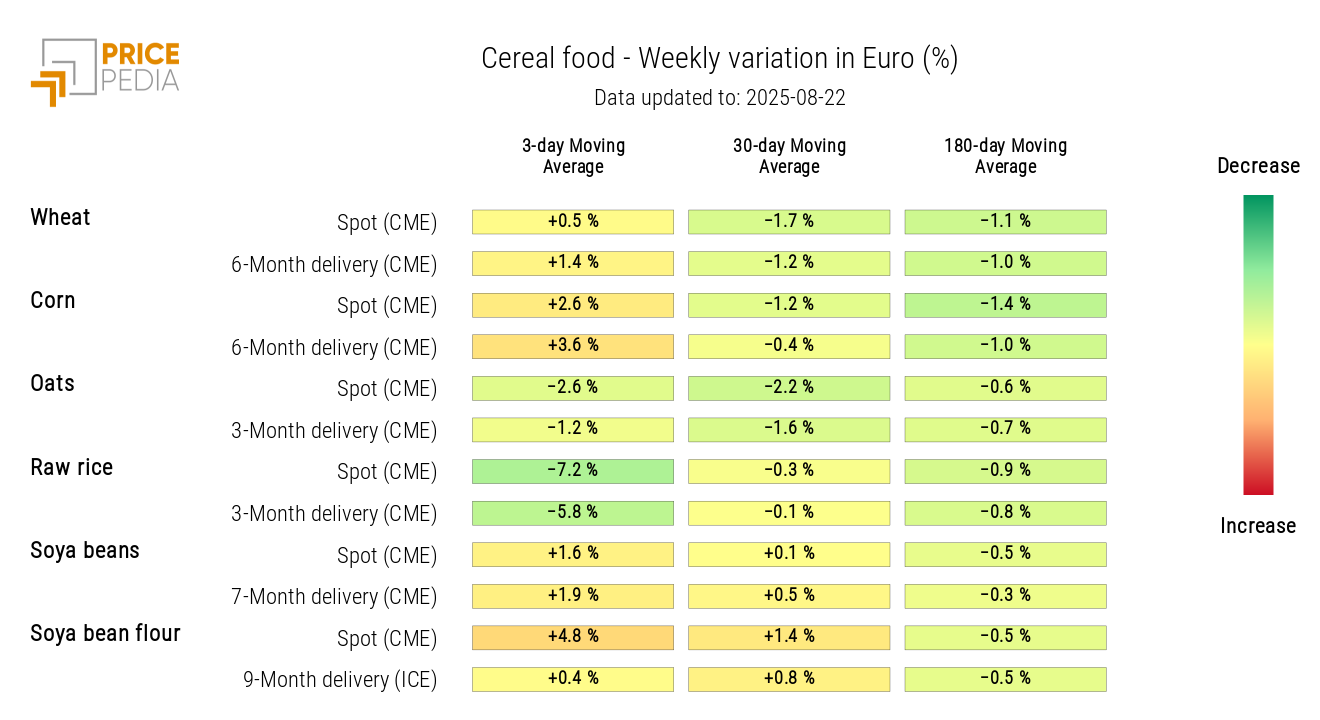

CEREALS

The cereals price heatmap in euros shows a significant drop in rice prices in the last week, alongside a slight increase in the prices of other cereals.

HeatMap of cereal prices in euros

TROPICALS

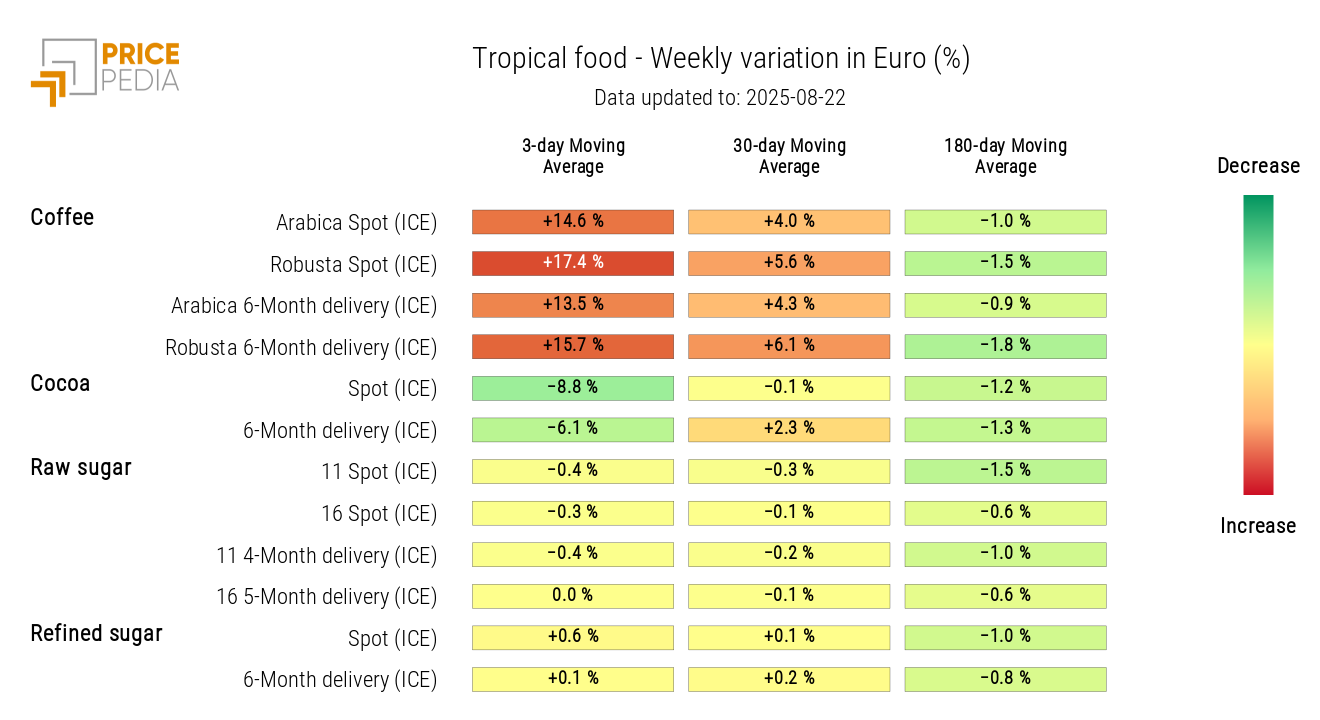

The tropicals price heatmap highlights the strong growth in coffee prices, alongside a significant decline in cocoa prices.

HeatMap of tropical food prices in euros

OILS

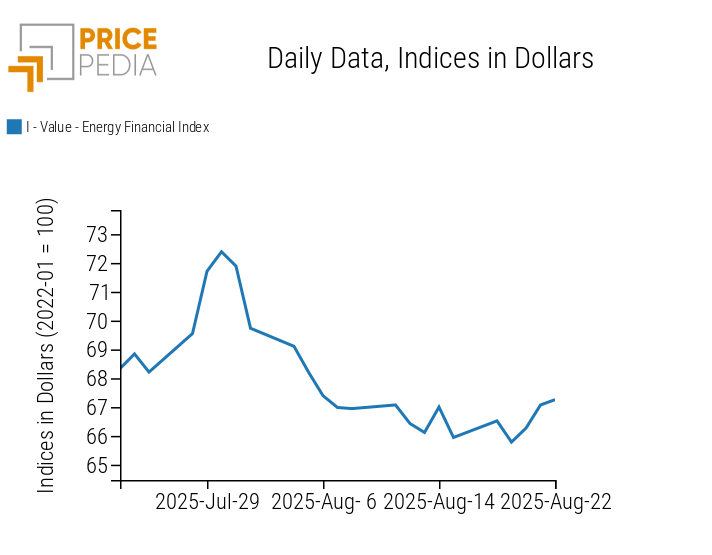

The food oils heatmap shows the slight increase recorded in the past week in almost all oil prices.

HeatMap of food oil prices in euros